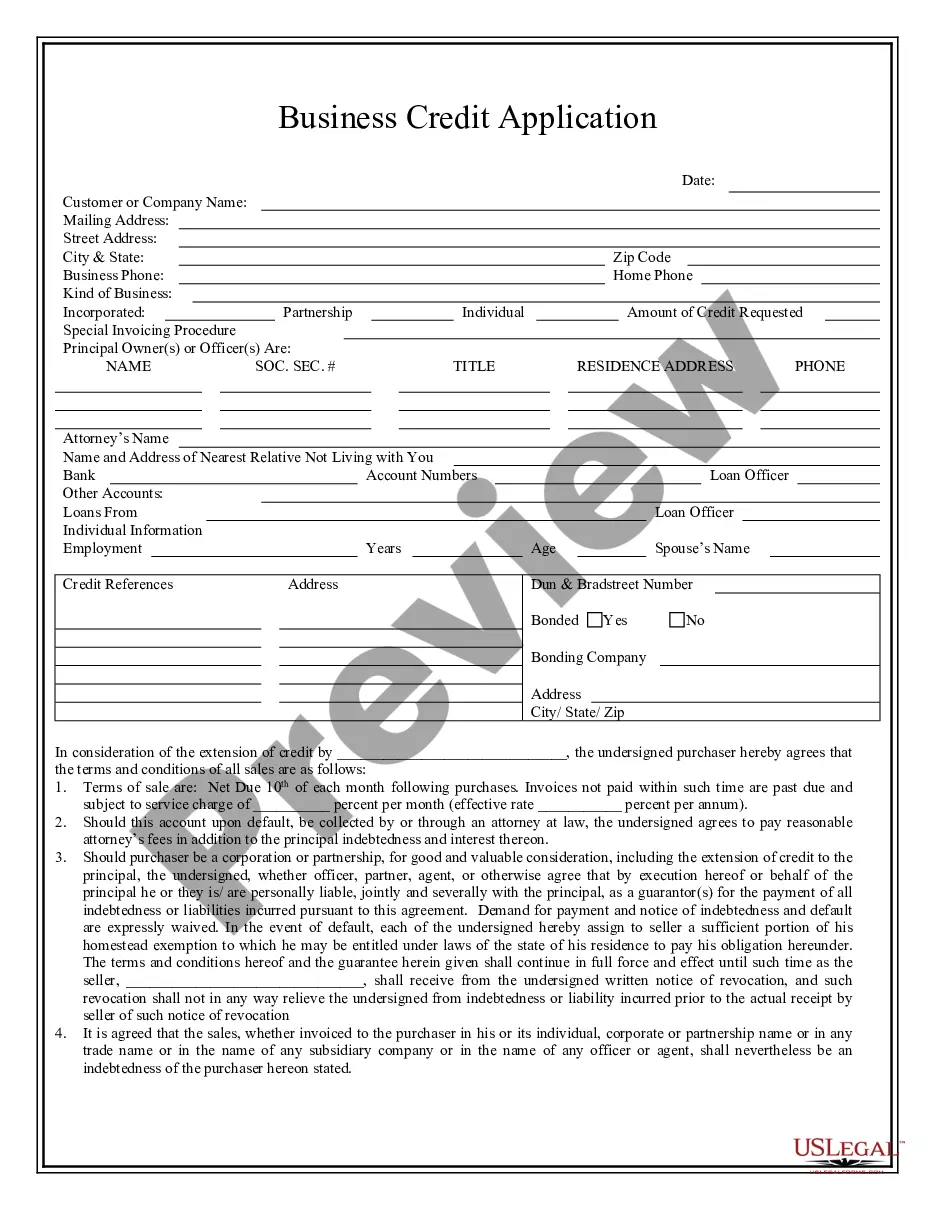

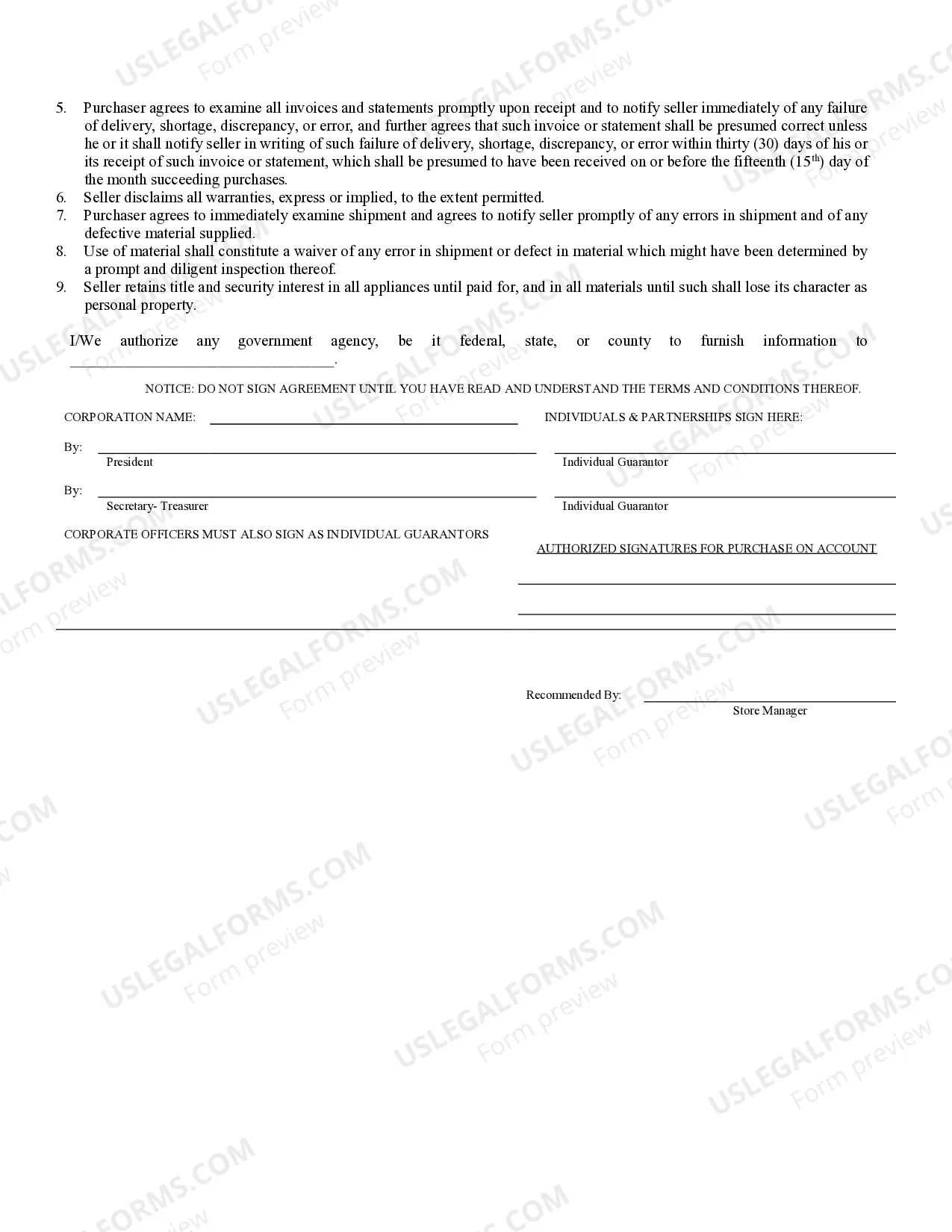

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Atlanta Georgia Business Credit Application is a formal document that businesses in Atlanta, Georgia can use to apply for credit from financial institutions or other lenders. This application includes essential information about the business, its financial history, and its credit needs. By submitting a business credit application, companies in Atlanta can gain access to funding options to support their growth and operational needs. Keywords: Atlanta Georgia, business credit application, formal document, businesses, financial institutions, lenders, essential information, financial history, credit needs, funding options, growth, operational needs. There are a few different types of Atlanta Georgia Business Credit Applications which can include: 1. Traditional Business Credit Application: This type of application is suitable for established businesses that have a proven financial track record. It typically requires detailed information about the company's financial statements, tax records, previous credit history, and business plan. 2. Small Business Credit Application: Meant for small businesses in Atlanta, this application focuses on providing credit options tailored to their specific needs. Small businesses may be required to submit financial statements, personal tax returns of the business owner(s), and other relevant documentation. 3. Start-up Business Credit Application: Start-up businesses in Atlanta can use this application to request credit options in the early stages of their operations. Lenders may require additional documentation, such as business plans, projections, personal guarantees, or collateral, to assess creditworthiness. 4. Line of Credit Application: Specifically for businesses seeking a revolving line of credit, this application allows companies to access funds as needed, up to a predetermined limit. The application may require details about the company's financials, projected cash flows, and intended use of the credit line. 5. Invoice Financing Application: This type of application is applicable to businesses that need immediate cash flow by converting their outstanding invoices into working capital. Lenders may require information about the business's outstanding invoices and customer payment history. Keywords: Traditional Business Credit Application, Small Business Credit Application, Start-up Business Credit Application, Line of Credit Application, Invoice Financing Application, Atlanta Georgia, established businesses, financial statements, tax records, credit history, business plan, small businesses, start-up businesses, early stages, operations, financial track record, personal tax returns, collateral, revolving line of credit, predetermined limit, projected cash flows, invoice financing, outstanding invoices, working capital, customer payment history.Atlanta Georgia Business Credit Application is a formal document that businesses in Atlanta, Georgia can use to apply for credit from financial institutions or other lenders. This application includes essential information about the business, its financial history, and its credit needs. By submitting a business credit application, companies in Atlanta can gain access to funding options to support their growth and operational needs. Keywords: Atlanta Georgia, business credit application, formal document, businesses, financial institutions, lenders, essential information, financial history, credit needs, funding options, growth, operational needs. There are a few different types of Atlanta Georgia Business Credit Applications which can include: 1. Traditional Business Credit Application: This type of application is suitable for established businesses that have a proven financial track record. It typically requires detailed information about the company's financial statements, tax records, previous credit history, and business plan. 2. Small Business Credit Application: Meant for small businesses in Atlanta, this application focuses on providing credit options tailored to their specific needs. Small businesses may be required to submit financial statements, personal tax returns of the business owner(s), and other relevant documentation. 3. Start-up Business Credit Application: Start-up businesses in Atlanta can use this application to request credit options in the early stages of their operations. Lenders may require additional documentation, such as business plans, projections, personal guarantees, or collateral, to assess creditworthiness. 4. Line of Credit Application: Specifically for businesses seeking a revolving line of credit, this application allows companies to access funds as needed, up to a predetermined limit. The application may require details about the company's financials, projected cash flows, and intended use of the credit line. 5. Invoice Financing Application: This type of application is applicable to businesses that need immediate cash flow by converting their outstanding invoices into working capital. Lenders may require information about the business's outstanding invoices and customer payment history. Keywords: Traditional Business Credit Application, Small Business Credit Application, Start-up Business Credit Application, Line of Credit Application, Invoice Financing Application, Atlanta Georgia, established businesses, financial statements, tax records, credit history, business plan, small businesses, start-up businesses, early stages, operations, financial track record, personal tax returns, collateral, revolving line of credit, predetermined limit, projected cash flows, invoice financing, outstanding invoices, working capital, customer payment history.