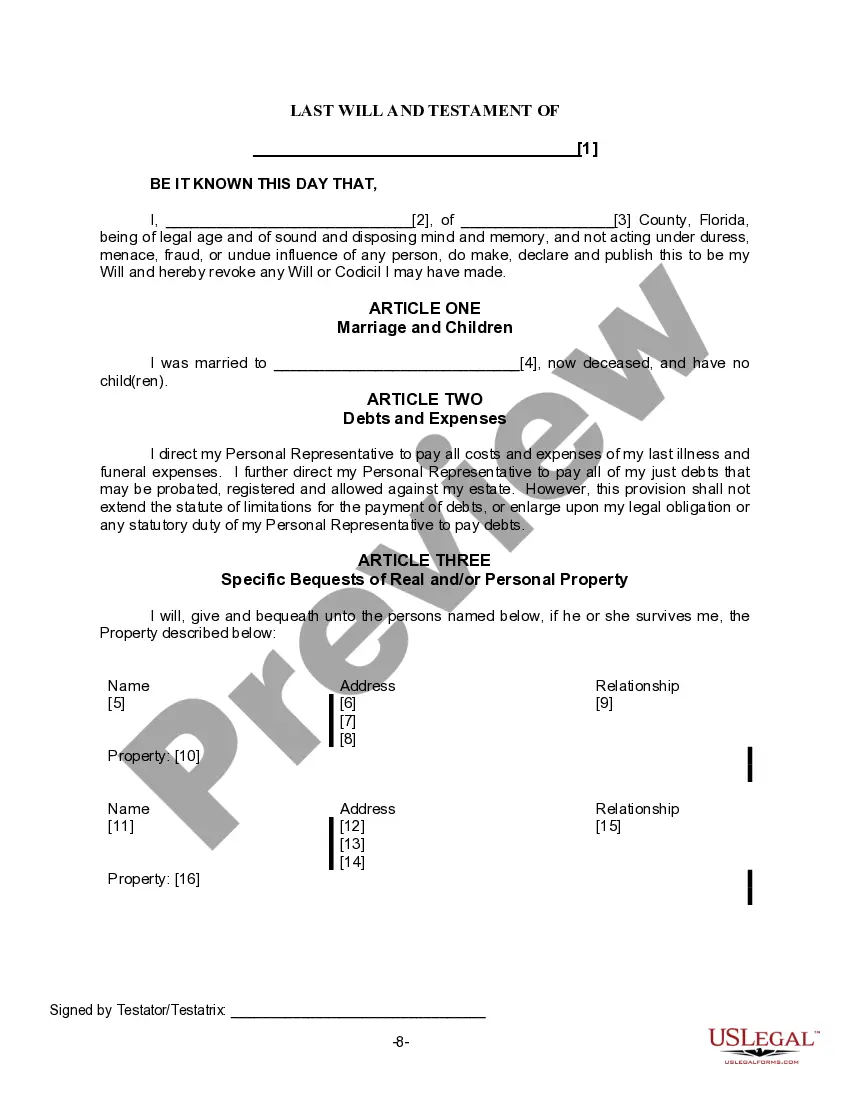

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Hillsborough Florida Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals in Hillsborough County, Florida, who have lost their spouse and have no children, to dictate the distribution of their assets and appoint a personal representative or executor of their estate. This form ensures that their final wishes are respected and followed after their passing. The following are some important keywords to understand regarding the Hillsborough Florida Legal Last Will Form for a Widow or Widower with no Children: 1. Last Will: A legal document that outlines an individual's wishes regarding the distribution of their assets, the appointment of an executor, and provisions for any dependents or beneficiaries upon their death. 2. Widow or Widower: A person who has lost their spouse and now finds themselves solely responsible for managing their own estate and assets. 3. Personal Representative: An individual appointed by the testator (the person creating the will) to oversee the distribution of the estate and ensure that the provisions of the will are carried out properly. 4. Executor: Another term for a personal representative, an executor is responsible for managing the testator's estate, paying debts and taxes, and distributing assets according to the instructions in the will. 5. Hillsborough County: The specific county in the state of Florida where the will is being created and will be legally valid. Different types or variations of the Hillsborough Florida Legal Last Will Form may include: 1. Hillsborough Florida Legal Last Will Form with Standard Distribution: This form allows the widow or widower to specify how their assets will be distributed among family members, friends, or charity organizations after their passing. It may also include provisions for any outstanding debts or taxes. 2. Hillsborough Florida Legal Last Will Form with Charitable Contributions: This form is similar to the standard distribution form but focuses on directing a portion or all of the assets to be donated to charitable organizations or causes chosen by the testator. 3. Hillsborough Florida Legal Last Will Form with Trust Provisions: This form enables the widow or widower to establish a trust, whether for the benefit of a particular individual or organization, which will hold and manage the assets allocated in accordance with the testator's wishes. It is important to consult with an attorney experienced in estate planning to ensure the correct form is utilized and to receive proper guidance throughout the process of creating a Last Will that accurately reflects the testator's intentions and complies with Florida state laws.

The Hillsborough Florida Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals in Hillsborough County, Florida, who have lost their spouse and have no children, to dictate the distribution of their assets and appoint a personal representative or executor of their estate. This form ensures that their final wishes are respected and followed after their passing. The following are some important keywords to understand regarding the Hillsborough Florida Legal Last Will Form for a Widow or Widower with no Children: 1. Last Will: A legal document that outlines an individual's wishes regarding the distribution of their assets, the appointment of an executor, and provisions for any dependents or beneficiaries upon their death. 2. Widow or Widower: A person who has lost their spouse and now finds themselves solely responsible for managing their own estate and assets. 3. Personal Representative: An individual appointed by the testator (the person creating the will) to oversee the distribution of the estate and ensure that the provisions of the will are carried out properly. 4. Executor: Another term for a personal representative, an executor is responsible for managing the testator's estate, paying debts and taxes, and distributing assets according to the instructions in the will. 5. Hillsborough County: The specific county in the state of Florida where the will is being created and will be legally valid. Different types or variations of the Hillsborough Florida Legal Last Will Form may include: 1. Hillsborough Florida Legal Last Will Form with Standard Distribution: This form allows the widow or widower to specify how their assets will be distributed among family members, friends, or charity organizations after their passing. It may also include provisions for any outstanding debts or taxes. 2. Hillsborough Florida Legal Last Will Form with Charitable Contributions: This form is similar to the standard distribution form but focuses on directing a portion or all of the assets to be donated to charitable organizations or causes chosen by the testator. 3. Hillsborough Florida Legal Last Will Form with Trust Provisions: This form enables the widow or widower to establish a trust, whether for the benefit of a particular individual or organization, which will hold and manage the assets allocated in accordance with the testator's wishes. It is important to consult with an attorney experienced in estate planning to ensure the correct form is utilized and to receive proper guidance throughout the process of creating a Last Will that accurately reflects the testator's intentions and complies with Florida state laws.