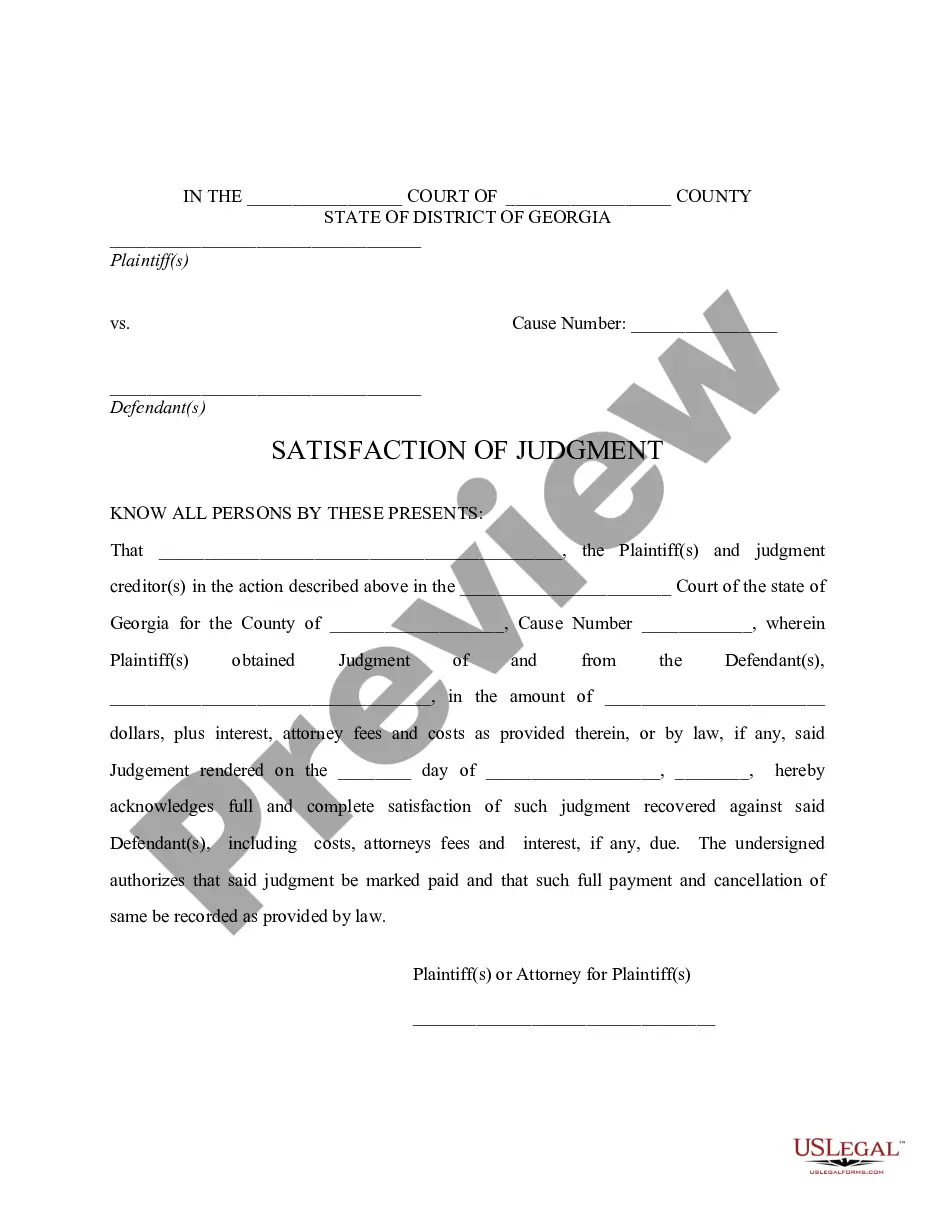

This is a satisfaction of judgment which indicates that a judgment has been paid in full, including all fees, costs and interest. It acknowledges full and complete satisfaction of the judgment and directs that the judgment be marked as paid in full.

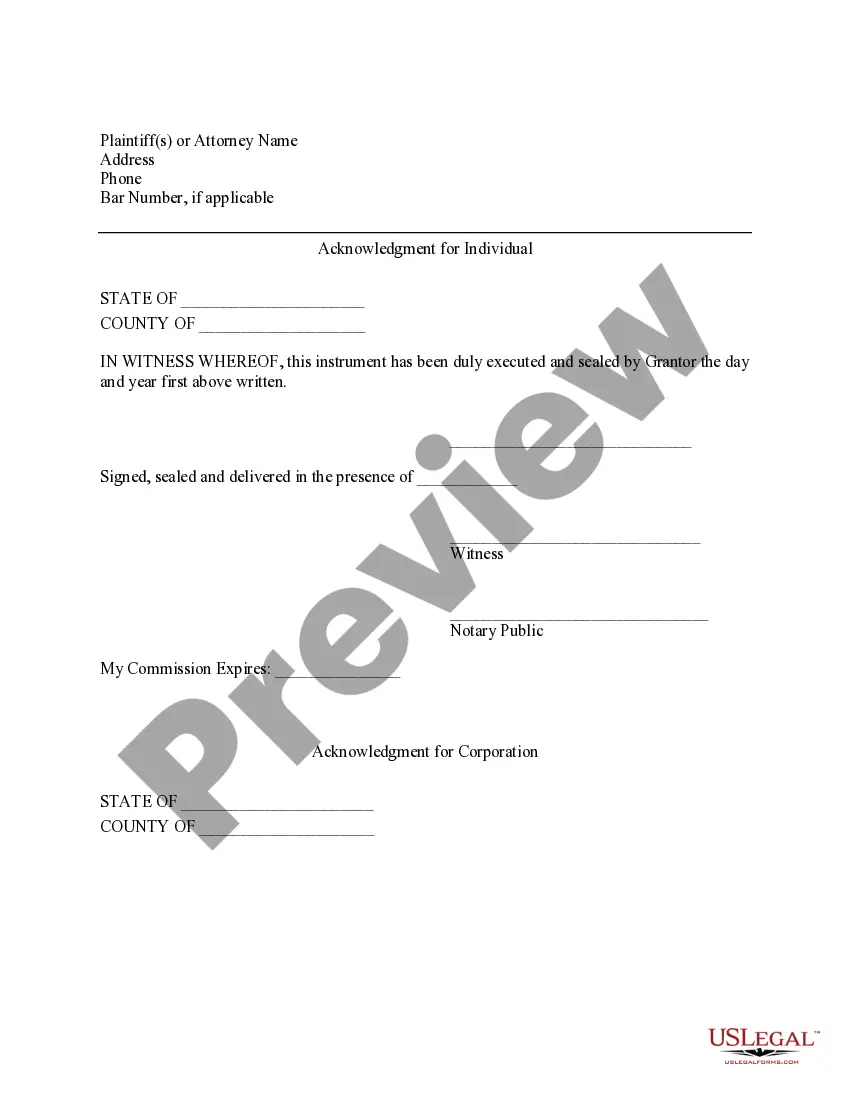

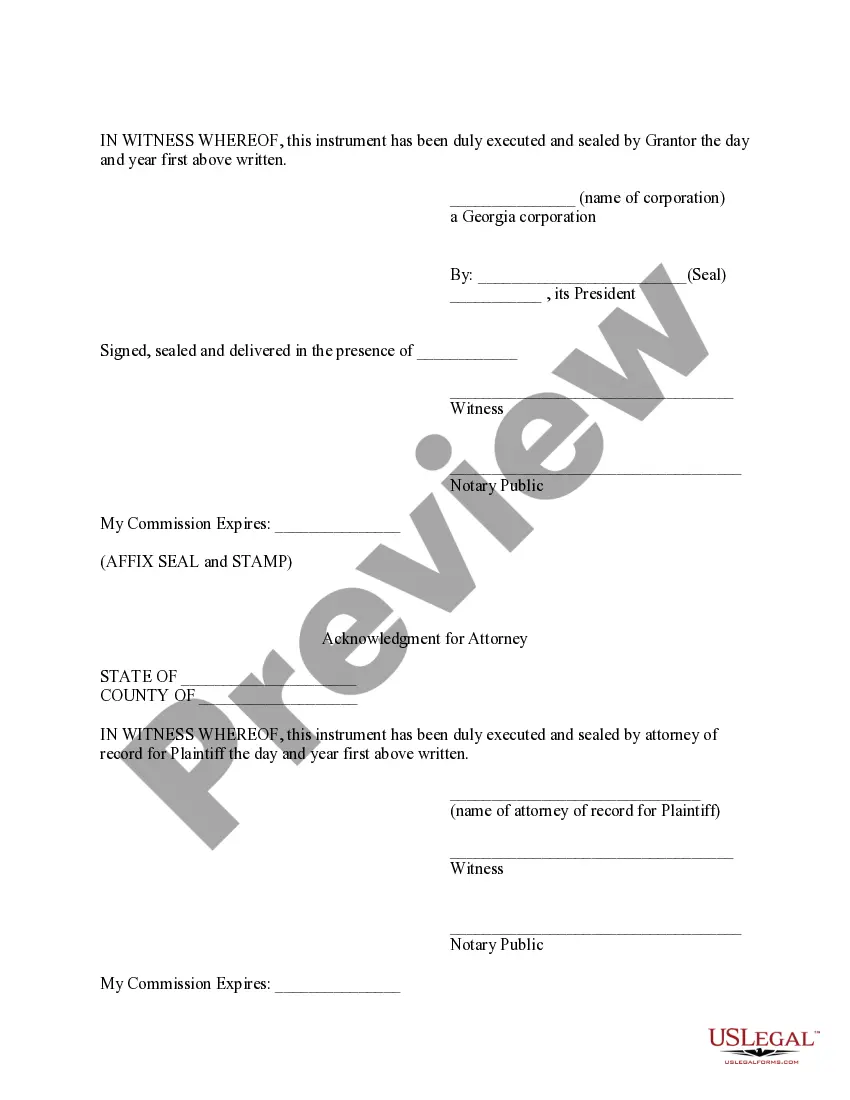

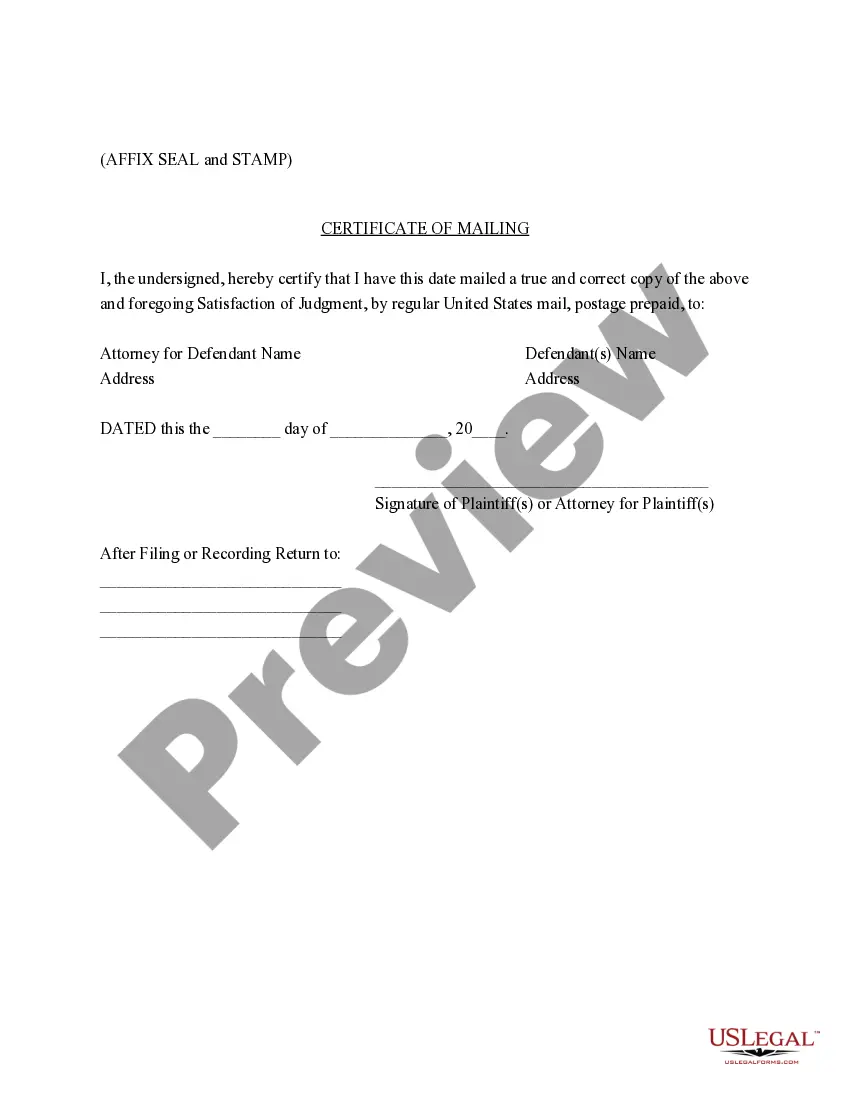

Fulton County, Georgia is well-known for its legal procedures and protocols when it comes to judgments and debt collections. In the legal realm, one of the crucial steps to conclude a judgment against a debtor is obtaining a Fulton Georgia Satisfaction of Judgment. A Fulton Georgia Satisfaction of Judgment is a legal document that signifies the resolution or fulfillment of a judgment against a debtor in Fulton County, Georgia. The satisfaction of judgment proves that the debtor has met their obligation, typically by repaying the debt in full, adhering to a court-approved payment plan, or complying with alternative arrangements made with the creditor. By obtaining a Fulton Georgia Satisfaction of Judgment, creditors and debtors alike can bring a sense of closure to the legal proceedings. Creditors can rest assured that their rightful claim has been satisfied, while debtors can find relief in knowing that their debt has been settled according to the court's decision. It's important to note that there are different types of Fulton Georgia Satisfaction of Judgment, depending on the specific circumstances of the case: 1. Full Satisfaction of Judgment: This type of satisfaction occurs when the debtor pays the entire judgment amount, along with any applicable interest and fees, within the specified timeframe set by the court. 2. Partial Satisfaction of Judgment: In cases where the debtor cannot pay the judgment amount in full, a partial satisfaction of judgment may be achieved. This occurs when the debtor pays a portion of the judgment, often through an agreed-upon payment plan, and the court acknowledges this as a partial resolution. 3. Voluntary Satisfaction of Judgment: Sometimes, debtors may choose to satisfy the judgment voluntarily, even before the court mandates it. By doing so, debtors can demonstrate their willingness to resolve the debt promptly, potentially avoiding further legal consequences. 4. Mutual Satisfaction of Judgment: In rare cases, both the creditor and debtor may agree to a mutual satisfaction of judgment. This happens when they come to an alternative resolution or negotiate new terms, which is acceptable to both parties involved. The court must still approve any such agreement to ensure fairness. Acquiring a Fulton Georgia Satisfaction of Judgment is a crucial step in the debt collection process. It denotes the successful conclusion of a legal dispute, bringing satisfaction to both the creditor and the debtor. It serves as proof that the debt has been fulfilled in compliance with the court's ruling, safeguarding the interests of all parties involved.Fulton County, Georgia is well-known for its legal procedures and protocols when it comes to judgments and debt collections. In the legal realm, one of the crucial steps to conclude a judgment against a debtor is obtaining a Fulton Georgia Satisfaction of Judgment. A Fulton Georgia Satisfaction of Judgment is a legal document that signifies the resolution or fulfillment of a judgment against a debtor in Fulton County, Georgia. The satisfaction of judgment proves that the debtor has met their obligation, typically by repaying the debt in full, adhering to a court-approved payment plan, or complying with alternative arrangements made with the creditor. By obtaining a Fulton Georgia Satisfaction of Judgment, creditors and debtors alike can bring a sense of closure to the legal proceedings. Creditors can rest assured that their rightful claim has been satisfied, while debtors can find relief in knowing that their debt has been settled according to the court's decision. It's important to note that there are different types of Fulton Georgia Satisfaction of Judgment, depending on the specific circumstances of the case: 1. Full Satisfaction of Judgment: This type of satisfaction occurs when the debtor pays the entire judgment amount, along with any applicable interest and fees, within the specified timeframe set by the court. 2. Partial Satisfaction of Judgment: In cases where the debtor cannot pay the judgment amount in full, a partial satisfaction of judgment may be achieved. This occurs when the debtor pays a portion of the judgment, often through an agreed-upon payment plan, and the court acknowledges this as a partial resolution. 3. Voluntary Satisfaction of Judgment: Sometimes, debtors may choose to satisfy the judgment voluntarily, even before the court mandates it. By doing so, debtors can demonstrate their willingness to resolve the debt promptly, potentially avoiding further legal consequences. 4. Mutual Satisfaction of Judgment: In rare cases, both the creditor and debtor may agree to a mutual satisfaction of judgment. This happens when they come to an alternative resolution or negotiate new terms, which is acceptable to both parties involved. The court must still approve any such agreement to ensure fairness. Acquiring a Fulton Georgia Satisfaction of Judgment is a crucial step in the debt collection process. It denotes the successful conclusion of a legal dispute, bringing satisfaction to both the creditor and the debtor. It serves as proof that the debt has been fulfilled in compliance with the court's ruling, safeguarding the interests of all parties involved.