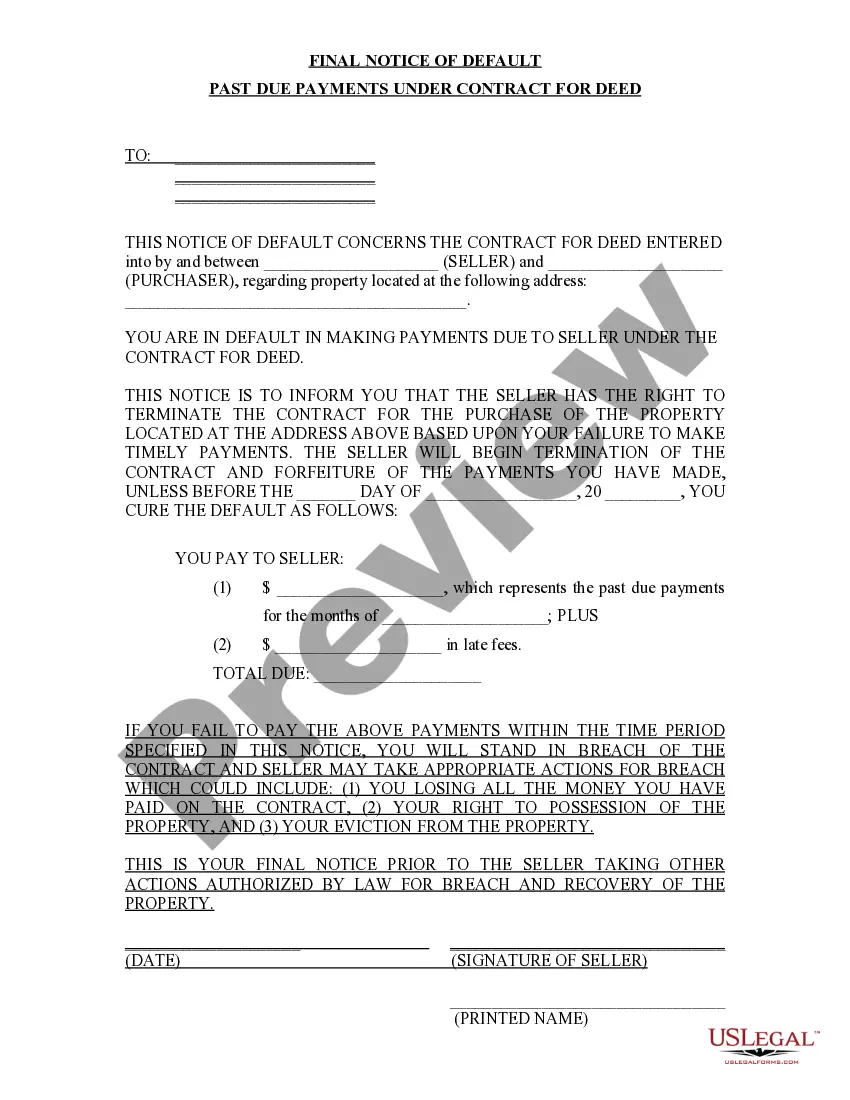

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

The Savannah Georgia Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document sent to a borrower who has failed to make their payments as agreed upon in the contract. This notice serves as a warning that the borrower is in default, and if they do not fulfill their financial obligations promptly, the lender may take further legal action or proceed with the foreclosure process. Keywords: Savannah Georgia, Final Notice of Default, Past Due Payments, Contract for Deed. Types of Savannah Georgia Final Notice of Default for Past Due Payments in connection with Contract for Deed: 1. Standard Final Notice of Default: This is the typical notice sent to a borrower when they have failed to make their scheduled payments on time. It outlines the amount owed, the due date, and provides the borrower with a specific timeframe to rectify the default before further action may be taken. 2. Acceleration Notice: In some cases, the lender may choose to accelerate the loan balance after a default has occurred. This means that the full remaining balance of the loan becomes due immediately, rather than allowing the borrower to catch up on missed payments over time. An Acceleration Notice informs the borrower about this change in repayment terms and provides instructions on how to proceed. 3. Cure or Quit Notice: This type of notice gives the borrower a specific timeframe, usually a few days, to either cure the default by paying the past due amount or "quit" the property, meaning they must vacate it. If the borrower fails to take any action within the given timeframe, the lender may initiate foreclosure proceedings. 4. Right to Cure Notice: This notice informs the borrower of their right to cure the default by paying the overdue amount and any associated fees within a specific timeframe. It also provides information on how to contact the lender or loan service to discuss the situation and make necessary arrangements. 5. Intent to Foreclose Notice: If the borrower fails to rectify the default within the specified timeframe mentioned in the previous notices, the lender may issue an Intent to Foreclose Notice. This notice officially informs the borrower that the lender intends to initiate foreclosure proceedings if the unpaid balance is not settled promptly. 6. Notice of Foreclosure Sale: If the borrower still fails to cure the default, the lender may proceed with a foreclosure sale. The Notice of Foreclosure Sale is sent to inform the borrower of the upcoming sale date and provides details on how the sale process will be conducted according to Georgia state law. It is essential for borrowers who receive any of these notices to seek legal advice or contact the lender immediately to explore options for resolving the default situation before further legal actions are taken.The Savannah Georgia Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document sent to a borrower who has failed to make their payments as agreed upon in the contract. This notice serves as a warning that the borrower is in default, and if they do not fulfill their financial obligations promptly, the lender may take further legal action or proceed with the foreclosure process. Keywords: Savannah Georgia, Final Notice of Default, Past Due Payments, Contract for Deed. Types of Savannah Georgia Final Notice of Default for Past Due Payments in connection with Contract for Deed: 1. Standard Final Notice of Default: This is the typical notice sent to a borrower when they have failed to make their scheduled payments on time. It outlines the amount owed, the due date, and provides the borrower with a specific timeframe to rectify the default before further action may be taken. 2. Acceleration Notice: In some cases, the lender may choose to accelerate the loan balance after a default has occurred. This means that the full remaining balance of the loan becomes due immediately, rather than allowing the borrower to catch up on missed payments over time. An Acceleration Notice informs the borrower about this change in repayment terms and provides instructions on how to proceed. 3. Cure or Quit Notice: This type of notice gives the borrower a specific timeframe, usually a few days, to either cure the default by paying the past due amount or "quit" the property, meaning they must vacate it. If the borrower fails to take any action within the given timeframe, the lender may initiate foreclosure proceedings. 4. Right to Cure Notice: This notice informs the borrower of their right to cure the default by paying the overdue amount and any associated fees within a specific timeframe. It also provides information on how to contact the lender or loan service to discuss the situation and make necessary arrangements. 5. Intent to Foreclose Notice: If the borrower fails to rectify the default within the specified timeframe mentioned in the previous notices, the lender may issue an Intent to Foreclose Notice. This notice officially informs the borrower that the lender intends to initiate foreclosure proceedings if the unpaid balance is not settled promptly. 6. Notice of Foreclosure Sale: If the borrower still fails to cure the default, the lender may proceed with a foreclosure sale. The Notice of Foreclosure Sale is sent to inform the borrower of the upcoming sale date and provides details on how the sale process will be conducted according to Georgia state law. It is essential for borrowers who receive any of these notices to seek legal advice or contact the lender immediately to explore options for resolving the default situation before further legal actions are taken.