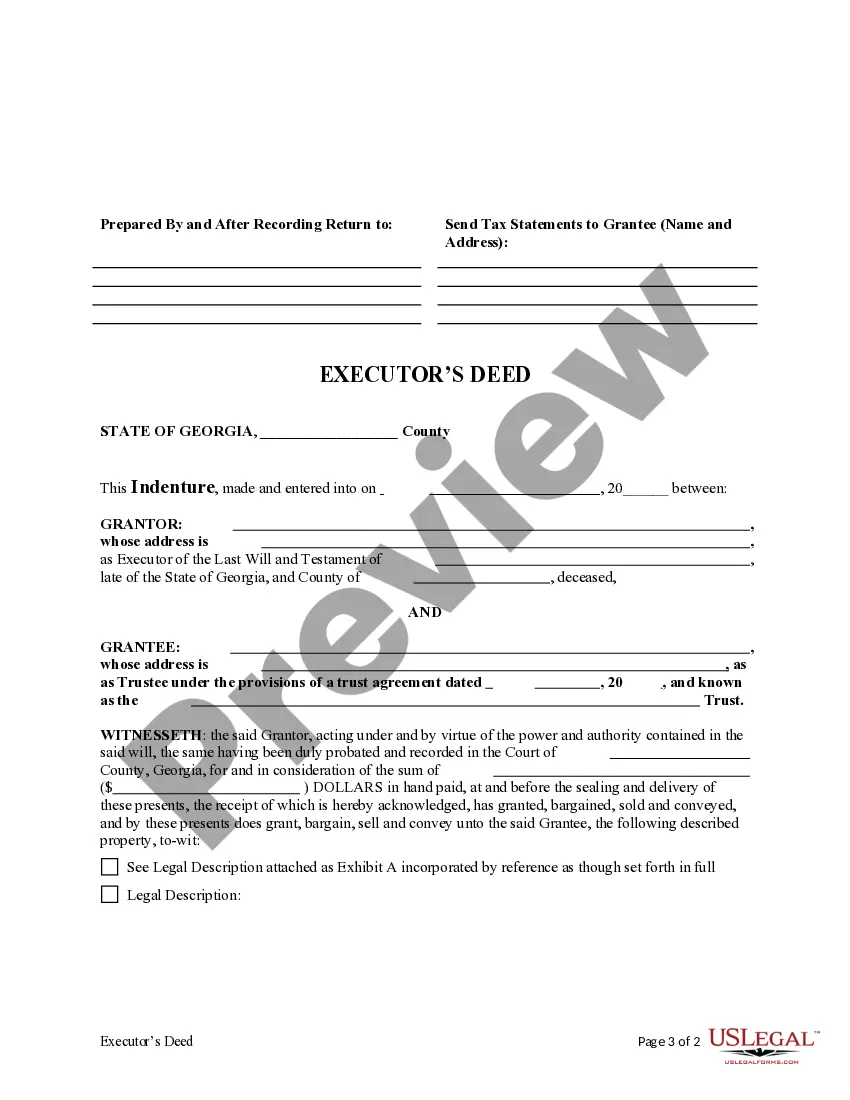

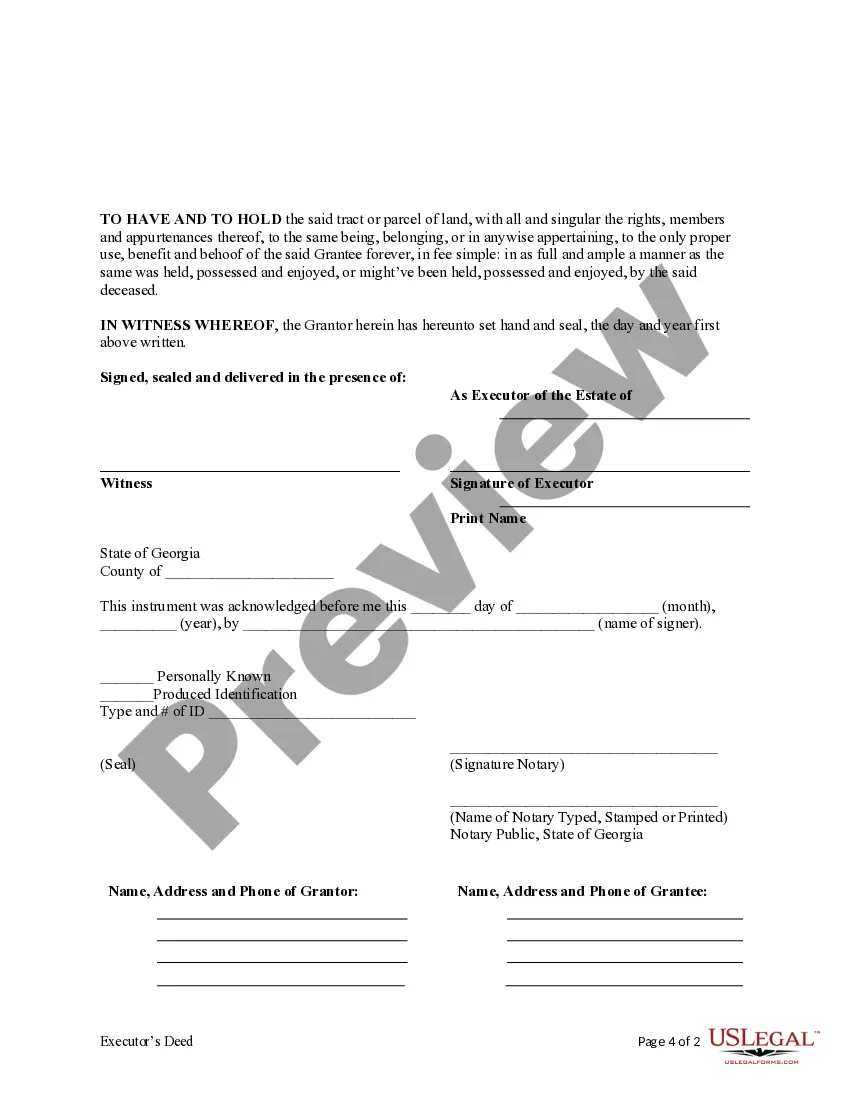

This form is an Executor's Deed where the Grantor is the executor of an estate and the Grantee is a Trust as purchaser of the property. Grantor conveys the described property to the Grantee. This deed complies with all state statutory laws.

South Fulton Georgia Executor's Deed to a Trust: A Comprehensive Guide In South Fulton, Georgia, an Executor's Deed to a Trust is a legal document that allows the executor of an estate to transfer property assets from the deceased individual's estate into a trust. This serves as a crucial step in the probate process, ensuring a smooth transition of ownership and protection of the deceased person's assets for the beneficiaries outlined in the trust. Keywords: South Fulton Georgia, Executor's Deed, Trust, Property assets, Probate process, Ownership transfer, Beneficiaries. There are different types of South Fulton Georgia Executor's Deed to a Trust. Some of these include: 1. Testamentary Trust Executor's Deed: This type of executor's deed is utilized when the trust is established through a will and becomes effective only upon the death of the testator (the deceased individual). The executor, appointed by the court, will transfer the property assets from the estate to the trust as outlined in the will. 2. Living Trust Executor's Deed: In this scenario, the trust is established during the lifetime of the settler (the person creating the trust) and becomes effective immediately. The trustee, who is often the settler themselves, transfers the property assets from the estate to the living trust. 3. Special Needs Trust Executor's Deed: This type of executor's deed pertains to a trust created specifically for a person with special needs, aiming to protect their assets while ensuring government assistance eligibility. The executor, following the deceased person's wishes and court's approval, transfers the assets from the estate to the special needs trust. 4. Charitable Trust Executor's Deed: In the case of a trust established for charitable or philanthropic purposes, the executor's deed is used to transfer the assets from the estate to the designated charitable trust. This allows the deceased person's charitable intents to be fulfilled. 5. Revocable Trust Executor's Deed: When the trust created by the deceased person is revocable, meaning it can be altered or revoked during their lifetime, the executor's deed is employed to transfer the assets from the estate to the revocable trust. The trustee, often the deceased person themselves, has the flexibility to make changes to the trust as needed. It is essential to consult with an experienced attorney specializing in estate planning and probate law in South Fulton, Georgia, to ensure the proper preparation and execution of the Executor's Deed to a Trust. The attorney can provide expert guidance throughout the probate process, ensuring compliance with local laws and regulations. Remember, the Executor's Deed to a Trust plays a crucial role in safeguarding property assets and facilitating the successful implementation of the deceased person's wishes as outlined in the trust document.South Fulton Georgia Executor's Deed to a Trust: A Comprehensive Guide In South Fulton, Georgia, an Executor's Deed to a Trust is a legal document that allows the executor of an estate to transfer property assets from the deceased individual's estate into a trust. This serves as a crucial step in the probate process, ensuring a smooth transition of ownership and protection of the deceased person's assets for the beneficiaries outlined in the trust. Keywords: South Fulton Georgia, Executor's Deed, Trust, Property assets, Probate process, Ownership transfer, Beneficiaries. There are different types of South Fulton Georgia Executor's Deed to a Trust. Some of these include: 1. Testamentary Trust Executor's Deed: This type of executor's deed is utilized when the trust is established through a will and becomes effective only upon the death of the testator (the deceased individual). The executor, appointed by the court, will transfer the property assets from the estate to the trust as outlined in the will. 2. Living Trust Executor's Deed: In this scenario, the trust is established during the lifetime of the settler (the person creating the trust) and becomes effective immediately. The trustee, who is often the settler themselves, transfers the property assets from the estate to the living trust. 3. Special Needs Trust Executor's Deed: This type of executor's deed pertains to a trust created specifically for a person with special needs, aiming to protect their assets while ensuring government assistance eligibility. The executor, following the deceased person's wishes and court's approval, transfers the assets from the estate to the special needs trust. 4. Charitable Trust Executor's Deed: In the case of a trust established for charitable or philanthropic purposes, the executor's deed is used to transfer the assets from the estate to the designated charitable trust. This allows the deceased person's charitable intents to be fulfilled. 5. Revocable Trust Executor's Deed: When the trust created by the deceased person is revocable, meaning it can be altered or revoked during their lifetime, the executor's deed is employed to transfer the assets from the estate to the revocable trust. The trustee, often the deceased person themselves, has the flexibility to make changes to the trust as needed. It is essential to consult with an experienced attorney specializing in estate planning and probate law in South Fulton, Georgia, to ensure the proper preparation and execution of the Executor's Deed to a Trust. The attorney can provide expert guidance throughout the probate process, ensuring compliance with local laws and regulations. Remember, the Executor's Deed to a Trust plays a crucial role in safeguarding property assets and facilitating the successful implementation of the deceased person's wishes as outlined in the trust document.