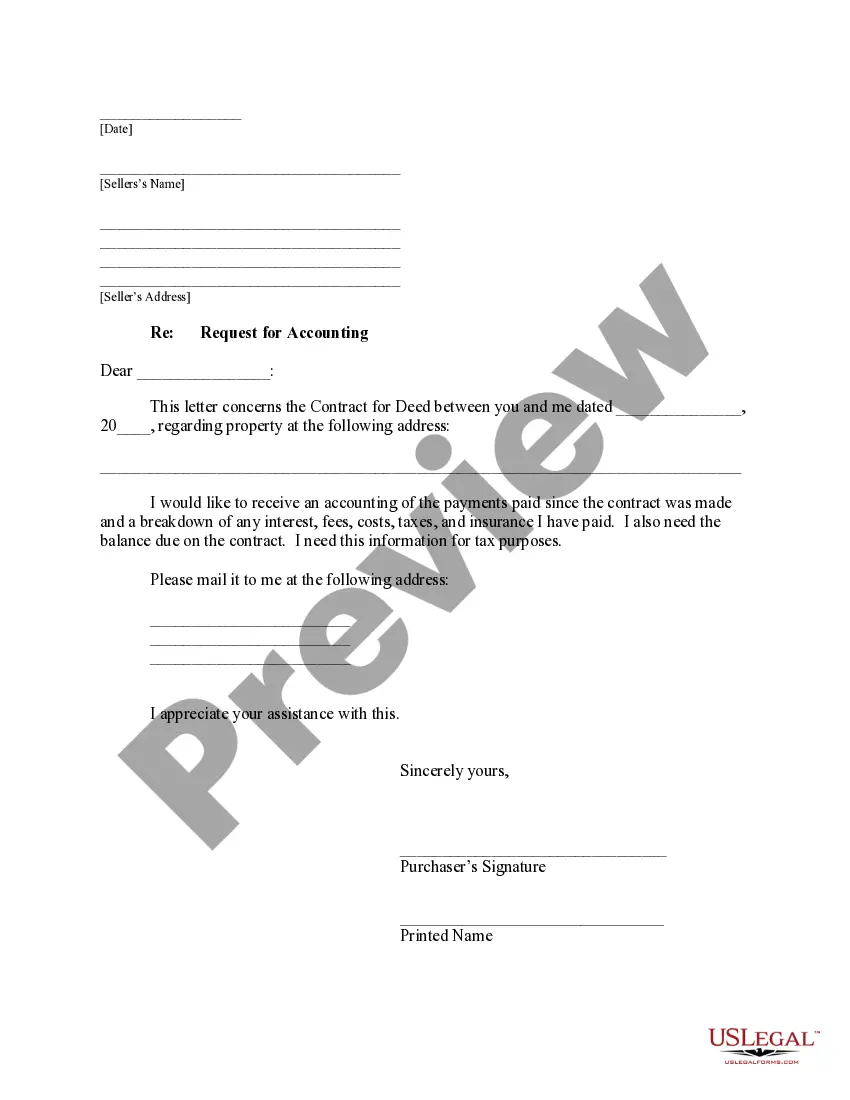

This is a Purchaser's Request of Accounting Statement from Seller. It is a request in writing to receive an accounting of the payments paid since the contract was made and a breakdown of any interest, fees, costs, taxes and insurance paid. It is also a request for the balance due on the contract.

Fulton Georgia Buyer's Request for Accounting from Seller under Contract for Deed When entering into a contract for deed in Fulton, Georgia, buyers often have the right to request an accounting from the seller. This request allows the buyers to receive a detailed breakdown of all financial transactions and obligations related to the property being sold. These accounting are crucial in ensuring transparency and maintaining a clear understanding of the financial aspects of the transaction. Keywords: Fulton Georgia, buyer's request, accounting, seller, contract for deed, financial transactions, obligations, transparency Different Types of Fulton Georgia Buyer's Request for Accounting from Seller under Contract for Deed: 1. Monthly Payments Accounting: This type of request focuses on the seller providing a clear breakdown of monthly payments made by the buyer against the purchase price. It includes a detailed explanation of principal, interest, and any additional fees applied during each payment period. 2. Escrow Account Accounting: In cases where an escrow account is established, the buyer may request an accounting specifically related to the funds held in the account. This includes details of deposits, withdrawals, and any interest earned. 3. Tax and Insurance Escrow Accounting: If the seller is responsible for managing tax and insurance payments, the buyer may request an accounting that outlines these expenses. It should provide a breakdown of the amount paid, due dates, and a confirmation of timely payments. 4. Conveyance Fee Accounting: To ensure transparency, buyers may request an accounting related to any conveyance fees assessed during the contract for deed transaction. This accounting will clearly detail the fees charged and any associated administrative costs. 5. Maintenance and Repair Expense Accounting: This type of request seeks an accounting of all maintenance and repair expenses incurred by the seller during the contract for deed period. It includes a breakdown of costs, nature of repairs, and supporting documentation, such as invoices and receipts. 6. Property Tax Accounting: Buyers may also request an accounting specifically related to property taxes. This includes information on tax assessments, due dates, and proof of timely payments made by the seller. In conclusion, Fulton Georgia buyers entering into a contract for deed have the right to request various accounting from the seller. These accounting range from monthly payment breakdowns to tax and insurance payments, maintenance expenses, and conveyance fees. Buyers should exercise their right to request these accounting to ensure transparency and understand the financial transactions and obligations associated with the property being purchased.Fulton Georgia Buyer's Request for Accounting from Seller under Contract for Deed When entering into a contract for deed in Fulton, Georgia, buyers often have the right to request an accounting from the seller. This request allows the buyers to receive a detailed breakdown of all financial transactions and obligations related to the property being sold. These accounting are crucial in ensuring transparency and maintaining a clear understanding of the financial aspects of the transaction. Keywords: Fulton Georgia, buyer's request, accounting, seller, contract for deed, financial transactions, obligations, transparency Different Types of Fulton Georgia Buyer's Request for Accounting from Seller under Contract for Deed: 1. Monthly Payments Accounting: This type of request focuses on the seller providing a clear breakdown of monthly payments made by the buyer against the purchase price. It includes a detailed explanation of principal, interest, and any additional fees applied during each payment period. 2. Escrow Account Accounting: In cases where an escrow account is established, the buyer may request an accounting specifically related to the funds held in the account. This includes details of deposits, withdrawals, and any interest earned. 3. Tax and Insurance Escrow Accounting: If the seller is responsible for managing tax and insurance payments, the buyer may request an accounting that outlines these expenses. It should provide a breakdown of the amount paid, due dates, and a confirmation of timely payments. 4. Conveyance Fee Accounting: To ensure transparency, buyers may request an accounting related to any conveyance fees assessed during the contract for deed transaction. This accounting will clearly detail the fees charged and any associated administrative costs. 5. Maintenance and Repair Expense Accounting: This type of request seeks an accounting of all maintenance and repair expenses incurred by the seller during the contract for deed period. It includes a breakdown of costs, nature of repairs, and supporting documentation, such as invoices and receipts. 6. Property Tax Accounting: Buyers may also request an accounting specifically related to property taxes. This includes information on tax assessments, due dates, and proof of timely payments made by the seller. In conclusion, Fulton Georgia buyers entering into a contract for deed have the right to request various accounting from the seller. These accounting range from monthly payment breakdowns to tax and insurance payments, maintenance expenses, and conveyance fees. Buyers should exercise their right to request these accounting to ensure transparency and understand the financial transactions and obligations associated with the property being purchased.