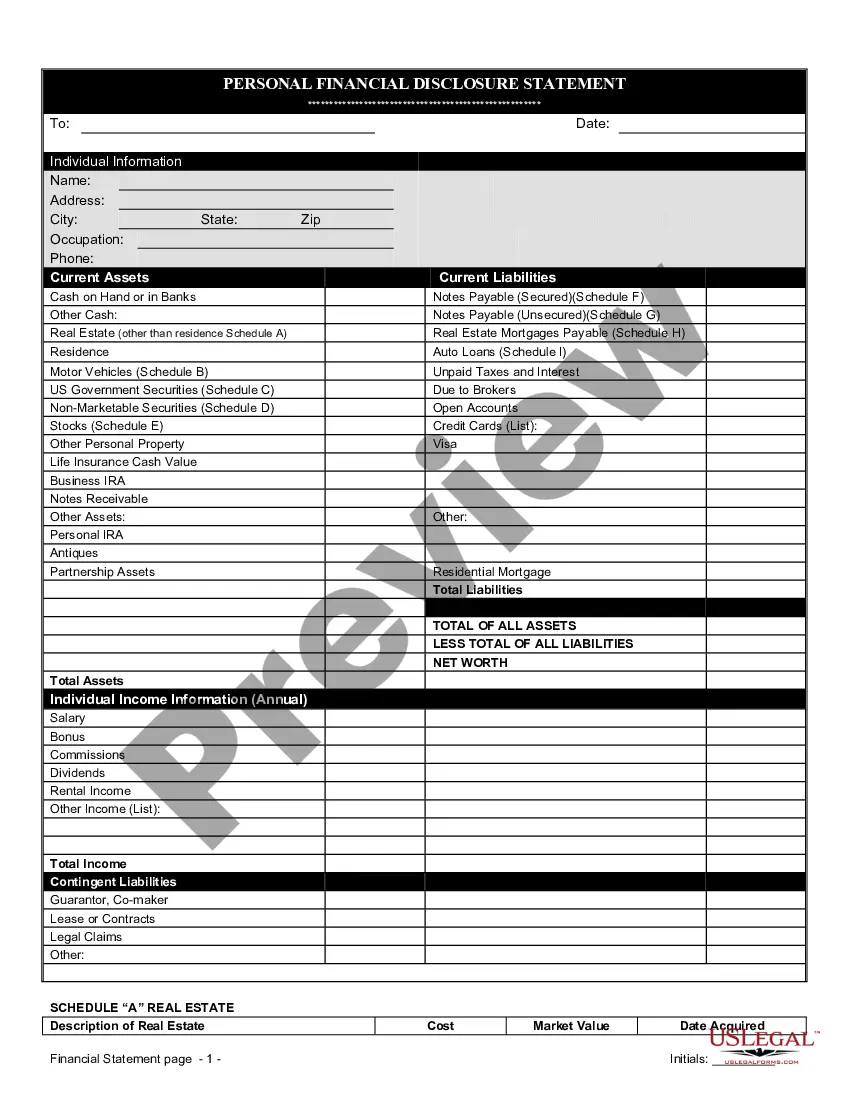

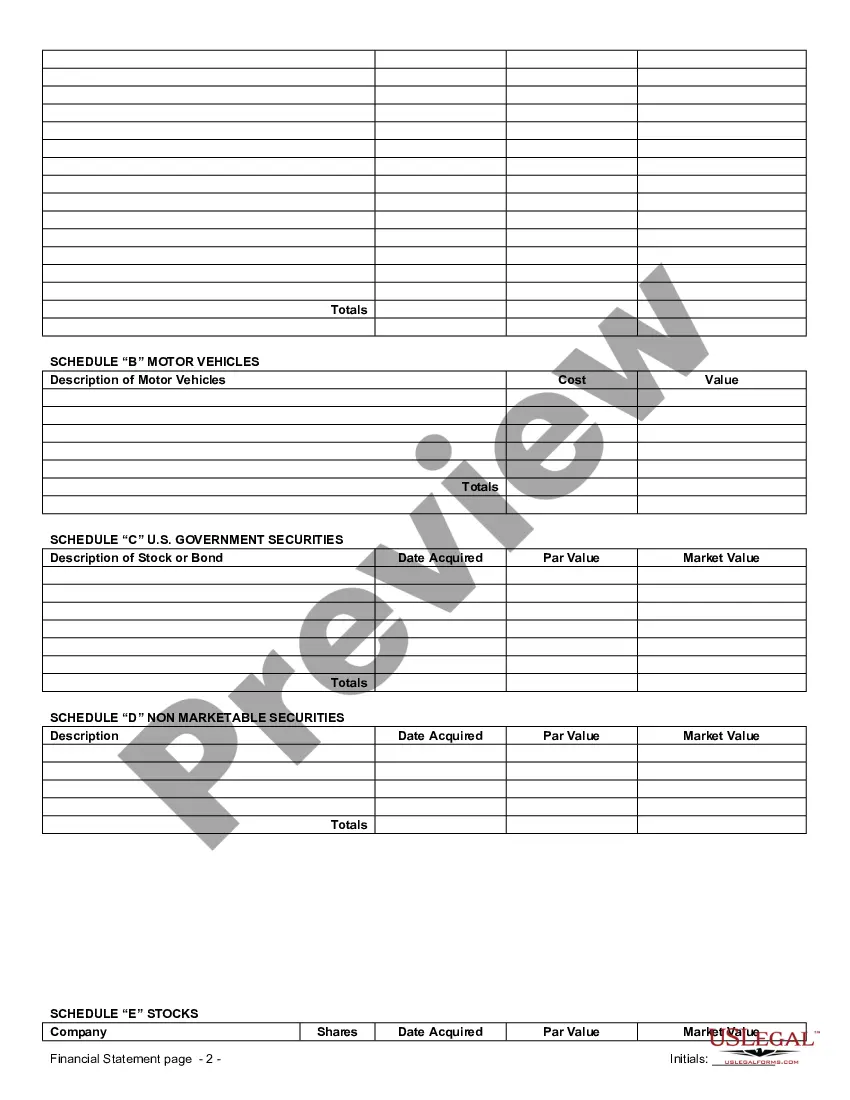

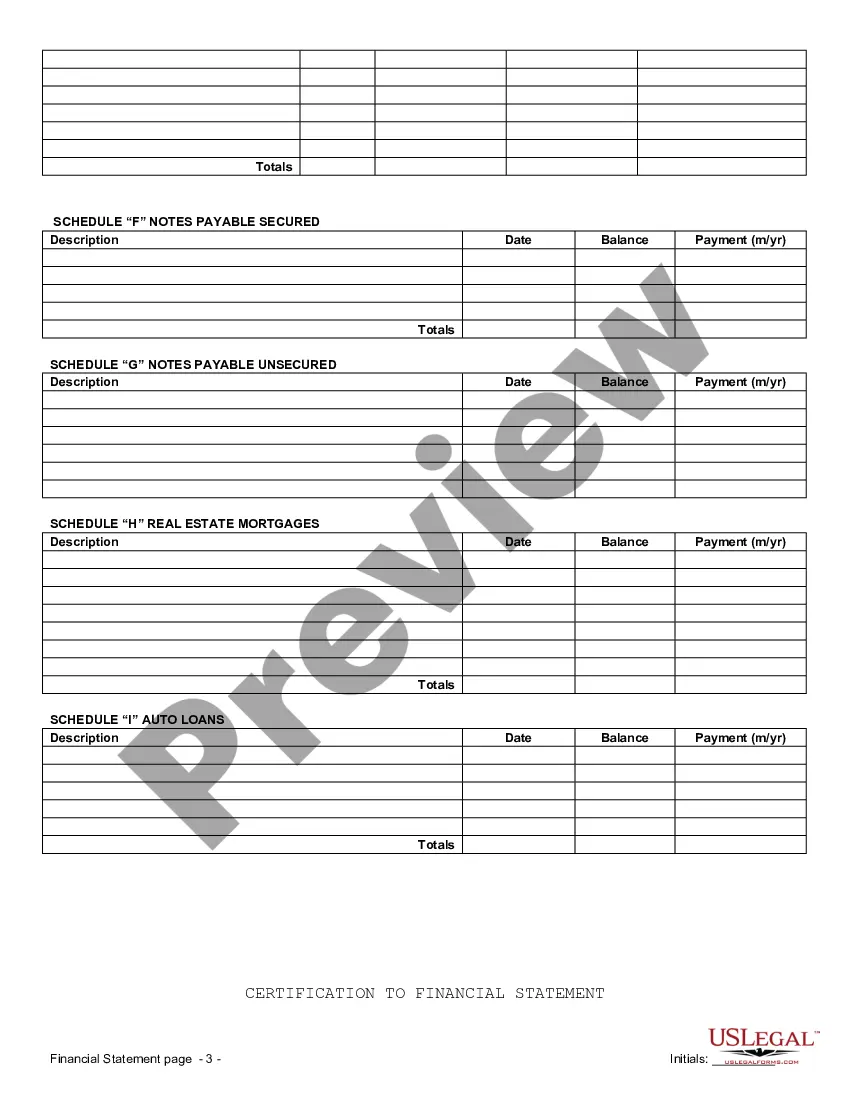

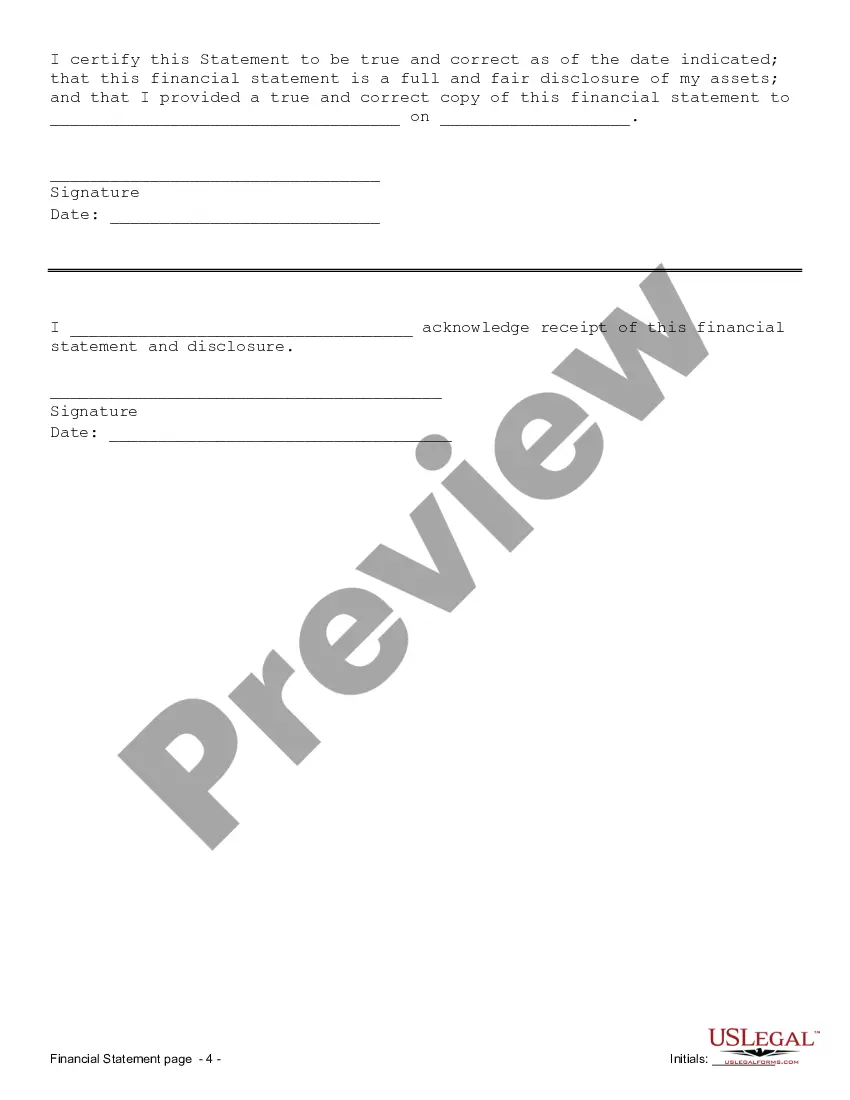

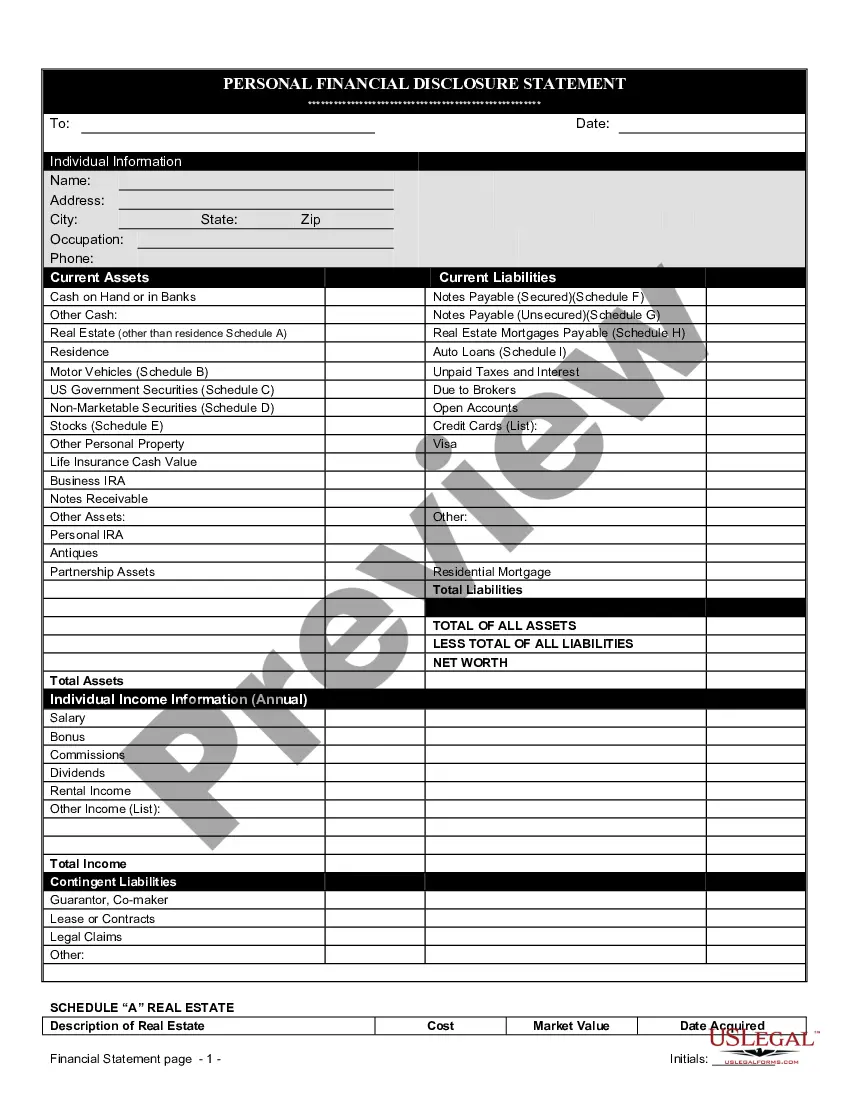

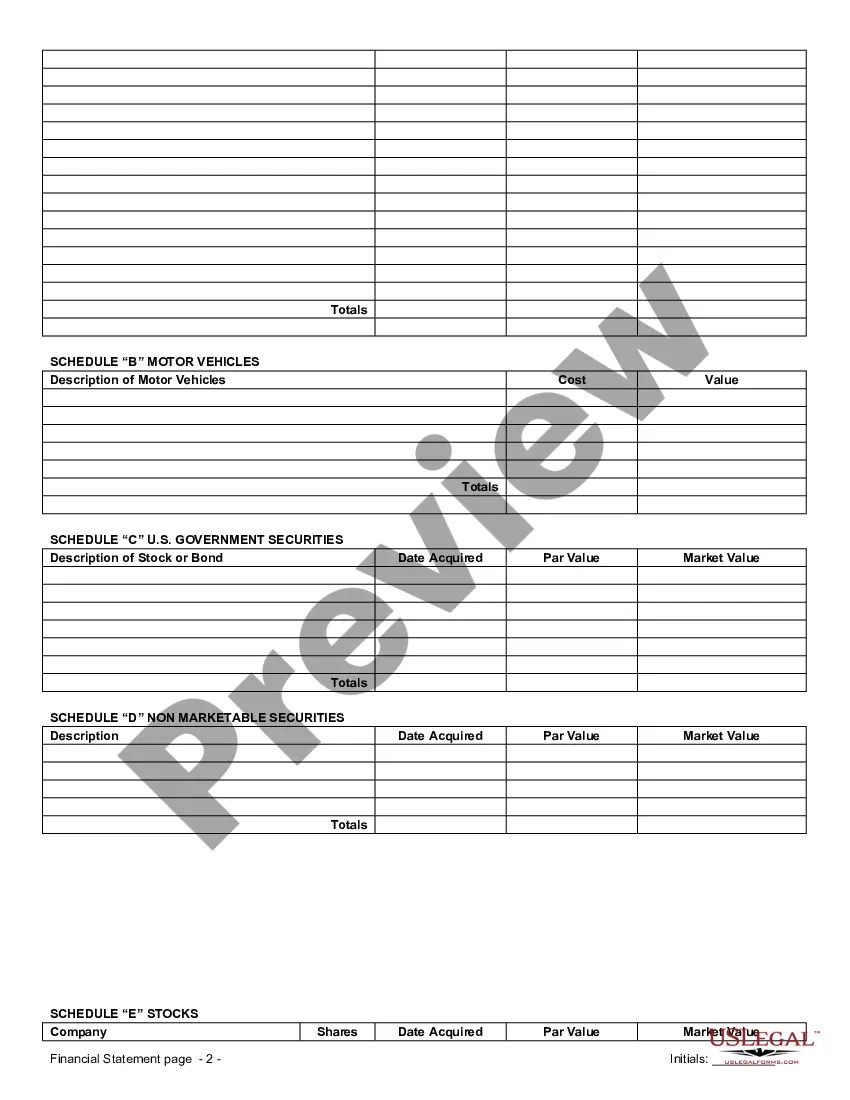

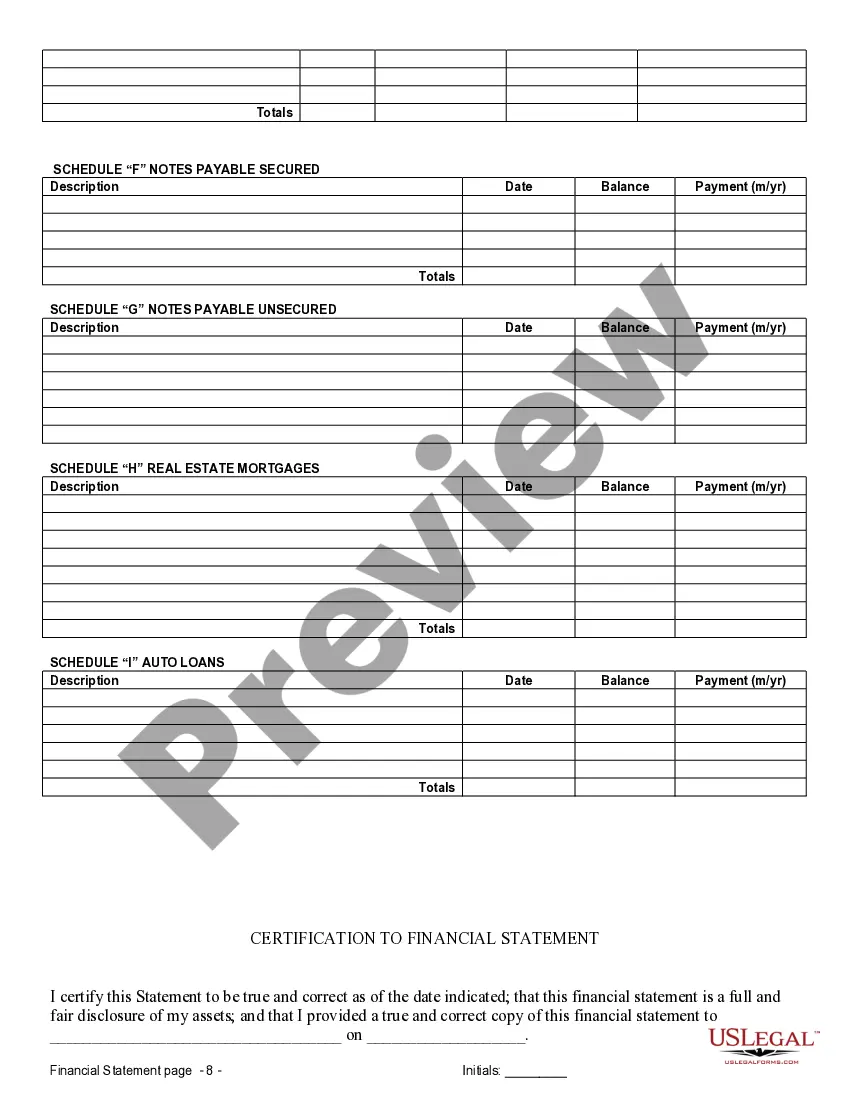

South Fulton Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement: A Comprehensive Guide The financial statements required in connection with a prenuptial or premarital agreement in South Fulton, Georgia play a crucial role in protecting the financial interests of both parties involved in a marriage. A prenuptial agreement is a legal contract created before marriage that outlines the distribution of assets and debts in the event of divorce or death. In order to ensure transparency and fairness, South Fulton mandates the inclusion of financial statements specific to this agreement. 1. Personal Financial Statement: A personal financial statement is a document that provides a detailed overview of an individual's financial situation. It includes information regarding income, assets, liabilities, expenses, and other relevant financial aspects. Each party needs to prepare their own personal financial statement to disclose their financial standing accurately. 2. Bank Statements: Bank statements are essential documents that demonstrate an individual's financial activities and transactions over a specific period. These statements provide an overview of income, expenses, savings, investments, and any outstanding debts. Both parties must provide their bank statements to ensure a comprehensive understanding of their financial situation. 3. Tax Returns: Tax returns are crucial in highlighting an individual's income, sources of income, deductions, and tax liabilities. These documents provide a clear picture of each party's financial contributions and help determine potential spousal support obligations in the future. The inclusion of tax returns is vital to ensure transparency and fairness when creating a prenuptial agreement. 4. Property Deeds and Titles: Property deeds and titles confirm ownership of real estate properties, vehicles, or any other valuable assets. These documents provide substantial evidence of property ownership, stating the respective party's name and their percentage of ownership. Including property deeds and titles ensures accurate asset division and establishes the rightful owner during the prenuptial agreement process. 5. Investment Portfolio Statements: Investment portfolio statements offer insights into an individual's investment and asset management activities. These statements provide comprehensive details about stocks, bonds, mutual funds, retirement accounts, and other investments. The inclusion of investment portfolio statements helps determine the value of each party's investment holdings and assists in asset division discussions. 6. Business Financial Statements: If either party owns a business, providing business financial statements becomes crucial. These statements typically include income statements, balance sheets, cash flow statements, and relevant tax documents related to the business. Business financial statements offer an accurate representation of the company's financial health and contribute to fair asset division discussions and potential spousal support calculations. In conclusion, South Fulton, Georgia mandates the inclusion of various financial statements in connection with a prenuptial or premarital agreement to ensure transparency, fairness, and protection of both parties involved. Personal financial statements, bank statements, tax returns, property deeds and titles, investment portfolio statements, and business financial statements all contribute to establishing a comprehensive understanding of each party's financial situation. Adhering to these requirements creates a solid foundation for a mutually beneficial prenuptial agreement.

South Fulton Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement: A Comprehensive Guide The financial statements required in connection with a prenuptial or premarital agreement in South Fulton, Georgia play a crucial role in protecting the financial interests of both parties involved in a marriage. A prenuptial agreement is a legal contract created before marriage that outlines the distribution of assets and debts in the event of divorce or death. In order to ensure transparency and fairness, South Fulton mandates the inclusion of financial statements specific to this agreement. 1. Personal Financial Statement: A personal financial statement is a document that provides a detailed overview of an individual's financial situation. It includes information regarding income, assets, liabilities, expenses, and other relevant financial aspects. Each party needs to prepare their own personal financial statement to disclose their financial standing accurately. 2. Bank Statements: Bank statements are essential documents that demonstrate an individual's financial activities and transactions over a specific period. These statements provide an overview of income, expenses, savings, investments, and any outstanding debts. Both parties must provide their bank statements to ensure a comprehensive understanding of their financial situation. 3. Tax Returns: Tax returns are crucial in highlighting an individual's income, sources of income, deductions, and tax liabilities. These documents provide a clear picture of each party's financial contributions and help determine potential spousal support obligations in the future. The inclusion of tax returns is vital to ensure transparency and fairness when creating a prenuptial agreement. 4. Property Deeds and Titles: Property deeds and titles confirm ownership of real estate properties, vehicles, or any other valuable assets. These documents provide substantial evidence of property ownership, stating the respective party's name and their percentage of ownership. Including property deeds and titles ensures accurate asset division and establishes the rightful owner during the prenuptial agreement process. 5. Investment Portfolio Statements: Investment portfolio statements offer insights into an individual's investment and asset management activities. These statements provide comprehensive details about stocks, bonds, mutual funds, retirement accounts, and other investments. The inclusion of investment portfolio statements helps determine the value of each party's investment holdings and assists in asset division discussions. 6. Business Financial Statements: If either party owns a business, providing business financial statements becomes crucial. These statements typically include income statements, balance sheets, cash flow statements, and relevant tax documents related to the business. Business financial statements offer an accurate representation of the company's financial health and contribute to fair asset division discussions and potential spousal support calculations. In conclusion, South Fulton, Georgia mandates the inclusion of various financial statements in connection with a prenuptial or premarital agreement to ensure transparency, fairness, and protection of both parties involved. Personal financial statements, bank statements, tax returns, property deeds and titles, investment portfolio statements, and business financial statements all contribute to establishing a comprehensive understanding of each party's financial situation. Adhering to these requirements creates a solid foundation for a mutually beneficial prenuptial agreement.