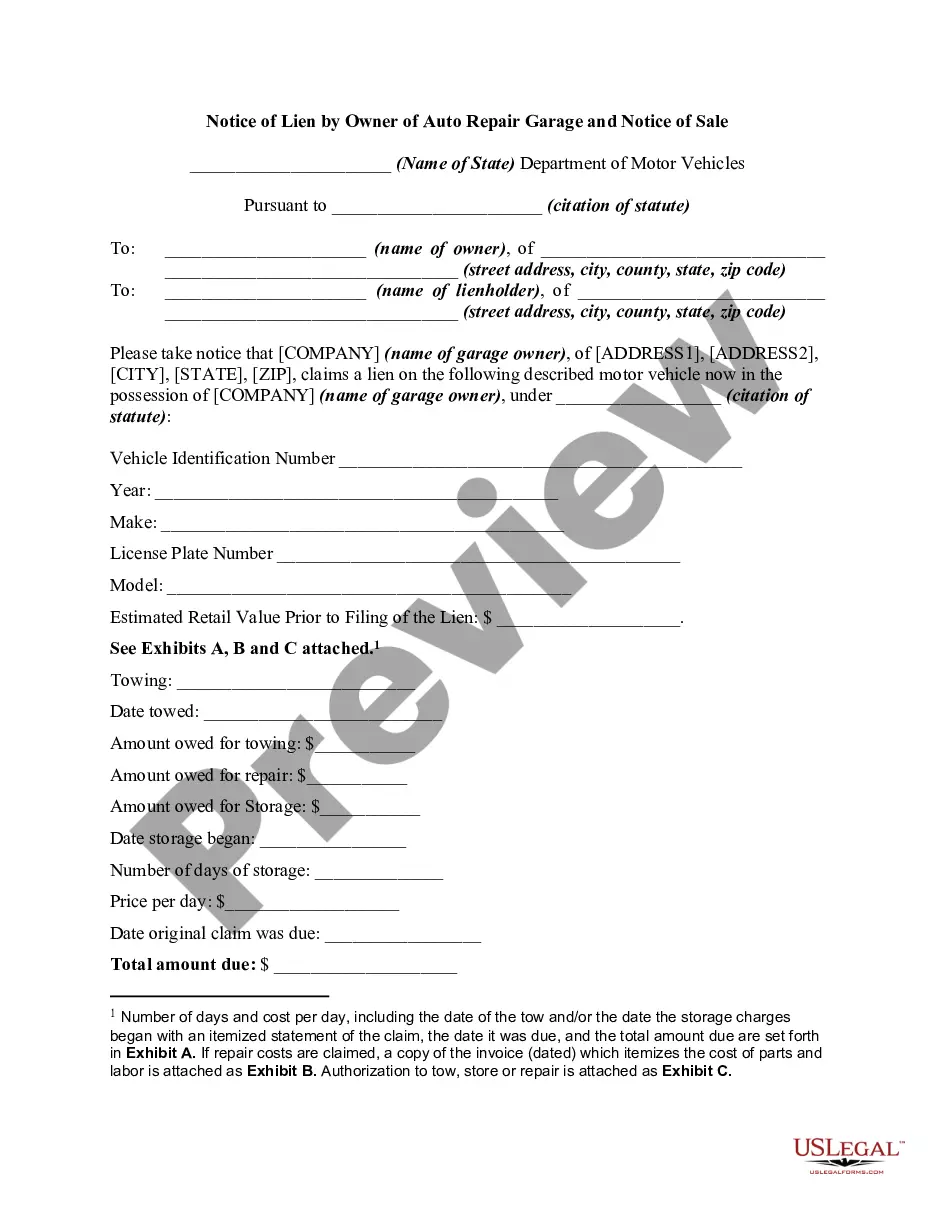

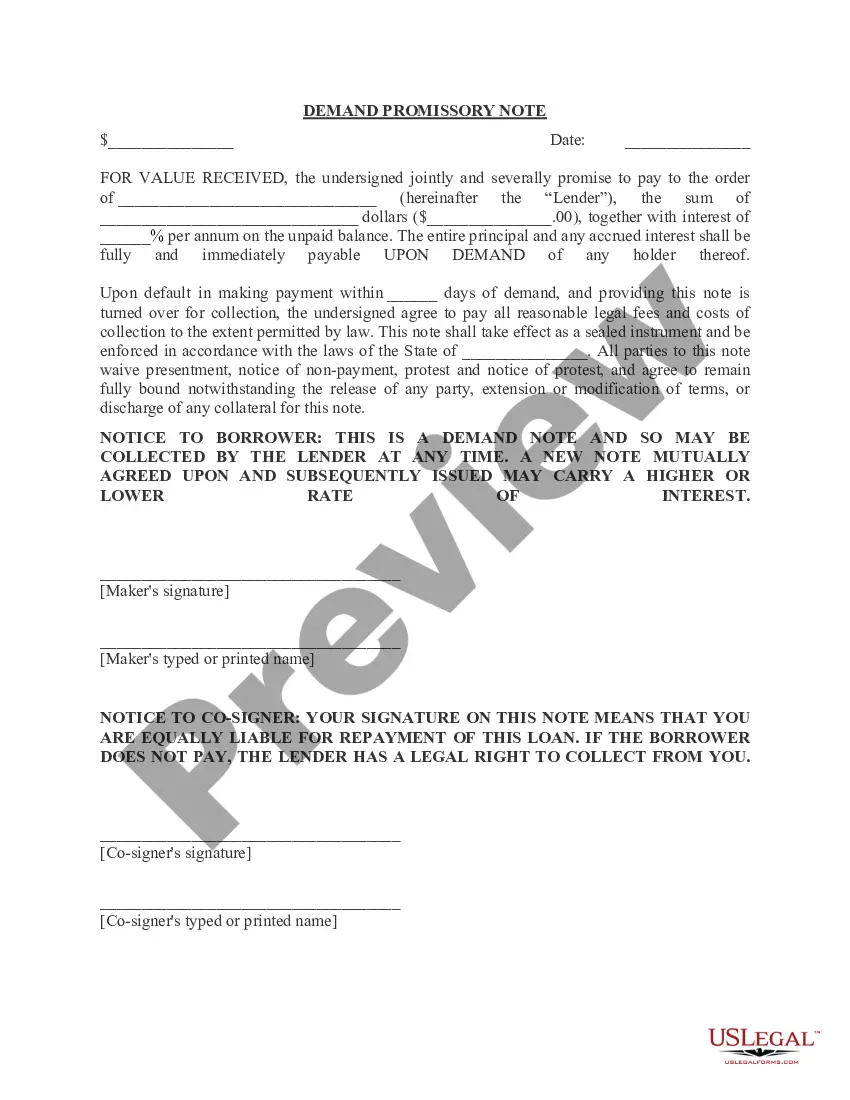

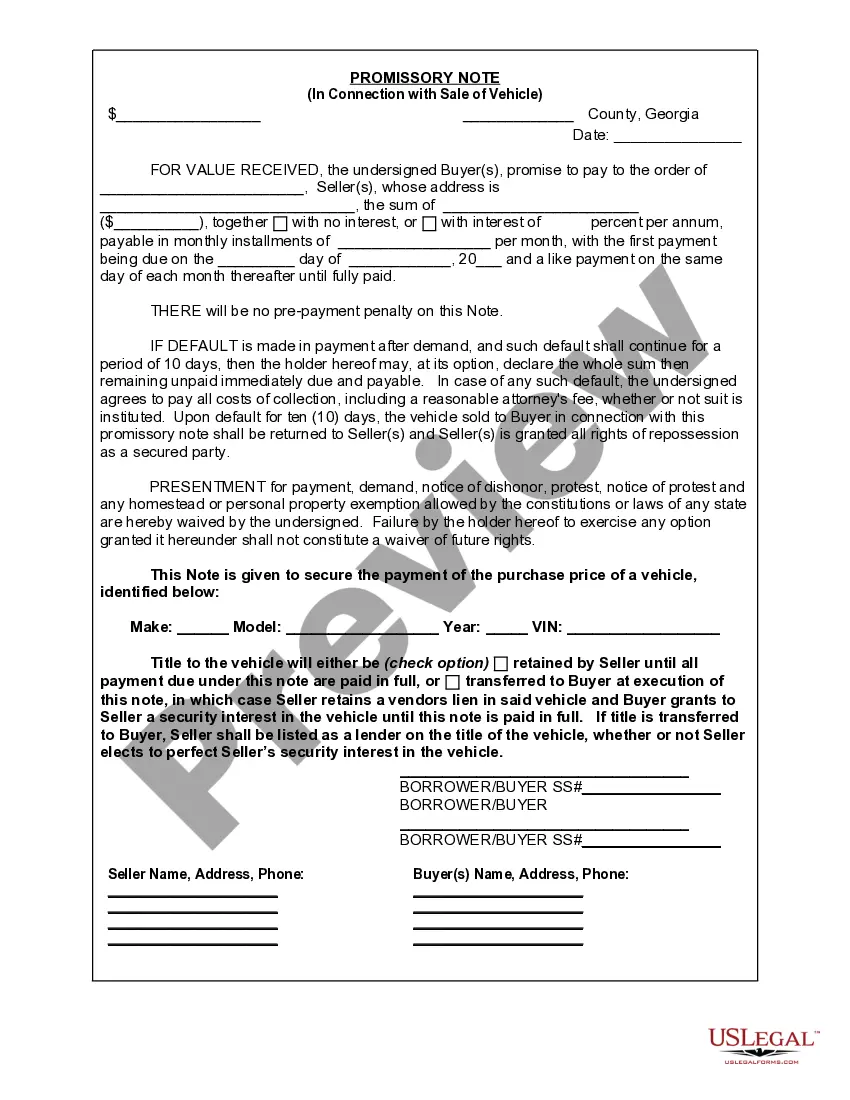

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

South Fulton Georgia Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Georgia Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Are you seeking a reliable and cost-effective provider of legal documents to acquire the South Fulton Georgia Promissory Note in relation to the Sale of a Vehicle or Automobile? US Legal Forms is your best choice.

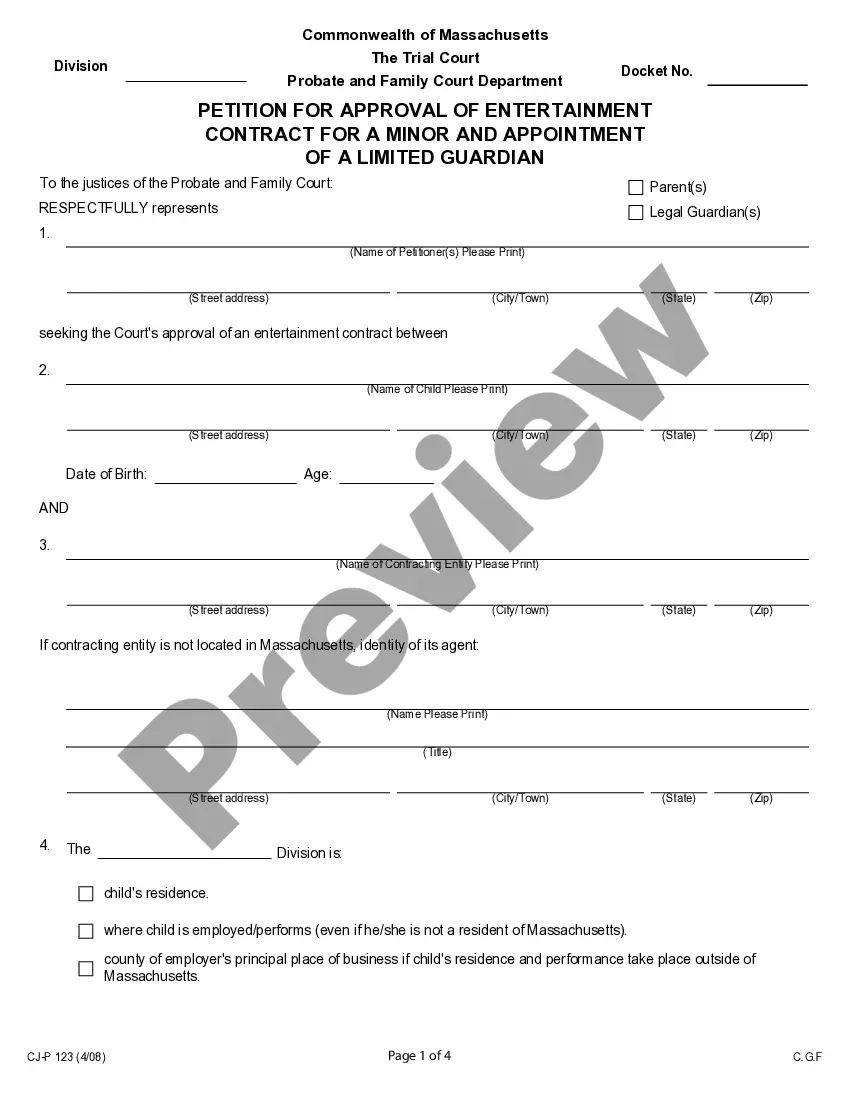

Whether you need a basic agreement to outline terms for living with your partner or a collection of files to facilitate your separation or divorce via the court system, we have you covered. Our platform offers over 85,000 current legal document templates for individual and business purposes. All templates that we provide are tailored and constructed in accordance with the guidelines of specific states and counties.

To retrieve the form, you must sign in to your account, find the necessary form, and click the Download button adjacent to it. Please remember that you can obtain your previously acquired document templates at any time in the My documents section.

Is this your initial visit to our platform? No need for concern. You can swiftly create an account, but before doing so, ensure you take the following steps.

Now you can proceed to register your account. Then select the subscription option and continue to payment. Once the payment is completed, download the South Fulton Georgia Promissory Note in relation to the Sale of a Vehicle or Automobile in any available format. You can revisit the website whenever you need and redownload the form without any additional fees.

Locating current legal documents has never been simpler. Try US Legal Forms today and put an end to wasting hours studying legal paperwork online once and for all.

- Verify that the South Fulton Georgia Promissory Note in relation to the Sale of a Vehicle or Automobile meets the regulations of your state and locality.

- Examine the details of the form (if available) to understand who and what the form is intended for.

- Restart your search if the form does not fit your legal circumstances.

Form popularity

FAQ

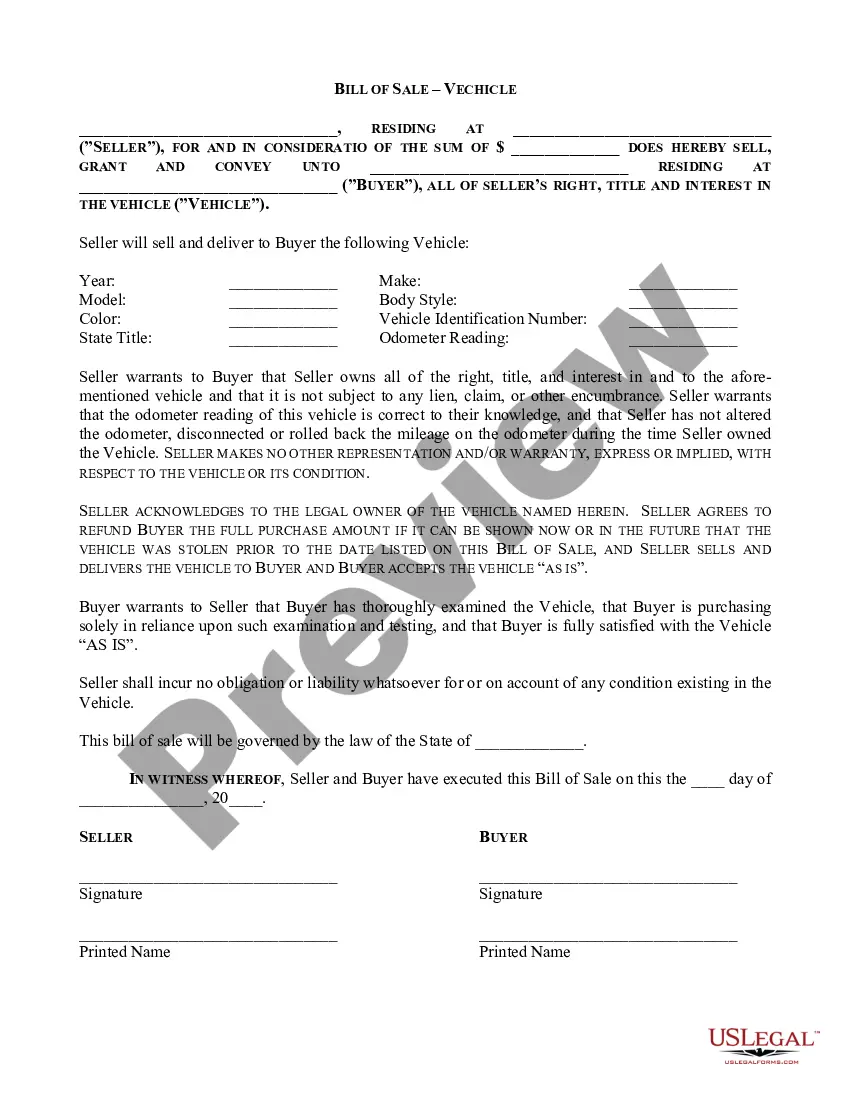

Filling out the South Fulton Georgia Promissory Note in Connection with Sale of Vehicle or Automobile is straightforward. Begin by entering the names and addresses of both the buyer and seller. Next, specify the amount being financed, the payment schedule, and any interest rates. Finally, include signatures and dates to validate the agreement.

For a South Fulton Georgia Promissory Note in Connection with Sale of Vehicle or Automobile to be valid, it must include certain key elements. These include the names of the borrower and lender, the amount borrowed, the interest rate if applicable, and the repayment terms. Additionally, both parties should sign the document to indicate their agreement. Following these guidelines will help ensure your promissory note stands up in a legal setting.

No, a promissory note does not need to be notarized in Georgia. However, a South Fulton Georgia Promissory Note in Connection with Sale of Vehicle or Automobile may benefit from notarization for clarity during legal challenges. A notarized note can serve as reliable proof in court if issues arise. It is a simple step that can provide peace of mind.

Yes, promissory notes are legally enforceable contracts. A South Fulton Georgia Promissory Note in Connection with Sale of Vehicle or Automobile outlines the borrower's promise to repay a specified amount, making it a binding agreement. If the borrower fails to comply, the lender can take legal action to recover the owed amount. Ensure that your document meets the necessary legal requirements to uphold its enforceability.

Yes, a South Fulton Georgia Promissory Note in Connection with Sale of Vehicle or Automobile can be valid even if it is not notarized. However, notarization adds an extra layer of security by verifying the identities of the parties involved. In the event of a dispute, having a notarized document may strengthen your position. Therefore, while notarization is not mandatory, it is often recommended.

Yes, you can use a promissory note to buy a car. This method allows you to secure financing where the seller agrees to accept payments over time. Be sure to include clear terms in your South Fulton Georgia Promissory Note in Connection with Sale of Vehicle or Automobile to ensure both parties understand the expectations. You can explore platforms like uslegalforms to help you create a legally sound document.

Writing a promissory note for a car involves specifying the details of the transaction. Include the name of the borrower and lender, the vehicle's identification details, the amount, payment schedules, and any interest rates. Make sure to sign and date the note to validate it legally. A well-prepared South Fulton Georgia Promissory Note in Connection with Sale of Vehicle or Automobile can protect both parties' interests.

To write a simple promissory note, begin with the title that states it's a promissory note. Clearly include the borrower's name, the lender's name, the amount borrowed, and the repayment terms. Additionally, specify the interest rate if applicable, and sign the document. This South Fulton Georgia Promissory Note in Connection with Sale of Vehicle or Automobile should detail all terms to avoid confusion later.

In Georgia, promissory notes do not necessarily need to be notarized to be valid, but notarization can add an extra layer of security. While a South Fulton Georgia Promissory Note in Connection with Sale of Vehicle or Automobile can be legally binding without a notary, having it notarized can simplify the enforcement process in case of a dispute. It may also provide credibility to the document in court. Considering notarization helps strengthen your transaction and safeguard your interests.

A promissory note is legally enforceable, provided it meets certain criteria established by law. To be valid, the South Fulton Georgia Promissory Note in Connection with Sale of Vehicle or Automobile must clearly outline the terms, include the signatures of both parties, and detail the payment schedule. If a borrower defaults, the lender can take legal action to collect the owed amount. This enforceability highlights the importance of having well-drafted promissory notes in vehicle transactions.