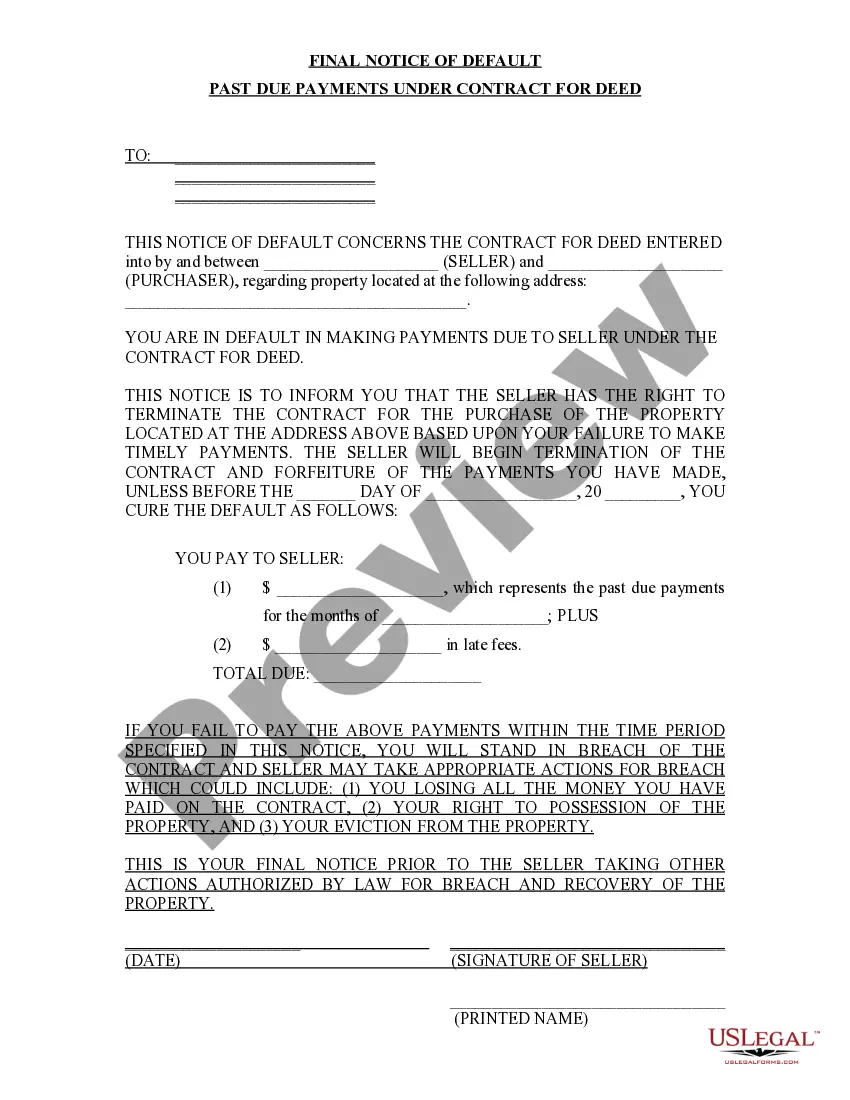

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Explaining Fulton Georgia Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Fulton Georgia, Final Notice of Default, Past Due Payments, Contract for Deed Introduction: In Fulton Georgia, a Final Notice of Default for Past Due Payments in connection with a Contract for Deed acts as a formal notification from the lender to the buyer, indicating that the buyer has failed to make timely payments as agreed upon within the terms of the Contract for Deed. This notice highlights the importance of fulfilling financial obligations to avoid potential consequences and aims to provide clarity and understanding regarding the different types of Final Notice of Default. Types of Fulton Georgia Final Notice of Default for Past Due Payments in connection with Contract for Deed: 1. Late Payment Notice: A Late Payment Notice is sent when the borrower fails to make their monthly payment within the specified time frame. This notice specifies the amount overdue, late fees incurred, and provides a grace period for the borrower to rectify the payment. 2. Default Notice: If the buyer fails to make payments repeatedly or within the grace period specified in the Late Payment Notice, a Default Notice will be issued. It states that the buyer has entered into default status, triggering potential consequences such as foreclosure if the outstanding amount is not settled promptly. 3. Demand Letter: After the issuance of a Default Notice, the lender may send a Demand Letter. This formal letter demands immediate payment, specifies the entire outstanding balance, including late fees, penalties, and any additional costs incurred due to the default. 4. Acceleration Notice: In case the borrower fails to respond to the Demand Letter or make satisfactory arrangements, an Acceleration Notice may be issued. This notice declares the full amount of the loan due immediately and accelerates the payment schedule. Failure to comply with the instructions outlined in the Acceleration Notice may result in foreclosure proceedings. 5. Foreclosure Notice: If all the preceding notices fail to resolve the overdue payment situation, the lender may proceed with a Foreclosure Notice. This notice declares the intent to take legal action, demanding the borrower to vacate the property voluntarily within a specified time period. Failure to comply may lead to foreclosure, resulting in the lender reclaiming the property. Conclusion: Fulton Georgia Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a series of formal notices sent by the lender to the borrower to address payment defaults. It is essential for buyers to fully understand the implications of each notice and take prompt action to resolve past due payments in order to maintain their legal and financial standing.Title: Explaining Fulton Georgia Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Fulton Georgia, Final Notice of Default, Past Due Payments, Contract for Deed Introduction: In Fulton Georgia, a Final Notice of Default for Past Due Payments in connection with a Contract for Deed acts as a formal notification from the lender to the buyer, indicating that the buyer has failed to make timely payments as agreed upon within the terms of the Contract for Deed. This notice highlights the importance of fulfilling financial obligations to avoid potential consequences and aims to provide clarity and understanding regarding the different types of Final Notice of Default. Types of Fulton Georgia Final Notice of Default for Past Due Payments in connection with Contract for Deed: 1. Late Payment Notice: A Late Payment Notice is sent when the borrower fails to make their monthly payment within the specified time frame. This notice specifies the amount overdue, late fees incurred, and provides a grace period for the borrower to rectify the payment. 2. Default Notice: If the buyer fails to make payments repeatedly or within the grace period specified in the Late Payment Notice, a Default Notice will be issued. It states that the buyer has entered into default status, triggering potential consequences such as foreclosure if the outstanding amount is not settled promptly. 3. Demand Letter: After the issuance of a Default Notice, the lender may send a Demand Letter. This formal letter demands immediate payment, specifies the entire outstanding balance, including late fees, penalties, and any additional costs incurred due to the default. 4. Acceleration Notice: In case the borrower fails to respond to the Demand Letter or make satisfactory arrangements, an Acceleration Notice may be issued. This notice declares the full amount of the loan due immediately and accelerates the payment schedule. Failure to comply with the instructions outlined in the Acceleration Notice may result in foreclosure proceedings. 5. Foreclosure Notice: If all the preceding notices fail to resolve the overdue payment situation, the lender may proceed with a Foreclosure Notice. This notice declares the intent to take legal action, demanding the borrower to vacate the property voluntarily within a specified time period. Failure to comply may lead to foreclosure, resulting in the lender reclaiming the property. Conclusion: Fulton Georgia Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a series of formal notices sent by the lender to the borrower to address payment defaults. It is essential for buyers to fully understand the implications of each notice and take prompt action to resolve past due payments in order to maintain their legal and financial standing.