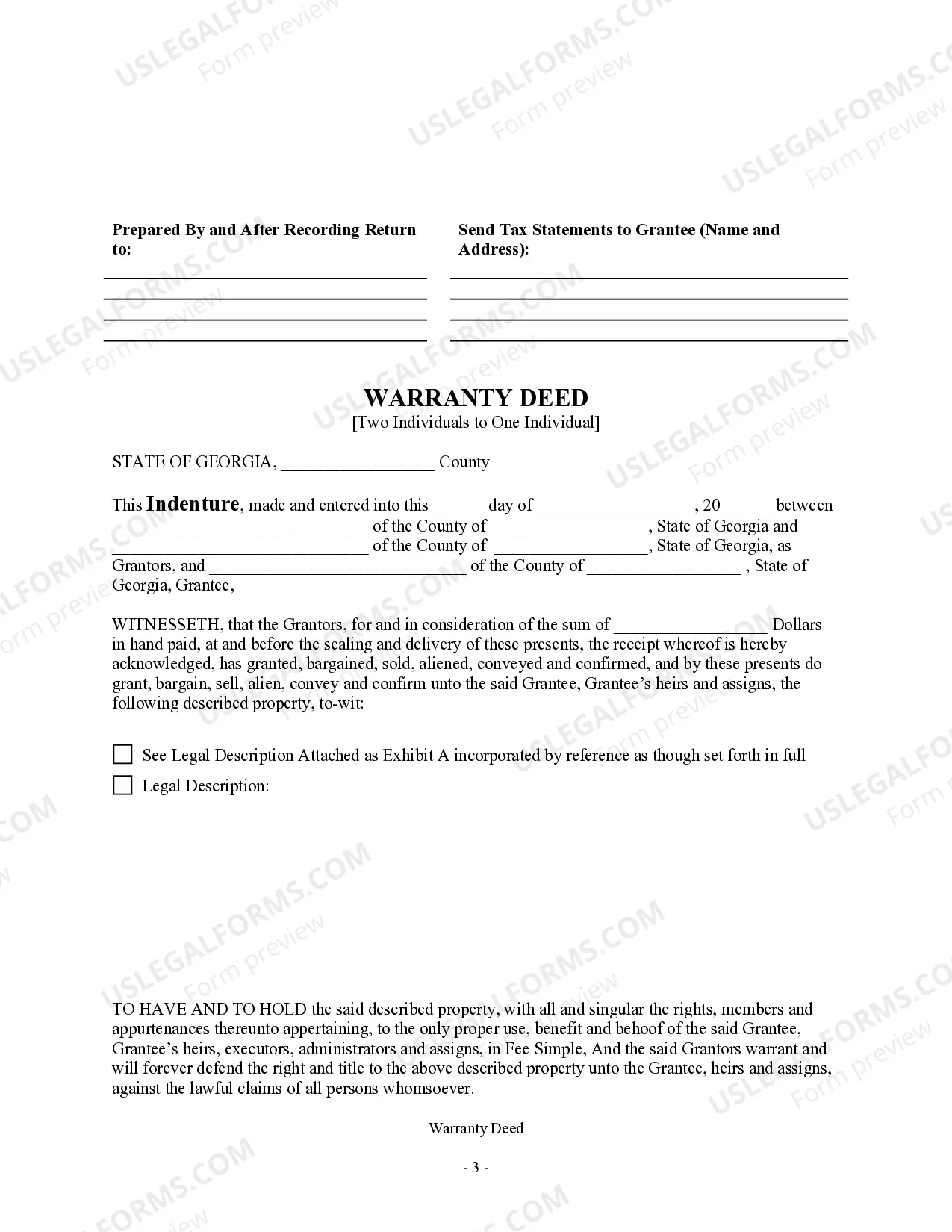

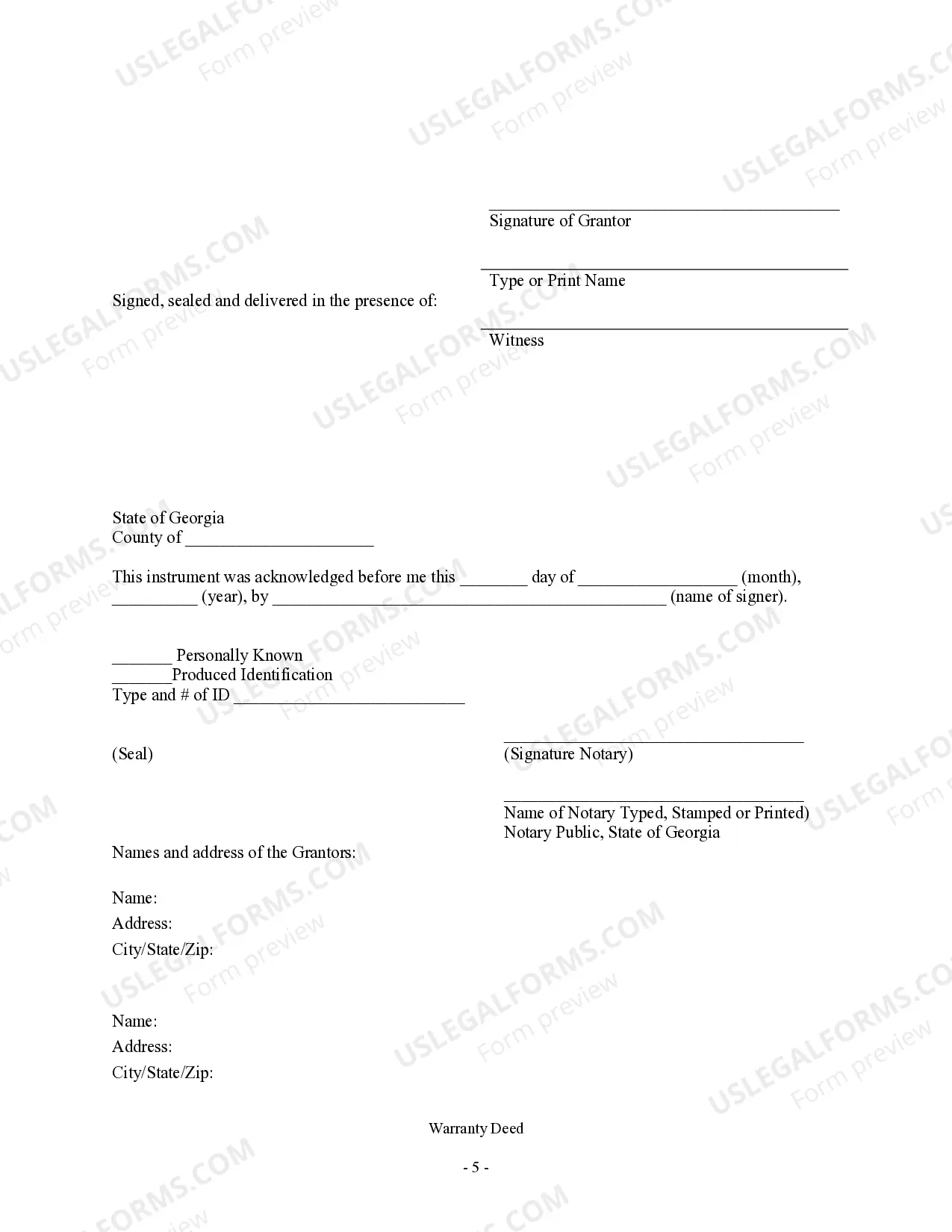

This form is a Warranty Deed between the two individual Grantors and the individual Grantee. Grantors convey and warrant the described property to the Grantee. This deed complies with all state statutory laws.

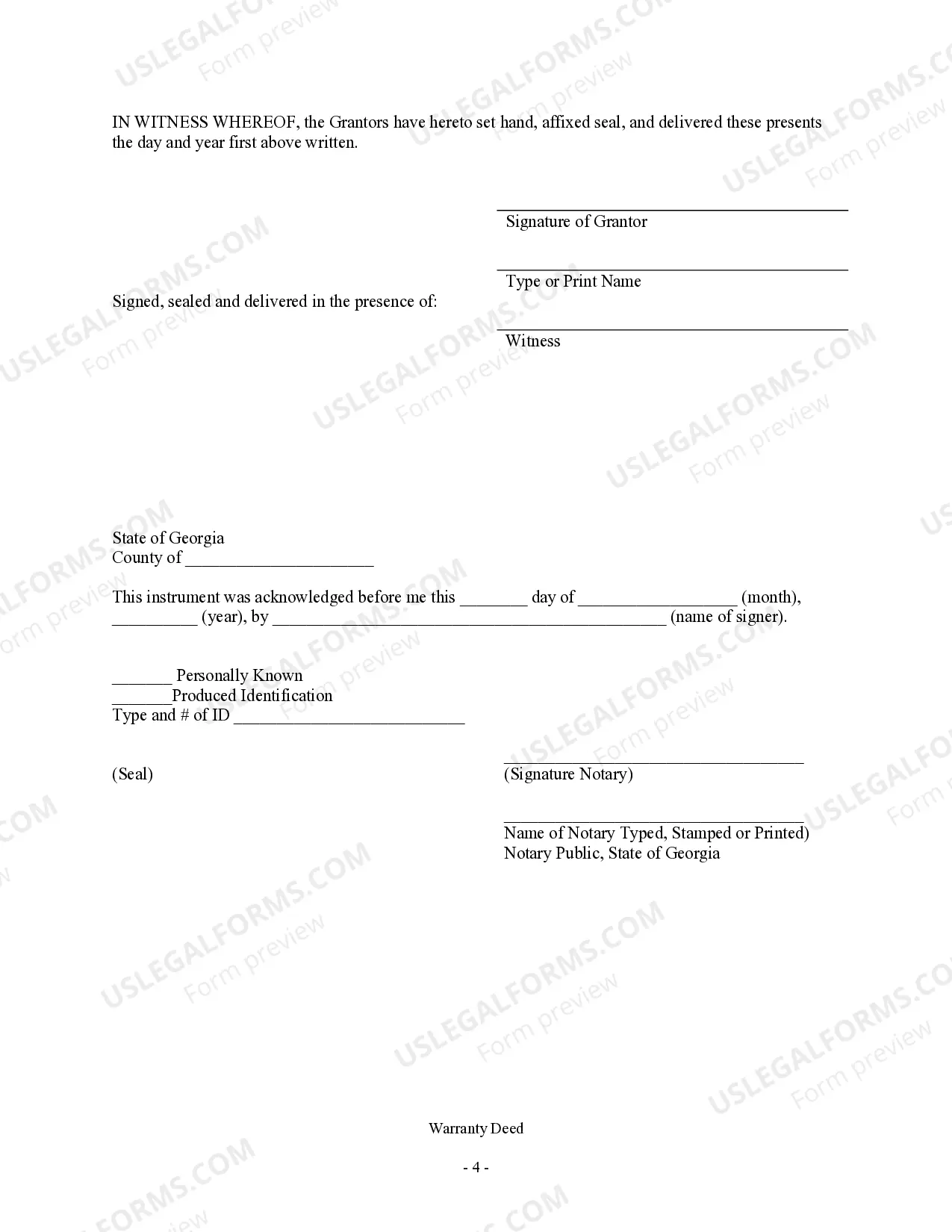

A Sandy Springs Georgia Warranty Deed — Two Individuals to One Individual refers to a legal document used in real estate transactions to transfer ownership of a property from two individuals to another individual, accompanied by a warranty of ownership and protection against any potential claims or defects. This type of deed provides assurance to the buyer that the property is free from any liens, encumbrances, or title defects. There are different types of Sandy Springs Georgia Warranty Deed — Two Individuals to One Individual, including: 1. General Warranty Deed: This deed offers the highest level of protection to the buyer, guaranteeing that the sellers hold clear and marketable title to the property and will defend the buyer against any future claims. 2. Special Warranty Deed: With this type of deed, the sellers only warrant that they have not caused any title issues during their ownership of the property. It offers limited protection compared to a general warranty deed. 3. Quitclaim Deed: This deed transfers the interest in a property from the two individuals to the buyer without any warranties or guarantees. It is typically used in situations where the parties involved have complete trust in each other and the property's title is not in question. The Sandy Springs Georgia Warranty Deed — Two Individuals to One Individual includes essential information such as the names and addresses of the sellers and the buyer, a legal property description, the purchase price or consideration, and the date of the transfer. This deed needs to be signed and notarized by all parties involved to become legally binding. Before executing this deed, it is crucial for both the buyer and seller to consult a qualified attorney or real estate professional to handle the transaction and ensure a smooth transfer of ownership. In addition, it is advisable for the buyer to conduct a thorough title search and obtain title insurance to further protect their interests.