If you live in a mandatory homeowner association you probably pay annual dues, also called annual assessments. These dues help pay for such things as; maintenance of the common facilities, and professional services (including accountants, attorneys, and management companies). It is also prudent for an association to establish a reserve account to be used for large future expenditures, such as resurfacing the pool. The provisions for paying annual dues are contained in the Declaration of Covenants for your association. The Declaration of Covenants is filed on the deed records in your county's Superior Court. You automatically agreed to the terms of these covenants by purchasing your home.

The amount of the annual dues or "assessment" is determined each year by the Board of the Association. To protect the interests of both the homeowners and their lenders, the covenants often establish a maximum assessment based on the anticipated costs for maintaining the community. Usually, this maximum cannot be exceeded without a vote from the membership, but some covenants allow the Board to increase this amount each year by a specific percentage, or in step with the Consumer Price Index.

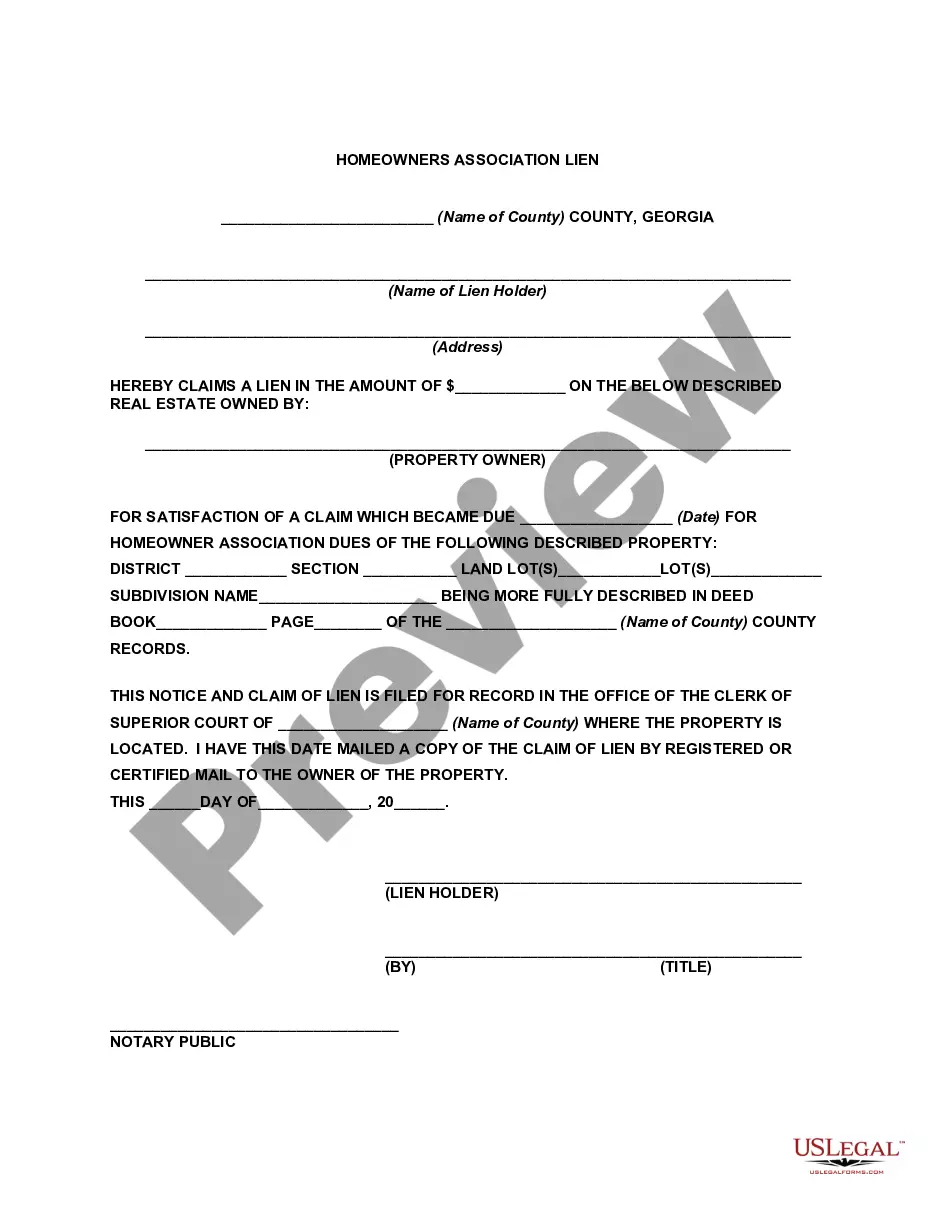

If a homeowner does not pay the dues, most covenants state that the association may charge a late fee and interest. In addition, a lien can be filed on the property called an "Assessment Lien." This lien may contain extra costs including recording fees, cancellation fees, and attorney fees. It is not necessary to institute suit in order to file the lien.

A Sandy Springs Georgia homeowners association lien refers to a legal claim placed on a property by a homeowners' association (HOA) in Sandy Springs, Georgia, due to the property owner's failure to meet their financial obligations, typically in the form of unpaid HOA dues or violation fines. This lien serves as a mechanism for the HOA to recover the outstanding amounts and ensure compliance with the association's rules and regulations. When homeowners in Sandy Springs, Georgia, choose to live in a community governed by an HOA, they agree to pay certain fees and abide by the association's guidelines. Non-payment of HOA dues or violation fines can result in the HOA enforcing a lien on the homeowner's property. The lien grants the association the right to take legal action to collect the outstanding amount, potentially leading to foreclosure if the debt remains unpaid. There are different types of Sandy Springs Georgia homeowners association liens based on the nature of the debt: 1. Assessment Lien: The most common type of lien, it arises when a homeowner fails to pay their regular HOA dues or special assessments. Regular HOA dues are typically collected monthly or annually to cover maintenance costs, property management fees, insurance, and community amenities. Special assessments may arise for unexpected expenses or large-scale community improvement projects. 2. Fine Lien: Another type of lien occurs when homeowners violate community rules and regulations, resulting in fines imposed by the HOA. These fines can be issued for various reasons such as failure to maintain the property, excessive noise, unapproved architectural modifications, or unauthorized use of common areas. If fines remain unpaid, the HOA can place a lien on the property. 3. Legal Fee Lien: In situations where the homeowner fails to meet their financial obligations and the HOA has to resort to legal action, such as hiring an attorney to handle collections or disputes, a legal fee lien may be imposed. This lien covers the expenses incurred by the association in pursuing legal action against the homeowner. To protect the interests of homeowners, the Sandy Springs Georgia Property Owners' Association Act provides certain rights and restrictions surrounding the imposition and enforcement of homeowners association liens. Homeowners should carefully review their HOA's governing documents, including the Declaration of Covenants, Conditions, and Restrictions (CC&Rs), to understand the specific procedures and remedies available to the association in case of non-payment or violations. In conclusion, a Sandy Springs Georgia homeowners association lien is a legal claim filed by an HOA to recoup unpaid dues or violation fines. The different types of liens include assessment liens, fine liens, and legal fee liens. Homeowners should be aware of their financial responsibilities and follow their HOA's guidelines to avoid potential liens and legal consequences.A Sandy Springs Georgia homeowners association lien refers to a legal claim placed on a property by a homeowners' association (HOA) in Sandy Springs, Georgia, due to the property owner's failure to meet their financial obligations, typically in the form of unpaid HOA dues or violation fines. This lien serves as a mechanism for the HOA to recover the outstanding amounts and ensure compliance with the association's rules and regulations. When homeowners in Sandy Springs, Georgia, choose to live in a community governed by an HOA, they agree to pay certain fees and abide by the association's guidelines. Non-payment of HOA dues or violation fines can result in the HOA enforcing a lien on the homeowner's property. The lien grants the association the right to take legal action to collect the outstanding amount, potentially leading to foreclosure if the debt remains unpaid. There are different types of Sandy Springs Georgia homeowners association liens based on the nature of the debt: 1. Assessment Lien: The most common type of lien, it arises when a homeowner fails to pay their regular HOA dues or special assessments. Regular HOA dues are typically collected monthly or annually to cover maintenance costs, property management fees, insurance, and community amenities. Special assessments may arise for unexpected expenses or large-scale community improvement projects. 2. Fine Lien: Another type of lien occurs when homeowners violate community rules and regulations, resulting in fines imposed by the HOA. These fines can be issued for various reasons such as failure to maintain the property, excessive noise, unapproved architectural modifications, or unauthorized use of common areas. If fines remain unpaid, the HOA can place a lien on the property. 3. Legal Fee Lien: In situations where the homeowner fails to meet their financial obligations and the HOA has to resort to legal action, such as hiring an attorney to handle collections or disputes, a legal fee lien may be imposed. This lien covers the expenses incurred by the association in pursuing legal action against the homeowner. To protect the interests of homeowners, the Sandy Springs Georgia Property Owners' Association Act provides certain rights and restrictions surrounding the imposition and enforcement of homeowners association liens. Homeowners should carefully review their HOA's governing documents, including the Declaration of Covenants, Conditions, and Restrictions (CC&Rs), to understand the specific procedures and remedies available to the association in case of non-payment or violations. In conclusion, a Sandy Springs Georgia homeowners association lien is a legal claim filed by an HOA to recoup unpaid dues or violation fines. The different types of liens include assessment liens, fine liens, and legal fee liens. Homeowners should be aware of their financial responsibilities and follow their HOA's guidelines to avoid potential liens and legal consequences.