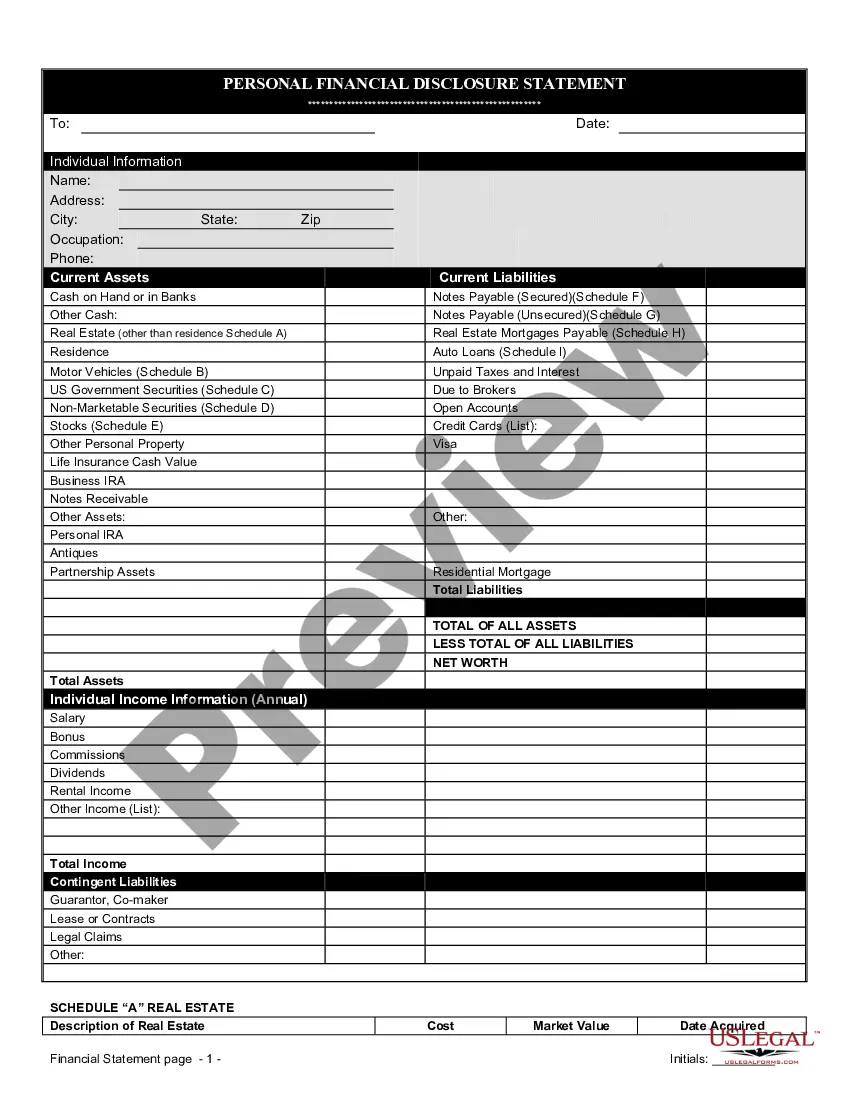

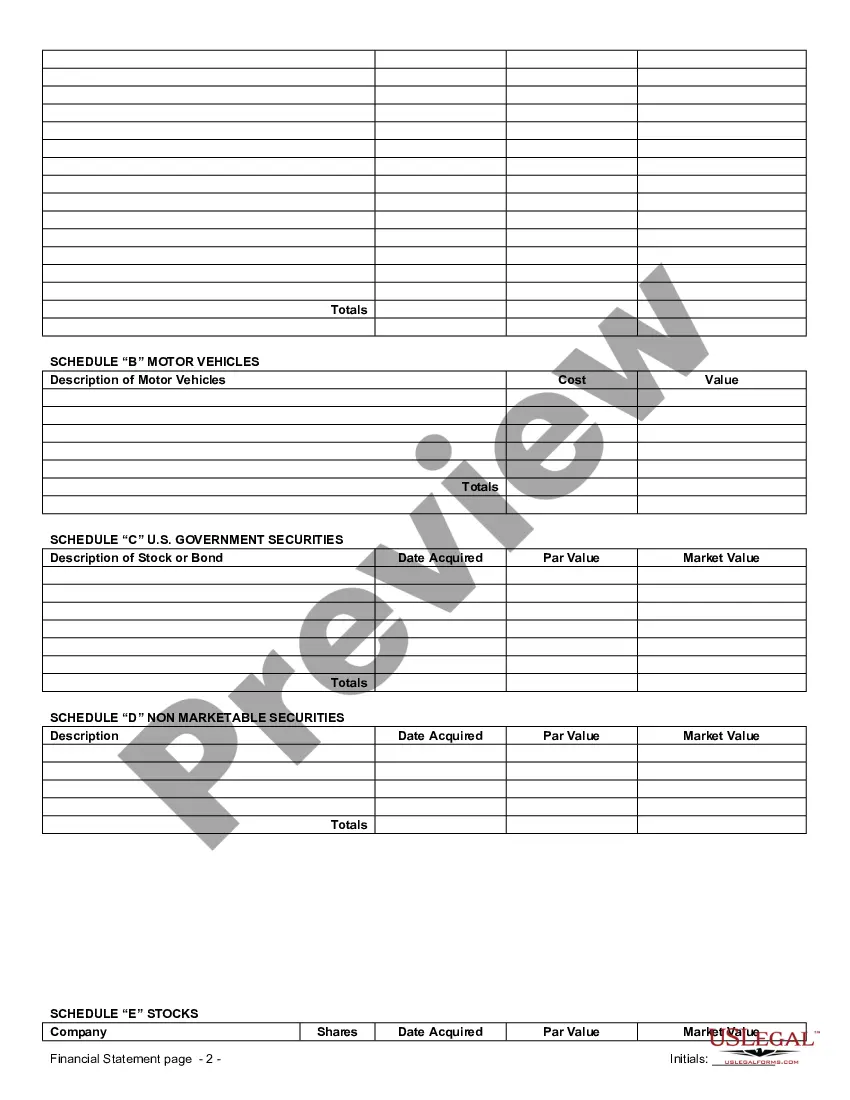

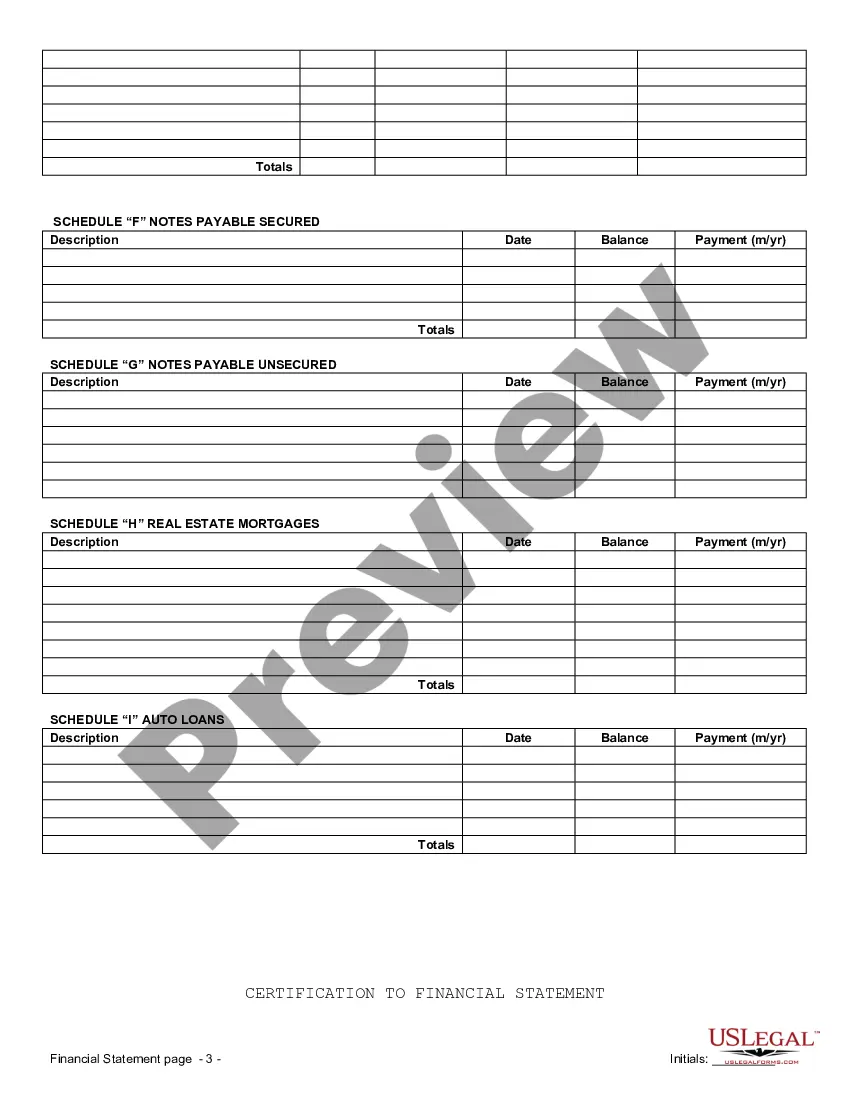

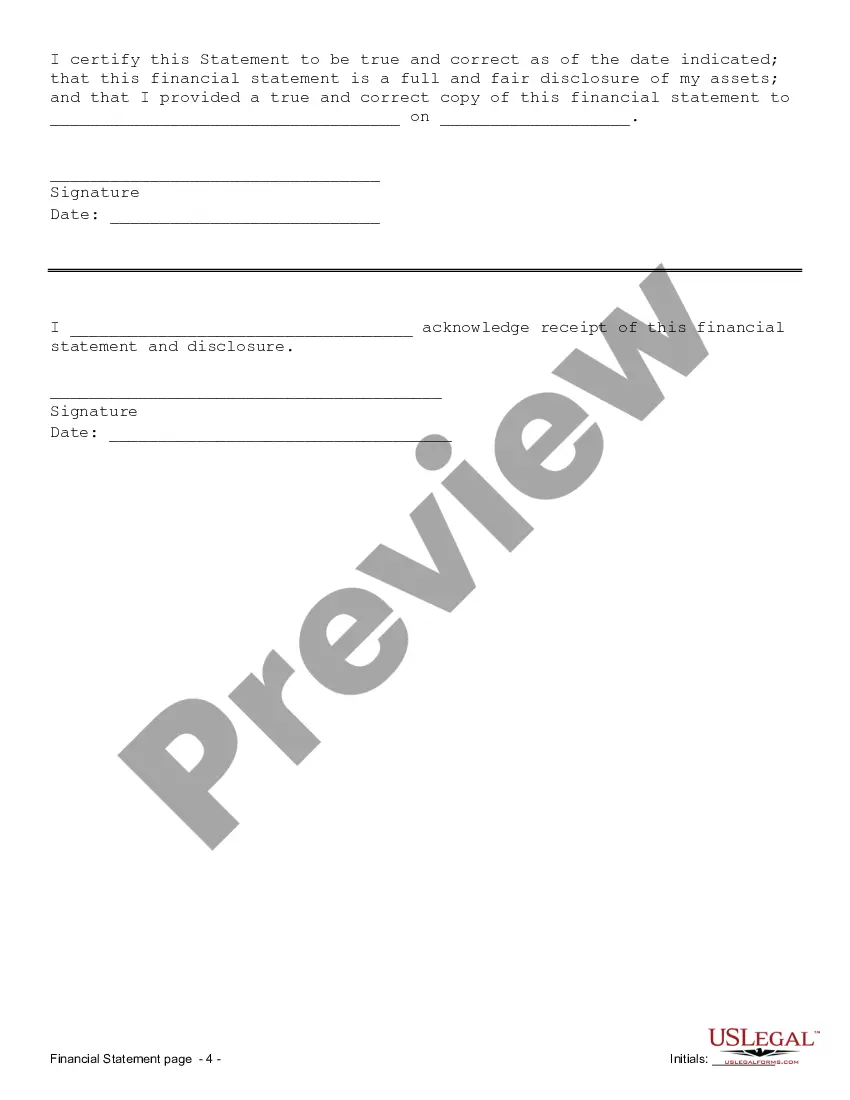

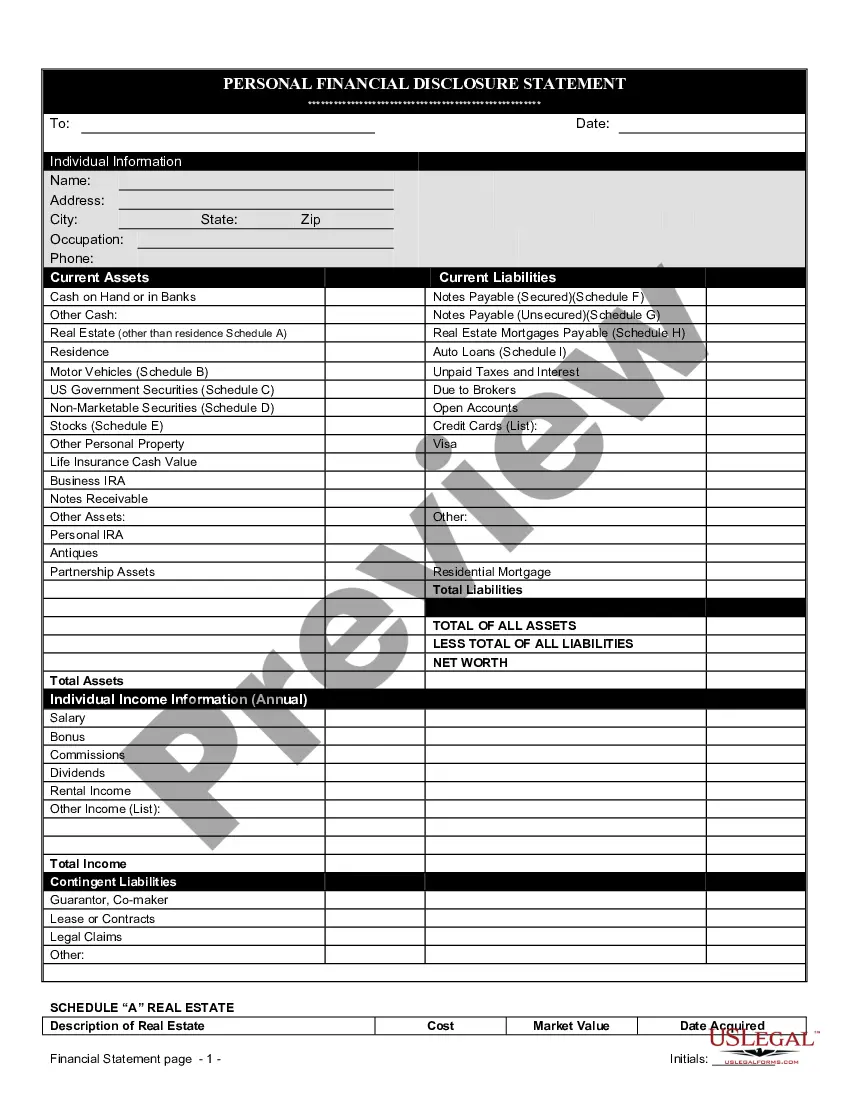

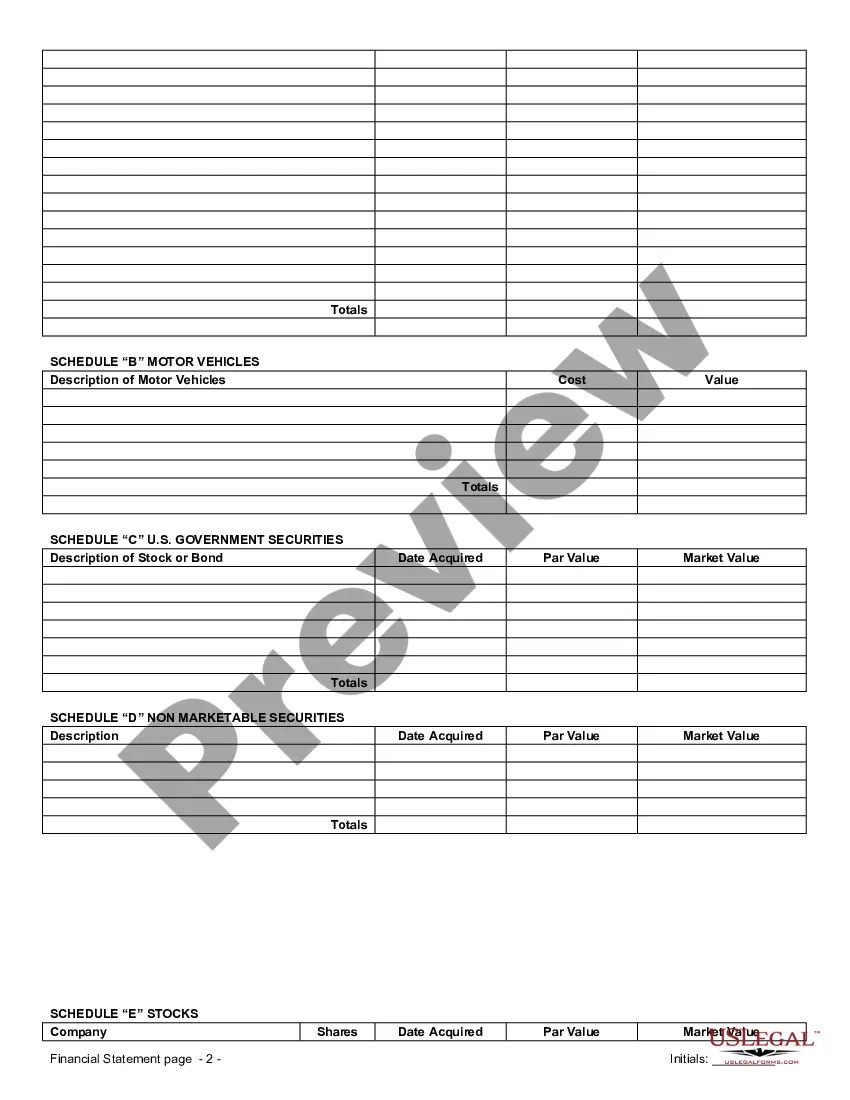

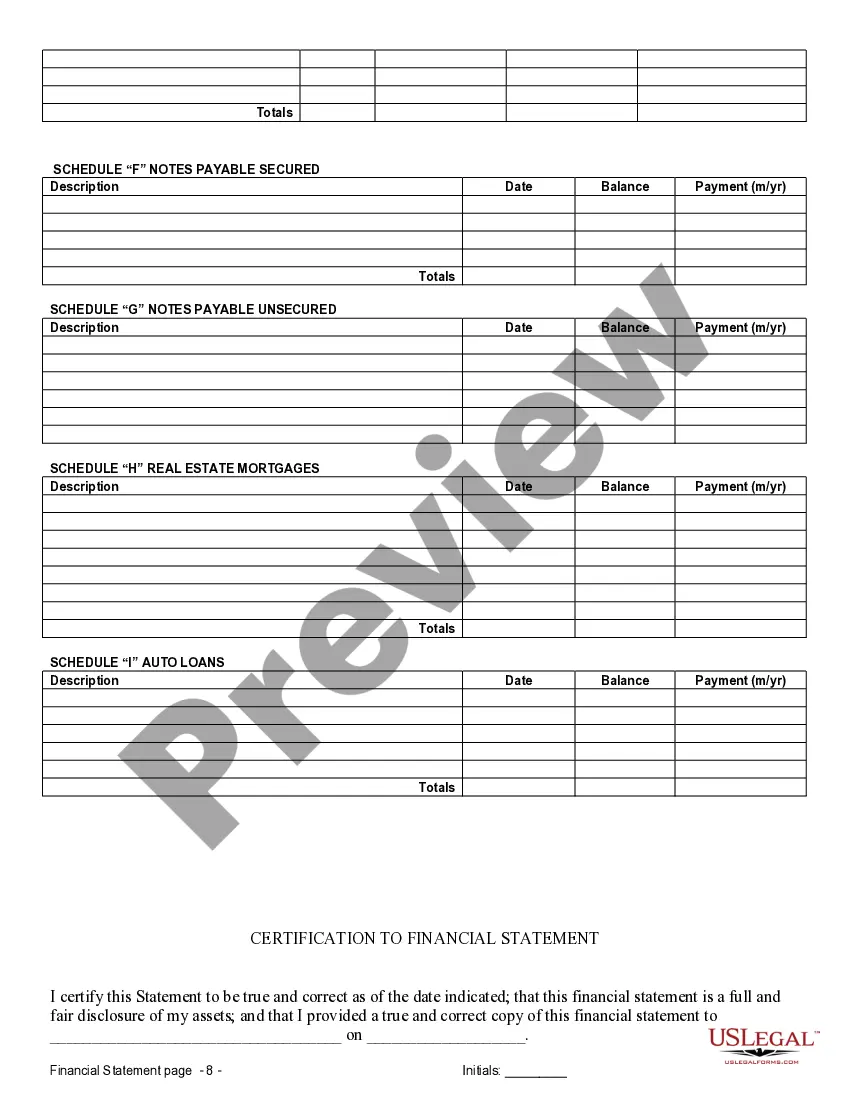

Fulton Georgia Financial Statements in Connection with Prenuptial Premarital Agreement: Comprehensive Overview In Fulton, Georgia, financial statements play a crucial role when creating a prenuptial (or premarital) agreement. These statements serve as key documents that help individuals outline and protect their financial interests before entering into marriage. Let's delve into the different types of Fulton Georgia Financial Statements used solely in connection with prenuptial or premarital agreements: 1. Personal Financial Statements: Personal financial statements highlight an individual's income, assets, expenses, and liabilities. These statements offer a comprehensive overview of one's financial standing and provide crucial information for assessing division of assets, debts, and potential spousal support in the event of a divorce. 2. Statement of Net Worth: A Statement of Net Worth is a detailed report that summarizes a person's financial situation. It encompasses an individual's assets, debts, cash reserves, investments, and property ownership. This statement aids in determining the equitable distribution of assets in case of separation or divorce. 3. Income Statements: Income statements provide a breakdown of an individual's income and expenses over a specific period. This financial statement helps evaluate the earning capacity and financial stability of each party involved. It assists in determining whether spousal support or alimony should be considered and to what extent in the event of a divorce. 4. Balance Sheets: Balance sheets present a snapshot of an individual's financial position by showcasing their assets, liabilities, and net worth. These statements are crucial in assessing the distribution of assets and debts in a prenuptial agreement, ensuring fairness and clarity during potential legal proceedings. 5. Tax Returns: Tax returns offer substantial insights into an individual's earnings, deductions, and overall financial health. Analyzing tax returns can be essential in understanding income sources, investments, business ownership, and potential obligations. Including tax returns in financial statements provides a comprehensive overview of one's financial capabilities and potential future obligations. 6. Business Statements: In cases where one or both parties are business owners, including business financial statements becomes vital. These statements outline the financial status, income, expenses, assets, and debts of the business. Incorporating these statements helps define the division of business assets, liabilities, and potential compensation in case of separation or divorce. In conclusion, Fulton, Georgia Financial Statements are an indispensable part of prenuptial and premarital agreements. They comprise personal financial statements, statements of net worth, income statements, balance sheets, tax returns, and business statements. These statements ensure transparency, fairness, and protection of individual and shared interests, providing a solid foundation for successful marital agreements.

Fulton Georgia Financial Statements in Connection with Prenuptial Premarital Agreement: Comprehensive Overview In Fulton, Georgia, financial statements play a crucial role when creating a prenuptial (or premarital) agreement. These statements serve as key documents that help individuals outline and protect their financial interests before entering into marriage. Let's delve into the different types of Fulton Georgia Financial Statements used solely in connection with prenuptial or premarital agreements: 1. Personal Financial Statements: Personal financial statements highlight an individual's income, assets, expenses, and liabilities. These statements offer a comprehensive overview of one's financial standing and provide crucial information for assessing division of assets, debts, and potential spousal support in the event of a divorce. 2. Statement of Net Worth: A Statement of Net Worth is a detailed report that summarizes a person's financial situation. It encompasses an individual's assets, debts, cash reserves, investments, and property ownership. This statement aids in determining the equitable distribution of assets in case of separation or divorce. 3. Income Statements: Income statements provide a breakdown of an individual's income and expenses over a specific period. This financial statement helps evaluate the earning capacity and financial stability of each party involved. It assists in determining whether spousal support or alimony should be considered and to what extent in the event of a divorce. 4. Balance Sheets: Balance sheets present a snapshot of an individual's financial position by showcasing their assets, liabilities, and net worth. These statements are crucial in assessing the distribution of assets and debts in a prenuptial agreement, ensuring fairness and clarity during potential legal proceedings. 5. Tax Returns: Tax returns offer substantial insights into an individual's earnings, deductions, and overall financial health. Analyzing tax returns can be essential in understanding income sources, investments, business ownership, and potential obligations. Including tax returns in financial statements provides a comprehensive overview of one's financial capabilities and potential future obligations. 6. Business Statements: In cases where one or both parties are business owners, including business financial statements becomes vital. These statements outline the financial status, income, expenses, assets, and debts of the business. Incorporating these statements helps define the division of business assets, liabilities, and potential compensation in case of separation or divorce. In conclusion, Fulton, Georgia Financial Statements are an indispensable part of prenuptial and premarital agreements. They comprise personal financial statements, statements of net worth, income statements, balance sheets, tax returns, and business statements. These statements ensure transparency, fairness, and protection of individual and shared interests, providing a solid foundation for successful marital agreements.