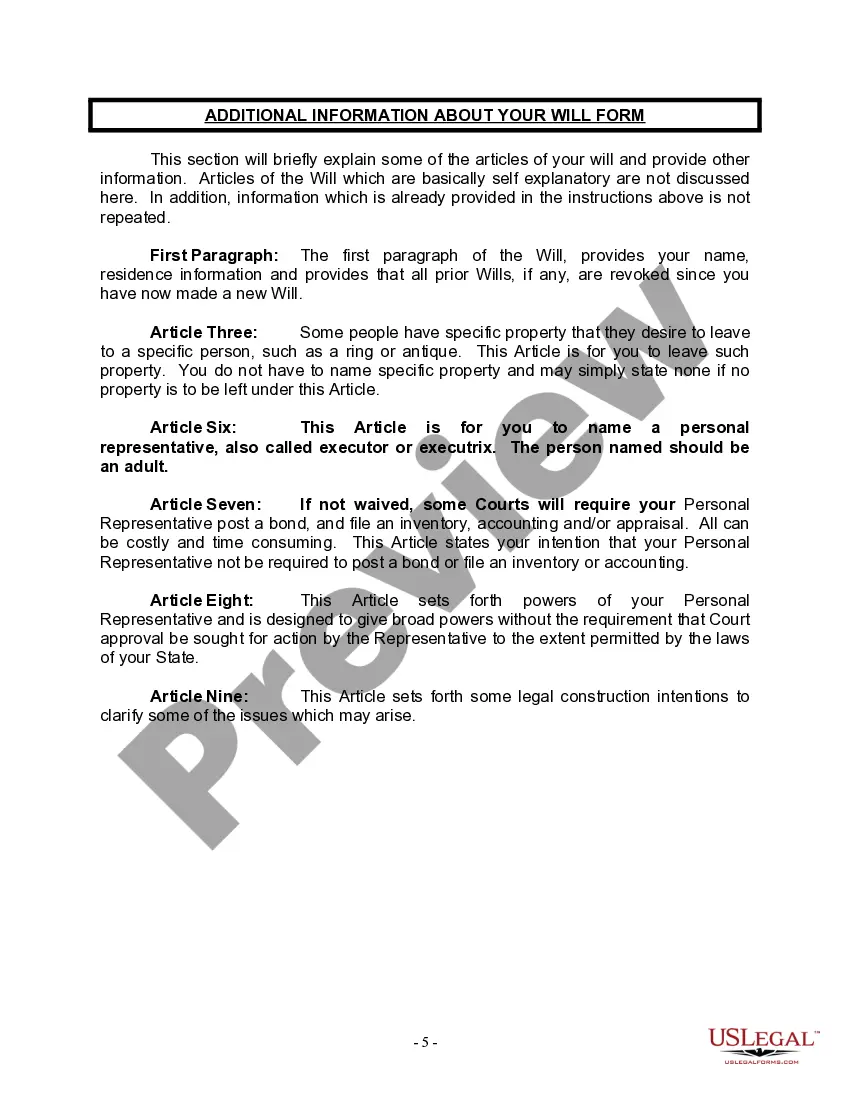

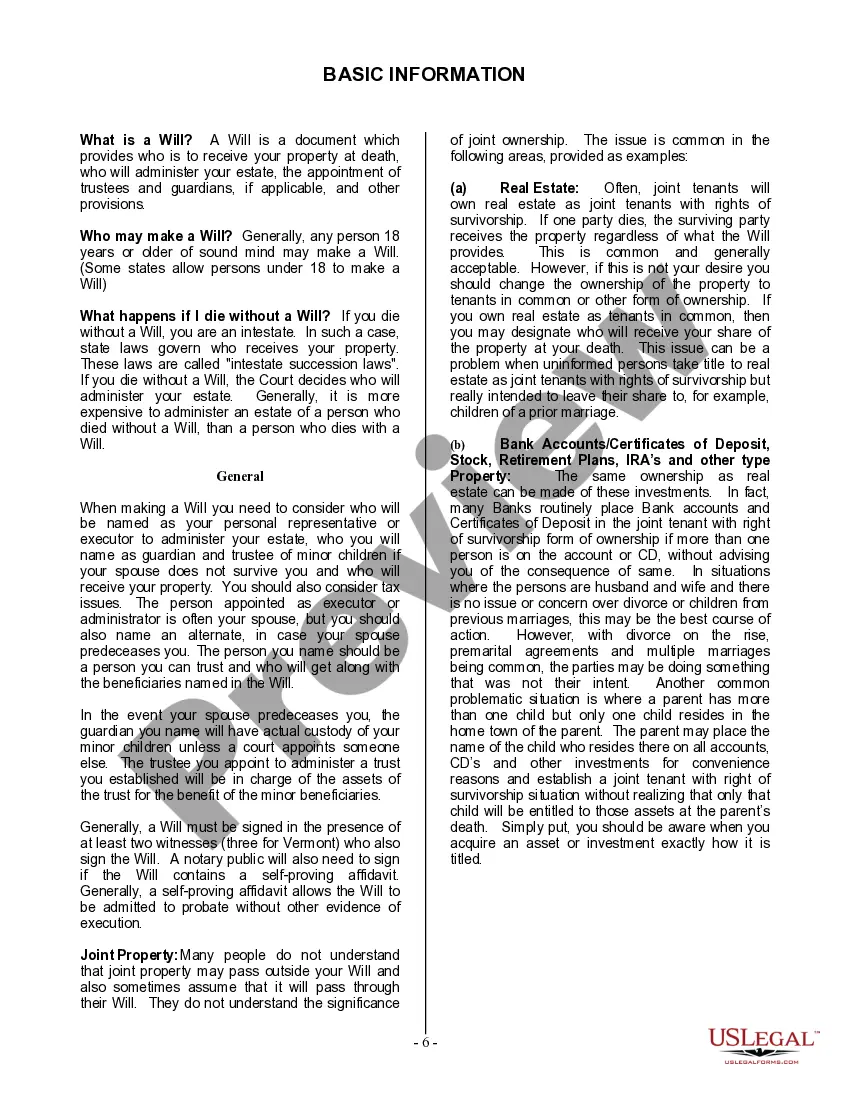

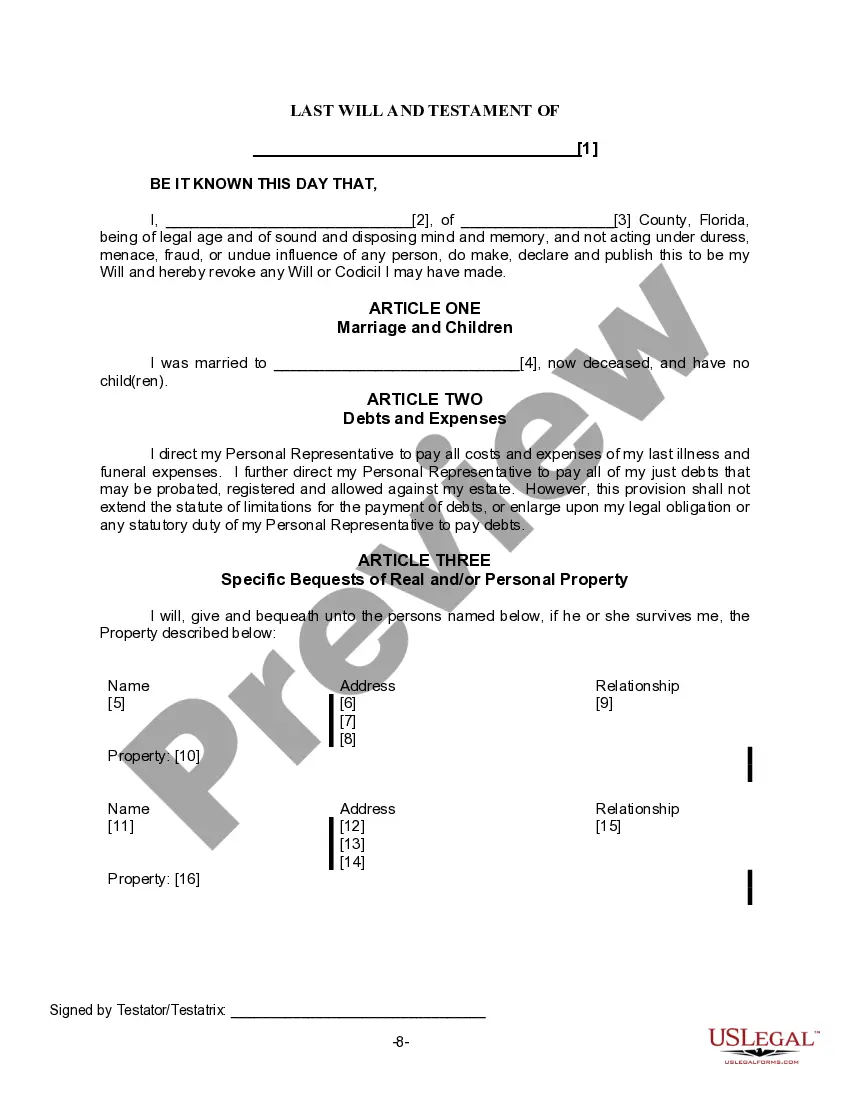

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Broward Florida Legal Last Will Form for a Widow or Widower with no Children is a crucial document that allows individuals in Broward County, Florida, who have lost their spouse and do not have any children to outline their wishes regarding the distribution of their assets and estate upon their passing. This legal form provides a comprehensive framework for a widow or widower to ensure that their assets, properties, and personal belongings are distributed according to their specific desires. By creating a valid Last Will and Testament, the individual can control who will inherit their assets, assign an executor to oversee the distribution process, and designate guardians for any dependents or pets in their care. Although there may be variations in the specific format or layout of the Broward Florida Legal Last Will Form for a Widow or Widower with no Children, its core elements usually include: 1. Personal Information: The form usually begins with a section that allows the individual to provide their full legal name, date of birth, address, and any other relevant identifying details. 2. Appointment of Executor: This section permits the widow or widower to designate an executor, sometimes called a personal representative, responsible for handling the estate's administration and distributing assets as mentioned in the will. 3. Asset Distribution: The form allows the widow or widower to outline how they want their assets distributed after their death. They may allocate specific items, such as real estate, bank accounts, investments, vehicles, possessions, and sentimental items, to named beneficiaries, friends, relatives, or charitable organizations. 4. Alternative Beneficiaries: To account for unforeseen circumstances, the form may include provisions for naming alternate beneficiaries, who would inherit the assets in case the primary beneficiaries are deceased or unable to receive the intended gifts. 5. Guardianship Designation: In case the widow or widower has dependents, including minor children or pets, this section enables them to appoint guardians who will assume responsibility for their care and well-being. 6. Special Requests and Instructions: The form may provide space for the widow or widower to include any additional wishes, such as funeral arrangements, healthcare directives, or certain conditions for beneficiaries to meet before receiving their inheritance. It's important to note that the Broward Florida Legal Last Will Form for a Widow or Widower with no Children may have different variations based on the specific legal requirements and preferences of the individual. It is advisable to consult an attorney specializing in estate planning or use an online legal service to ensure the form complies with all relevant rules and regulations in Broward County, Florida.

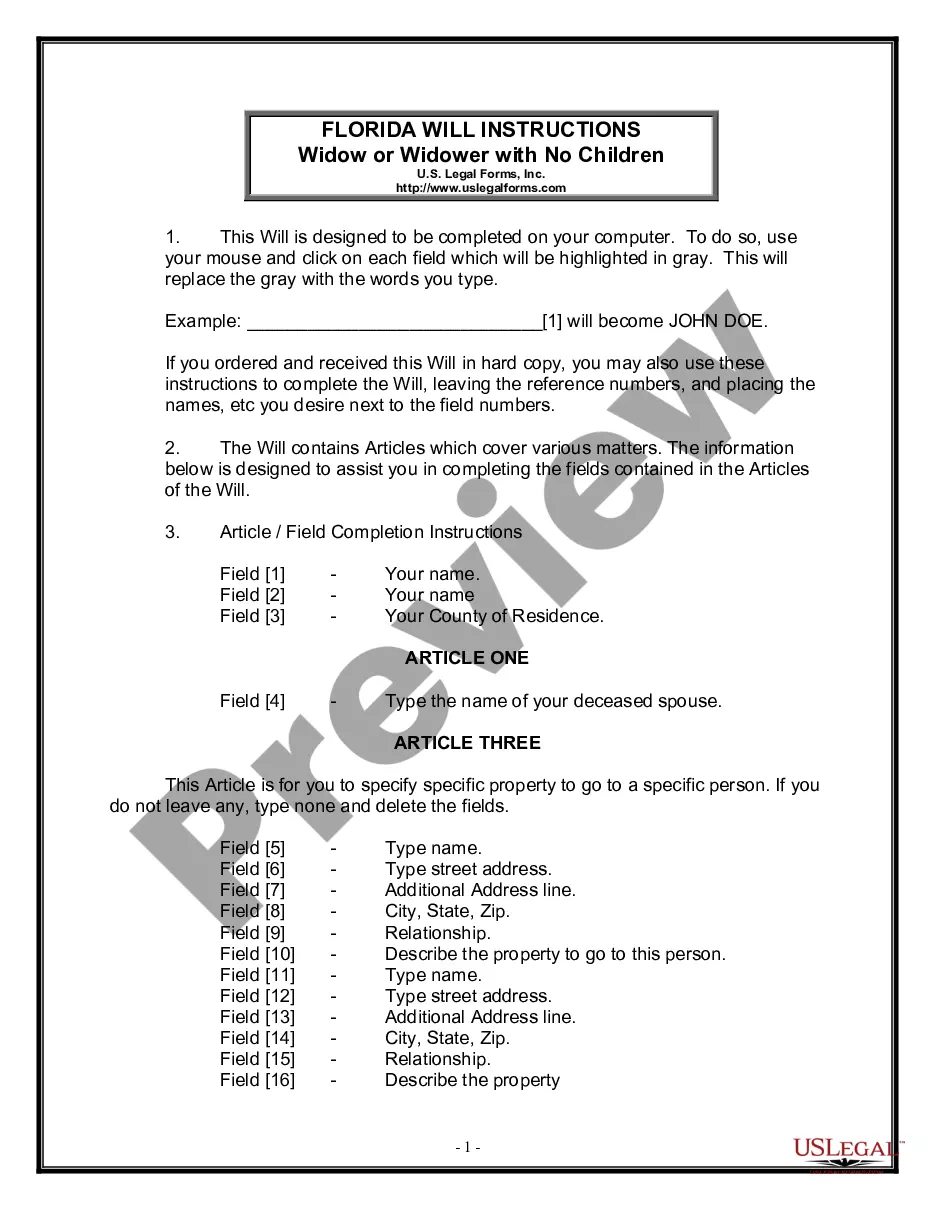

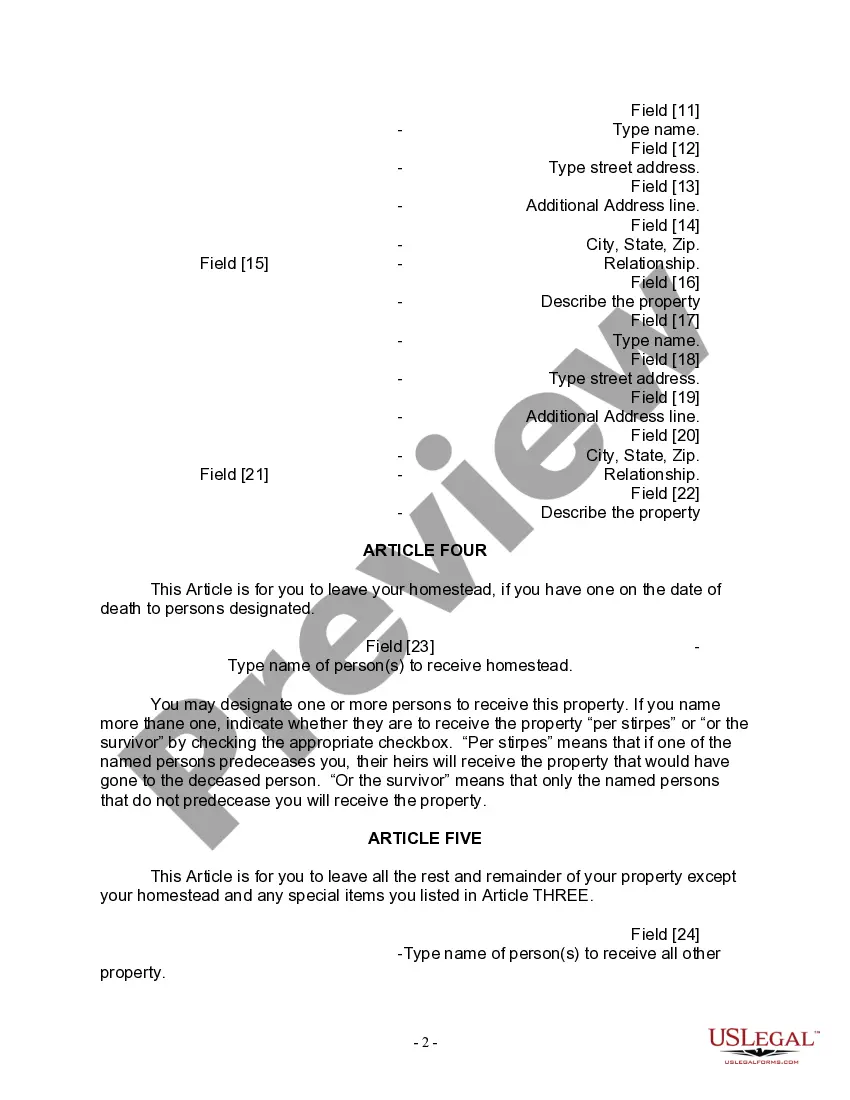

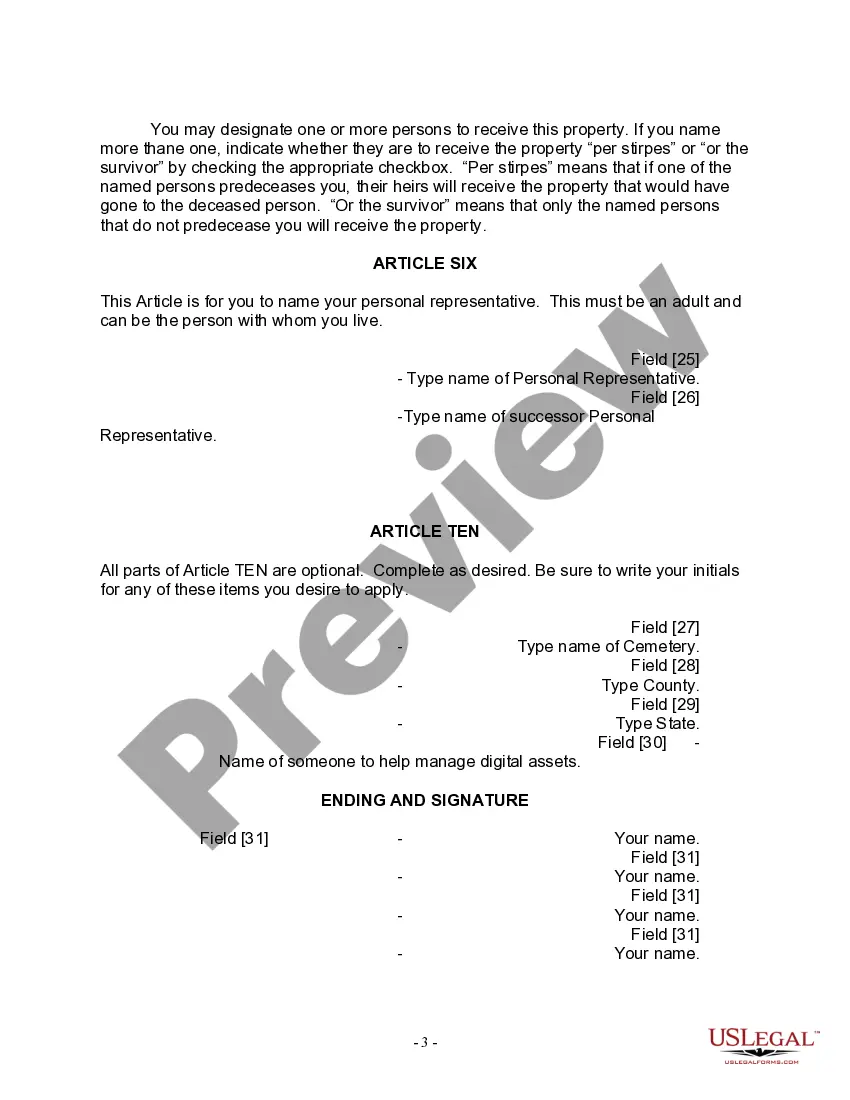

The Broward Florida Legal Last Will Form for a Widow or Widower with no Children is a crucial document that allows individuals in Broward County, Florida, who have lost their spouse and do not have any children to outline their wishes regarding the distribution of their assets and estate upon their passing. This legal form provides a comprehensive framework for a widow or widower to ensure that their assets, properties, and personal belongings are distributed according to their specific desires. By creating a valid Last Will and Testament, the individual can control who will inherit their assets, assign an executor to oversee the distribution process, and designate guardians for any dependents or pets in their care. Although there may be variations in the specific format or layout of the Broward Florida Legal Last Will Form for a Widow or Widower with no Children, its core elements usually include: 1. Personal Information: The form usually begins with a section that allows the individual to provide their full legal name, date of birth, address, and any other relevant identifying details. 2. Appointment of Executor: This section permits the widow or widower to designate an executor, sometimes called a personal representative, responsible for handling the estate's administration and distributing assets as mentioned in the will. 3. Asset Distribution: The form allows the widow or widower to outline how they want their assets distributed after their death. They may allocate specific items, such as real estate, bank accounts, investments, vehicles, possessions, and sentimental items, to named beneficiaries, friends, relatives, or charitable organizations. 4. Alternative Beneficiaries: To account for unforeseen circumstances, the form may include provisions for naming alternate beneficiaries, who would inherit the assets in case the primary beneficiaries are deceased or unable to receive the intended gifts. 5. Guardianship Designation: In case the widow or widower has dependents, including minor children or pets, this section enables them to appoint guardians who will assume responsibility for their care and well-being. 6. Special Requests and Instructions: The form may provide space for the widow or widower to include any additional wishes, such as funeral arrangements, healthcare directives, or certain conditions for beneficiaries to meet before receiving their inheritance. It's important to note that the Broward Florida Legal Last Will Form for a Widow or Widower with no Children may have different variations based on the specific legal requirements and preferences of the individual. It is advisable to consult an attorney specializing in estate planning or use an online legal service to ensure the form complies with all relevant rules and regulations in Broward County, Florida.