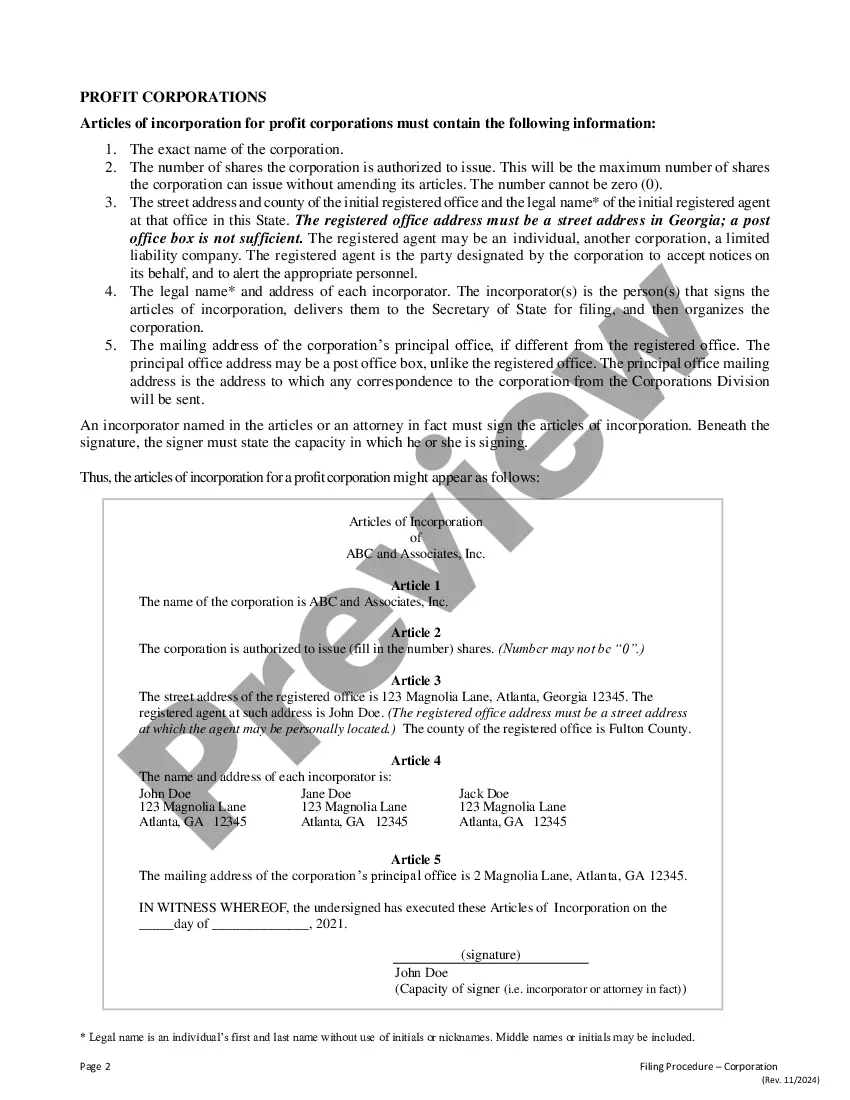

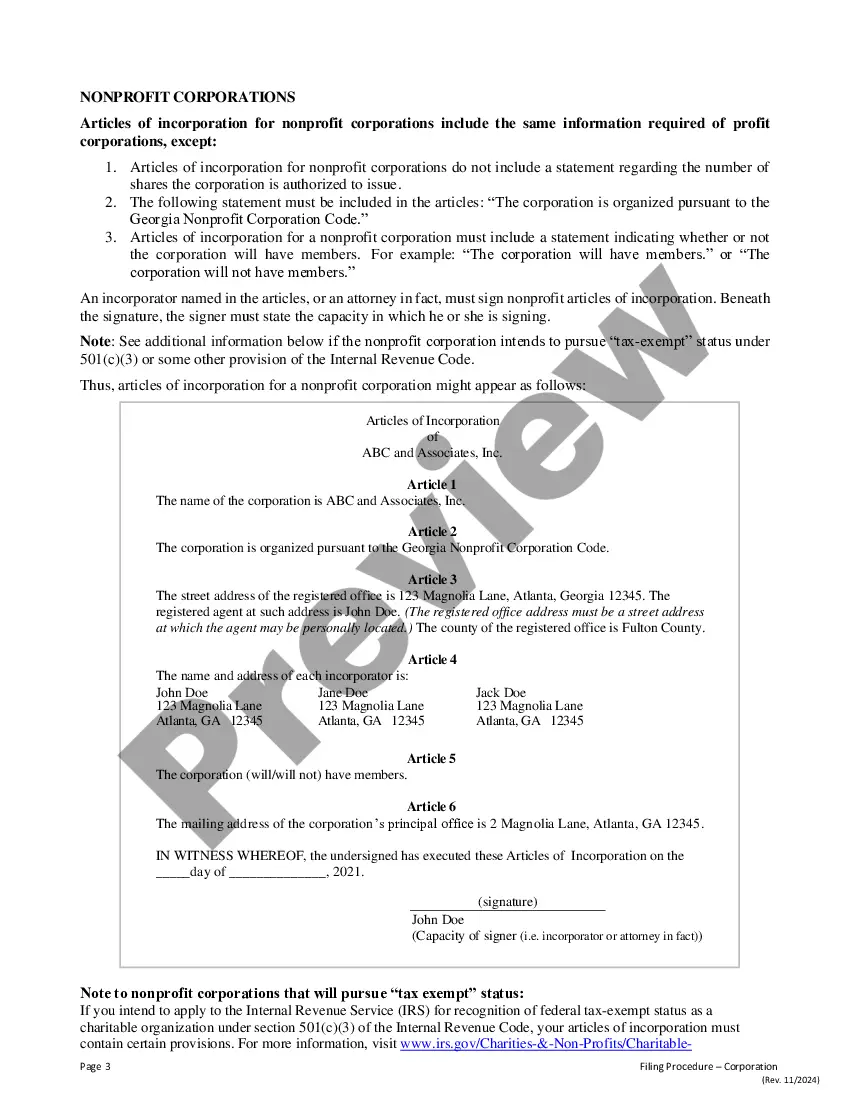

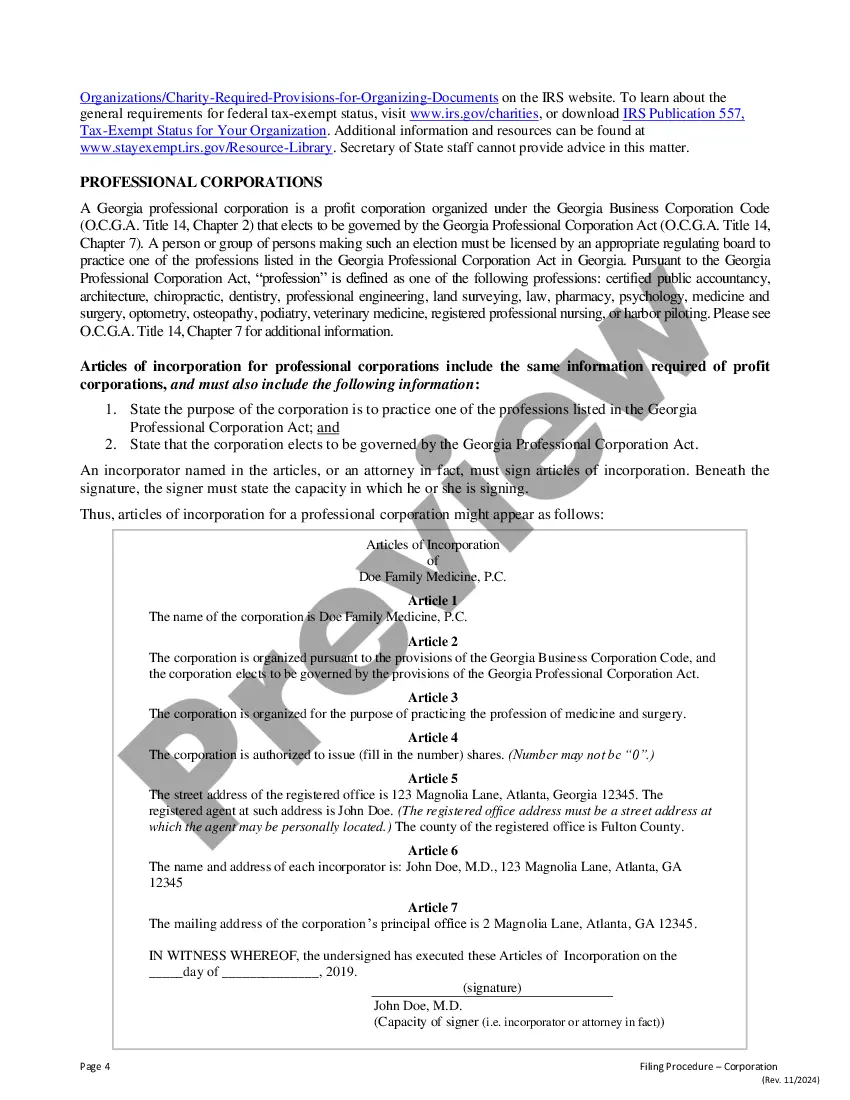

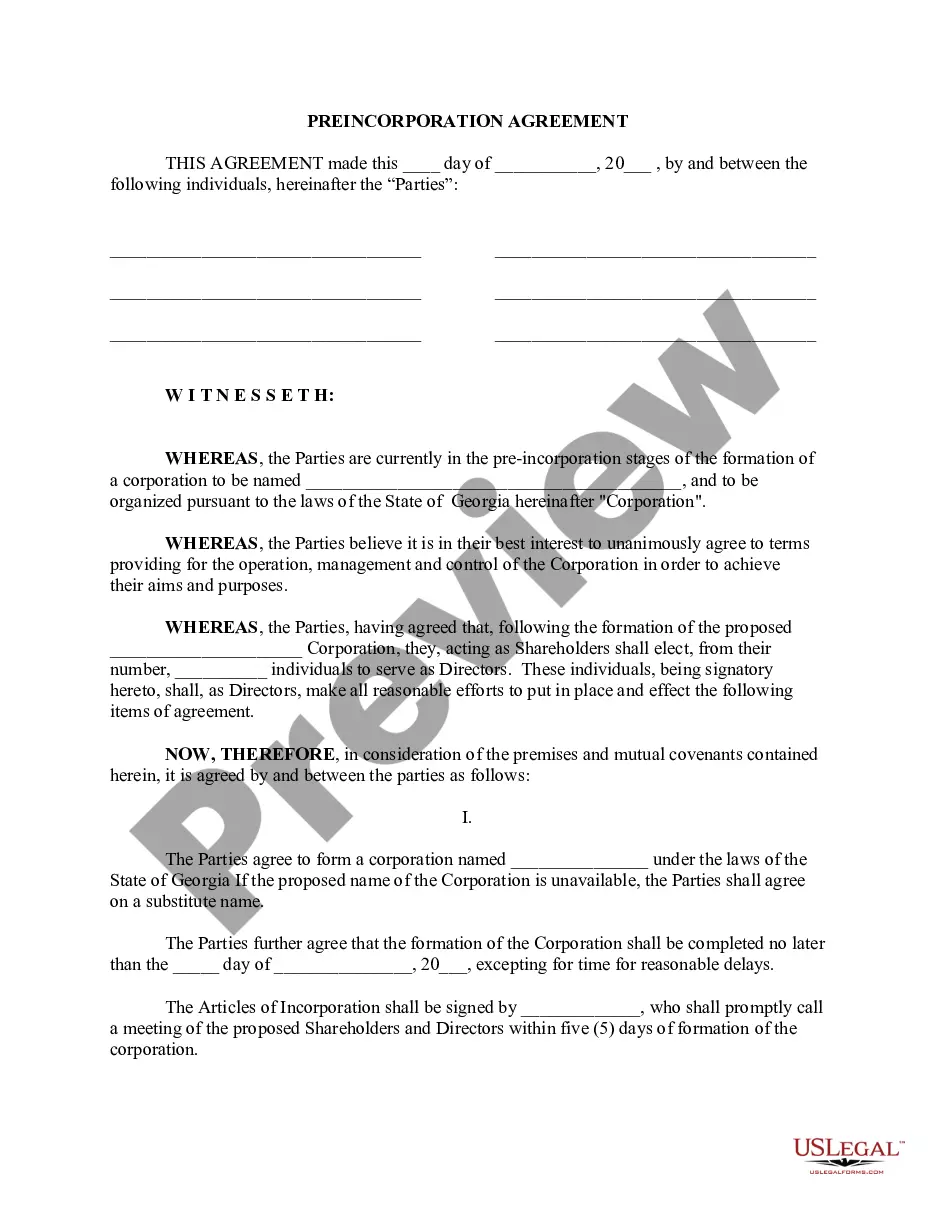

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

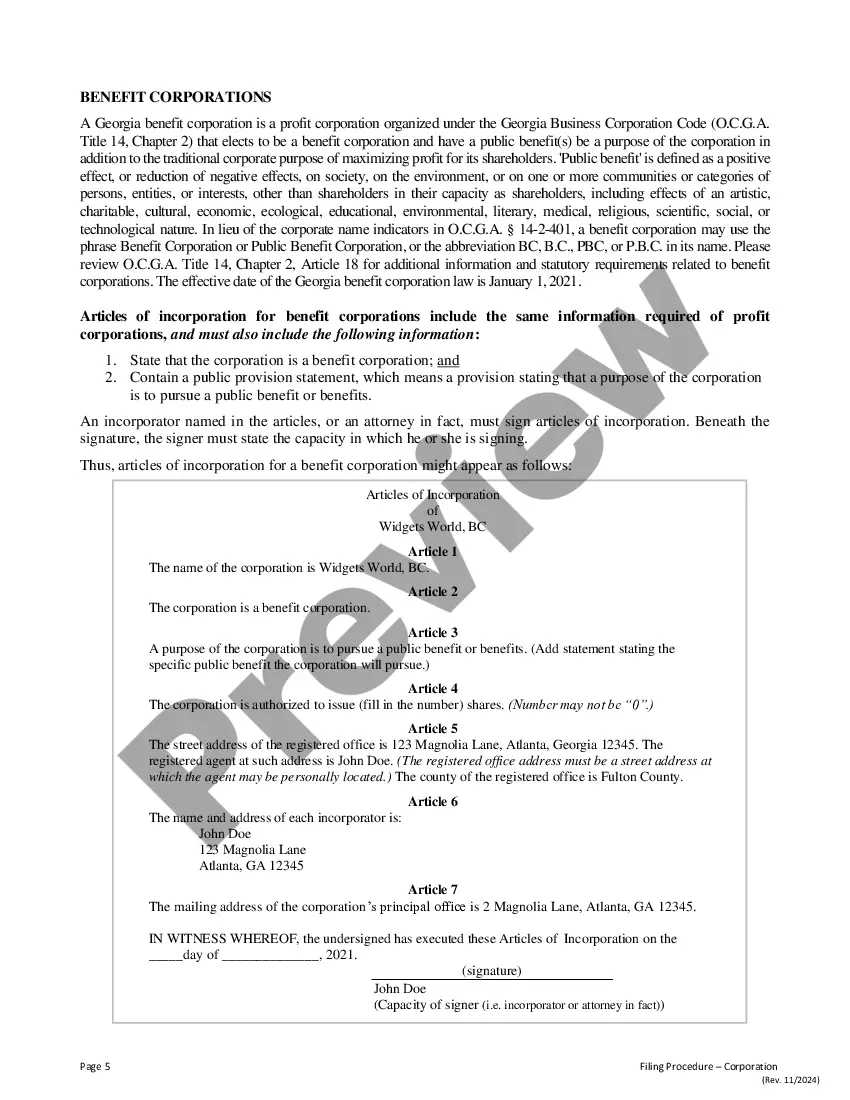

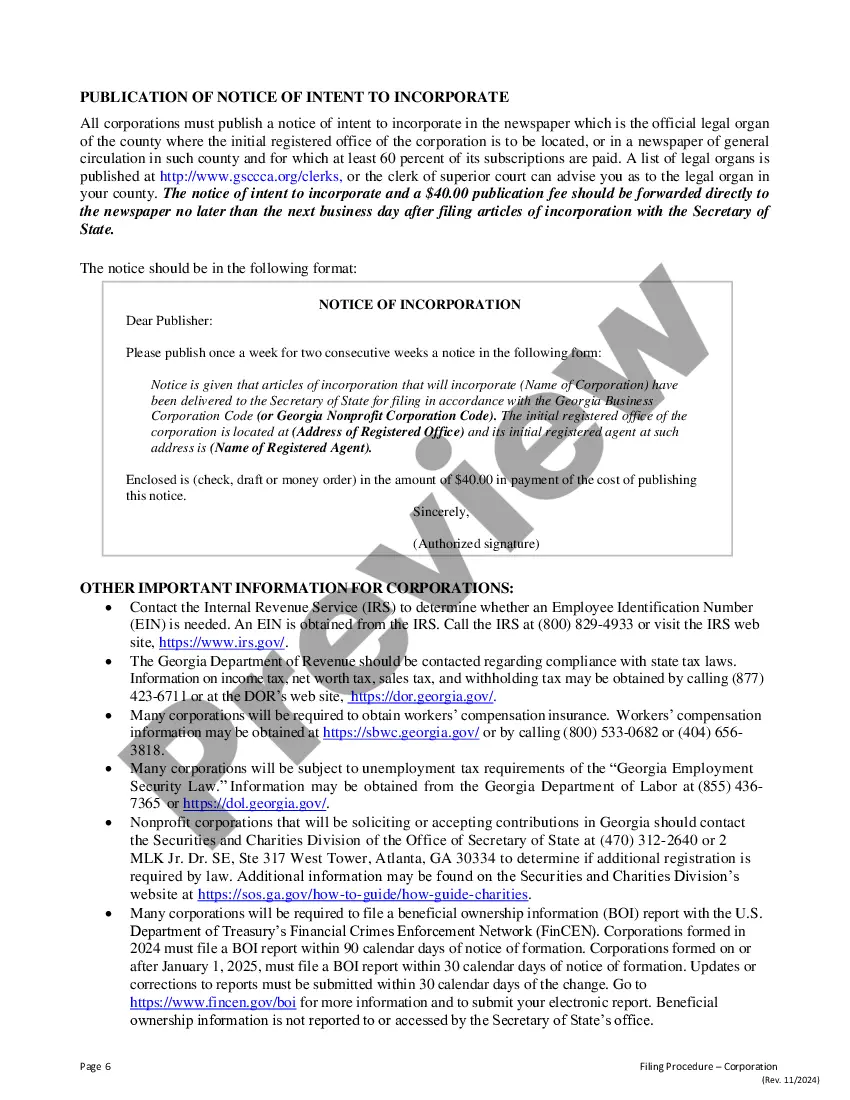

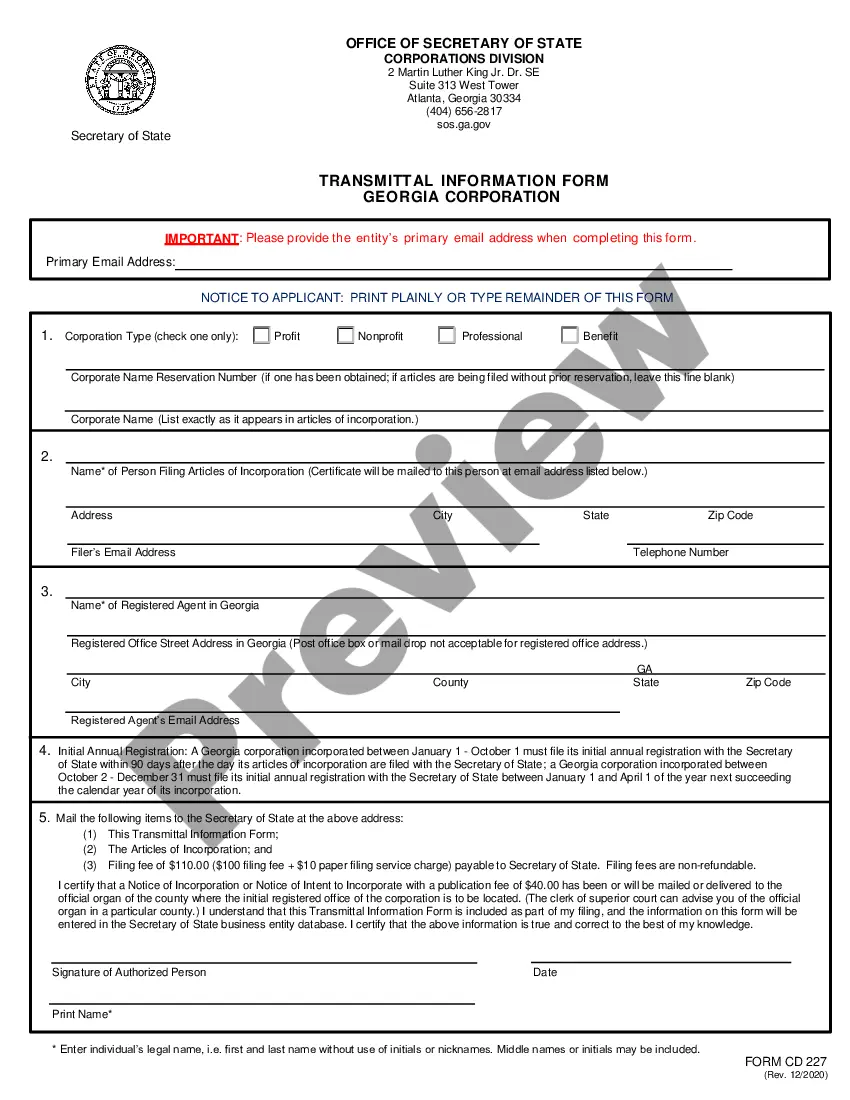

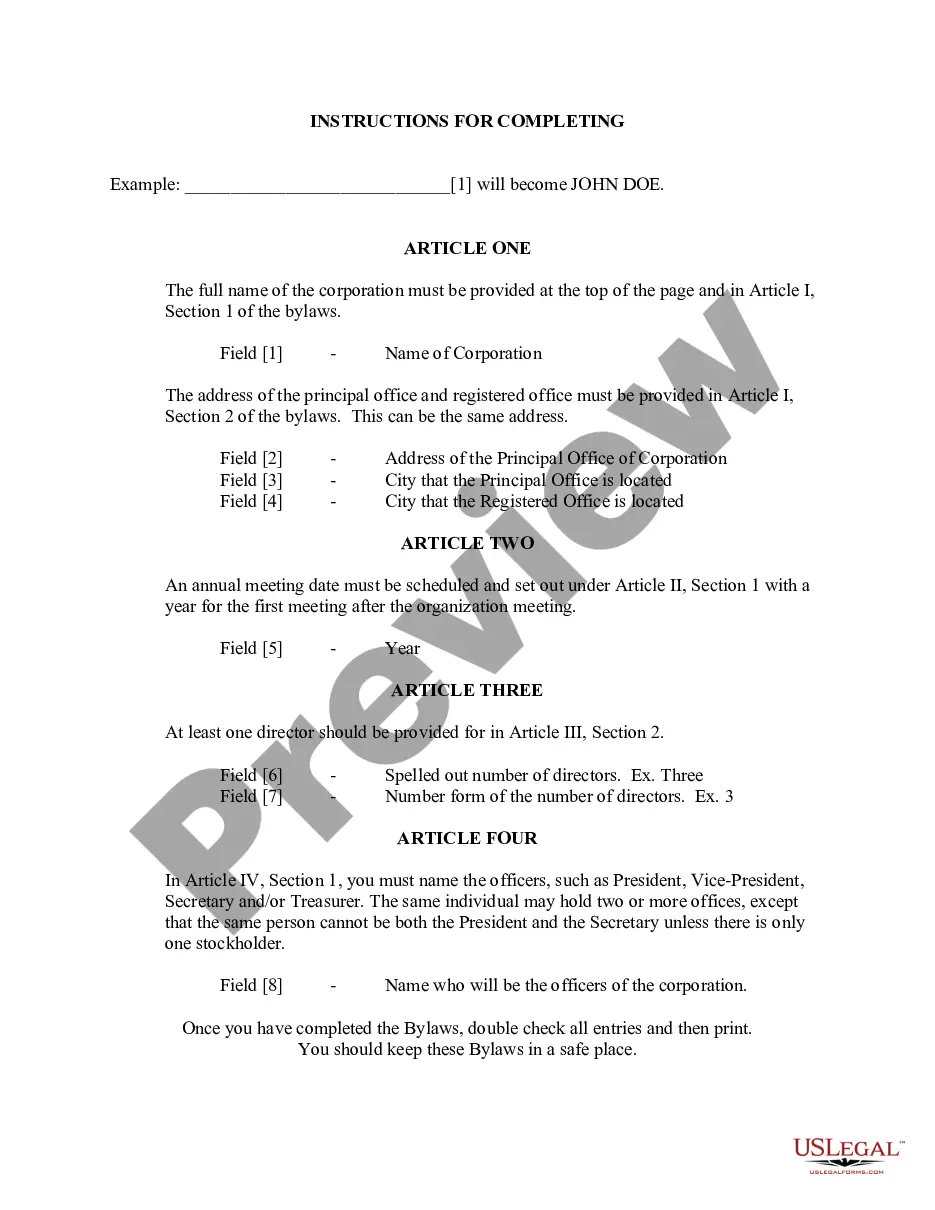

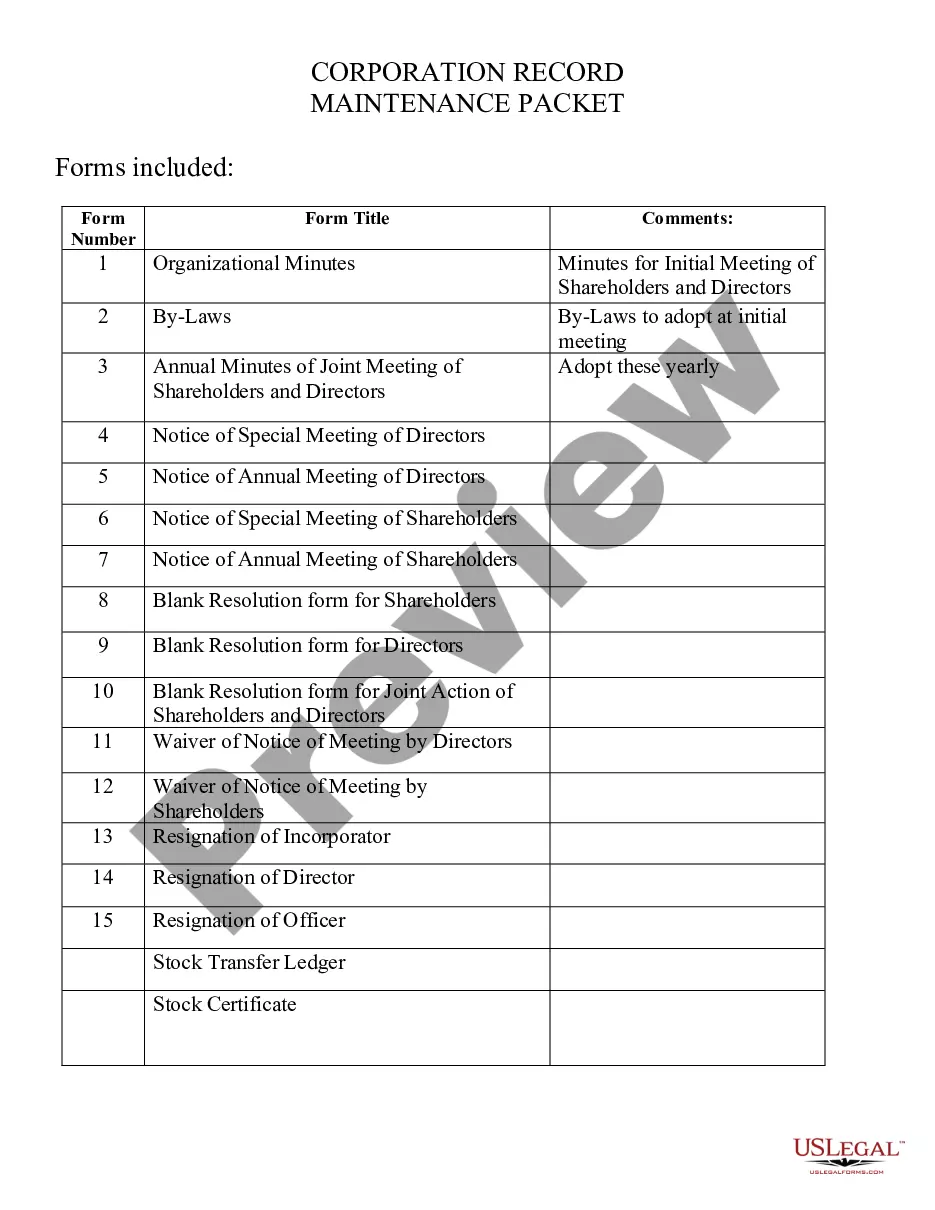

The Fulton Georgia Articles of Incorporation for Domestic For-Profit Corporation is a legal document that outlines the formation of a domestic for-profit corporation in Fulton County, Georgia. These articles play a crucial role in establishing and governing the corporation within the state. The Fulton Georgia Articles of Incorporation for Domestic For-Profit Corporation include various important details and keywords, such as: 1. Corporation Name: The articles require the corporation to state its official name as it will be registered with the state authorities. Selecting a unique and distinguishable name is essential to prevent any conflicts with existing corporations. 2. Registered Agent: The document identifies the registered agent and their address within Fulton County. This person or entity acts as the official representative for the corporation and ensures proper communication with the state. 3. Business Purpose: The articles outline the specific purpose for which the corporation is formed. It is important to state the primary business activity or services that the corporation will engage in to provide clarity regarding its operations. 4. Capital Structure: This section defines the authorized capital, which is the total number of shares the corporation can issue. It may also include details about different classes of shares and their respective rights, preferences, and limitations. 5. Incorporates: The names and addresses of the incorporates need to be disclosed. Incorporates are the individuals or entities initiating the formation of the corporation and sign the articles. 6. Duration: The articles specify the duration of the corporation's existence, which is typically perpetual unless stated otherwise. 7. Bylaws: While not a part of the articles, it is often mentioned that the corporation will adopt bylaws to govern its internal operations and decision-making processes. Different types of Fulton Georgia Articles of Incorporation for Domestic For-Profit Corporation may include variations or additional clauses to suit specific requirements. Some possible variations include: 1. Professional Corporation: If the corporation is established to provide professional services, such as legal or medical services, a certain set of guidelines and restrictions may apply. These articles of incorporation will outline the specific regulations associated with operating as a professional corporation. 2. Close Corporation: In some cases, a corporation may opt to operate as a close corporation, restricting the transferability of its stock to a limited number of shareholders. The articles of incorporation for a close corporation would include provisions related to the number of shareholders and requirements for stock transfers. 3. Nonprofit Corporation: If the corporation is formed for charitable, educational, or religious purposes, the articles of incorporation for a nonprofit corporation would differ significantly from those of a for-profit corporation. These articles would include specific provisions relevant to nonprofit operations, tax-exempt status, and compliance with state and federal regulations. In conclusion, the Fulton Georgia Articles of Incorporation for Domestic For-Profit Corporation is a critical document that encompasses various essential aspects of forming and operating a for-profit corporation in Fulton County. It is important to consult with legal professionals or utilize reliable online resources to ensure compliance with state laws and include all relevant keywords and information when drafting the articles.The Fulton Georgia Articles of Incorporation for Domestic For-Profit Corporation is a legal document that outlines the formation of a domestic for-profit corporation in Fulton County, Georgia. These articles play a crucial role in establishing and governing the corporation within the state. The Fulton Georgia Articles of Incorporation for Domestic For-Profit Corporation include various important details and keywords, such as: 1. Corporation Name: The articles require the corporation to state its official name as it will be registered with the state authorities. Selecting a unique and distinguishable name is essential to prevent any conflicts with existing corporations. 2. Registered Agent: The document identifies the registered agent and their address within Fulton County. This person or entity acts as the official representative for the corporation and ensures proper communication with the state. 3. Business Purpose: The articles outline the specific purpose for which the corporation is formed. It is important to state the primary business activity or services that the corporation will engage in to provide clarity regarding its operations. 4. Capital Structure: This section defines the authorized capital, which is the total number of shares the corporation can issue. It may also include details about different classes of shares and their respective rights, preferences, and limitations. 5. Incorporates: The names and addresses of the incorporates need to be disclosed. Incorporates are the individuals or entities initiating the formation of the corporation and sign the articles. 6. Duration: The articles specify the duration of the corporation's existence, which is typically perpetual unless stated otherwise. 7. Bylaws: While not a part of the articles, it is often mentioned that the corporation will adopt bylaws to govern its internal operations and decision-making processes. Different types of Fulton Georgia Articles of Incorporation for Domestic For-Profit Corporation may include variations or additional clauses to suit specific requirements. Some possible variations include: 1. Professional Corporation: If the corporation is established to provide professional services, such as legal or medical services, a certain set of guidelines and restrictions may apply. These articles of incorporation will outline the specific regulations associated with operating as a professional corporation. 2. Close Corporation: In some cases, a corporation may opt to operate as a close corporation, restricting the transferability of its stock to a limited number of shareholders. The articles of incorporation for a close corporation would include provisions related to the number of shareholders and requirements for stock transfers. 3. Nonprofit Corporation: If the corporation is formed for charitable, educational, or religious purposes, the articles of incorporation for a nonprofit corporation would differ significantly from those of a for-profit corporation. These articles would include specific provisions relevant to nonprofit operations, tax-exempt status, and compliance with state and federal regulations. In conclusion, the Fulton Georgia Articles of Incorporation for Domestic For-Profit Corporation is a critical document that encompasses various essential aspects of forming and operating a for-profit corporation in Fulton County. It is important to consult with legal professionals or utilize reliable online resources to ensure compliance with state laws and include all relevant keywords and information when drafting the articles.