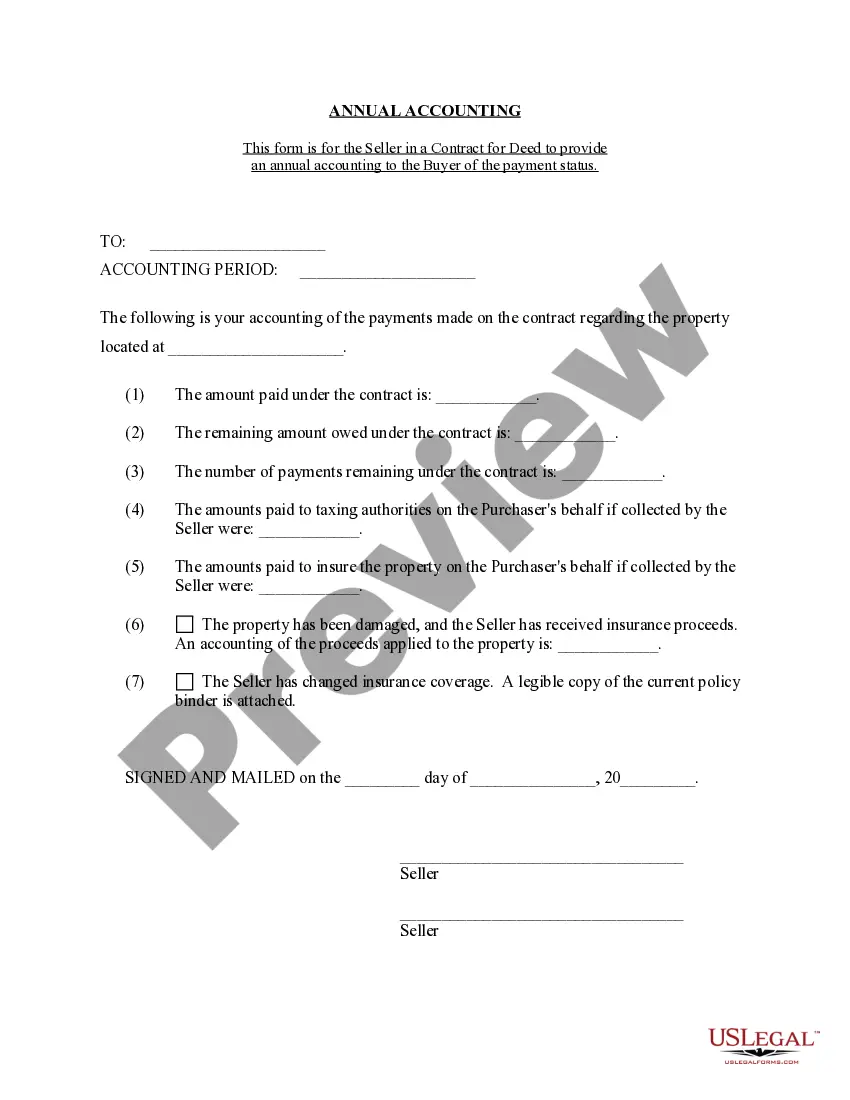

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Sandy Springs Georgia Contract for Deed Seller's Annual Accounting Statement is a crucial document required by both buyers and sellers involved in a contract for deed in Sandy Springs, Georgia. This financial statement provides detailed information about the financial transactions and obligations related to the contract for deed agreement. It serves as a transparent record of the payments made by the buyer and the expenses incurred by the seller over the course of a year. The Sandy Springs Georgia Contract for Deed Seller's Annual Accounting Statement includes essential components such as the property's address, the names of the buyer and seller, and the effective date of the accounting period. This statement features a comprehensive breakdown of all financial details, serving as proof of compliance with the terms of the contract between both parties. There are two primary types of Sandy Springs Georgia Contract for Deed Seller's Annual Accounting Statements: 1. Income Statement: This type of statement outlines the financial inflow of the seller from the buyer's payments. It provides a summary of all the payments received, such as the principal amount, interest, and any late fees or penalties accrued. The income statement also showcases any additional income generated from the property during the accounting period, such as rent or lease payments. 2. Expense Statement: The expense statement highlights all the expenses incurred by the seller during the accounting period. It includes mortgage payments, property taxes, insurance premiums, maintenance and repair costs, and any other relevant expenses directly related to the property. This statement demonstrates the seller's financial responsibilities in maintaining the property and ensuring its habitability. The Sandy Springs Georgia Contract for Deed Seller's Annual Accounting Statement is an essential tool for both buyers and sellers. It offers transparency and enables both parties to monitor the financial progress of the contract for deed agreement. By maintaining accurate annual accounting statements, sellers can ensure compliance with the terms of the contract, while buyers can stay informed about their financial contributions and remaining obligations.The Sandy Springs Georgia Contract for Deed Seller's Annual Accounting Statement is a crucial document required by both buyers and sellers involved in a contract for deed in Sandy Springs, Georgia. This financial statement provides detailed information about the financial transactions and obligations related to the contract for deed agreement. It serves as a transparent record of the payments made by the buyer and the expenses incurred by the seller over the course of a year. The Sandy Springs Georgia Contract for Deed Seller's Annual Accounting Statement includes essential components such as the property's address, the names of the buyer and seller, and the effective date of the accounting period. This statement features a comprehensive breakdown of all financial details, serving as proof of compliance with the terms of the contract between both parties. There are two primary types of Sandy Springs Georgia Contract for Deed Seller's Annual Accounting Statements: 1. Income Statement: This type of statement outlines the financial inflow of the seller from the buyer's payments. It provides a summary of all the payments received, such as the principal amount, interest, and any late fees or penalties accrued. The income statement also showcases any additional income generated from the property during the accounting period, such as rent or lease payments. 2. Expense Statement: The expense statement highlights all the expenses incurred by the seller during the accounting period. It includes mortgage payments, property taxes, insurance premiums, maintenance and repair costs, and any other relevant expenses directly related to the property. This statement demonstrates the seller's financial responsibilities in maintaining the property and ensuring its habitability. The Sandy Springs Georgia Contract for Deed Seller's Annual Accounting Statement is an essential tool for both buyers and sellers. It offers transparency and enables both parties to monitor the financial progress of the contract for deed agreement. By maintaining accurate annual accounting statements, sellers can ensure compliance with the terms of the contract, while buyers can stay informed about their financial contributions and remaining obligations.