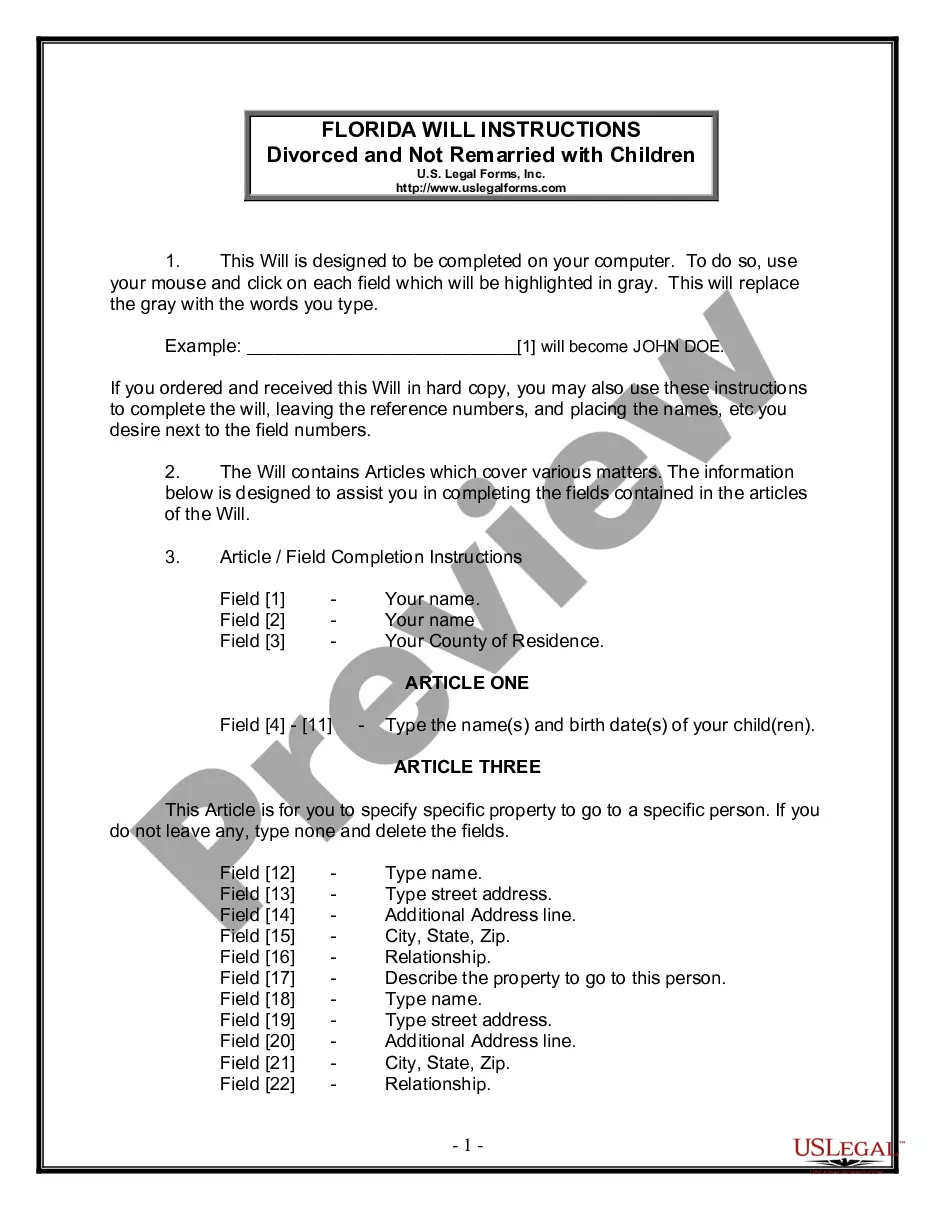

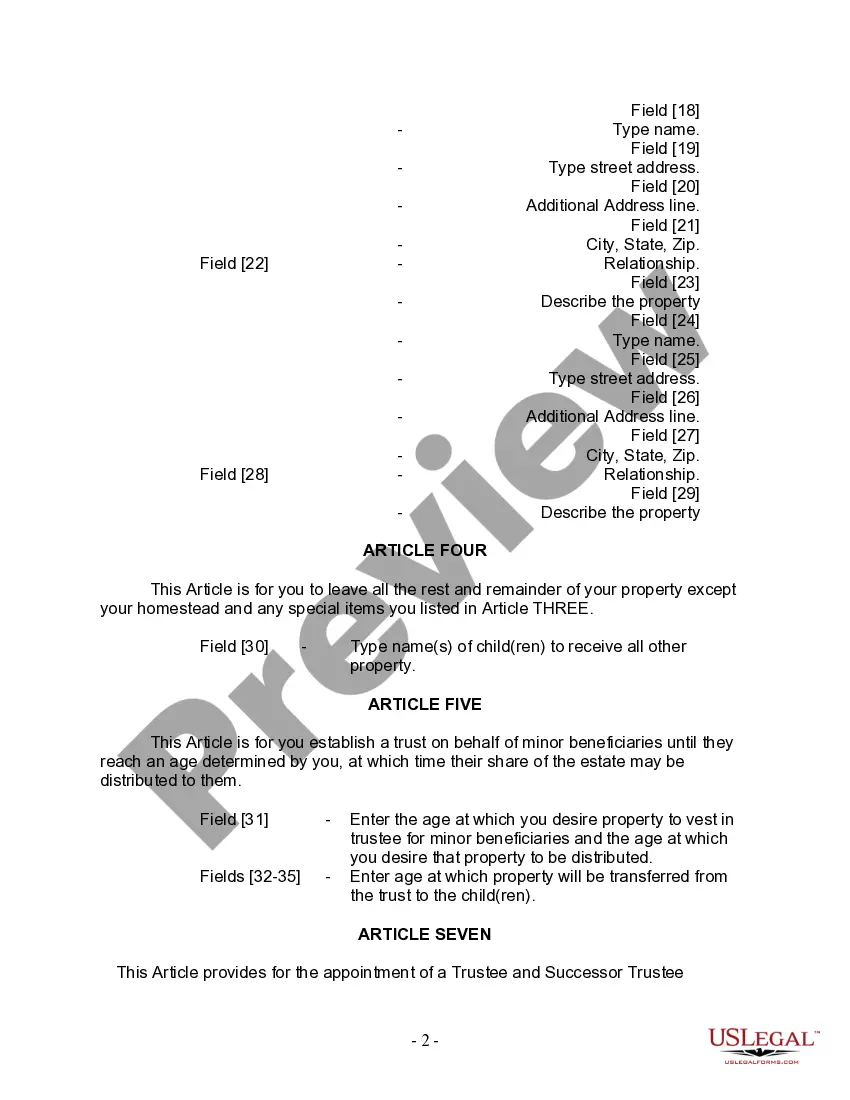

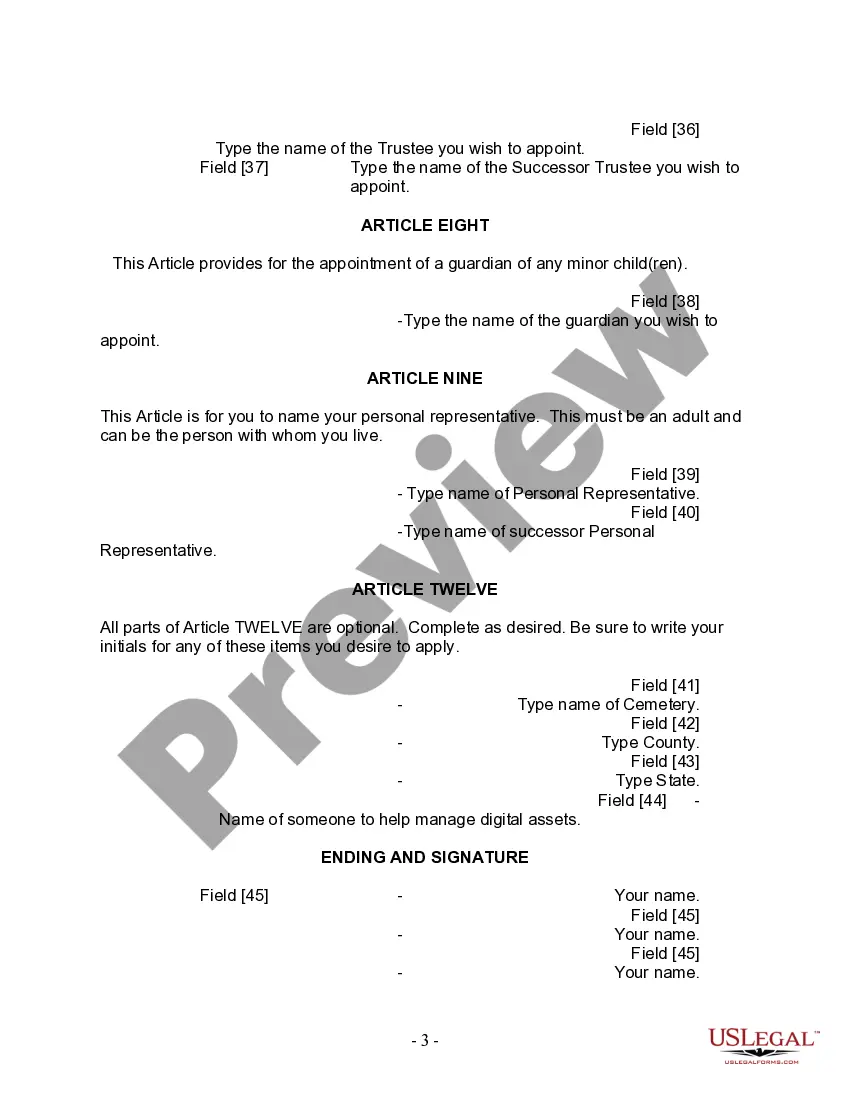

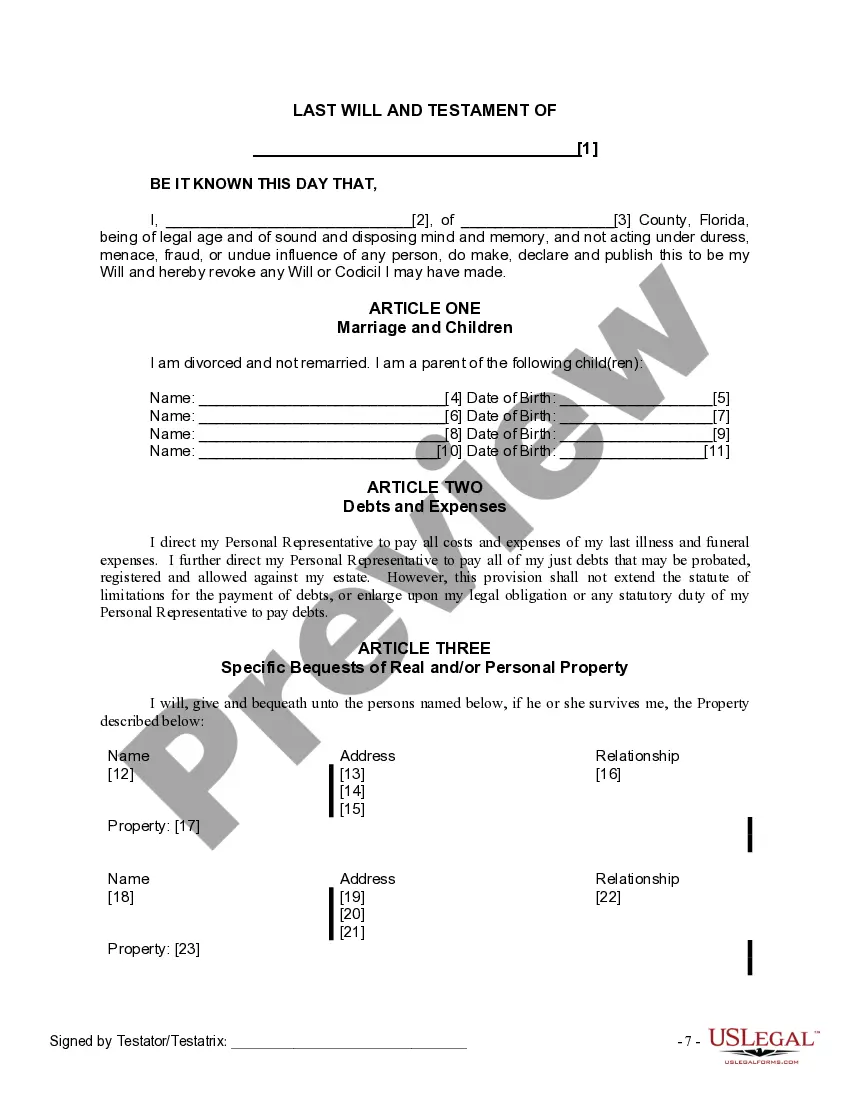

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Fort Lauderdale Florida Legal Last Will and Testament Form for Divorced Person Not Remarried with Adult and Minor Children is a vital legal document that allows individuals who have experienced divorce to outline their wishes regarding the distribution of their assets and the care of their minor children upon their death. This form provides a comprehensive framework for individuals to ensure that their loved ones are protected and their wishes are respected after they pass away. Keywords: Fort Lauderdale, Florida, Legal Last Will and Testament Form, Divorced Person, Not Remarried, Adult and Minor Children, assets, care, death, protected, loved ones, wishes, respected. There are no specific variations or types of the Fort Lauderdale Florida Legal Last Will and Testament Form for Divorced Person Not Remarried with Adult and Minor Children. However, individuals can customize the content within the form to suit their specific needs and requirements. Some common elements that may be included in this type of Last Will and Testament form are: 1. Appointment of an Executor: The form allows individuals to name an executor, who will be responsible for managing their estate and ensuring that their wishes are carried out. 2. Distribution of Assets: Individuals can specify how they want their assets, such as property, bank accounts, investments, and personal belongings, to be distributed among their beneficiaries. This is particularly important in cases where there are adult and minor children involved. 3. Guardian for Minor Children: If the individual has minor children, they can designate a guardian who will be responsible for the care and well-being of their children in the event of their death. This ensures that their children will be raised by someone they trust and who shares their values. 4. Trusts for Minor Children: Individuals can set up trusts for their minor children to manage their inheritance until they reach a specific age or milestone, such as completing higher education. This helps protect their assets and ensures they are used appropriately for the benefit of the children. 5. Alternate Beneficiaries: In case the primary beneficiaries named in the will are unable to inherit for any reason, individuals can name alternate beneficiaries to ensure that their assets are not left unclaimed or subject to probate. It is important to note that this description is based on general information and should not be considered legal advice. It is recommended to consult with an attorney specializing in estate planning in Fort Lauderdale, Florida, to ensure that the will accurately reflects the individual's wishes and is legally valid.

The Fort Lauderdale Florida Legal Last Will and Testament Form for Divorced Person Not Remarried with Adult and Minor Children is a vital legal document that allows individuals who have experienced divorce to outline their wishes regarding the distribution of their assets and the care of their minor children upon their death. This form provides a comprehensive framework for individuals to ensure that their loved ones are protected and their wishes are respected after they pass away. Keywords: Fort Lauderdale, Florida, Legal Last Will and Testament Form, Divorced Person, Not Remarried, Adult and Minor Children, assets, care, death, protected, loved ones, wishes, respected. There are no specific variations or types of the Fort Lauderdale Florida Legal Last Will and Testament Form for Divorced Person Not Remarried with Adult and Minor Children. However, individuals can customize the content within the form to suit their specific needs and requirements. Some common elements that may be included in this type of Last Will and Testament form are: 1. Appointment of an Executor: The form allows individuals to name an executor, who will be responsible for managing their estate and ensuring that their wishes are carried out. 2. Distribution of Assets: Individuals can specify how they want their assets, such as property, bank accounts, investments, and personal belongings, to be distributed among their beneficiaries. This is particularly important in cases where there are adult and minor children involved. 3. Guardian for Minor Children: If the individual has minor children, they can designate a guardian who will be responsible for the care and well-being of their children in the event of their death. This ensures that their children will be raised by someone they trust and who shares their values. 4. Trusts for Minor Children: Individuals can set up trusts for their minor children to manage their inheritance until they reach a specific age or milestone, such as completing higher education. This helps protect their assets and ensures they are used appropriately for the benefit of the children. 5. Alternate Beneficiaries: In case the primary beneficiaries named in the will are unable to inherit for any reason, individuals can name alternate beneficiaries to ensure that their assets are not left unclaimed or subject to probate. It is important to note that this description is based on general information and should not be considered legal advice. It is recommended to consult with an attorney specializing in estate planning in Fort Lauderdale, Florida, to ensure that the will accurately reflects the individual's wishes and is legally valid.