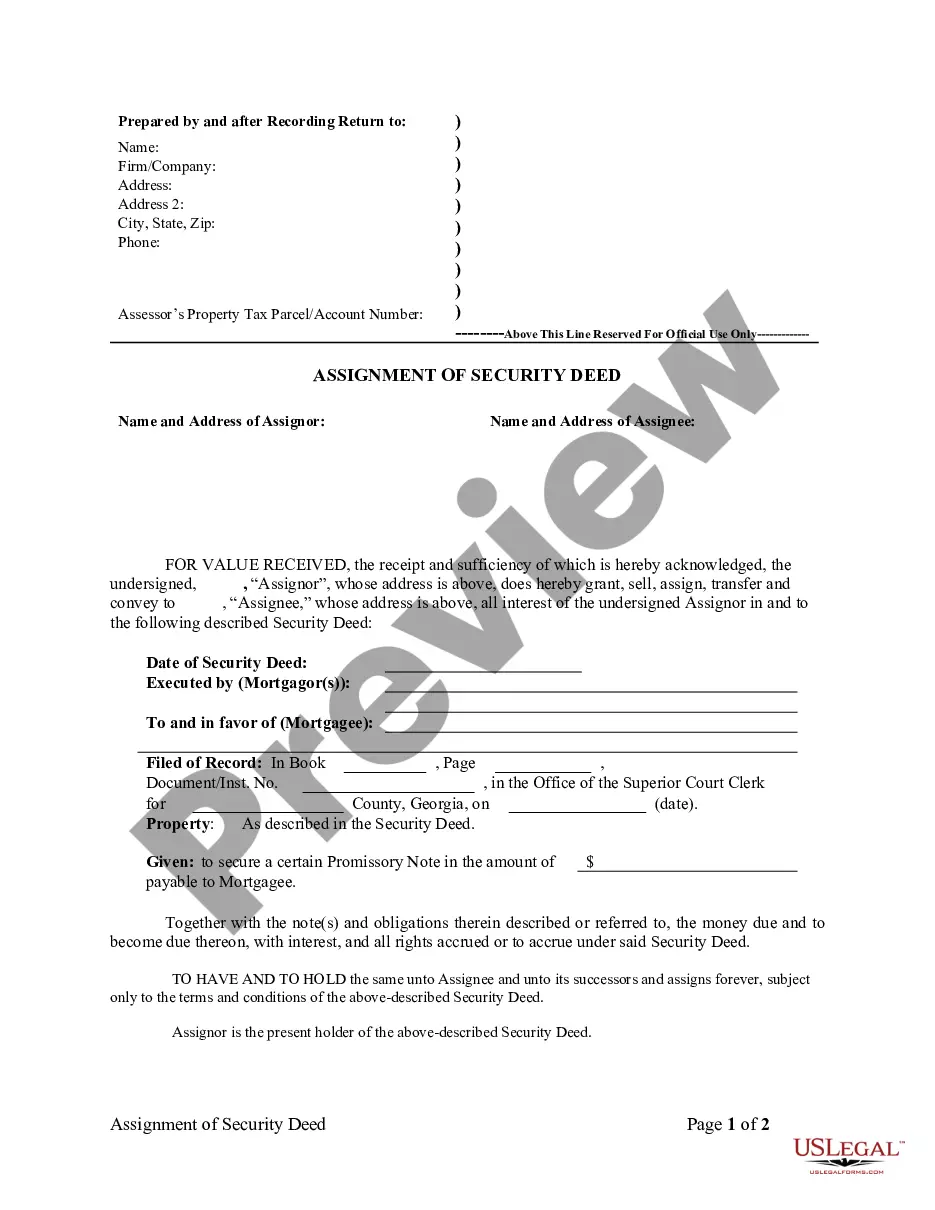

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

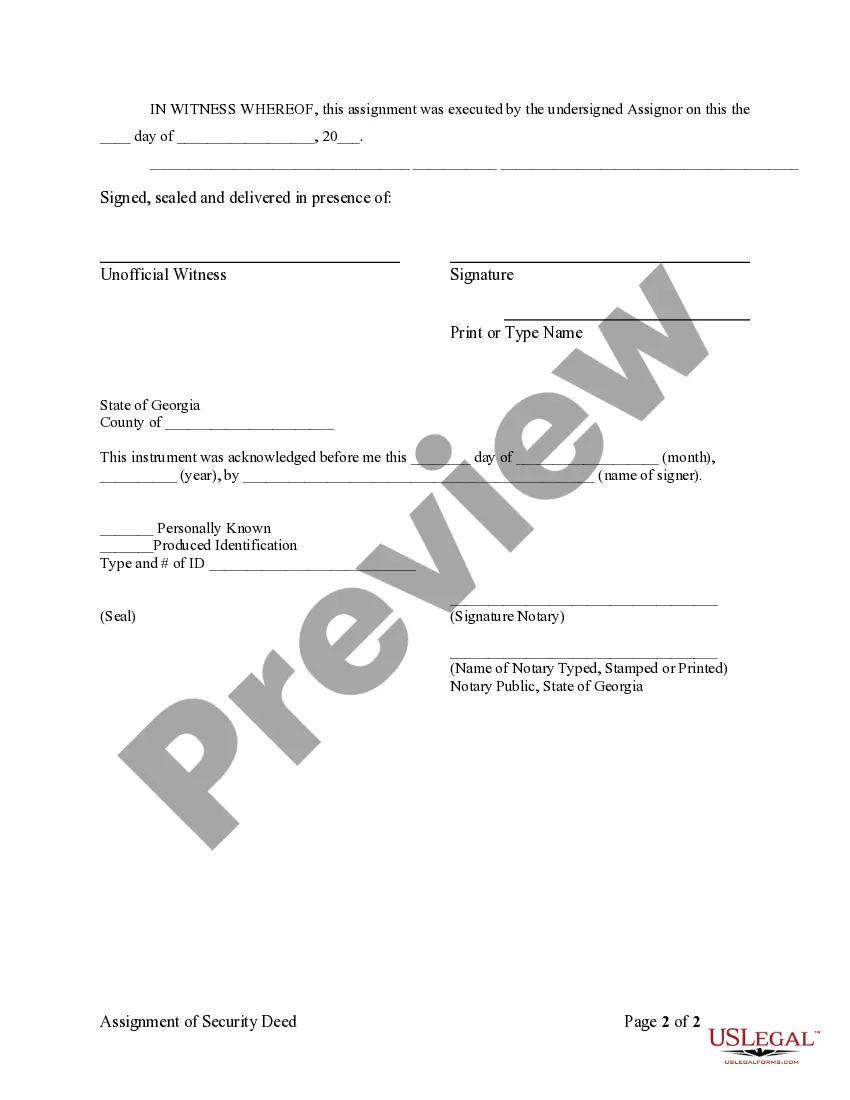

Title: Understanding the Sandy Springs Georgia Assignment of Security Deed from Individual Mortgage — Holder Introduction: The Sandy Springs Georgia Assignment of Security Deed is an essential legal document that facilitates the transfer of ownership or transfer of a mortgage from an individual mortgage holder (the assignor) to another individual or entity (the assignee). This detailed description will delve into the nature and types of Assignment of Security Deed variations found in Sandy Springs, Georgia, and explain the key aspects of this legal instrument. 1. Sandy Springs Georgia Assignment of Security Deed Explained: The Assignment of Security Deed is a legally binding agreement that allows the assignor, the holder of the mortgage, to transfer the rights, title, and interest to the mortgage lien to another party. It occurs when the original lender sells or assigns the debt obligation to a third party, enabling the assignee to assume the role of the mortgage holder. 2. Types of Assignment of Security Deed in Sandy Springs, Georgia: a. Partial Assignment of Security Deed: A partial assignment occurs when a mortgage holder transfers only a portion of their interest in the mortgage to another party, typically a financial institution. The assignee then becomes a beneficiary of the assigned portion. b. Full Assignment of Security Deed: In a full assignment, the mortgage holder transfers the complete ownership of the mortgage, including both the rights and obligations, to another party. The assignee assumes all responsibilities and benefits associated with the mortgage. c. Assignment of Security Deed with Assumption: This type of assignment occurs when the mortgage holder assigns the security deed while the assignee simultaneously agrees to assume the mortgage's obligations and make the necessary payments required by the original agreement. d. Assignment of Security Deed for Investment Purposes: Investors sometimes engage in assignments where they purchase mortgage debt at a discounted price from the original mortgage holder, usually with the goal of earning profits through loan restructuring or foreclosure proceedings. 3. Key Elements of Sandy Springs Georgia Assignment of Security Deed: a. Identification of Parties: The assignment document must clearly identify the assignor (original mortgage holder) and the assignee. b. Property Description: The document should contain an accurate legal description of the property attached to the mortgage. c. Transfer of Rights: The assignment must specify the rights, title, and interest being transferred from the assignor to the assignee. d. Consideration: The assignment should state the value or consideration for which the mortgage debt is being assigned. e. Signatures and Notarization: To ensure legality, the signatures of the assignor, assignee, and notary public are required. Conclusion: The Sandy Springs Georgia Assignment of Security Deed from Individual Mortgage — Holder is a crucial legal instrument that facilitates the transfer of mortgage ownership. Understanding the various types and key elements associated with this assignment is essential for all parties involved in real estate transactions, ensuring a smooth transfer of mortgage interests within the legal framework of Sandy Springs, Georgia.Title: Understanding the Sandy Springs Georgia Assignment of Security Deed from Individual Mortgage — Holder Introduction: The Sandy Springs Georgia Assignment of Security Deed is an essential legal document that facilitates the transfer of ownership or transfer of a mortgage from an individual mortgage holder (the assignor) to another individual or entity (the assignee). This detailed description will delve into the nature and types of Assignment of Security Deed variations found in Sandy Springs, Georgia, and explain the key aspects of this legal instrument. 1. Sandy Springs Georgia Assignment of Security Deed Explained: The Assignment of Security Deed is a legally binding agreement that allows the assignor, the holder of the mortgage, to transfer the rights, title, and interest to the mortgage lien to another party. It occurs when the original lender sells or assigns the debt obligation to a third party, enabling the assignee to assume the role of the mortgage holder. 2. Types of Assignment of Security Deed in Sandy Springs, Georgia: a. Partial Assignment of Security Deed: A partial assignment occurs when a mortgage holder transfers only a portion of their interest in the mortgage to another party, typically a financial institution. The assignee then becomes a beneficiary of the assigned portion. b. Full Assignment of Security Deed: In a full assignment, the mortgage holder transfers the complete ownership of the mortgage, including both the rights and obligations, to another party. The assignee assumes all responsibilities and benefits associated with the mortgage. c. Assignment of Security Deed with Assumption: This type of assignment occurs when the mortgage holder assigns the security deed while the assignee simultaneously agrees to assume the mortgage's obligations and make the necessary payments required by the original agreement. d. Assignment of Security Deed for Investment Purposes: Investors sometimes engage in assignments where they purchase mortgage debt at a discounted price from the original mortgage holder, usually with the goal of earning profits through loan restructuring or foreclosure proceedings. 3. Key Elements of Sandy Springs Georgia Assignment of Security Deed: a. Identification of Parties: The assignment document must clearly identify the assignor (original mortgage holder) and the assignee. b. Property Description: The document should contain an accurate legal description of the property attached to the mortgage. c. Transfer of Rights: The assignment must specify the rights, title, and interest being transferred from the assignor to the assignee. d. Consideration: The assignment should state the value or consideration for which the mortgage debt is being assigned. e. Signatures and Notarization: To ensure legality, the signatures of the assignor, assignee, and notary public are required. Conclusion: The Sandy Springs Georgia Assignment of Security Deed from Individual Mortgage — Holder is a crucial legal instrument that facilitates the transfer of mortgage ownership. Understanding the various types and key elements associated with this assignment is essential for all parties involved in real estate transactions, ensuring a smooth transfer of mortgage interests within the legal framework of Sandy Springs, Georgia.