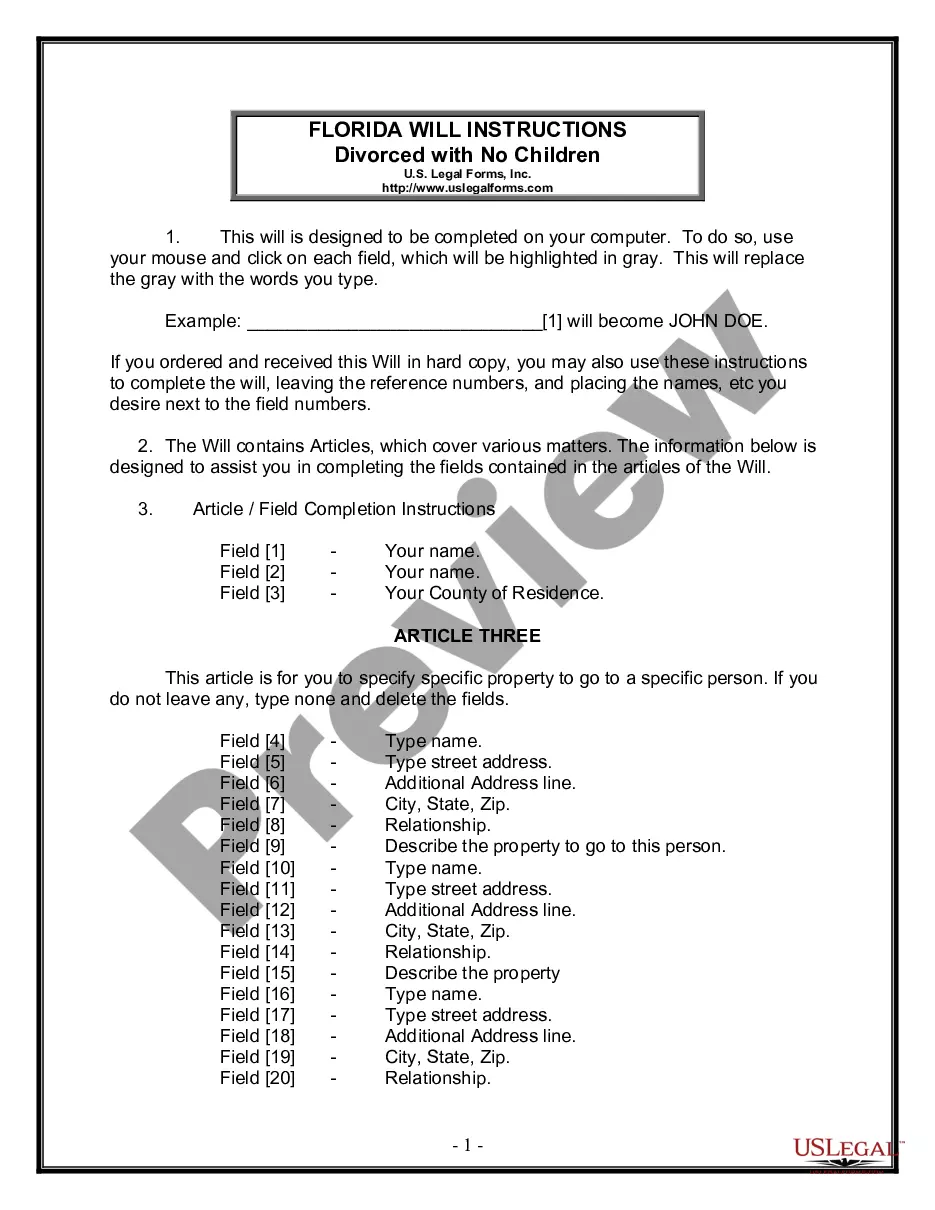

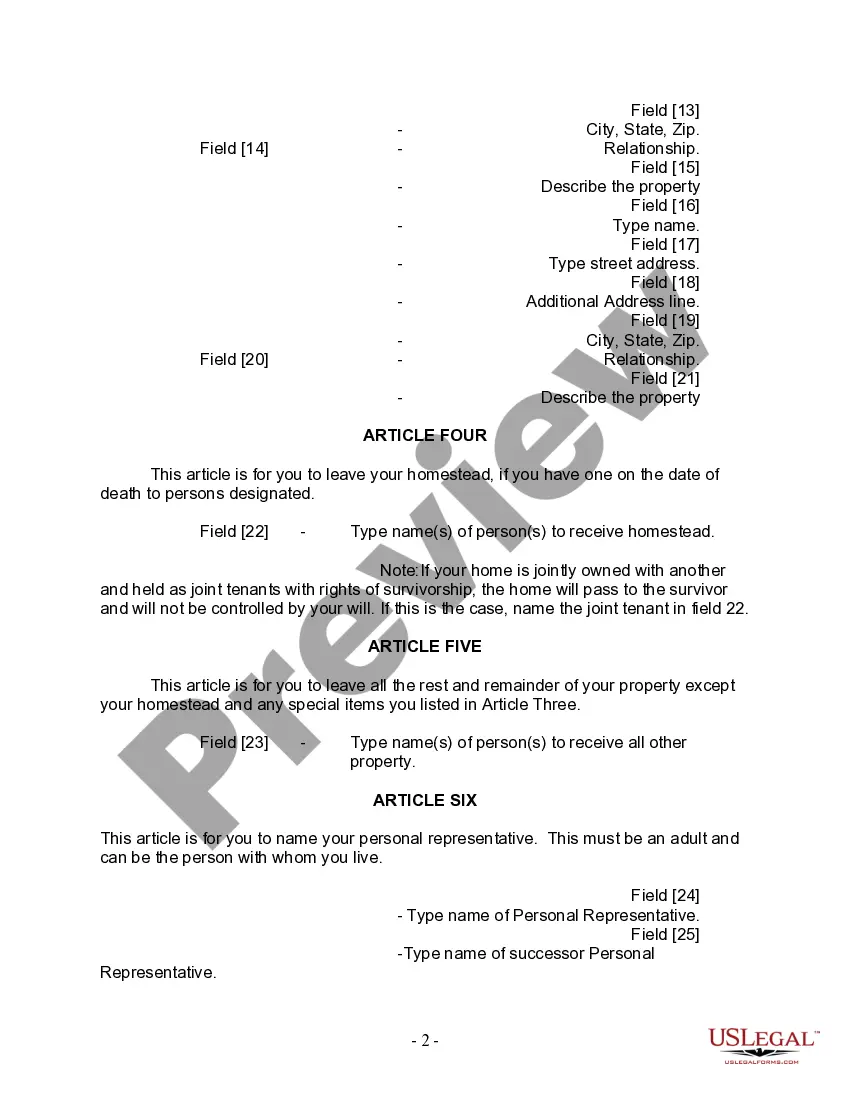

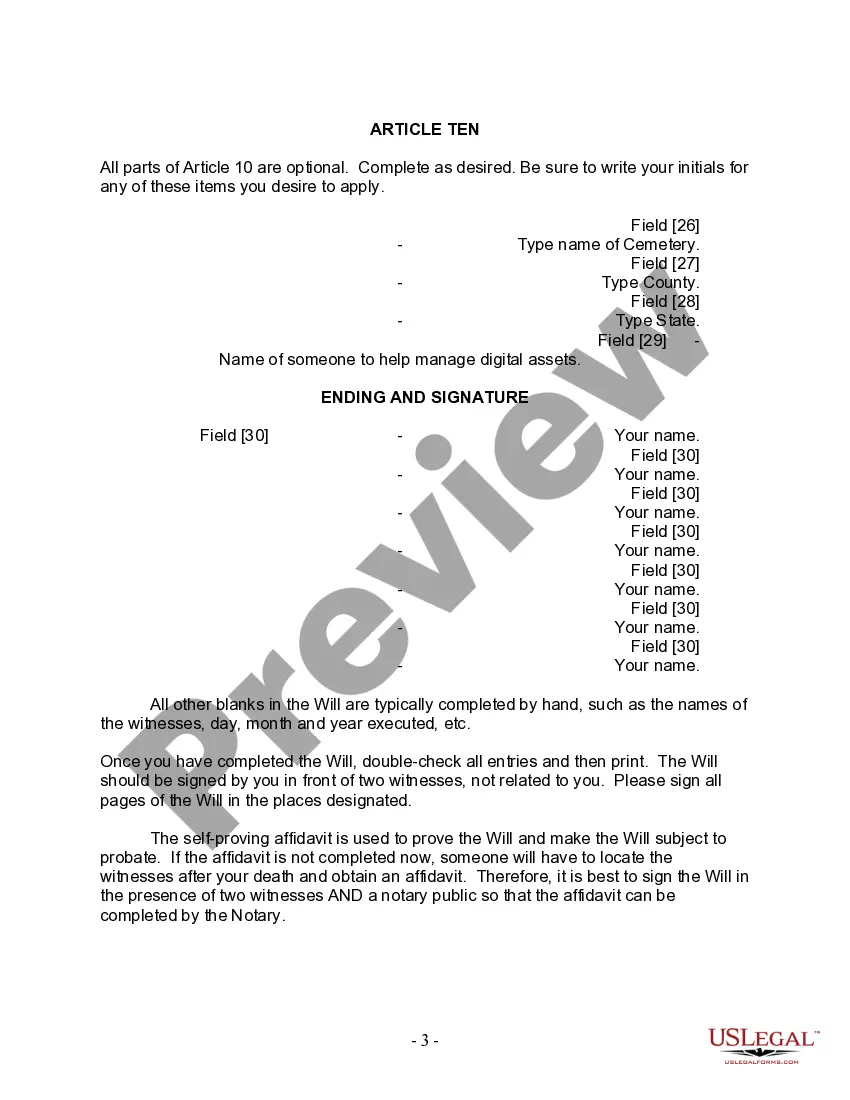

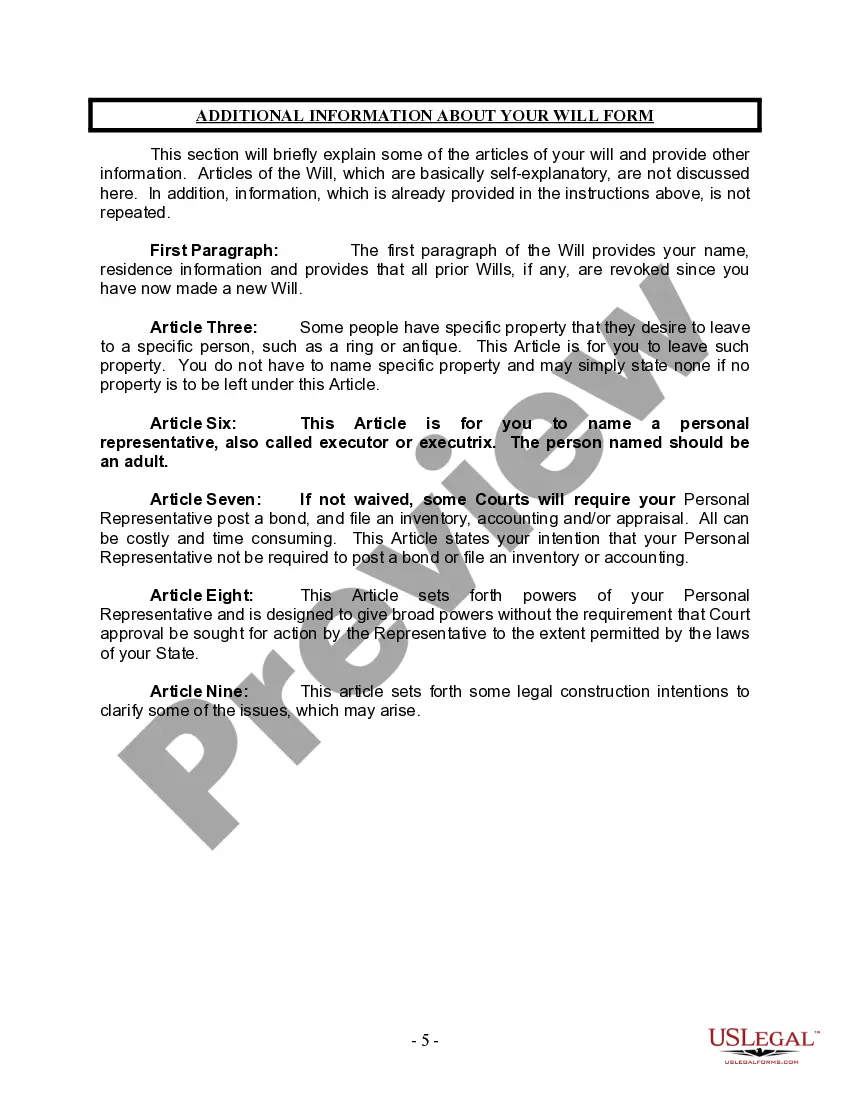

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. A Broward Florida Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legal document specifically designed for individuals who have been through a divorce, are currently not remarried, and do not have any children. This form allows them to dictate how their assets should be distributed after their passing and appoint an executor to ensure their wishes are carried out. In Broward County, Florida, there may be various types of Broward Florida Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, depending on specific circumstances. It's crucial to consult with a legal professional or research the available options to choose the appropriate form that suits your needs. When creating this type of will, it's essential to consider the following elements: 1. Personal Information: The form will require the individual's full legal name, address, and any other necessary identifying information. 2. Distribution of Assets: The person creating the will can specify how their assets, including property, investments, bank accounts, and personal belongings, should be distributed among beneficiaries. These beneficiaries can be family members, friends, or even charitable organizations. 3. Appointment of an Executor: An executor is responsible for managing the deceased person's estate, settling debts, and distributing assets according to the will's instructions. The form allows the individual to appoint a trustworthy individual to fulfill this role. 4. Alternate Beneficiaries and Executors: It is advisable to name alternate beneficiaries and executors in case the primary choices are unable or unwilling to fulfill their roles. 5. Specific Bequests: The individual can make specific bequests, directing certain assets or amounts of money to specific individuals or organizations. 6. Residuary Clause: This states how any remaining assets not specifically mentioned or assigned in the will shall be distributed. 7. Provisions for Pets: If desired, the person can include provisions for the care and well-being of their pets, including naming a caregiver and providing funds for their care. 8. Witness and Notary Requirements: To ensure the will's validity, it must be signed in the presence of witnesses and, in some cases, notarized. Remember, it is crucial to seek the guidance of a qualified estate planning attorney when creating a Broward Florida Legal Last Will and Testament Form. This will ensure that the document complies with all applicable laws and accurately reflects your wishes.

A Broward Florida Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legal document specifically designed for individuals who have been through a divorce, are currently not remarried, and do not have any children. This form allows them to dictate how their assets should be distributed after their passing and appoint an executor to ensure their wishes are carried out. In Broward County, Florida, there may be various types of Broward Florida Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, depending on specific circumstances. It's crucial to consult with a legal professional or research the available options to choose the appropriate form that suits your needs. When creating this type of will, it's essential to consider the following elements: 1. Personal Information: The form will require the individual's full legal name, address, and any other necessary identifying information. 2. Distribution of Assets: The person creating the will can specify how their assets, including property, investments, bank accounts, and personal belongings, should be distributed among beneficiaries. These beneficiaries can be family members, friends, or even charitable organizations. 3. Appointment of an Executor: An executor is responsible for managing the deceased person's estate, settling debts, and distributing assets according to the will's instructions. The form allows the individual to appoint a trustworthy individual to fulfill this role. 4. Alternate Beneficiaries and Executors: It is advisable to name alternate beneficiaries and executors in case the primary choices are unable or unwilling to fulfill their roles. 5. Specific Bequests: The individual can make specific bequests, directing certain assets or amounts of money to specific individuals or organizations. 6. Residuary Clause: This states how any remaining assets not specifically mentioned or assigned in the will shall be distributed. 7. Provisions for Pets: If desired, the person can include provisions for the care and well-being of their pets, including naming a caregiver and providing funds for their care. 8. Witness and Notary Requirements: To ensure the will's validity, it must be signed in the presence of witnesses and, in some cases, notarized. Remember, it is crucial to seek the guidance of a qualified estate planning attorney when creating a Broward Florida Legal Last Will and Testament Form. This will ensure that the document complies with all applicable laws and accurately reflects your wishes.