A Hillsborough Florida Legal Last Will and Testament Form with All Property to Trust, also known as a Pour Over Will, is a legal document used to ensure an organized and effective distribution of property according to an individual's wishes after their death. This document is specifically designed for residents of Hillsborough County, Florida, and it encompasses various important elements to create a comprehensive estate plan. The Pour Over Will serves as a crucial part of a broader legal strategy for managing assets, particularly in cases where a living trust has been established. By using this document, individuals can confirm that any property not already included in their living trust will "pour over" into the trust upon their demise. This means that any assets not specifically mentioned in the trust or the Last Will and Testament will be transferred to the trust, subject to the designated trustee's management. The Hillsborough Florida Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will allows individuals to name their trusted beneficiaries, appointed executors, and any other necessary details. These details might include guardianship nominations for minor children or instructions for the distribution of specific assets. It's important to note that there aren't distinct types of Hillsborough Florida Legal Last Will and Testament Forms with All Property to Trust called Pour Over Wills. However, individuals can customize their Pour Over Will to suit their unique circumstances, ensuring that their final wishes are accurately documented and fulfilled. By consulting an attorney specializing in estate planning, individuals can personalize their Pour Over Will to reflect their specific assets, beneficiaries, and additional preferences. In conclusion, a Hillsborough Florida Legal Last Will and Testament Form with All Property to Trust, i.e., a Pour Over Will, is an indispensable legal document for residents of Hillsborough County. It empowers individuals to define their beneficiaries, distribute their estate, and provide instructions for their assets, while ensuring a smooth transition of property into their established trust. By comprehensively drafting this document, individuals can safeguard their assets, minimize probate complications, and establish a legacy that reflects their true intentions.

Hillsborough Florida Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Hillsborough Florida Last Will And Testament With All Property To Trust Called A Pour Over Will?

If you are looking for a relevant form template, it’s impossible to choose a better place than the US Legal Forms site – probably the most extensive libraries on the internet. Here you can find a huge number of form samples for organization and individual purposes by types and regions, or keywords. Using our high-quality search feature, discovering the most up-to-date Hillsborough Florida Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will is as easy as 1-2-3. Moreover, the relevance of each and every file is confirmed by a group of expert lawyers that regularly check the templates on our platform and revise them in accordance with the latest state and county demands.

If you already know about our platform and have an account, all you should do to receive the Hillsborough Florida Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

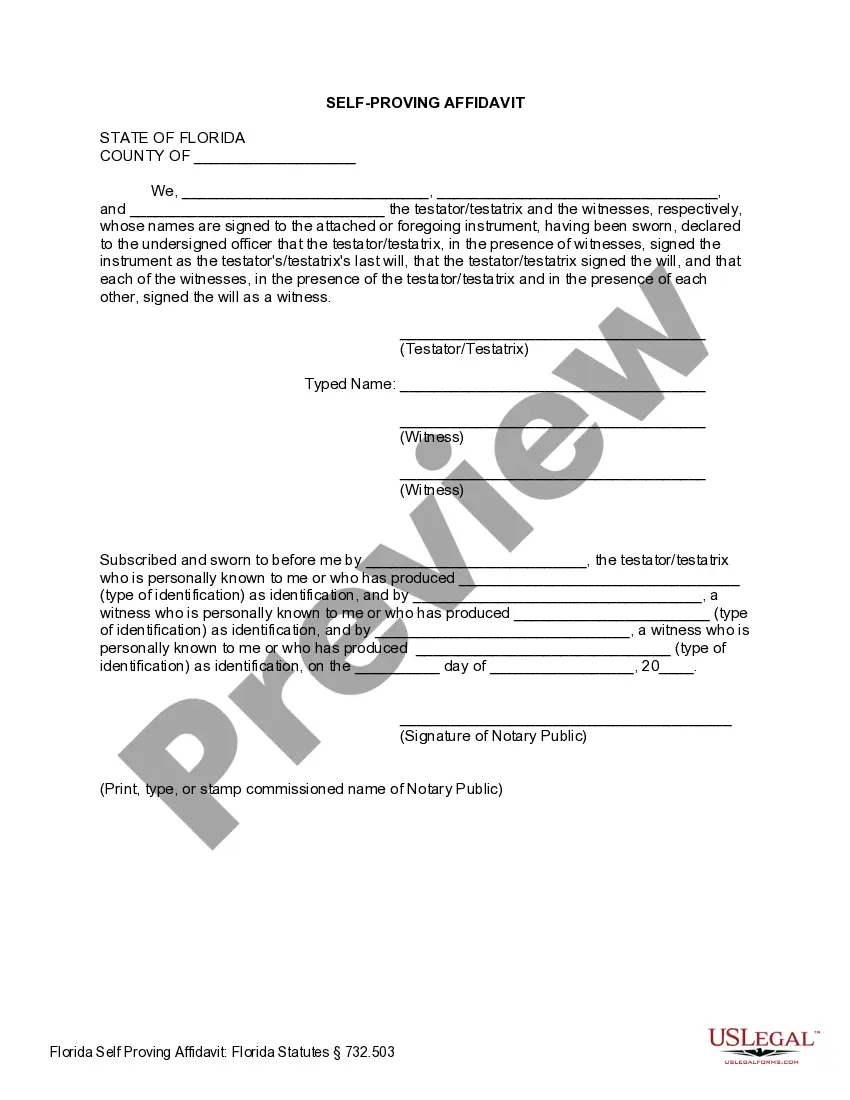

- Make sure you have opened the form you need. Check its explanation and utilize the Preview feature (if available) to see its content. If it doesn’t suit your needs, utilize the Search option near the top of the screen to find the needed record.

- Confirm your decision. Select the Buy now button. Next, pick the preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Get the template. Pick the format and download it on your device.

- Make modifications. Fill out, revise, print, and sign the received Hillsborough Florida Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will.

Each and every template you add to your account has no expiration date and is yours forever. You always have the ability to gain access to them using the My Forms menu, so if you need to receive an additional copy for modifying or printing, you may return and save it again whenever you want.

Make use of the US Legal Forms professional library to gain access to the Hillsborough Florida Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will you were looking for and a huge number of other professional and state-specific samples on one website!