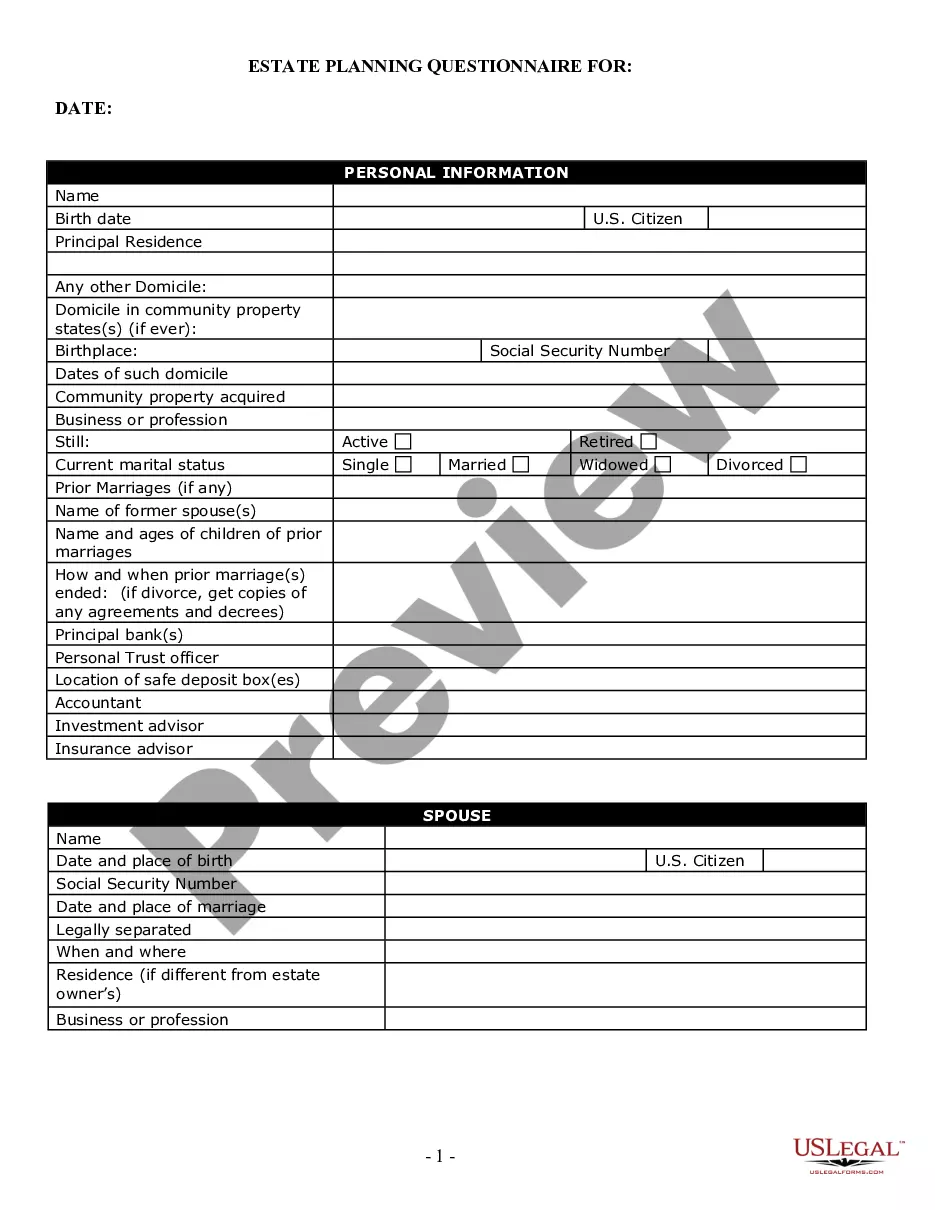

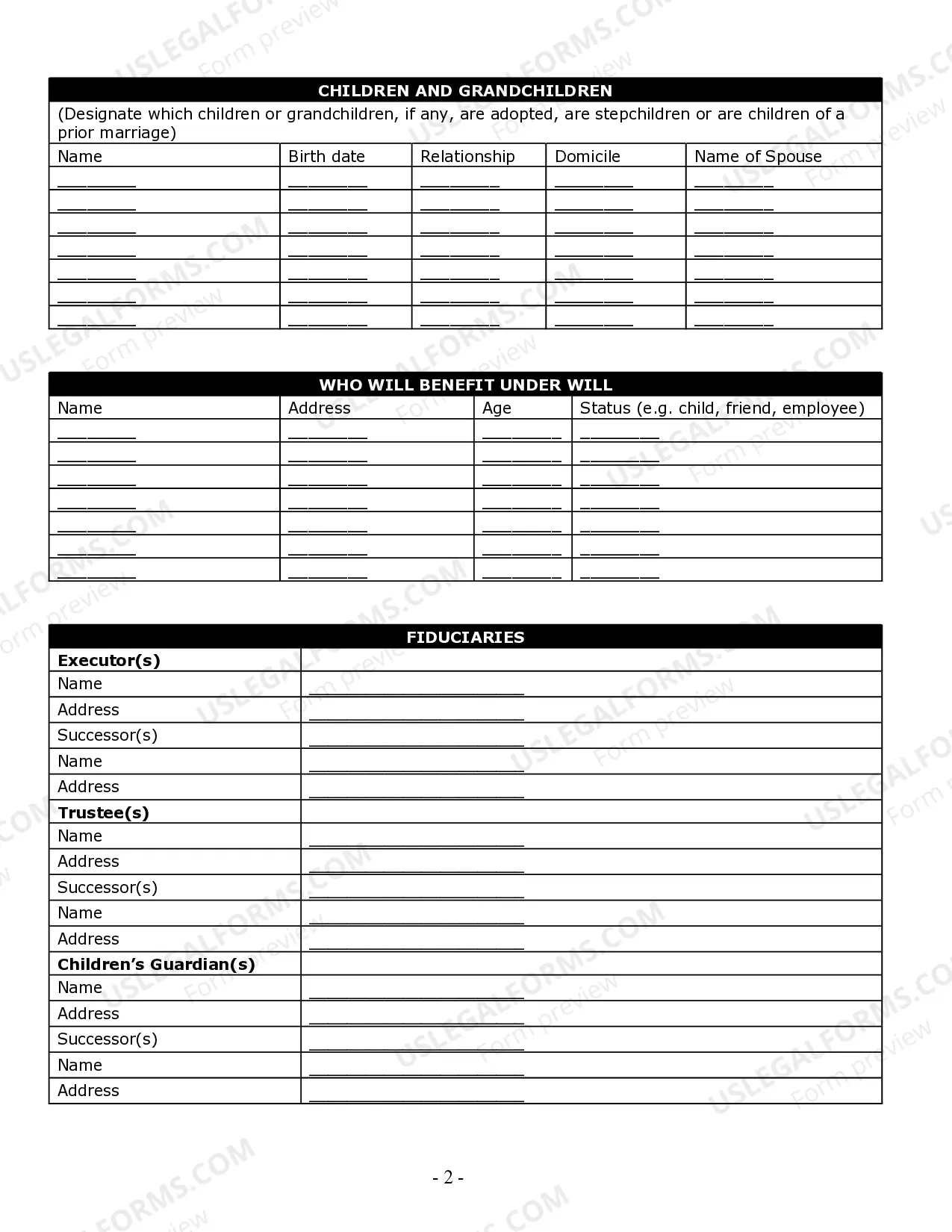

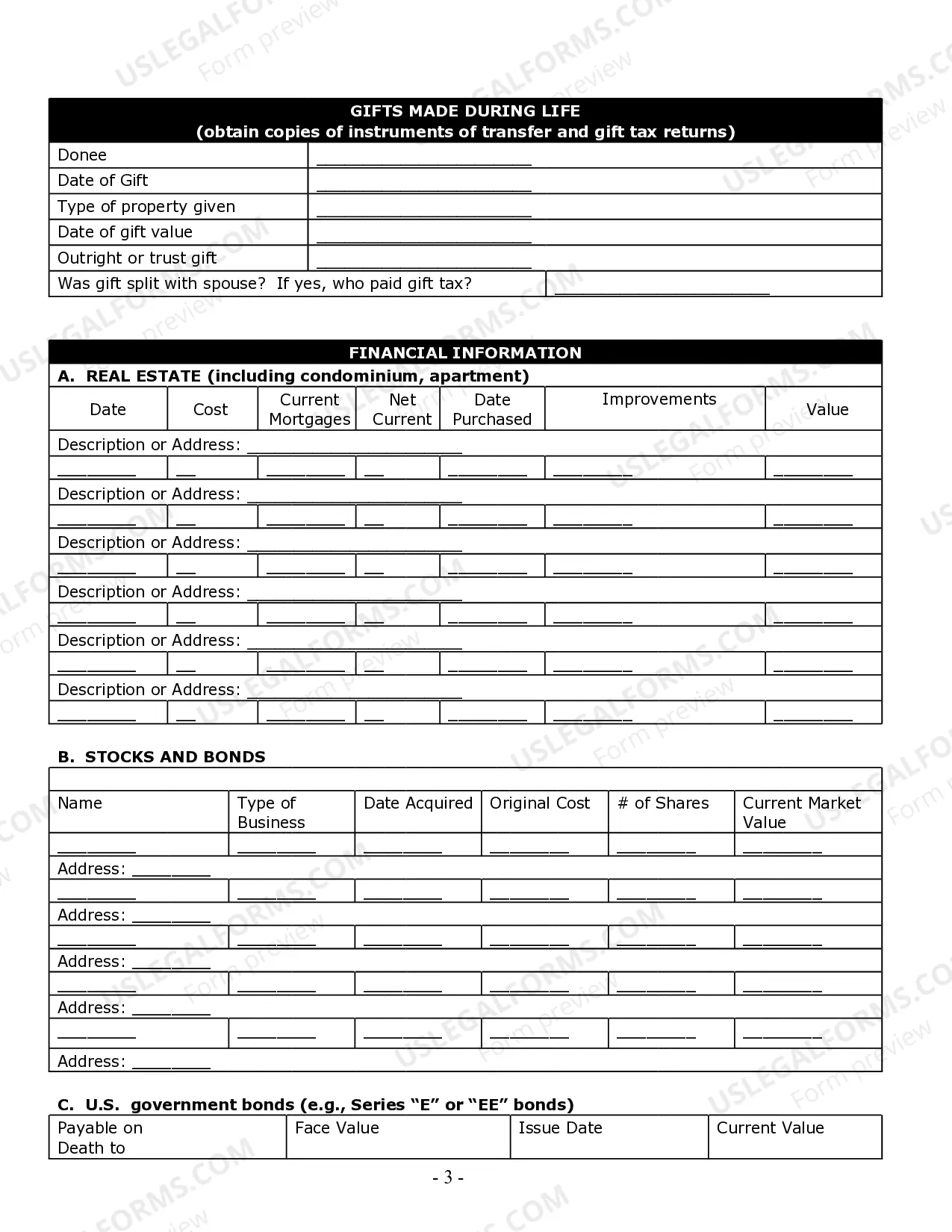

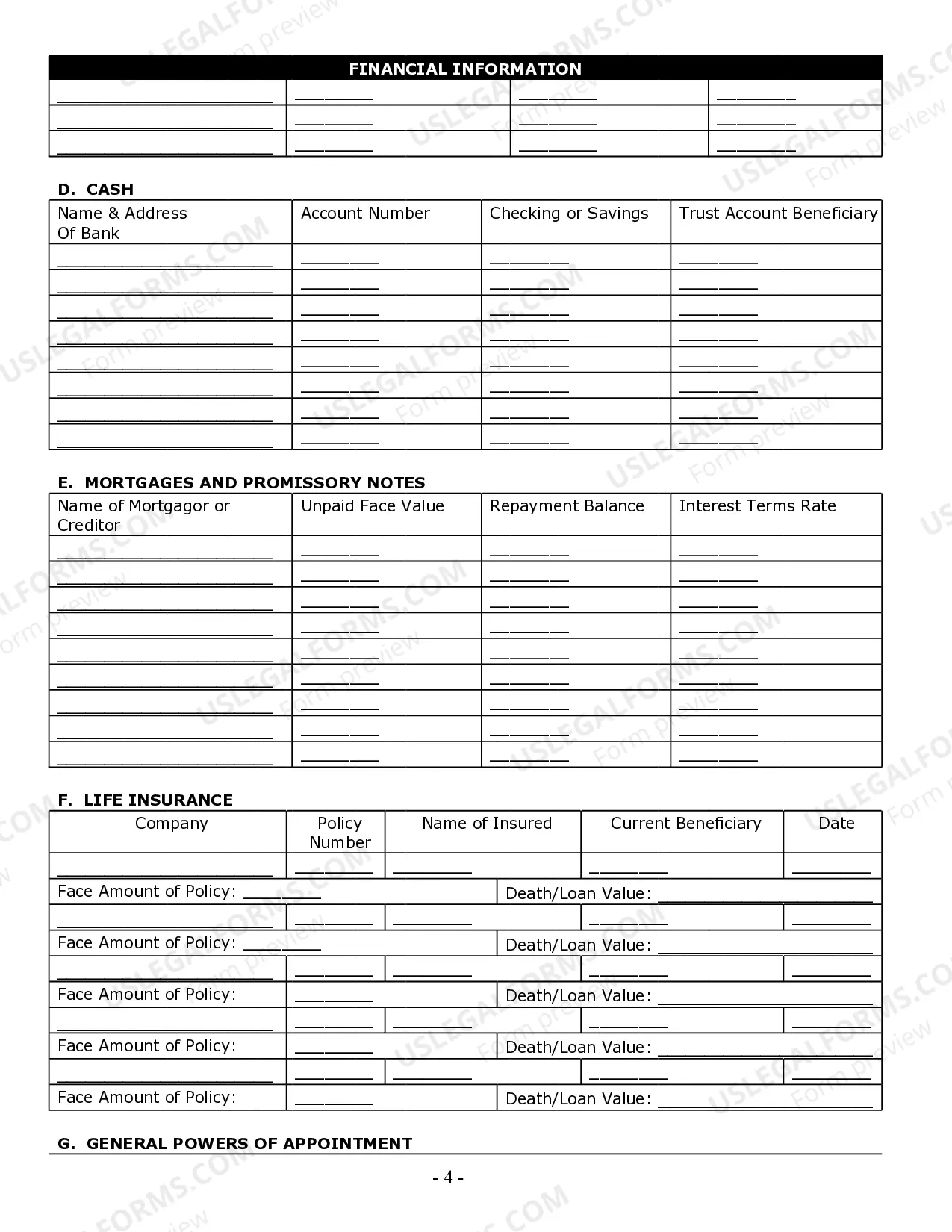

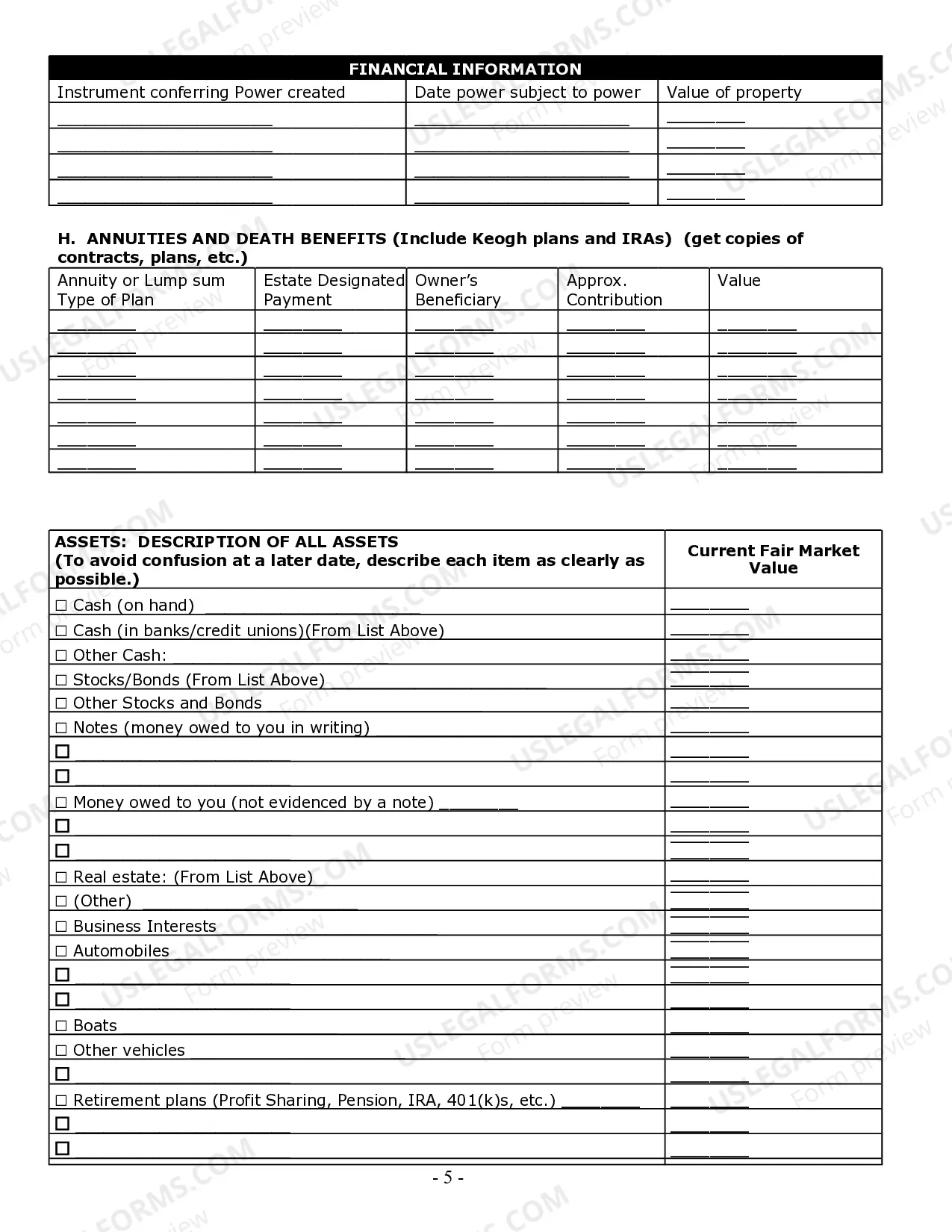

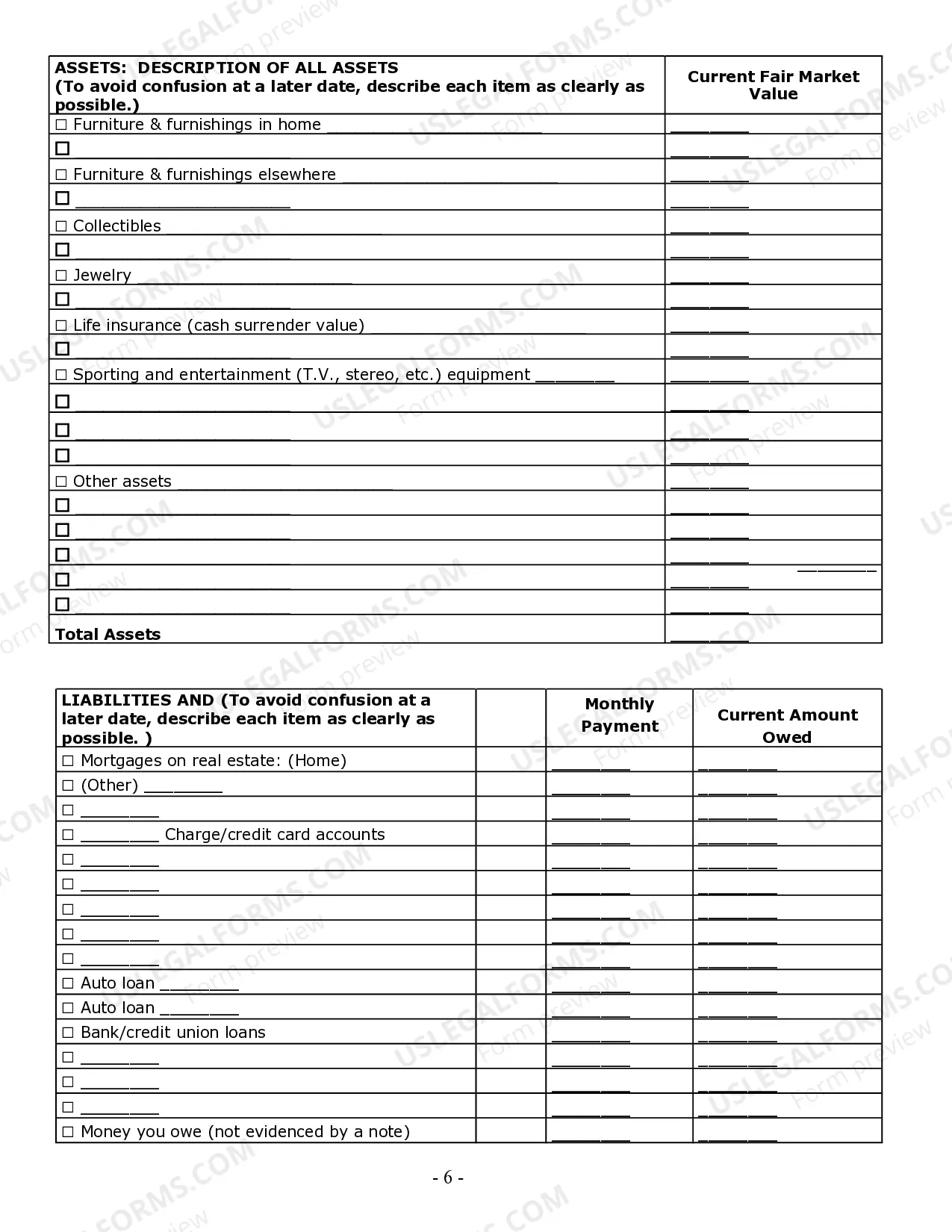

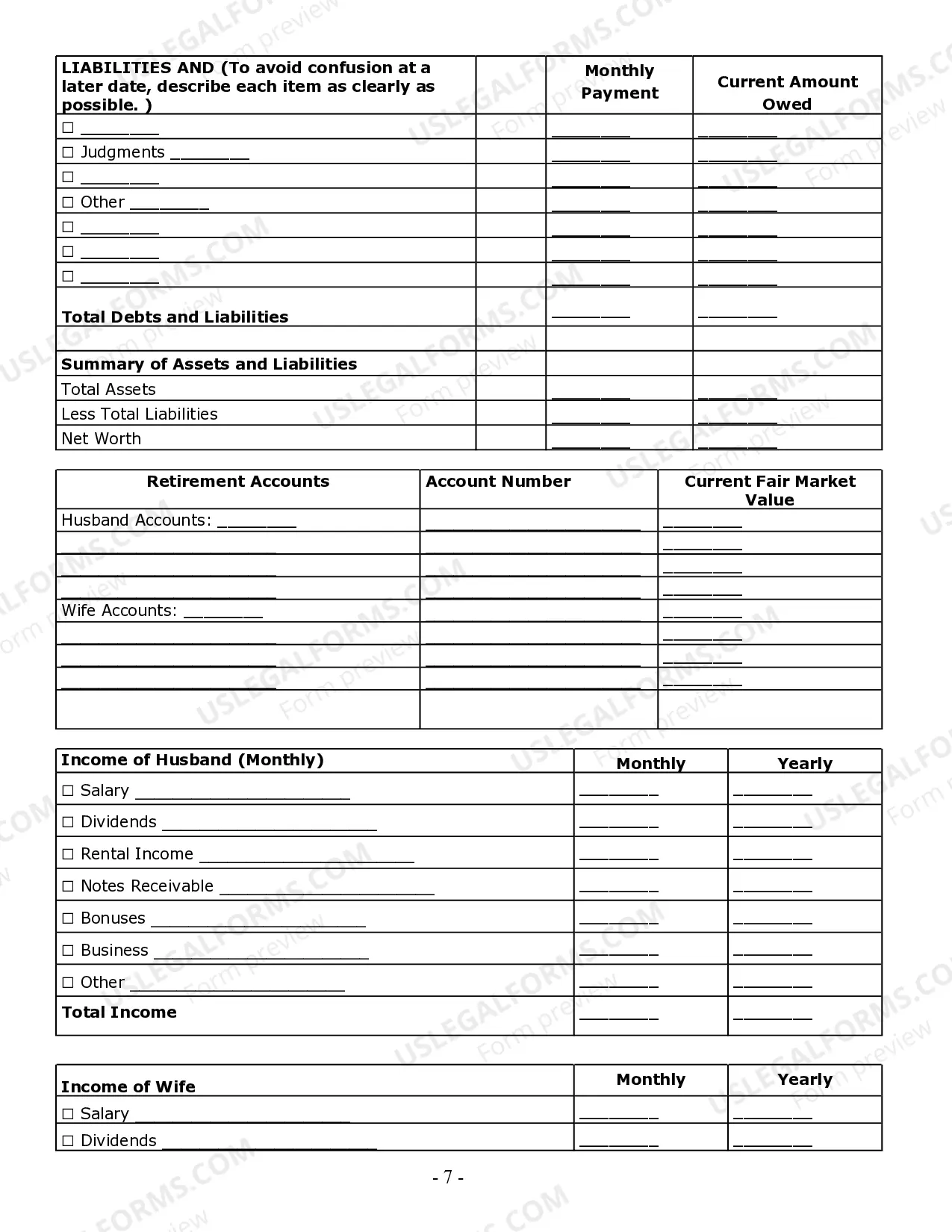

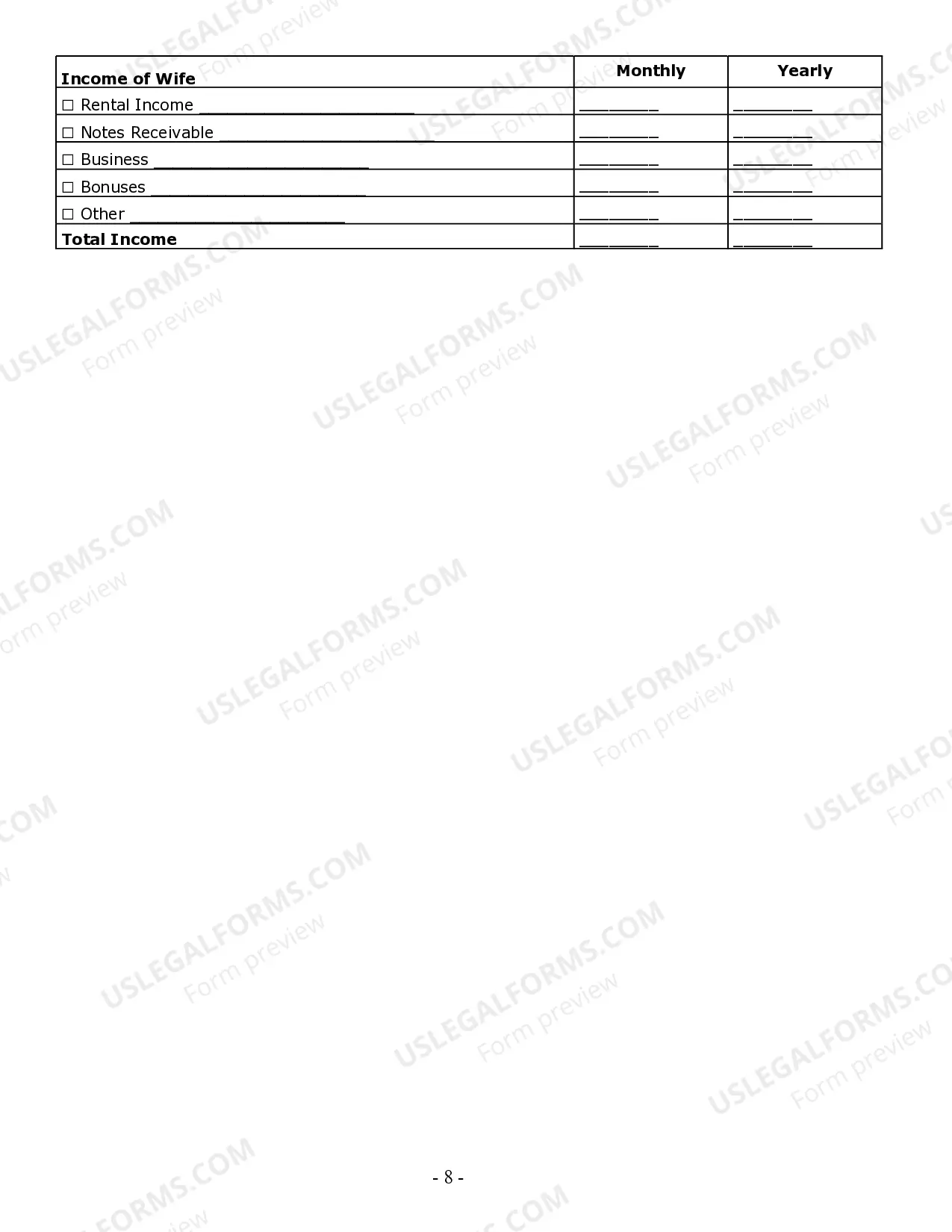

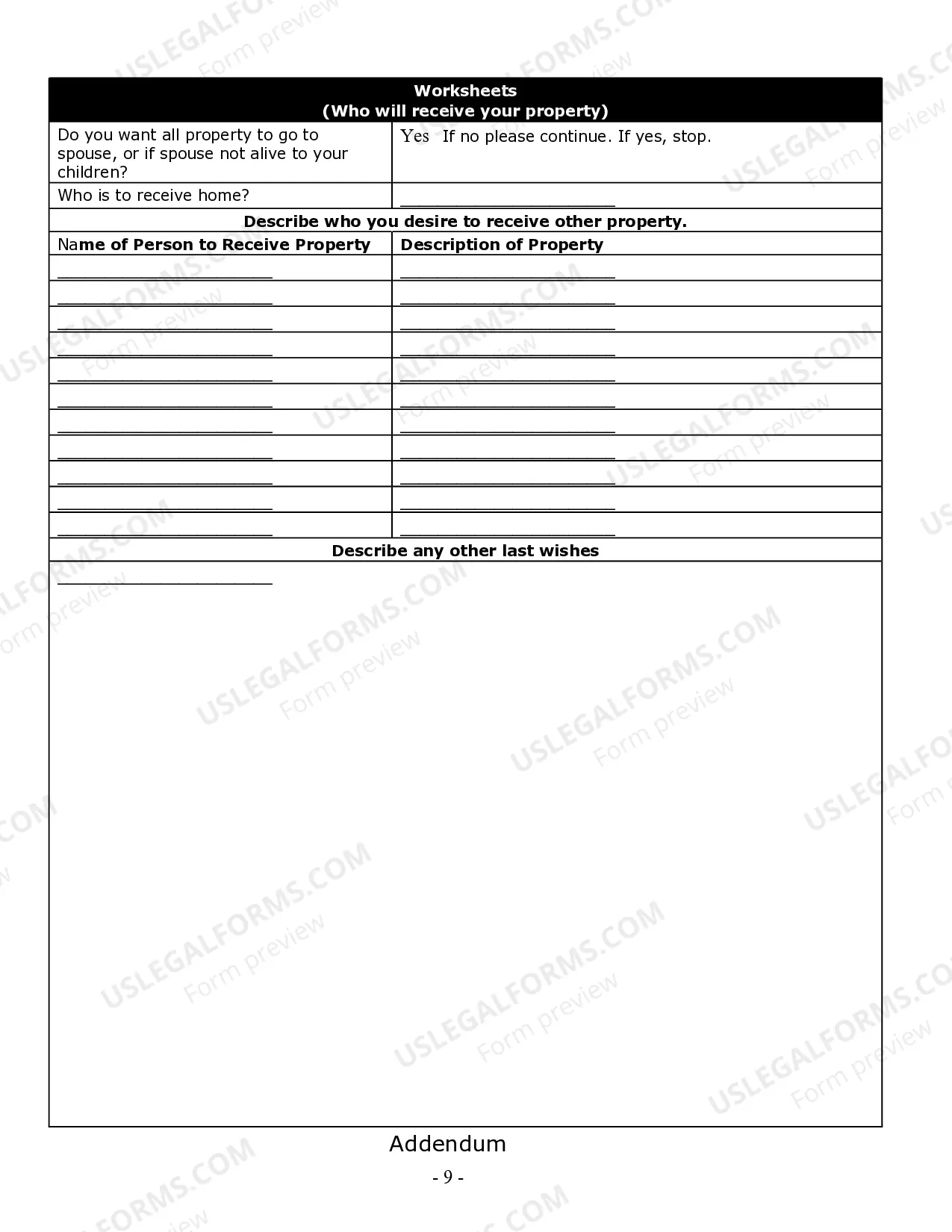

Fort Lauderdale, Florida Estate Planning Questionnaire and Worksheets are comprehensive tools designed to assist individuals in organizing and documenting their estate planning wishes and preferences. With these questionnaires and worksheets, individuals can effectively plan for the distribution of their assets, outline their healthcare and financial decisions, and address important legal considerations. The Fort Lauderdale, Florida Estate Planning Questionnaire and Worksheets cover essential aspects of estate planning, ensuring that no crucial detail is overlooked. They typically include sections such as personal information, family members, asset inventory, beneficiaries, healthcare preferences, power of attorney designations, and final wishes. 1. Personal information: This section collects vital personal details, such as name, contact information, and identification documents. It is essential for establishing the legal identity of the individual. 2. Family members: These worksheets provide a space to record information about immediate family members, such as spouses, children, and grandchildren. They may also include details about any previous marriages or divorced partners. 3. Asset inventory: In this section, individuals can list and describe all their assets, including bank accounts, properties, investments, and valuable possessions. Assigning accurate values to these assets is crucial for effective estate planning. 4. Beneficiaries: These questionnaires help individuals define their desired beneficiaries for their assets. Individuals can specify the percentage or specific items they want to allocate to each beneficiary, ensuring their intentions are clear. 5. Healthcare preferences: Fort Lauderdale's estate planning materials often include worksheets for documenting healthcare and end-of-life preferences. These provide guidance for medical decisions in case an individual becomes incapacitated or unable to communicate their wishes. 6. Power of attorney designations: These documents allow individuals to appoint trusted individuals, known as attorneys-in-fact, to make decisions on their behalf regarding healthcare, finances, and legal matters. The questionnaires facilitate the designation of these agents and outline their responsibilities. 7. Final wishes: This section permits individuals to express their preferences regarding funeral arrangements, burial or cremation options, and any other specific requests they may have for their memorial service or disposition of remains. Fort Lauderdale, Florida Estate Planning Questionnaire and Worksheets are also available in different variations to cater to specific needs: 1. Basic Estate Planning Worksheets: These questionnaires provide a general overview of essential estate planning components and serve as a starting point for individuals new to the estate planning process. 2. Advanced Estate Planning Worksheets: For individuals with more complex financial situations or unique concerns, advanced worksheets offer more detailed sections for trust planning, tax considerations, business succession, and charitable giving. 3. Guardianship Designation Worksheets: These questionnaires focus specifically on appointing guardians for minor children. They help individuals determine their preferred guardians and outline important factors related to the upbringing and care of their children. In conclusion, Fort Lauderdale, Florida Estate Planning Questionnaire and Worksheets are comprehensive tools that aid individuals in organizing and documenting their estate planning wishes. With sections covering personal information, asset inventory, beneficiaries, healthcare preferences, power of attorney designations, and final wishes, these questionnaires offer a clear and structured approach to ensure efficient estate planning. Different variations cater to various needs, including basic planning, advanced financial situations, and guardianship designation.

Fort Lauderdale Florida Estate Planning Questionnaire and Worksheets

Description

How to fill out Fort Lauderdale Florida Estate Planning Questionnaire And Worksheets?

We consistently aim to minimize or prevent legal complications when handling intricate law-related or financial matters.

To achieve this, we seek attorney options that are generally very costly.

Nonetheless, not all legal complications are similarly intricate.

The majority can be managed by ourselves.

Take advantage of US Legal Forms whenever you need to acquire and download the Fort Lauderdale Florida Estate Planning Questionnaire and Worksheets or any other document swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your matters independently without resorting to a lawyer.

- We offer access to legal document templates that are not always publicly accessible.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

Yes, you can write your own will and have it notarized in Florida. Utilizing the Fort Lauderdale Florida Estate Planning Questionnaire and Worksheets can guide you through the necessary steps. Just ensure that your will includes essential elements to be valid, such as your signature and witnesses. Notarization can add an extra layer of authenticity, making your document stronger.

You do not need a lawyer to make a will in Florida, but consulting one can provide valuable insight. Many people use the Fort Lauderdale Florida Estate Planning Questionnaire and Worksheets to draft a will on their own. However, if your estate is complex or you have specific wishes, a lawyer can help ensure all legal requirements are met. It's important to make sure your will reflects your intentions clearly.

Choosing between a will and a trust in Florida depends on your specific circumstances and goals. A will is straightforward and becomes effective upon your death, while a trust can provide benefits during your lifetime, such as avoiding probate. Many individuals find that a combination of both offers the best overall protection and flexibility. Utilizing the Fort Lauderdale Florida Estate Planning Questionnaire and Worksheets can help clarify your needs and guide you in making the best decision.

The estate planning process generally involves seven essential steps. First, assess your current financial situation and assets. Next, define your goals, then choose the right tools, such as wills and trusts. Following that, select your beneficiaries and powers of attorney, ensure proper documentation, and finally, review and update your plan regularly. The Fort Lauderdale Florida Estate Planning Questionnaire and Worksheets can simplify these steps, making your planning process more efficient.

Yes, you can prepare your own will in Florida without a lawyer, but it is essential to follow state laws closely. Using resources like the Fort Lauderdale Florida Estate Planning Questionnaire and Worksheets can guide you in correctly drafting your will. However, you may wish to have a legal professional review it to ensure that it meets all legal requirements, which can help avoid complications later.

Writing a last will and testament in Florida involves several key steps. Begin by clearly stating your title as the testator, then detail your assets and how you wish to distribute them. Include information about guardianship for minor children if applicable. To ensure validity, you should sign the document in the presence of at least two witnesses, which you can easily manage using the Fort Lauderdale Florida Estate Planning Questionnaire and Worksheets.

The seven steps in financial planning are setting financial goals, gathering financial data, analyzing current financial status, developing a financial plan, implementing the plan, monitoring progress, and making adjustments as needed. Each step helps create a solid foundation for your financial future. Incorporating the Fort Lauderdale Florida Estate Planning Questionnaire and Worksheets can simplify your financial planning and estate management process.

The most important part of estate planning is ensuring that your wishes are clearly outlined and legally documented. This protects your loved ones from confusion and potential disputes after your passing. Using resources like the Fort Lauderdale Florida Estate Planning Questionnaire and Worksheets can provide clarity and organization to your estate planning process.

The estate planning process generally involves identifying your assets, choosing an appropriate plan, selecting your beneficiaries, designating an executor, planning for taxes, considering guardianship for children, and finally, reviewing your plan. Following these steps ensures your loved ones are protected and your wishes are honored. The Fort Lauderdale Florida Estate Planning Questionnaire and Worksheets assist in mapping out each of these critical areas effectively.

The seven steps in the planning process include defining your goals, gathering information, analyzing your situation, exploring options, making decisions, implementing your plan, and reviewing your plan regularly. Each of these steps helps create a well-structured approach to your future. Utilizing resources like the Fort Lauderdale Florida Estate Planning Questionnaire and Worksheets can greatly enhance this planning journey.

Interesting Questions

More info

It's easy to see why when you hear how much your appraiser can get paid. Many appraisers are making six-figures from their work as the market rises or falls, but there's only so much they can do. With that in mind, you will probably want to create a charitable entity that will be able to hold and use your appreciated real estate in perpetuity. GSA is a nationwide nonprofit organization that can help the next generation buy homes in a more affordable way. The GSA Foundation gives to charities in a number of ways. There's no cost to you for your GSA Foundation membership, but it'll cost you more in legal fees and taxes. The GSA Foundation isn't just another charity. It helps you keep more of your tax dollars and other funds working for your organization in the long term. A GSA Trust is the perfect way to keep all of your money and property from the sale of the homes you buy by using your real estate appraisal report.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.