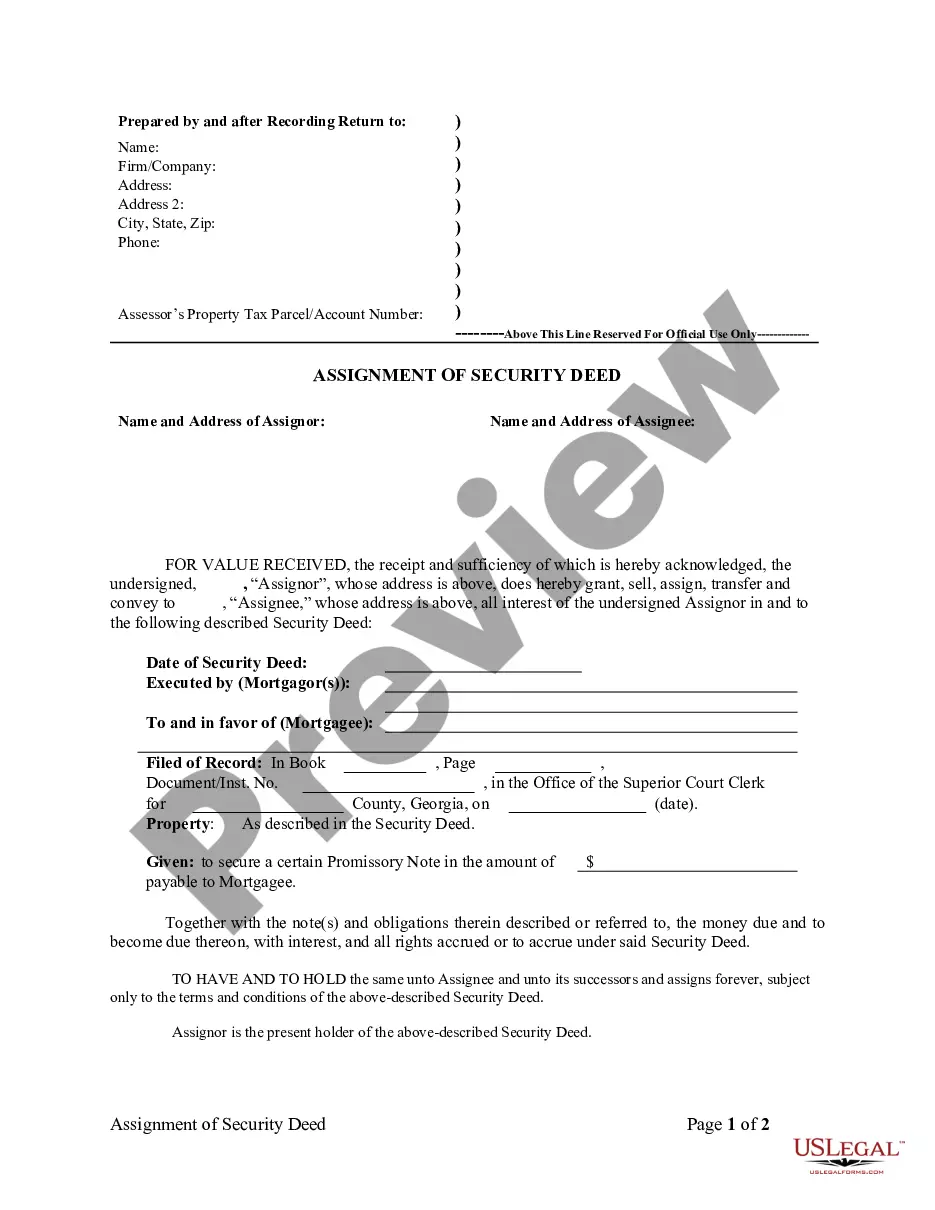

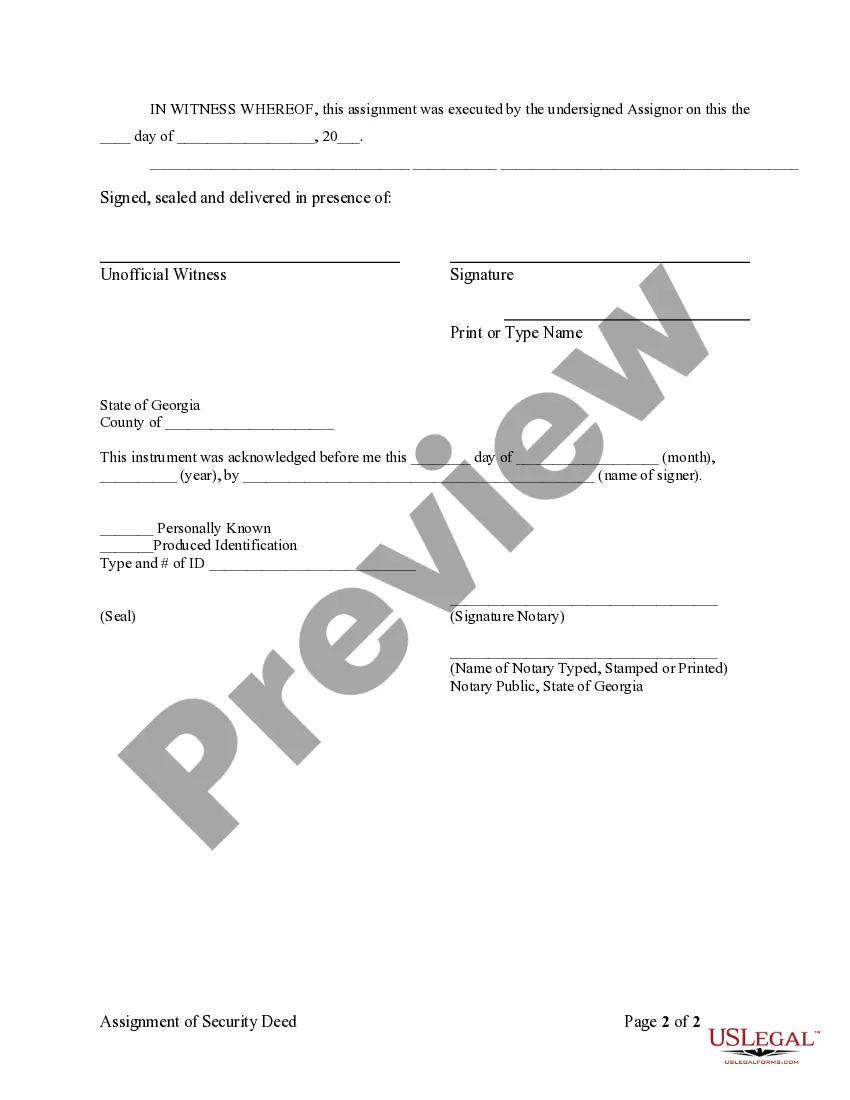

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Description: The Savannah Georgia Assignment of Security Deed from Individual Mortgage — Holder is a legal document that serves to transfer the rights and interests of the holder of a mortgage to another party. This transfer of rights may occur for various reasons, such as loan modification, loan sale, or refinancing. The assignment of the security deed is a crucial step in the mortgage process, ensuring proper documentation of the transfer and protecting the interests of all parties involved. Keywords: — Savannah Georgia: Refers to the specific geographical location where the assignment of security deed is taking place. — Assignment of Security Deed: Describes the legal action of transferring the rights and interests of a mortgage holder to another party. — Individual Mortgage-Holder: Refers to an individual who holds the mortgage on a property and wishes to transfer their rights. — Mortgage: A loan secured by a property, typically used for the purchase of real estate. — Holder: The entity or individual who possesses and owns the mortgage. — Transfer: The act of moving rights and obligations from one party to another. — Loan Modification: The process of making changes to the original terms of a loan to accommodate the borrower's financial situation. — Loan Sale: The transfer of a loan from one lender or investor to another. — Refinancing: The process of obtaining a new loan to replace an existing loan, often with better terms. Different Types of Savannah Georgia Assignment of Security Deed from Individual Mortgage — Holder: 1. Loan Modification Assignment: This type of assignment occurs when the mortgage holder and the borrower agree to modify the terms of the loan, such as reducing the interest rate or extending the repayment period. The assignment document will outline the changes made and the new terms agreed upon. 2. Loan Sale Assignment: In this type of assignment, the mortgage holder sells the loan to another lender or investor. The assignment document will state the details of the sale, including the new owner of the loan and any changes to the terms. 3. Refinancing Assignment: When a borrower refinances their mortgage, they obtain a new loan to pay off the existing mortgage. The original mortgage holder will assign the security deed to the new lender, and the assignment document will reflect the transfer of rights and the new terms of the refinanced loan. It is important to note that the specific terms and requirements of the Savannah Georgia Assignment of Security Deed from Individual Mortgage — Holder may vary depending on state laws and individual mortgage agreements. Consulting with a qualified legal professional is recommended to ensure compliance and accuracy in completing this process.Description: The Savannah Georgia Assignment of Security Deed from Individual Mortgage — Holder is a legal document that serves to transfer the rights and interests of the holder of a mortgage to another party. This transfer of rights may occur for various reasons, such as loan modification, loan sale, or refinancing. The assignment of the security deed is a crucial step in the mortgage process, ensuring proper documentation of the transfer and protecting the interests of all parties involved. Keywords: — Savannah Georgia: Refers to the specific geographical location where the assignment of security deed is taking place. — Assignment of Security Deed: Describes the legal action of transferring the rights and interests of a mortgage holder to another party. — Individual Mortgage-Holder: Refers to an individual who holds the mortgage on a property and wishes to transfer their rights. — Mortgage: A loan secured by a property, typically used for the purchase of real estate. — Holder: The entity or individual who possesses and owns the mortgage. — Transfer: The act of moving rights and obligations from one party to another. — Loan Modification: The process of making changes to the original terms of a loan to accommodate the borrower's financial situation. — Loan Sale: The transfer of a loan from one lender or investor to another. — Refinancing: The process of obtaining a new loan to replace an existing loan, often with better terms. Different Types of Savannah Georgia Assignment of Security Deed from Individual Mortgage — Holder: 1. Loan Modification Assignment: This type of assignment occurs when the mortgage holder and the borrower agree to modify the terms of the loan, such as reducing the interest rate or extending the repayment period. The assignment document will outline the changes made and the new terms agreed upon. 2. Loan Sale Assignment: In this type of assignment, the mortgage holder sells the loan to another lender or investor. The assignment document will state the details of the sale, including the new owner of the loan and any changes to the terms. 3. Refinancing Assignment: When a borrower refinances their mortgage, they obtain a new loan to pay off the existing mortgage. The original mortgage holder will assign the security deed to the new lender, and the assignment document will reflect the transfer of rights and the new terms of the refinanced loan. It is important to note that the specific terms and requirements of the Savannah Georgia Assignment of Security Deed from Individual Mortgage — Holder may vary depending on state laws and individual mortgage agreements. Consulting with a qualified legal professional is recommended to ensure compliance and accuracy in completing this process.