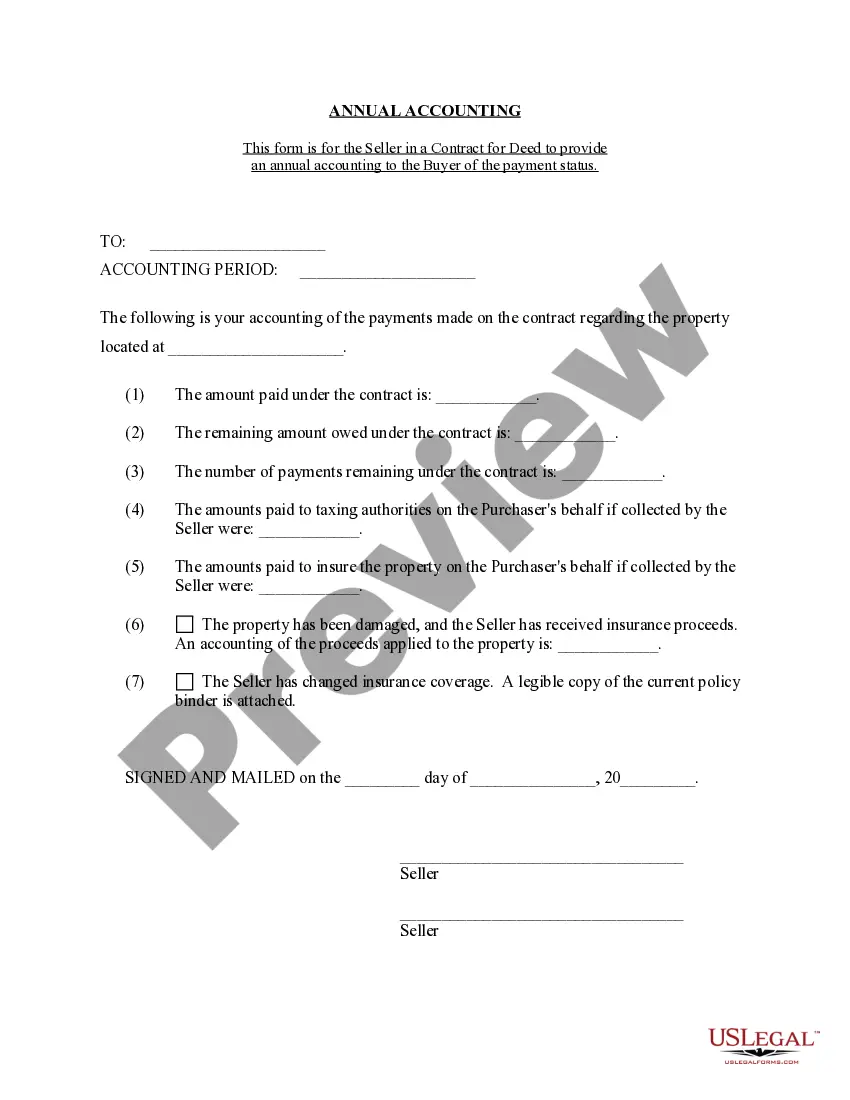

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

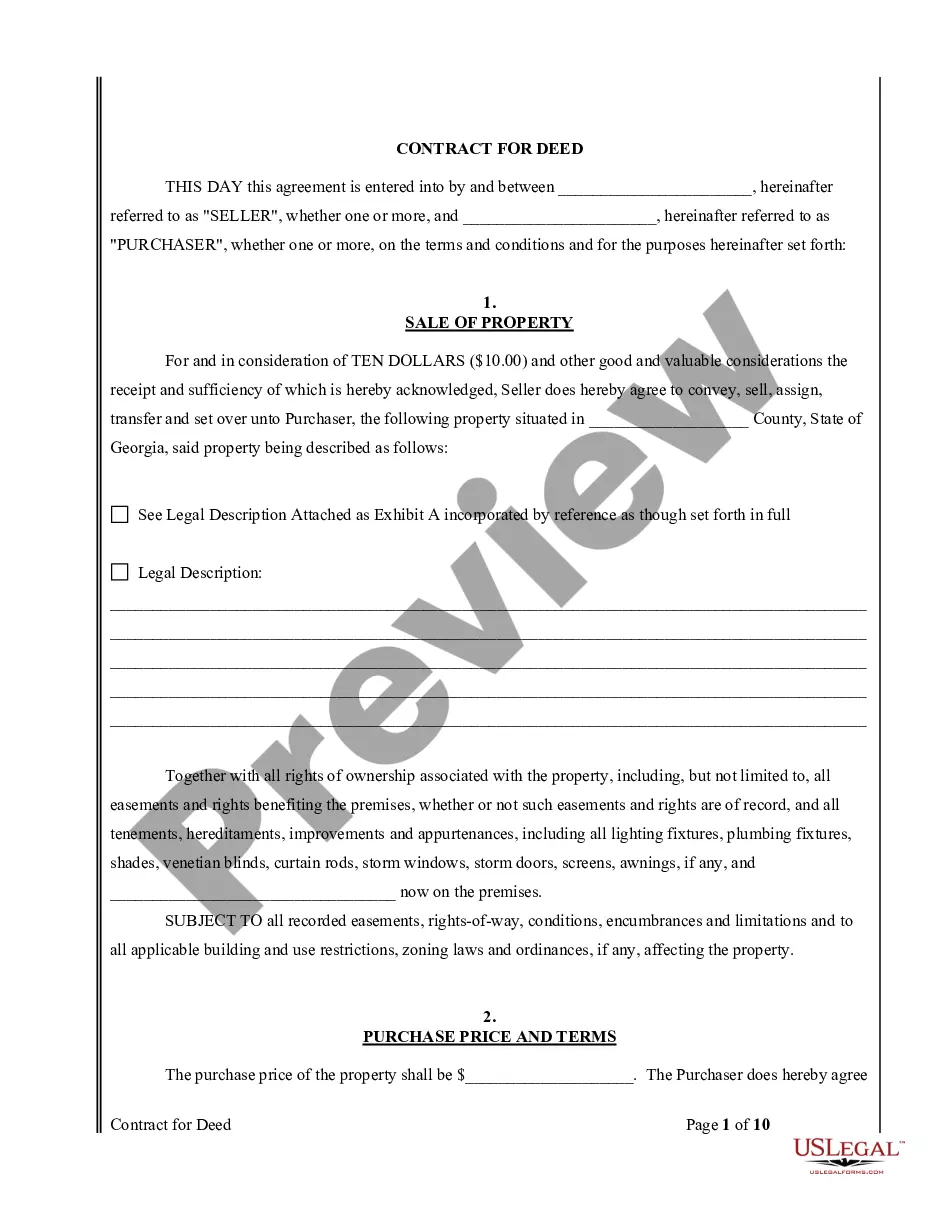

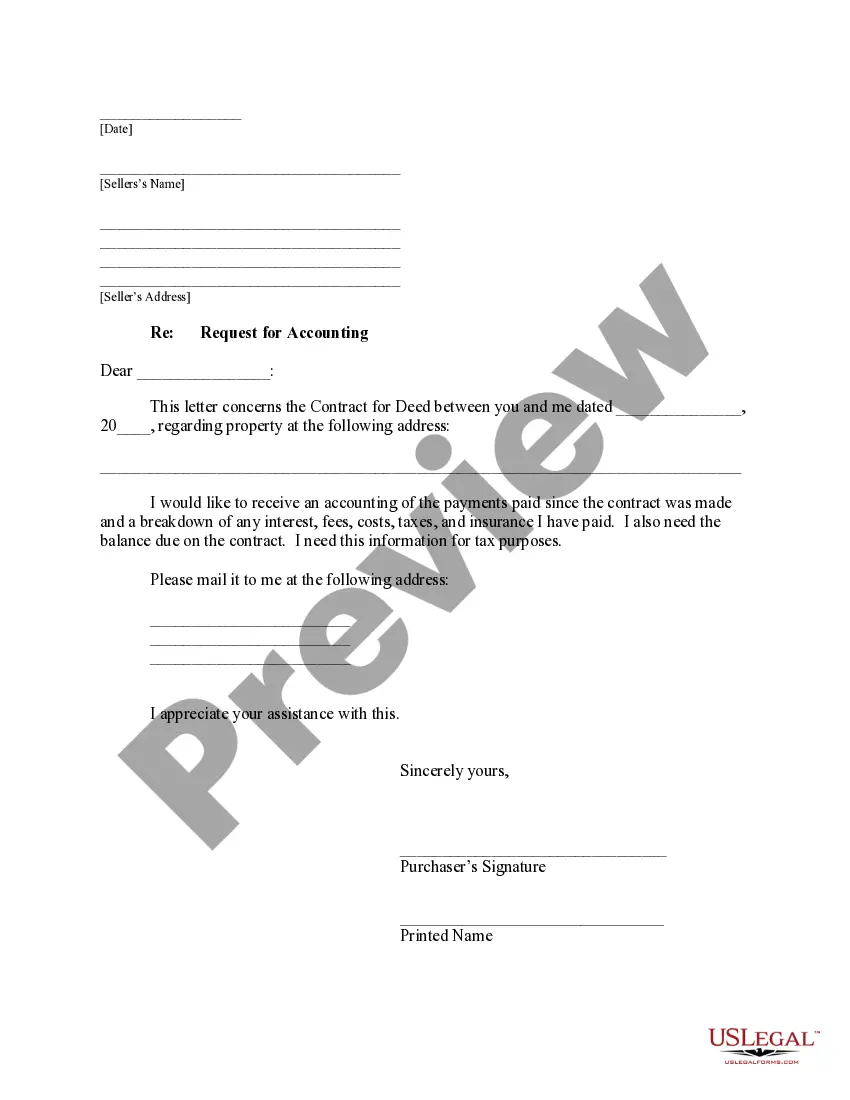

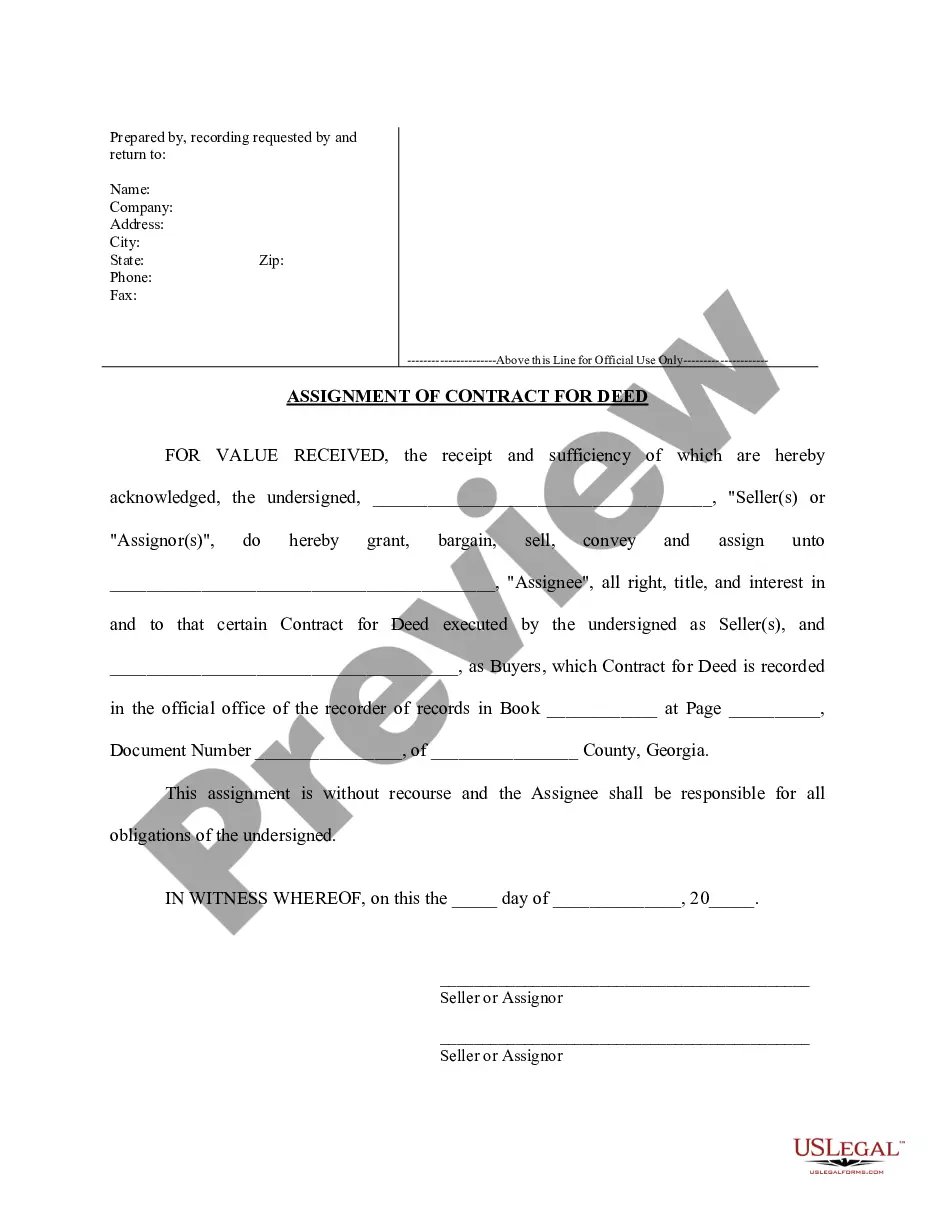

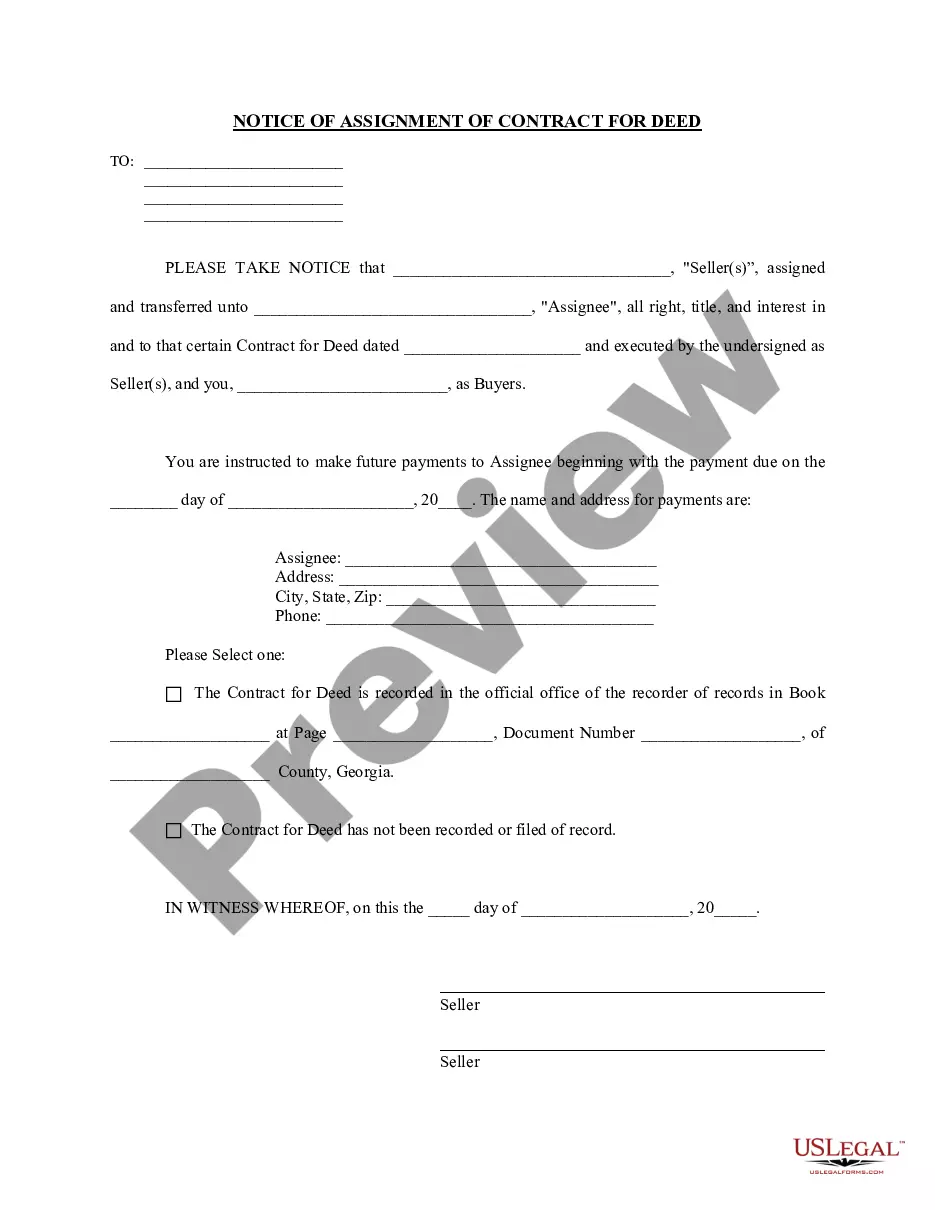

Savannah Georgia Contract for Deed Seller's Annual Accounting Statement is a crucial document that lays out the financial details and transactions between the seller and buyer in a contract for deed arrangement in Savannah, Georgia. This statement provides a comprehensive breakdown of the financial aspects associated with the contract for deed and helps ensure transparency and accuracy in the financial dealings. The Savannah Georgia Contract for Deed Seller's Annual Accounting Statement typically includes information such as the total payments made by the buyer during the accounting year, the principal amount remaining, the interest accrued, any fees or charges, and the overall balance left on the contract. This document serves as a record of the financial relationship between the seller and the buyer and aids in keeping both parties informed about the progress of the contract. In addition to the general Savannah Georgia Contract for Deed Seller's Annual Accounting Statement, there might be several variations or types specific to different scenarios. These variations may include: 1. Early Payoff Statement: This type of accounting statement is issued when the buyer intends to pay off the contract for deed before the scheduled completion date. It provides a detailed breakdown of the remaining principal, any applicable credits, and the final payment required for the early payoff. 2. Delinquency Statement: In cases where the buyer fails to make timely payments or defaults on their obligations, the seller may issue a delinquency statement. This statement outlines the outstanding payments, penalties, interest, or any legal steps that may be taken due to non-compliance. 3. Tax and Insurance Statement: This accounting statement is prepared to inform the buyer about the allocation and payment of property taxes and insurance premiums associated with the property. It provides a clear breakdown of the amounts paid, the due dates, and any adjustments made. 4. Escrow Statement: If an escrow account is established between the seller and buyer to cover expenses such as property taxes and insurance, the escrow statement outlines the deposits, withdrawals, and remaining balance in the account. It ensures accountability and transparency in the management of the escrow funds. The Savannah Georgia Contract for Deed Seller's Annual Accounting Statement, along with its various types, plays a critical role in maintaining financial records and ensuring clarity in the ongoing contract for deed arrangement. It aids in building trust, resolving any disputes, and keeping both parties involved in the contract for deed well-informed about the financial aspects of their agreement.Savannah Georgia Contract for Deed Seller's Annual Accounting Statement is a crucial document that lays out the financial details and transactions between the seller and buyer in a contract for deed arrangement in Savannah, Georgia. This statement provides a comprehensive breakdown of the financial aspects associated with the contract for deed and helps ensure transparency and accuracy in the financial dealings. The Savannah Georgia Contract for Deed Seller's Annual Accounting Statement typically includes information such as the total payments made by the buyer during the accounting year, the principal amount remaining, the interest accrued, any fees or charges, and the overall balance left on the contract. This document serves as a record of the financial relationship between the seller and the buyer and aids in keeping both parties informed about the progress of the contract. In addition to the general Savannah Georgia Contract for Deed Seller's Annual Accounting Statement, there might be several variations or types specific to different scenarios. These variations may include: 1. Early Payoff Statement: This type of accounting statement is issued when the buyer intends to pay off the contract for deed before the scheduled completion date. It provides a detailed breakdown of the remaining principal, any applicable credits, and the final payment required for the early payoff. 2. Delinquency Statement: In cases where the buyer fails to make timely payments or defaults on their obligations, the seller may issue a delinquency statement. This statement outlines the outstanding payments, penalties, interest, or any legal steps that may be taken due to non-compliance. 3. Tax and Insurance Statement: This accounting statement is prepared to inform the buyer about the allocation and payment of property taxes and insurance premiums associated with the property. It provides a clear breakdown of the amounts paid, the due dates, and any adjustments made. 4. Escrow Statement: If an escrow account is established between the seller and buyer to cover expenses such as property taxes and insurance, the escrow statement outlines the deposits, withdrawals, and remaining balance in the account. It ensures accountability and transparency in the management of the escrow funds. The Savannah Georgia Contract for Deed Seller's Annual Accounting Statement, along with its various types, plays a critical role in maintaining financial records and ensuring clarity in the ongoing contract for deed arrangement. It aids in building trust, resolving any disputes, and keeping both parties involved in the contract for deed well-informed about the financial aspects of their agreement.