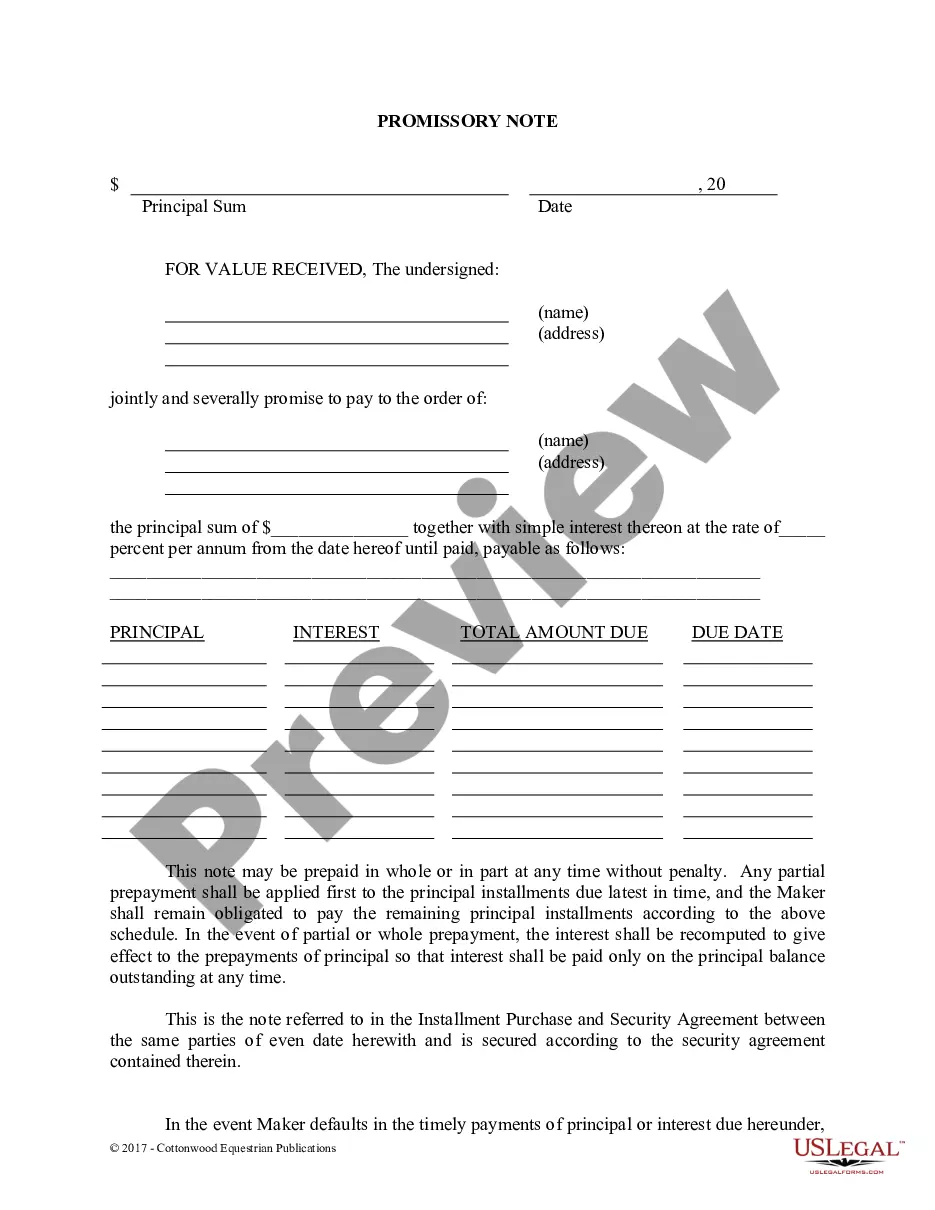

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

A Sandy Springs Georgia Promissory Note — Horse Equine Form is a legally binding document that outlines the terms and conditions of a loan agreement involving the purchase or lease of a horse or equine property in Sandy Springs, Georgia. This form is essential for establishing a clear agreement between the lender and the borrower, ensuring that both parties are aware of their rights and responsibilities. The Sandy Springs Georgia Promissory Note — Horse Equine Form typically includes the following details: 1. Parties involved: The form includes the names, addresses, and contact information of the lender (also known as the payee) and the borrower (also known as the promise). 2. Loan amount: The form specifies the amount of money that the borrower agrees to repay to the lender. This may include the purchase price of the horse or equine property, any additional fees, or agreed-upon interest rates. 3. Payment schedule: The form outlines the specific dates or intervals at which the borrower must make payments to the lender. This includes the frequency and duration of payments. 4. Interest rates: If applicable, the form states the interest rate the borrower will pay on the loan. This rate can be fixed or variable, depending on the agreement between the parties. 5. Collateral: The form may include details about any collateral provided by the borrower to secure the loan. This could be the horse or equine property being financed or any other valuable assets. 6. Default and remedies: The form specifies the actions that can be taken by the lender in case of default, such as repossession of the horse, legal action, or other remedies available under the Georgia law. 7. Governing law: The form states that the agreement is subject to the laws and regulations of the state of Georgia, specifically Sandy Springs. There might be various types of Sandy Springs Georgia Promissory Note — Horse Equine Forms depending on the specific purpose or situation. Some common variations may include: 1. Purchase Agreement Promissory Note: This form is used when the loan is intended to finance the purchase of a horse or equine property in Sandy Springs, Georgia. 2. Lease Agreement Promissory Note: This form is used when the loan is intended to facilitate the lease of a horse or equine property in Sandy Springs, Georgia. 3. Breeding Loan Promissory Note: This form is used when the loan is specifically for breeding purposes, such as financing the expenses associated with breeding a horse in Sandy Springs, Georgia. In conclusion, a Sandy Springs Georgia Promissory Note — Horse Equine Form is a vital legal document used to formalize loan agreements between lenders and borrowers in the context of horse or equine properties. These forms ensure that both parties are protected and aware of their obligations, thereby promoting transparency and clarity in the borrowing process.A Sandy Springs Georgia Promissory Note — Horse Equine Form is a legally binding document that outlines the terms and conditions of a loan agreement involving the purchase or lease of a horse or equine property in Sandy Springs, Georgia. This form is essential for establishing a clear agreement between the lender and the borrower, ensuring that both parties are aware of their rights and responsibilities. The Sandy Springs Georgia Promissory Note — Horse Equine Form typically includes the following details: 1. Parties involved: The form includes the names, addresses, and contact information of the lender (also known as the payee) and the borrower (also known as the promise). 2. Loan amount: The form specifies the amount of money that the borrower agrees to repay to the lender. This may include the purchase price of the horse or equine property, any additional fees, or agreed-upon interest rates. 3. Payment schedule: The form outlines the specific dates or intervals at which the borrower must make payments to the lender. This includes the frequency and duration of payments. 4. Interest rates: If applicable, the form states the interest rate the borrower will pay on the loan. This rate can be fixed or variable, depending on the agreement between the parties. 5. Collateral: The form may include details about any collateral provided by the borrower to secure the loan. This could be the horse or equine property being financed or any other valuable assets. 6. Default and remedies: The form specifies the actions that can be taken by the lender in case of default, such as repossession of the horse, legal action, or other remedies available under the Georgia law. 7. Governing law: The form states that the agreement is subject to the laws and regulations of the state of Georgia, specifically Sandy Springs. There might be various types of Sandy Springs Georgia Promissory Note — Horse Equine Forms depending on the specific purpose or situation. Some common variations may include: 1. Purchase Agreement Promissory Note: This form is used when the loan is intended to finance the purchase of a horse or equine property in Sandy Springs, Georgia. 2. Lease Agreement Promissory Note: This form is used when the loan is intended to facilitate the lease of a horse or equine property in Sandy Springs, Georgia. 3. Breeding Loan Promissory Note: This form is used when the loan is specifically for breeding purposes, such as financing the expenses associated with breeding a horse in Sandy Springs, Georgia. In conclusion, a Sandy Springs Georgia Promissory Note — Horse Equine Form is a vital legal document used to formalize loan agreements between lenders and borrowers in the context of horse or equine properties. These forms ensure that both parties are protected and aware of their obligations, thereby promoting transparency and clarity in the borrowing process.