The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce.

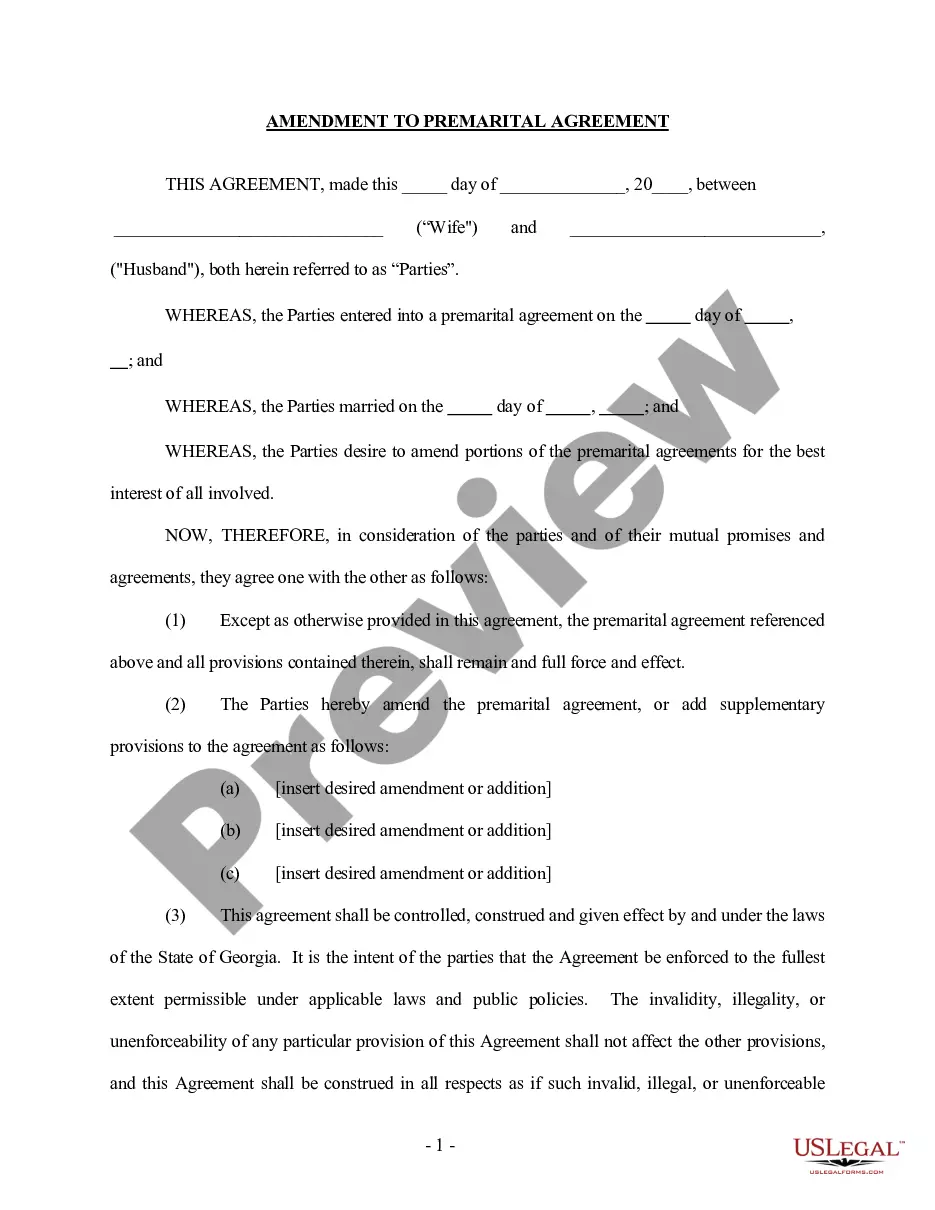

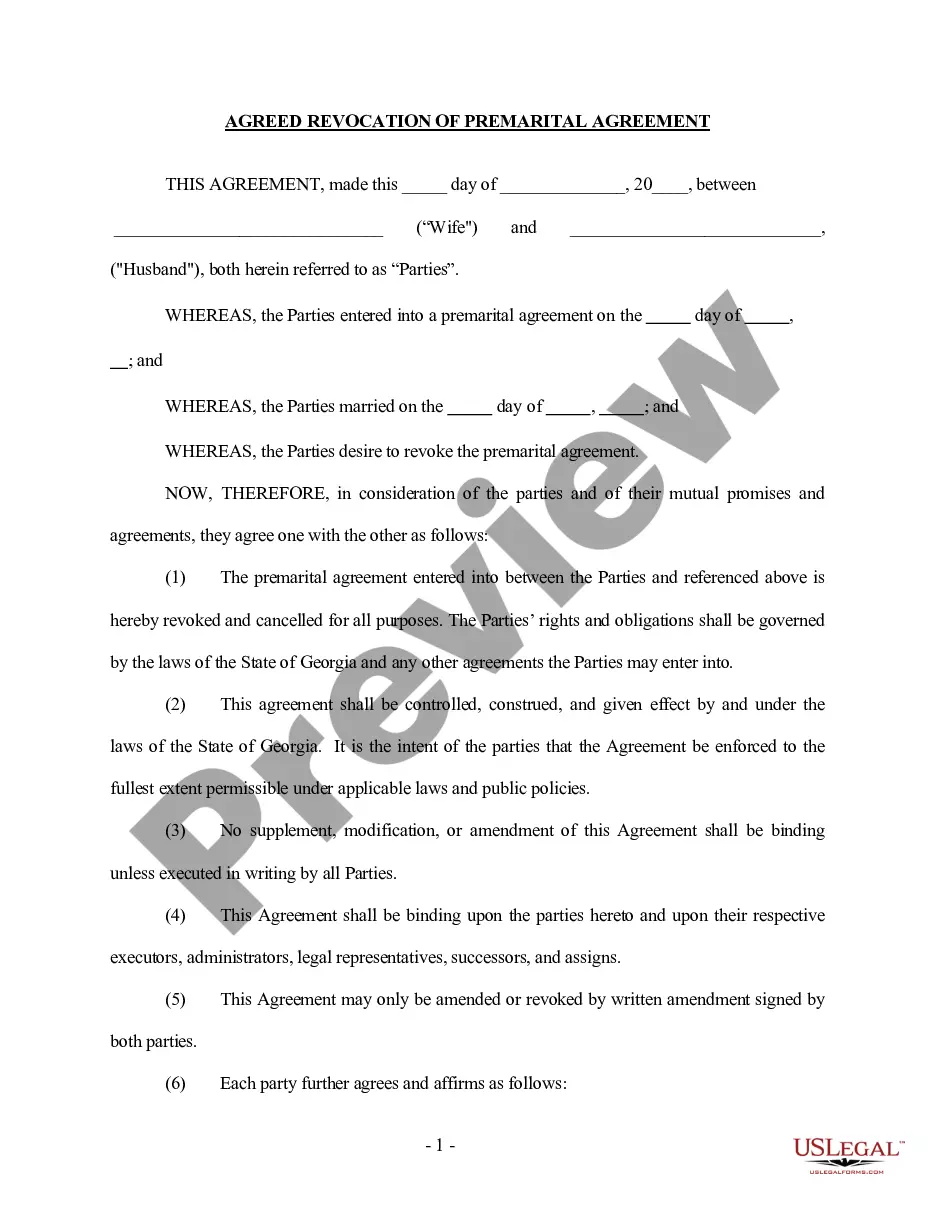

These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will disposed properly. A Savannah Georgia Prenuptial Premarital Agreement without Financial Statements is a legally binding contract entered into by two individuals before they get married, outlining their rights and responsibilities in the event of a divorce or separation. This agreement helps couples address various sensitive issues such as the division of assets, debts, and potential spousal support, thus providing a framework for a smoother dissolution of marriage if it ever occurs. Here are the key points to consider regarding this type of agreement: 1. Definition: A Savannah Georgia Prenuptial Premarital Agreement without Financial Statements is a contract entered into by engaged couples in Savannah, Georgia, without requiring a complete disclosure of their financial information. It must be voluntarily and knowingly signed by both parties, free from any duress, coercion, or undue influence. 2. Purpose: The primary purpose of this agreement is to determine how the couple's assets, debts, and other financial matters will be divided in the event of a divorce or separation. It aims to protect each party's interests and ensure fair treatment while avoiding potentially contentious disputes during legal proceedings. 3. Scope: The agreement covers various aspects, including how both spouses' individual and joint assets will be managed and distributed, how debts and liabilities will be handled, potential spousal support (alimony), and any other financial matters the couple wishes to address. However, it does not require disclosing detailed financial statements. 4. Flexibility: Couples have the freedom to tailor their Savannah Georgia Prenuptial Premarital Agreement without Financial Statements to suit their specific circumstances. They can include clauses pertaining to property division, inheritances, separate assets, real estate, business interests, retirement funds, investments, and other relevant considerations. 5. Execution: To ensure validity, the prenuptial agreement must be in writing, signed by both parties, and notarized. It is advisable for each party to seek independent legal counsel to understand their respective rights and obligations fully. Consulting with an experienced family law attorney specializing in prenuptial agreements is highly recommended during its negotiation, drafting, and execution stages. Different types of Savannah Georgia Prenuptial Premarital Agreements without Financial Statements may include: 1. Simple Asset Division Agreement: This type of agreement focuses on defining how the couple's assets will be divided in the event of a divorce or separation but does not delve into other financial matters such as debts or spousal support. 2. Business Protection Agreement: Particularly useful when one or both spouses own a business, this agreement outlines how the business's assets and operations will be handled if the marriage ends, ensuring the enterprise's stability and safeguarding the spouse not actively involved in the business. 3. Inheritance Protection Agreement: Couples who wish to protect their inheritances or their ability to leave assets to specific beneficiaries through a will or trust can include provisions in their prenuptial agreement to address these concerns explicitly. 4. Exclusive Use Agreement: This type of prenuptial agreement determines which assets, such as real estate properties, vehicles, or personal possessions, will remain exclusively owned and used by one spouse, even in the case of a divorce. In conclusion, a Savannah Georgia Prenuptial Premarital Agreement without Financial Statements is a customized contract designed to protect couples' financial interests in the event of divorce or separation. It is a valuable tool for fostering open communication, preventing potential disputes, and ensuring a fair and amicable resolution to any potential split.

A Savannah Georgia Prenuptial Premarital Agreement without Financial Statements is a legally binding contract entered into by two individuals before they get married, outlining their rights and responsibilities in the event of a divorce or separation. This agreement helps couples address various sensitive issues such as the division of assets, debts, and potential spousal support, thus providing a framework for a smoother dissolution of marriage if it ever occurs. Here are the key points to consider regarding this type of agreement: 1. Definition: A Savannah Georgia Prenuptial Premarital Agreement without Financial Statements is a contract entered into by engaged couples in Savannah, Georgia, without requiring a complete disclosure of their financial information. It must be voluntarily and knowingly signed by both parties, free from any duress, coercion, or undue influence. 2. Purpose: The primary purpose of this agreement is to determine how the couple's assets, debts, and other financial matters will be divided in the event of a divorce or separation. It aims to protect each party's interests and ensure fair treatment while avoiding potentially contentious disputes during legal proceedings. 3. Scope: The agreement covers various aspects, including how both spouses' individual and joint assets will be managed and distributed, how debts and liabilities will be handled, potential spousal support (alimony), and any other financial matters the couple wishes to address. However, it does not require disclosing detailed financial statements. 4. Flexibility: Couples have the freedom to tailor their Savannah Georgia Prenuptial Premarital Agreement without Financial Statements to suit their specific circumstances. They can include clauses pertaining to property division, inheritances, separate assets, real estate, business interests, retirement funds, investments, and other relevant considerations. 5. Execution: To ensure validity, the prenuptial agreement must be in writing, signed by both parties, and notarized. It is advisable for each party to seek independent legal counsel to understand their respective rights and obligations fully. Consulting with an experienced family law attorney specializing in prenuptial agreements is highly recommended during its negotiation, drafting, and execution stages. Different types of Savannah Georgia Prenuptial Premarital Agreements without Financial Statements may include: 1. Simple Asset Division Agreement: This type of agreement focuses on defining how the couple's assets will be divided in the event of a divorce or separation but does not delve into other financial matters such as debts or spousal support. 2. Business Protection Agreement: Particularly useful when one or both spouses own a business, this agreement outlines how the business's assets and operations will be handled if the marriage ends, ensuring the enterprise's stability and safeguarding the spouse not actively involved in the business. 3. Inheritance Protection Agreement: Couples who wish to protect their inheritances or their ability to leave assets to specific beneficiaries through a will or trust can include provisions in their prenuptial agreement to address these concerns explicitly. 4. Exclusive Use Agreement: This type of prenuptial agreement determines which assets, such as real estate properties, vehicles, or personal possessions, will remain exclusively owned and used by one spouse, even in the case of a divorce. In conclusion, a Savannah Georgia Prenuptial Premarital Agreement without Financial Statements is a customized contract designed to protect couples' financial interests in the event of divorce or separation. It is a valuable tool for fostering open communication, preventing potential disputes, and ensuring a fair and amicable resolution to any potential split.