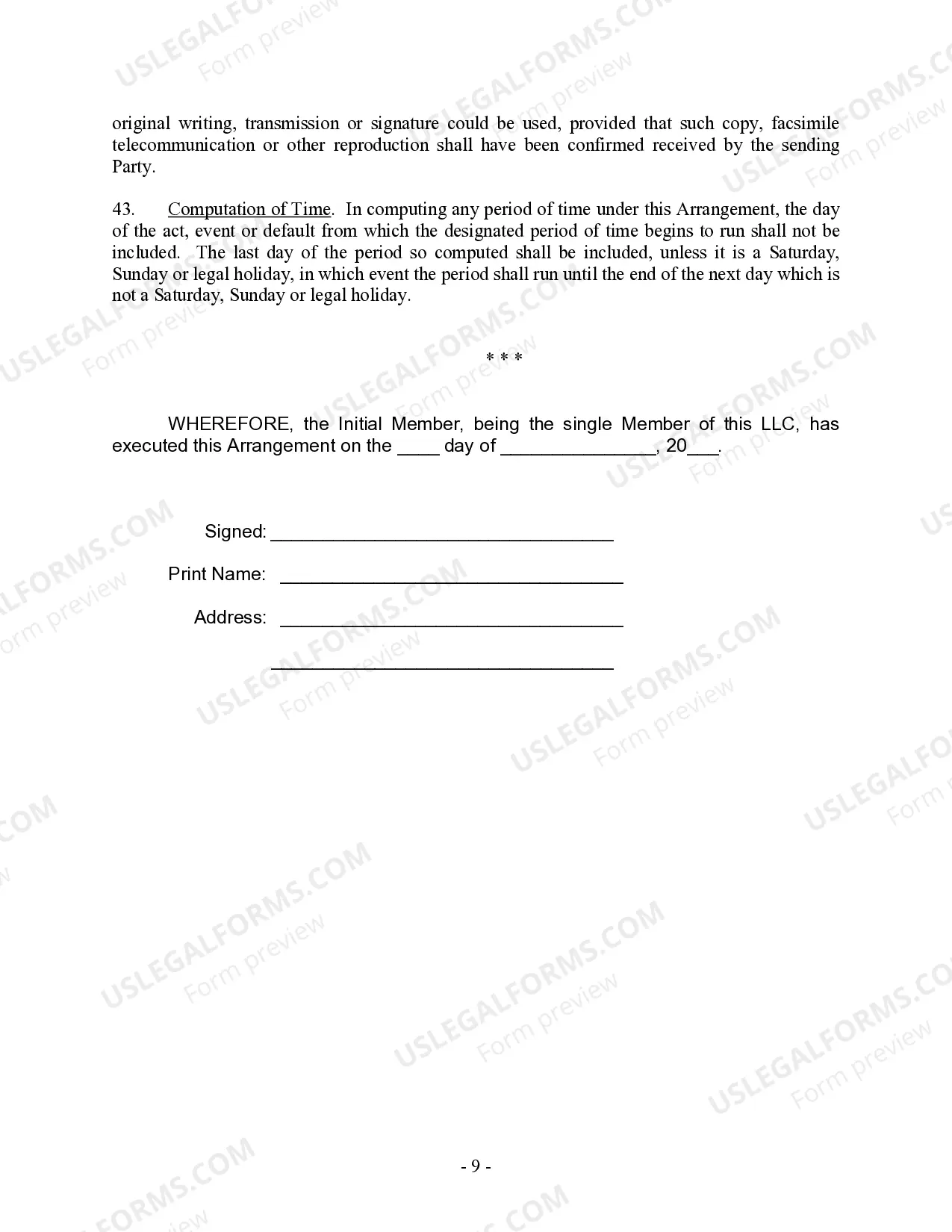

This Operating Agreement is for a Limited Liability Company with only one Member. This form may be perfect for an LLC started by one person. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

Atlanta Georgia Single Member Limited Liability Company LLC Operating Agreement

Description

How to fill out Atlanta Georgia Single Member Limited Liability Company LLC Operating Agreement?

If you are in search of a legitimate document, it’s hard to discover a more user-friendly service than the US Legal Forms website – one of the most extensive collections available online.

With this collection, you can locate thousands of sample forms for both business and personal use, categorized by type and state, or by keywords.

Using our efficient search feature, finding the most up-to-date Atlanta Georgia Single Member Limited Liability Company LLC Operating Agreement is as simple as one-two-three.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Retrieve the document. Choose the format and download it to your device.

- Moreover, the accuracy of each document is confirmed by a team of professional attorneys who routinely review the templates on our platform and refresh them in line with the latest regulations at the state and county levels.

- If you are already familiar with our system and possess a registered account, all that's required to obtain the Atlanta Georgia Single Member Limited Liability Company LLC Operating Agreement is to Log In to your account and select the Download option.

- Should this be your first time utilizing US Legal Forms, simply follow the instructions provided below.

- Ensure you have identified the document you need. Review its details and use the Preview function to examine its contents. If it doesn't fulfill your requirements, utilize the Search bar at the top of the screen to find the desired document.

- Verify your selection. Select the Buy now button. Then, choose your preferred subscription plan and enter your information to register for an account.

Form popularity

FAQ

There are many benefits to forming an LLC versus operating as a sole proprietorship. A single-member LLC is generally shielded from personal liability for debts associated with the business. Note: Single-member LLCs must be careful to avoid commingling business and personal assets.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

From the perspective of the IRS, changing from an LLC with more than one member to a single-member LLC is considered the end of the partnership tax status. This is comparable to closing a partnership and reopening as a sole proprietorship as far as taxes are involved.

The pros and cons of a single member LLC ProsConsFlexible federal income tax filing (choose to file as a sole prop or corporation)Must maintain corporate veil?piercing it puts your assets at riskCan pass on ownership to others, eg. family members2 more rows ?

In addition to articles of organization, Missouri statute requires all limited liability companies to have an operating agreement.

An operating agreement is a legal document that outlines the personal interests of the member(s), the management architecture, and various other provisions related to the operating structure of the LLC.

Prepare an Operating Agreement An LLC operating agreement is not required in Illinois, but is highly recommended. This is an internal document that establishes how you will run your LLC. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

Georgia does not require an SMLLC to have an operating agreement. However, even though an SMLLC has just one member, an operating agreement is highly recommended. An SMLLC operating agreement does not need to be filed with the state. The operating agreement is usually made between the single member and the LLC itself.

It can secure your liability protection. This is crucial to understand, as it's the primary main reason that your single-member LLC needs an operating agreement. Even if an operating agreement isn't required in your state, running your company without an operating agreement could jeopardize your LLC status.

member LLC is easier for tax purposes because no federal tax return is required, unless the business decides to be treated as a corporation for tax purposes. The income is reported on the member's tax return. A multiple member LLC must file tax return, and give the members K1 forms to file with their returns.

More info

The Operating Agreement of either. For a limited liability company, membership in the company is limited to members of the same race, religion, color, national origin or ancestry and residency within this state as the LLC's sole member. Georgia Stat. §14-11-120(b); 14-11-111(b); Ga. Code §14-11-1109(b); Ala. Code §33-2-3(f); Alaska Stat. §70.01, 707.22; Ariz. Rev. Stat. Ann. §25-1102(A); Colo. Rev. Stat. Ann. §16-11-104(5) (effective July 1, 1998); Conn. Gen. Stat. §§53-202a(1), (3), (4), 53a-10a(a); Del. Code Ann., Tit. 10, §1134(b)(1) (West 1998); District of Columbia Code Ann. §§27-101(1), (4), (5) (West 1998); Fla. Stat. §201.103(b)(11) (West 1998); Ga. Code Ann. 14-11-1104(b); Ga. Code Ann. §14-11-1080(a)(1); Hawaii Rev. Stat. §171-9(2), HRS §11-10-4; 111 Stat. 962(a)(2) (Supp. 1996); 1 U.S.C. §§ 801(a)(1), 828(a) 12-902(g) (1991); 1 U.S.C. § 111(a) (1996); In re Estate of White, 869 F.2d 1190, 1196 n.1 (11th Cir. 1989); see generally C. Stall, Jr.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.