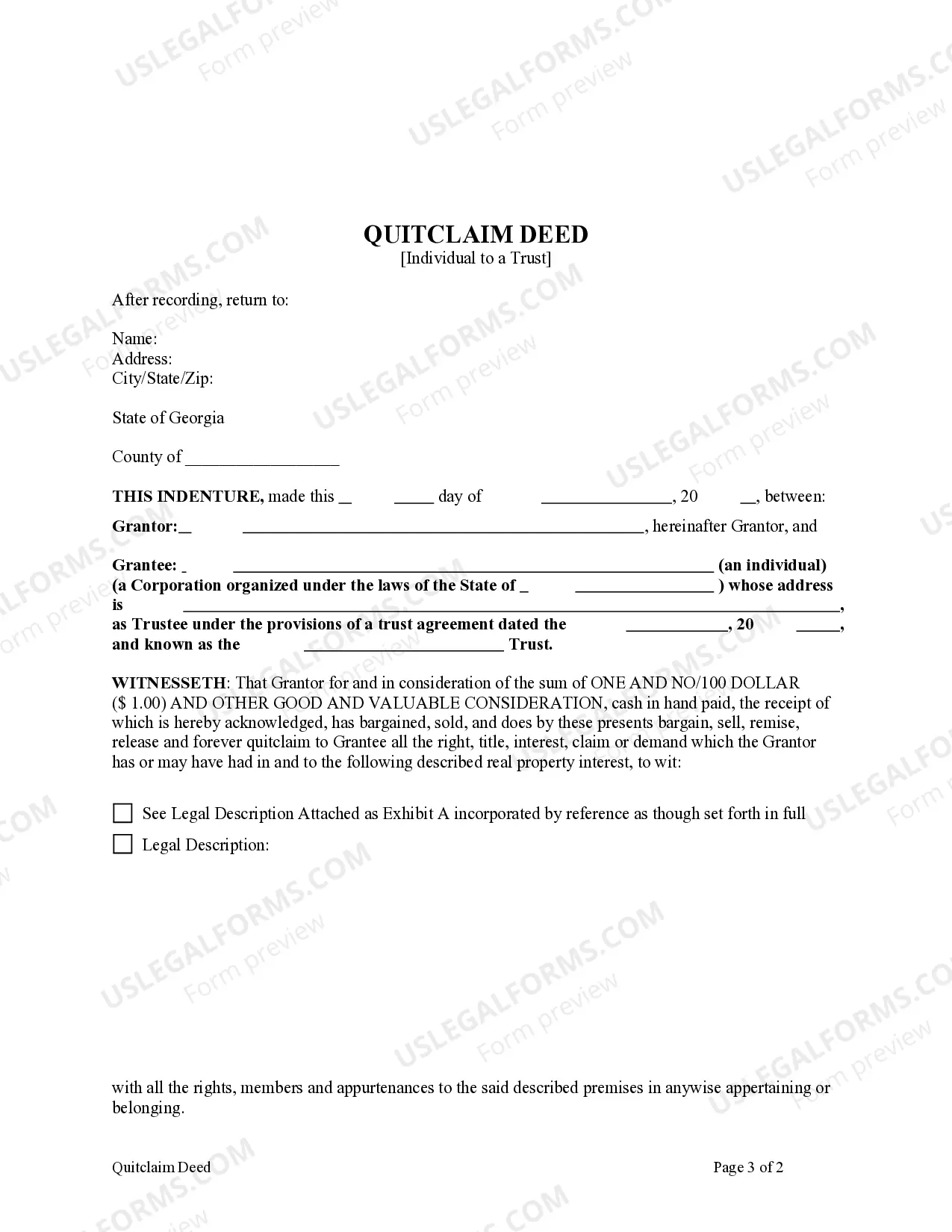

This form is a Quitclaim Deed where the Grantor is an Individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

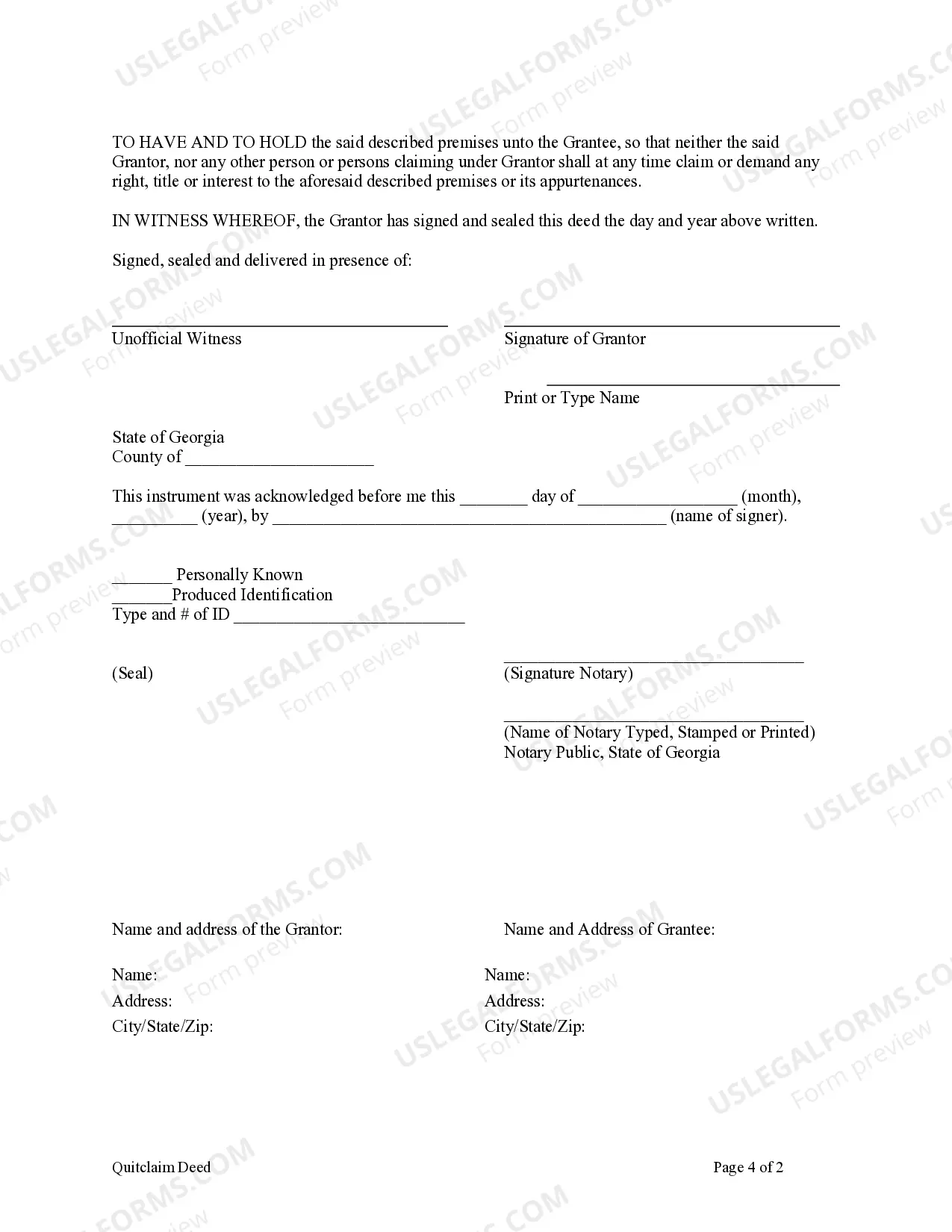

A Savannah Georgia Quitclaim Deed — Individual to a Trust is a legal document that transfers ownership of a property from an individual to a trust. This type of deed is commonly used when a property owner wants to transfer their property into a trust, either for estate planning purposes or to protect their assets. The process of creating a Quitclaim Deed involves several important steps. First, the individual must gather all the relevant information about the property, including the legal description, current owner's name, and tax identification number. It is essential to ensure accurate details to prevent any complications during the transfer process. Once all the necessary information is assembled, the individual must draft the Quitclaim Deed document. This should be done with the assistance of a qualified legal professional to ensure accuracy and compliance with local laws. The Quitclaim Deed should clearly state the intention to transfer ownership from the individual to the trust, including the trust's legal name and address. There may be different types of Savannah Georgia Quitclaim Deeds — Individual to a Trust, including: 1. Revocable Living Trust Quitclaim Deed: This type of deed is commonly used when the individual wants to transfer their property to a revocable living trust, allowing them to maintain control over their assets during their lifetime. With this deed, the individual can easily revoke or modify the terms of the trust if needed. 2. Irrevocable Trust Quitclaim Deed: In contrast to a revocable living trust, an irrevocable trust is set in stone and cannot be altered or revoked without the explicit consent of the beneficiaries. This type of Quitclaim Deed is used when the individual wants to permanently transfer ownership to the trust, typically for asset protection or estate tax planning purposes. 3. Family Trust Quitclaim Deed: This type of deed is used to transfer ownership of a property from an individual to a trust established for the benefit of their family members. It allows the individual to ensure their loved ones' well-being while retaining some level of control over the property. It is highly recommended consulting with an experienced attorney or real estate professional to ensure that all legal requirements are met and that the transfer process is properly executed. Additionally, it is crucial to consider the potential tax and financial implications of transferring property to a trust before proceeding with a Quitclaim Deed.A Savannah Georgia Quitclaim Deed — Individual to a Trust is a legal document that transfers ownership of a property from an individual to a trust. This type of deed is commonly used when a property owner wants to transfer their property into a trust, either for estate planning purposes or to protect their assets. The process of creating a Quitclaim Deed involves several important steps. First, the individual must gather all the relevant information about the property, including the legal description, current owner's name, and tax identification number. It is essential to ensure accurate details to prevent any complications during the transfer process. Once all the necessary information is assembled, the individual must draft the Quitclaim Deed document. This should be done with the assistance of a qualified legal professional to ensure accuracy and compliance with local laws. The Quitclaim Deed should clearly state the intention to transfer ownership from the individual to the trust, including the trust's legal name and address. There may be different types of Savannah Georgia Quitclaim Deeds — Individual to a Trust, including: 1. Revocable Living Trust Quitclaim Deed: This type of deed is commonly used when the individual wants to transfer their property to a revocable living trust, allowing them to maintain control over their assets during their lifetime. With this deed, the individual can easily revoke or modify the terms of the trust if needed. 2. Irrevocable Trust Quitclaim Deed: In contrast to a revocable living trust, an irrevocable trust is set in stone and cannot be altered or revoked without the explicit consent of the beneficiaries. This type of Quitclaim Deed is used when the individual wants to permanently transfer ownership to the trust, typically for asset protection or estate tax planning purposes. 3. Family Trust Quitclaim Deed: This type of deed is used to transfer ownership of a property from an individual to a trust established for the benefit of their family members. It allows the individual to ensure their loved ones' well-being while retaining some level of control over the property. It is highly recommended consulting with an experienced attorney or real estate professional to ensure that all legal requirements are met and that the transfer process is properly executed. Additionally, it is crucial to consider the potential tax and financial implications of transferring property to a trust before proceeding with a Quitclaim Deed.