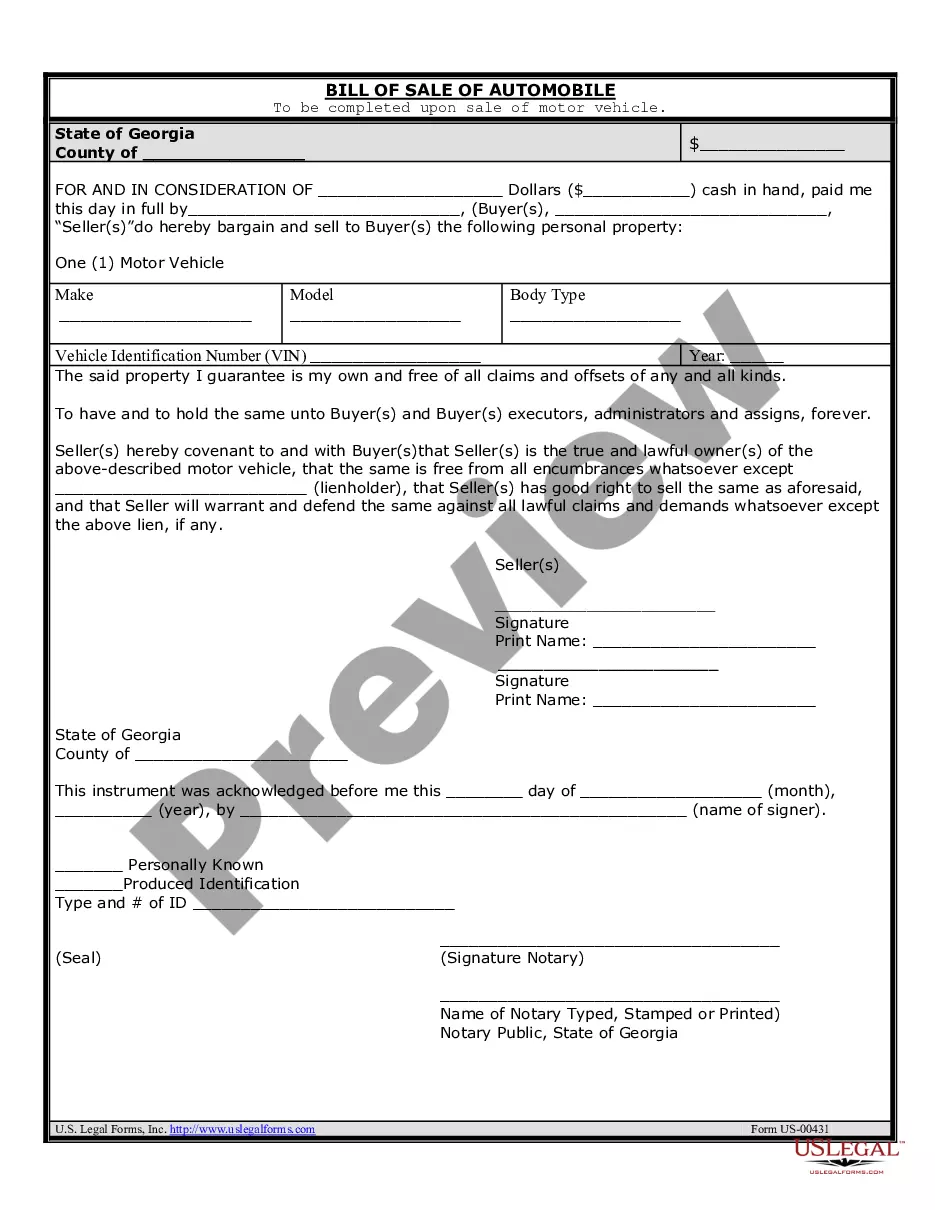

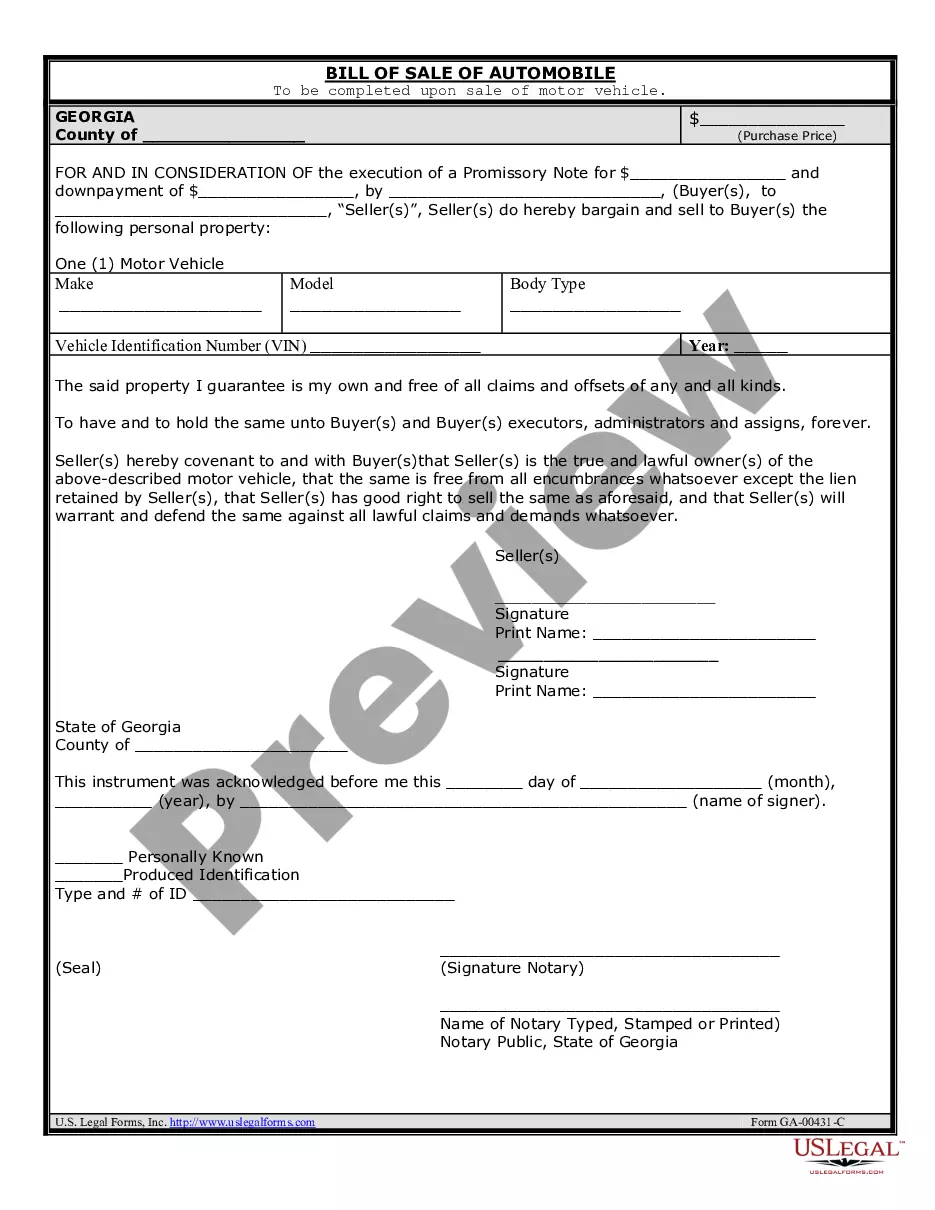

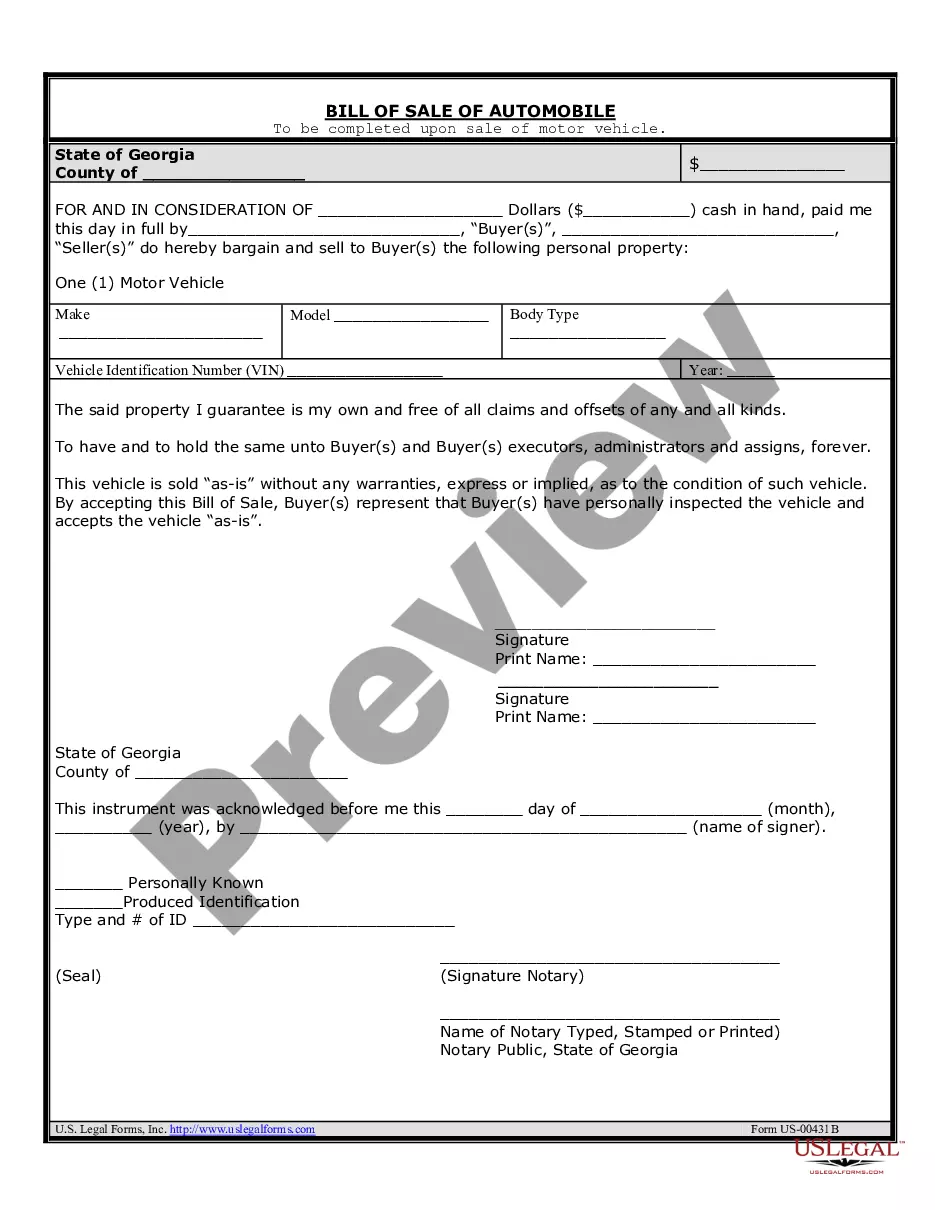

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Savannah Georgia Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and a seller. This type of promissory note is commonly used when a seller has agreed to finance all or a portion of the purchase price of a vehicle, allowing the buyer to make installment payments over a period of time. Keywords: Savannah Georgia Promissory Note, sale of vehicle, automobile, loan agreement, buyer, seller, finance, installment payments. There are several types of Savannah Georgia Promissory Notes in connection with the sale of a vehicle or automobile, depending on the specific terms agreed upon between the buyer and seller. Some common types include: 1. Simple Installment Sale Promissory Note: This type of promissory note outlines the buyer's obligation to make regular installment payments to the seller until the total purchase price is paid off. The note specifies the payment schedule, interest rate (if any), and consequences for default. 2. Balloon Payment Promissory Note: In this type of promissory note, the buyer agrees to make smaller monthly payments over a set period of time, but with a large final "balloon" payment due at the end of the loan term. This option can help buyers who may not have immediate access to a large sum of money but expect a lump sum payment in the future. 3. Secured Promissory Note: This note is used when the seller requires the buyer to provide collateral, such as the vehicle being purchased, to secure the loan. If the buyer defaults on the payments, the seller has the right to repossess the vehicle and sell it to recover their losses. 4. Unsecured Promissory Note: Unlike a secured note, an unsecured note does not require collateral. The buyer is still obligated to make payments, but the seller does not have a specific asset to repossess in case of default. This type of promissory note is typically used when the buyer has a good credit history and a high likelihood of repayment. 5. Interest-Free Promissory Note: In some cases, the buyer and seller may agree to a promissory note without any interest charged. This can be beneficial for the buyer as it reduces the overall cost of the loan, while still providing a clear repayment structure. It is important to note that creating and executing a Savannah Georgia Promissory Note should be done with the guidance of legal professionals to ensure compliance with state laws and protection of both parties involved in the transaction.A Savannah Georgia Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and a seller. This type of promissory note is commonly used when a seller has agreed to finance all or a portion of the purchase price of a vehicle, allowing the buyer to make installment payments over a period of time. Keywords: Savannah Georgia Promissory Note, sale of vehicle, automobile, loan agreement, buyer, seller, finance, installment payments. There are several types of Savannah Georgia Promissory Notes in connection with the sale of a vehicle or automobile, depending on the specific terms agreed upon between the buyer and seller. Some common types include: 1. Simple Installment Sale Promissory Note: This type of promissory note outlines the buyer's obligation to make regular installment payments to the seller until the total purchase price is paid off. The note specifies the payment schedule, interest rate (if any), and consequences for default. 2. Balloon Payment Promissory Note: In this type of promissory note, the buyer agrees to make smaller monthly payments over a set period of time, but with a large final "balloon" payment due at the end of the loan term. This option can help buyers who may not have immediate access to a large sum of money but expect a lump sum payment in the future. 3. Secured Promissory Note: This note is used when the seller requires the buyer to provide collateral, such as the vehicle being purchased, to secure the loan. If the buyer defaults on the payments, the seller has the right to repossess the vehicle and sell it to recover their losses. 4. Unsecured Promissory Note: Unlike a secured note, an unsecured note does not require collateral. The buyer is still obligated to make payments, but the seller does not have a specific asset to repossess in case of default. This type of promissory note is typically used when the buyer has a good credit history and a high likelihood of repayment. 5. Interest-Free Promissory Note: In some cases, the buyer and seller may agree to a promissory note without any interest charged. This can be beneficial for the buyer as it reduces the overall cost of the loan, while still providing a clear repayment structure. It is important to note that creating and executing a Savannah Georgia Promissory Note should be done with the guidance of legal professionals to ensure compliance with state laws and protection of both parties involved in the transaction.