Are you a business owner in Tampa, Florida who is self-insured? If so, then you may be required to obtain a Tampa Florida Self-Insurers Surety Bond. This surety bond is a form of financial protection that ensures you will fulfill your obligations as a self-insurer. A Tampa Florida Self-Insurers Surety Bond serves as a guarantee to the state and your employees that you will have sufficient funds to cover any workers' compensation claims or other liabilities that may arise. By obtaining this bond, you are demonstrating your commitment to providing financial security and peace of mind to those who depend on your self-insured status. There are different types of Tampa Florida Self-Insurers Surety Bonds that you might need to consider. These include: 1. Workers' Compensation Surety Bond: This bond is specifically designed for self-insured employers who have coverage for workers' compensation claims. It ensures that you will have the necessary funds to meet the financial obligations in case of an accident or injury occurring at your workplace. 2. Liability Surety Bond: If you are self-insured for general liability or professional liability, you may need this bond. It guarantees that you will have the financial means to cover any claims made against your business for damages or losses. 3. Automobile Liability Surety Bond: For self-insured businesses with a fleet of vehicles, this bond may be required. It provides assurance that you will have the necessary funds to compensate for any injuries or damages caused by your company's vehicles. 4. Performance Surety Bond: In some cases, self-insured businesses may be required to obtain a performance surety bond. This bond guarantees that you will fulfill your contractual obligations and complete projects as agreed upon. When considering a Tampa Florida Self-Insurers Surety Bond, it is important to work with a licensed surety bond provider who can guide you through the process. They will assess your specific needs and help you determine the appropriate bond amount to meet the state's requirements. In summary, if you are a self-insured business owner in Tampa, Florida, obtaining a Tampa Florida Self-Insurers Surety Bond is a critical step in ensuring financial protection and meeting your obligations. Consider the different types of bonds available and consult with a trusted surety bond provider to help you navigate through the process.

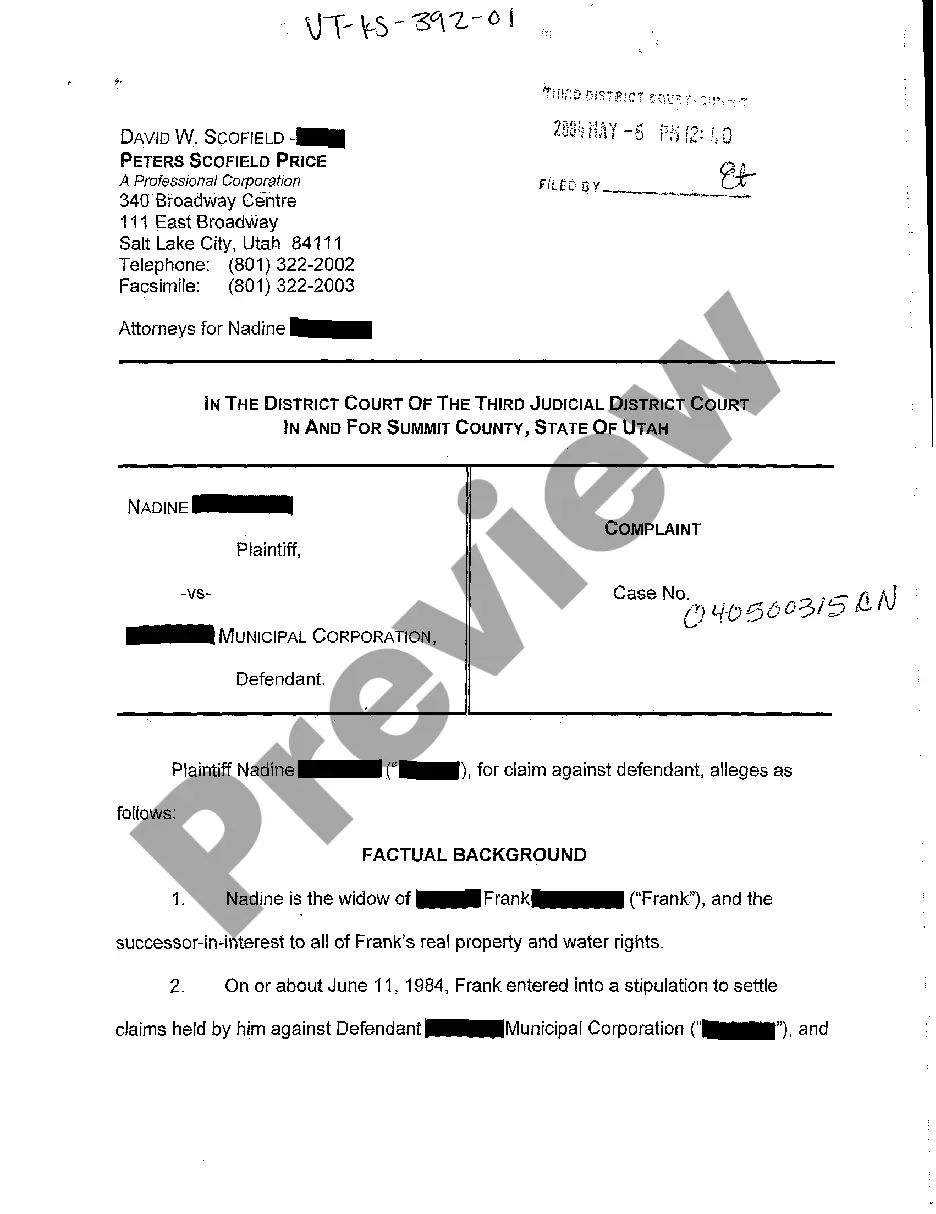

Tampa Florida Self-Insurers Surety Bond

Description

How to fill out Tampa Florida Self-Insurers Surety Bond?

Do you need a reliable and inexpensive legal forms supplier to get the Tampa Florida Self-Insurers Surety Bond? US Legal Forms is your go-to solution.

Whether you need a simple arrangement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of particular state and county.

To download the document, you need to log in account, find the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Tampa Florida Self-Insurers Surety Bond conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the document is good for.

- Restart the search in case the template isn’t good for your specific scenario.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Tampa Florida Self-Insurers Surety Bond in any available file format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending hours learning about legal paperwork online once and for all.