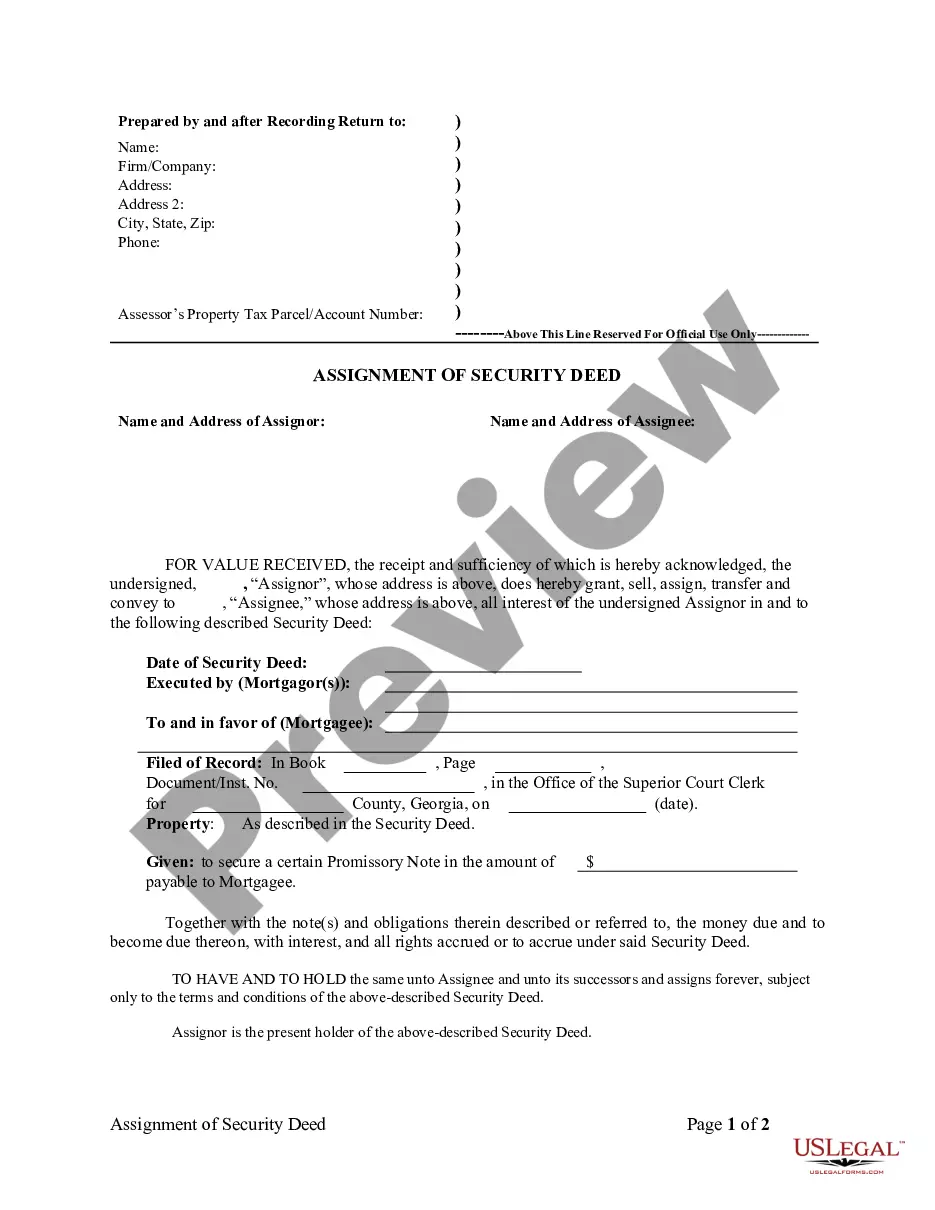

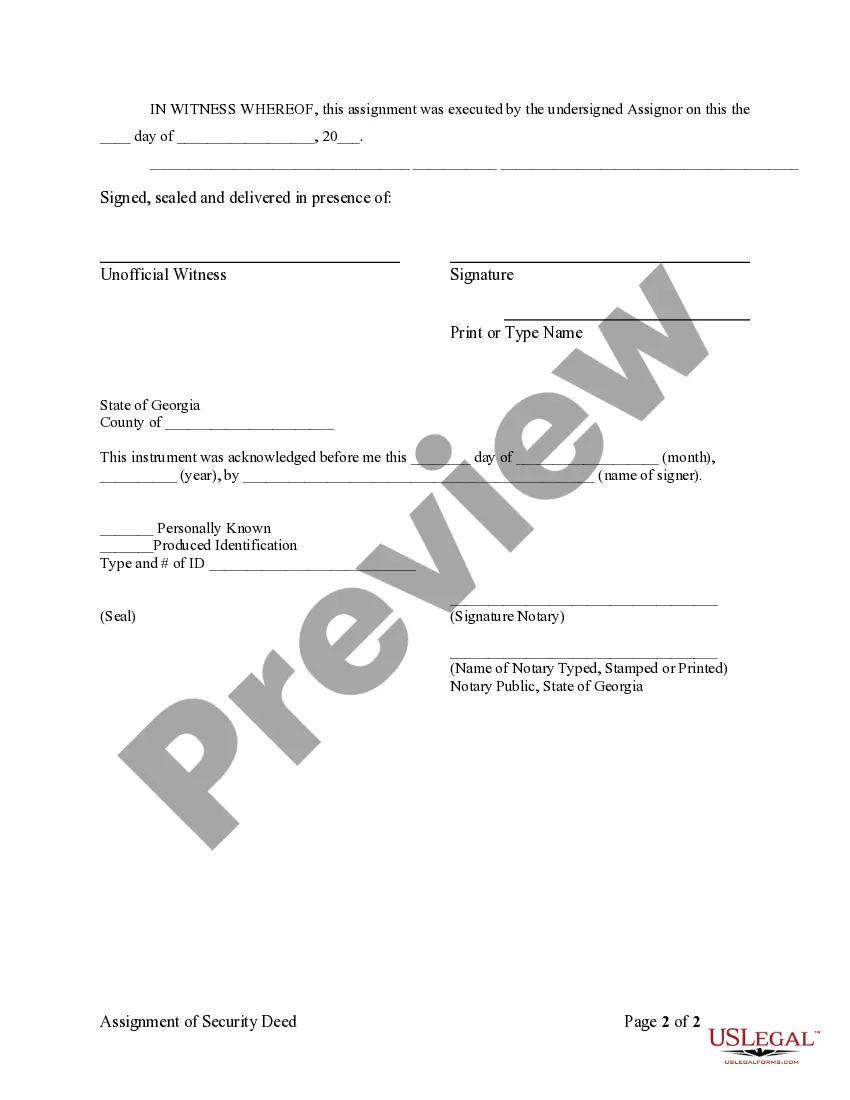

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

South Fulton Georgia Assignment of Security Deed from Individual Mortgage — Holder is a legal document that involves the transfer of a mortgage holder's ownership and rights to a security deed on a property located in South Fulton, Georgia. This assignment typically occurs when the original mortgage holder, also known as the lender or the note holder, assigns the security deed to another party, such as another financial institution or an investor. In this legal transaction, relevant keywords related to South Fulton Georgia Assignment of Security Deed from Individual Mortgage — Holder include: 1. South Fulton, Georgia: Referring to the specific location where the property subject to the security deed is situated. South Fulton is a county in Georgia known for its diverse communities and growing real estate market. 2. Assignment of Security Deed: The process of transferring the rights, ownership, and interests associated with a security deed from one individual mortgage holder to another party. 3. Individual Mortgage — Holder: The original mortgage holder, often a financial institution, individual, or entity that lent the funds for the property purchase or refinancing. The individual mortgage holder is the assignor in this assignment process. 4. Security Deed: A legal document that serves as collateral for a mortgage loan, granting the lender a security interest in the property on which the loan is secured. 5. Note Holder: The individual or entity that holds the promissory note detailing the terms and conditions of the mortgage loan, including repayment terms and interest rates. Different types of South Fulton Georgia Assignment of Security Deed from Individual Mortgage — Holder can include: 1. Voluntary Assignment: This occurs when the original mortgage holder willingly assigns the security deed to another party, often due to financial or strategic reasons. The parties involved typically negotiate the terms of the assignment. 2. Involuntary Assignment: This may happen when the original mortgage holder is unable to meet their obligations or has defaulted on the loan. In such cases, the security deed may be assigned through foreclosure proceedings or other legal processes. 3. Intercreditor Assignment: In situations where multiple mortgage holders or creditors have claims on the same property, an intercreditor assignment may be used to allocate the rights and priorities of each holder. 4. Collateral Assignment: In some cases, a mortgage holder may assign the security deed as collateral for the repayment of a separate debt obligation, creating a collateral assignment of the security deed. In conclusion, South Fulton Georgia Assignment of Security Deed from Individual Mortgage — Holder represents the transfer of a mortgage holder's rights and ownership of a security deed in South Fulton, Georgia. This legal transaction involves the voluntary or involuntary assignment of the security deed, potentially leading to the involvement of multiple mortgage holders or creditors.South Fulton Georgia Assignment of Security Deed from Individual Mortgage — Holder is a legal document that involves the transfer of a mortgage holder's ownership and rights to a security deed on a property located in South Fulton, Georgia. This assignment typically occurs when the original mortgage holder, also known as the lender or the note holder, assigns the security deed to another party, such as another financial institution or an investor. In this legal transaction, relevant keywords related to South Fulton Georgia Assignment of Security Deed from Individual Mortgage — Holder include: 1. South Fulton, Georgia: Referring to the specific location where the property subject to the security deed is situated. South Fulton is a county in Georgia known for its diverse communities and growing real estate market. 2. Assignment of Security Deed: The process of transferring the rights, ownership, and interests associated with a security deed from one individual mortgage holder to another party. 3. Individual Mortgage — Holder: The original mortgage holder, often a financial institution, individual, or entity that lent the funds for the property purchase or refinancing. The individual mortgage holder is the assignor in this assignment process. 4. Security Deed: A legal document that serves as collateral for a mortgage loan, granting the lender a security interest in the property on which the loan is secured. 5. Note Holder: The individual or entity that holds the promissory note detailing the terms and conditions of the mortgage loan, including repayment terms and interest rates. Different types of South Fulton Georgia Assignment of Security Deed from Individual Mortgage — Holder can include: 1. Voluntary Assignment: This occurs when the original mortgage holder willingly assigns the security deed to another party, often due to financial or strategic reasons. The parties involved typically negotiate the terms of the assignment. 2. Involuntary Assignment: This may happen when the original mortgage holder is unable to meet their obligations or has defaulted on the loan. In such cases, the security deed may be assigned through foreclosure proceedings or other legal processes. 3. Intercreditor Assignment: In situations where multiple mortgage holders or creditors have claims on the same property, an intercreditor assignment may be used to allocate the rights and priorities of each holder. 4. Collateral Assignment: In some cases, a mortgage holder may assign the security deed as collateral for the repayment of a separate debt obligation, creating a collateral assignment of the security deed. In conclusion, South Fulton Georgia Assignment of Security Deed from Individual Mortgage — Holder represents the transfer of a mortgage holder's rights and ownership of a security deed in South Fulton, Georgia. This legal transaction involves the voluntary or involuntary assignment of the security deed, potentially leading to the involvement of multiple mortgage holders or creditors.