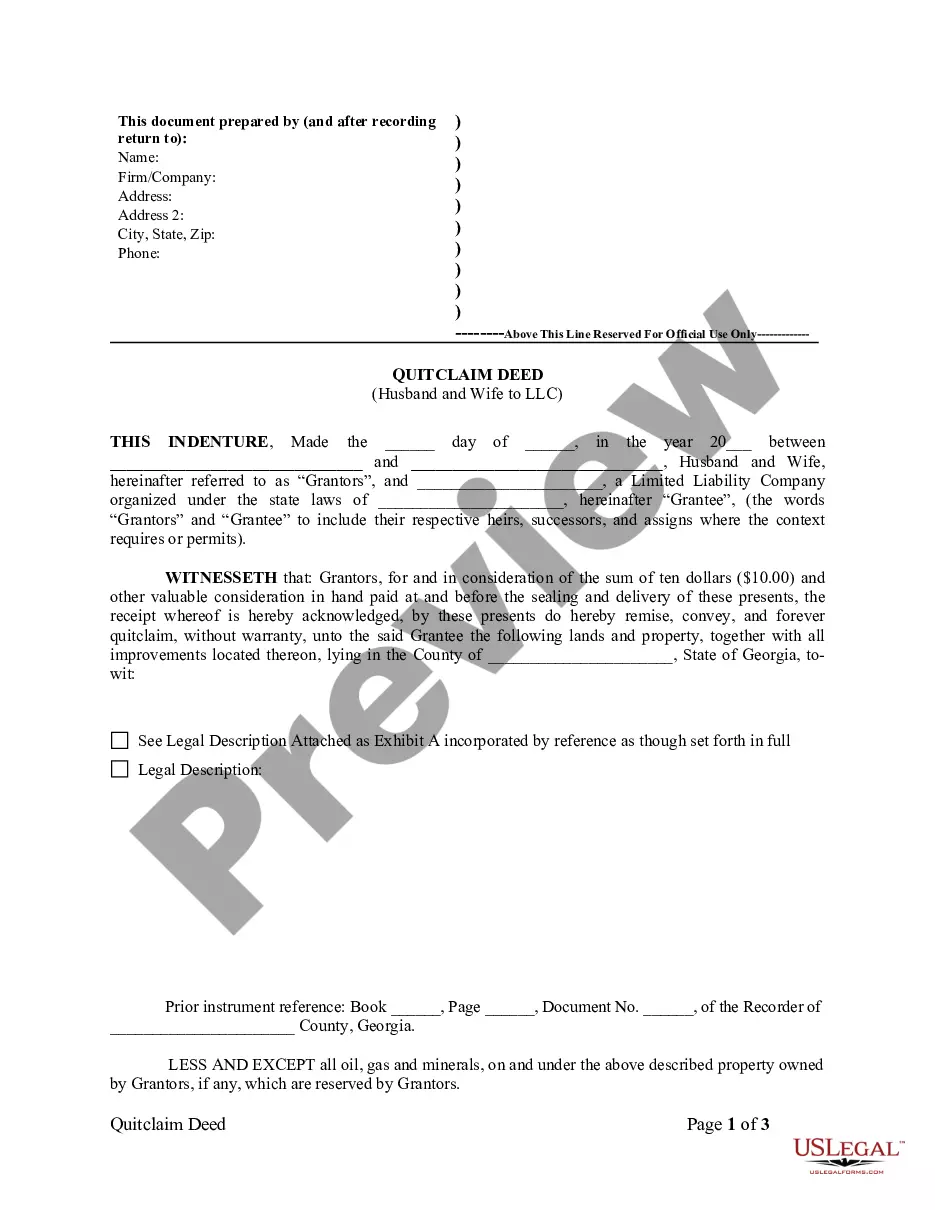

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Sandy Springs Georgia Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of a property from a married couple to a limited liability company (LLC) in Sandy Springs, Georgia. This type of deed is commonly used when a couple wishes to transfer the property to an LLC, often for tax or liability purposes. A Quitclaim Deed is a specific type of deed that allows the transfer of property ownership without making any warranties or guarantees about the property's title. The person transferring the property is simply giving up any claim they may have on the property, if any, without promising that they have full ownership rights. There can be different variations or types of Sandy Springs Georgia Quitclaim Deeds from Husband and Wife to LLC, depending on the specific circumstances and requirements of the parties involved. Some of these variations may include: 1. Simple Quitclaim Deed: This is the most common type, where both the husband and wife are the granters, transferring their ownership rights to the LLC as the grantee. 2. Joint Tenancy with Right of Survivorship Quitclaim Deed: If the property is owned by the husband and wife as joint tenants with the right of survivorship, this type of deed ensures that if one spouse passes away, the surviving spouse will automatically have full ownership of the property. The surviving spouse can then transfer the property to the LLC through a Quitclaim Deed. 3. Tenants in Common Quitclaim Deed: If the husband and wife own the property as tenants in common, each with a separate percentage interest, they can transfer their individual shares to the LLC using a Quitclaim Deed. This type of deed allows for unequal ownership interests in the LLC. 4. Trustee Quitclaim Deed: In some cases, if the property is held in a trust with the husband and wife as trustees, they may transfer the property to the LLC as trustees using a Quitclaim Deed. This allows for seamless ownership transfer while maintaining the property within a trust structure. It is important to note that to create a legally binding Sandy Springs Georgia Quitclaim Deed from Husband and Wife to LLC, it is advisable to seek the assistance of a qualified real estate attorney or title company familiar with the specific laws and regulations in Sandy Springs, Georgia. This will ensure that the deed is properly prepared and filed with the relevant county recorder's office, providing a smooth transfer of ownership from the husband and wife to the LLC.A Sandy Springs Georgia Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of a property from a married couple to a limited liability company (LLC) in Sandy Springs, Georgia. This type of deed is commonly used when a couple wishes to transfer the property to an LLC, often for tax or liability purposes. A Quitclaim Deed is a specific type of deed that allows the transfer of property ownership without making any warranties or guarantees about the property's title. The person transferring the property is simply giving up any claim they may have on the property, if any, without promising that they have full ownership rights. There can be different variations or types of Sandy Springs Georgia Quitclaim Deeds from Husband and Wife to LLC, depending on the specific circumstances and requirements of the parties involved. Some of these variations may include: 1. Simple Quitclaim Deed: This is the most common type, where both the husband and wife are the granters, transferring their ownership rights to the LLC as the grantee. 2. Joint Tenancy with Right of Survivorship Quitclaim Deed: If the property is owned by the husband and wife as joint tenants with the right of survivorship, this type of deed ensures that if one spouse passes away, the surviving spouse will automatically have full ownership of the property. The surviving spouse can then transfer the property to the LLC through a Quitclaim Deed. 3. Tenants in Common Quitclaim Deed: If the husband and wife own the property as tenants in common, each with a separate percentage interest, they can transfer their individual shares to the LLC using a Quitclaim Deed. This type of deed allows for unequal ownership interests in the LLC. 4. Trustee Quitclaim Deed: In some cases, if the property is held in a trust with the husband and wife as trustees, they may transfer the property to the LLC as trustees using a Quitclaim Deed. This allows for seamless ownership transfer while maintaining the property within a trust structure. It is important to note that to create a legally binding Sandy Springs Georgia Quitclaim Deed from Husband and Wife to LLC, it is advisable to seek the assistance of a qualified real estate attorney or title company familiar with the specific laws and regulations in Sandy Springs, Georgia. This will ensure that the deed is properly prepared and filed with the relevant county recorder's office, providing a smooth transfer of ownership from the husband and wife to the LLC.