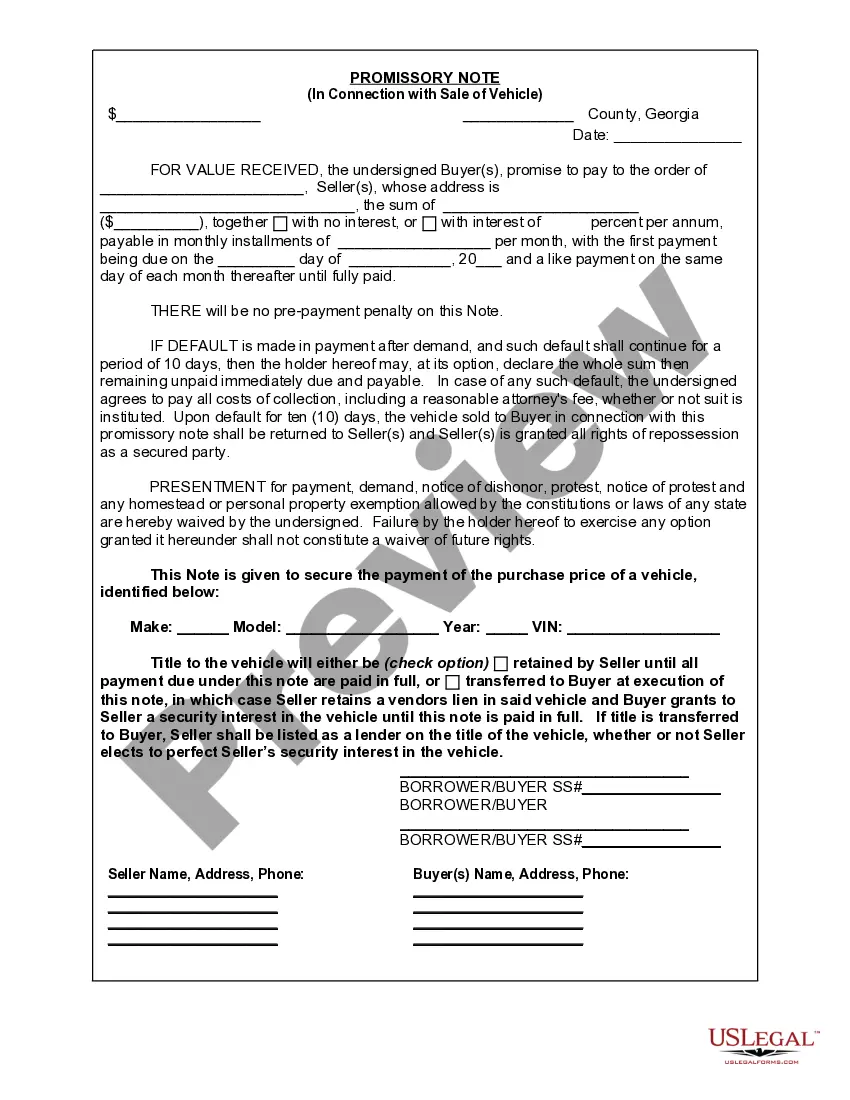

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Atlanta Georgia Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Georgia Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Irrespective of social or occupational standing, completing legal paperwork is an unfortunate obligation in today's professional landscape.

Frequently, it’s nearly unfeasible for someone lacking any legal training to construct such documents from scratch, primarily due to the complex terminology and legal intricacies they entail.

This is where US Legal Forms proves to be beneficial.

Ensure the form you selected fits your region, considering that regulations in one state or county don’t apply to another.

Examine the document and review a brief description (if available) of situations for which the paper may be utilized.

- Our service provides an extensive repository of over 85,000 ready-to-use state-specific documents applicable to nearly any legal situation.

- US Legal Forms also acts as a remarkable tool for associates or legal advisors aiming to enhance their efficiency with our DIY forms.

- Whether you require the Atlanta Georgia Promissory Note concerning the Sale of a Vehicle or any other document suitable for your state or county, with US Legal Forms, everything is readily accessible.

- Here’s how to obtain the Atlanta Georgia Promissory Note regarding the Sale of a Vehicle swiftly using our reliable service.

- If you are currently a member, feel free to Log In to your account to download the relevant form.

- However, if you’re new to our library, ensure to follow these guidelines prior to downloading the Atlanta Georgia Promissory Note in Relation to the Sale of a Vehicle.

Form popularity

FAQ

Governing Law. A Georgia promissory note must be signed and dated by the borrower and a witness. It should also be notarized.

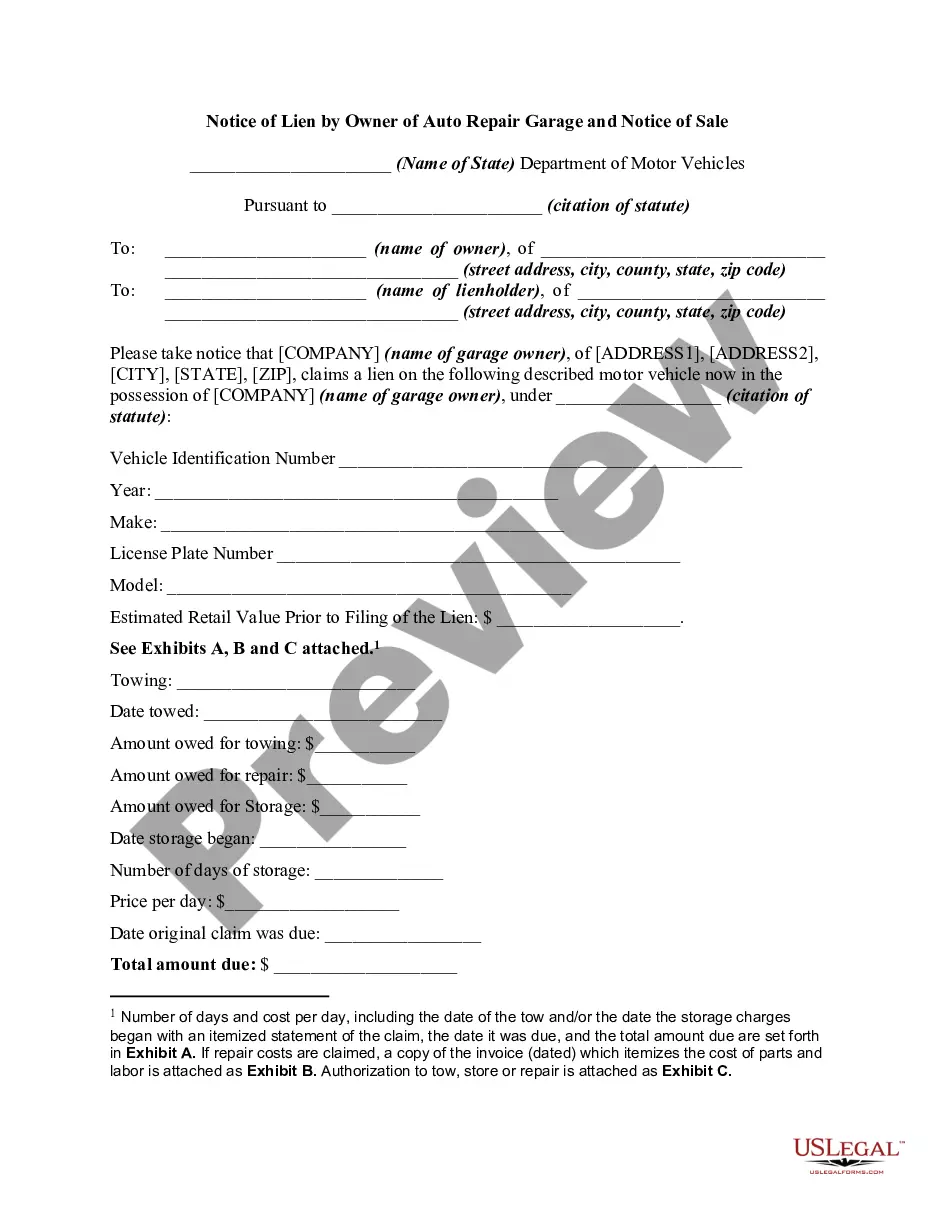

Information contained in a basic vehicle promissory note should include: The amount of the loan. How payment will be made. What the interest rate will be. What the payment schedule will be. What the grace period on payments is, if any. What defaulting and missed payment penalties will be.

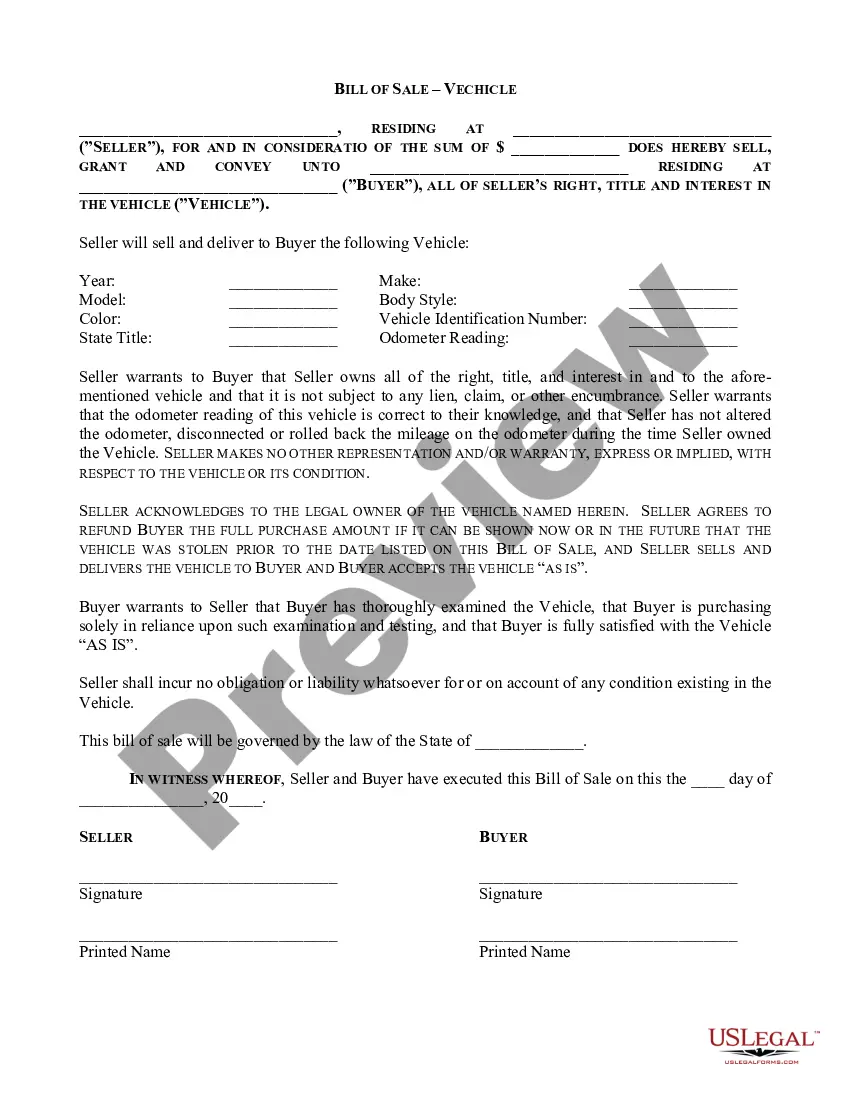

A promissory note is a promise to pay. So a bill of sale for an automobile with a promissory note is what you might expect from the (very long) name: A certification someone has bought, and promises to pay for, your car. In this case, likely in monthly installments.

A car promissory note is an agreement where a borrower promises to make payments in exchange for a vehicle. It typically has even terms throughout the loan, but often also includes a lump sum down payment at the beginning of the loan term. It also should include information about the make and model of the vehicle.

Financial institutions such as banks and lenders often use promissory notes when issuing real estate mortgage loans or student loans. Companies or individuals also use promissory notes when issuing or taking on personal loans or corporate loans.

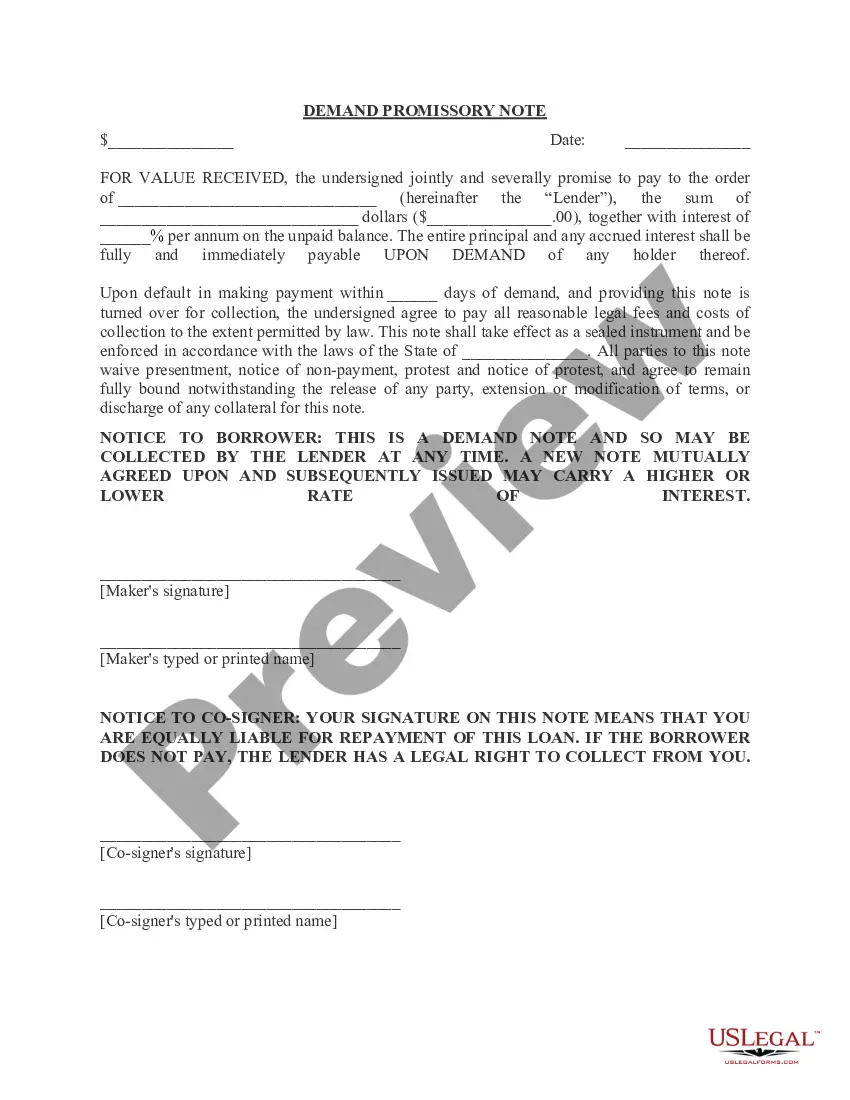

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends. If you are lending a large amount of money to someone (or to a business), then you may want to create a promissory note from a promissory note template.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

The promissory note should only be used if the buyer intends to make a down payment at the time of purchase and pay the remainder over time.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.