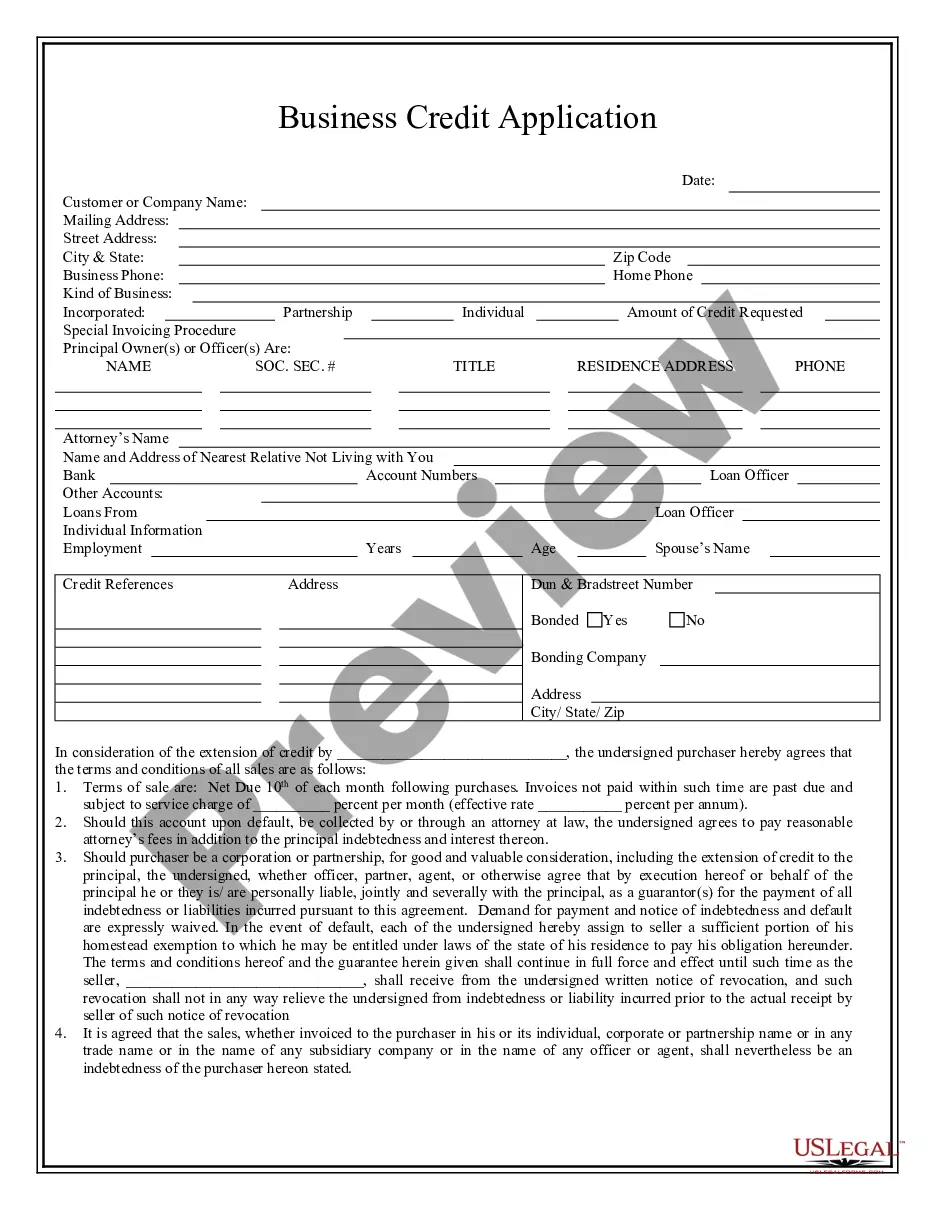

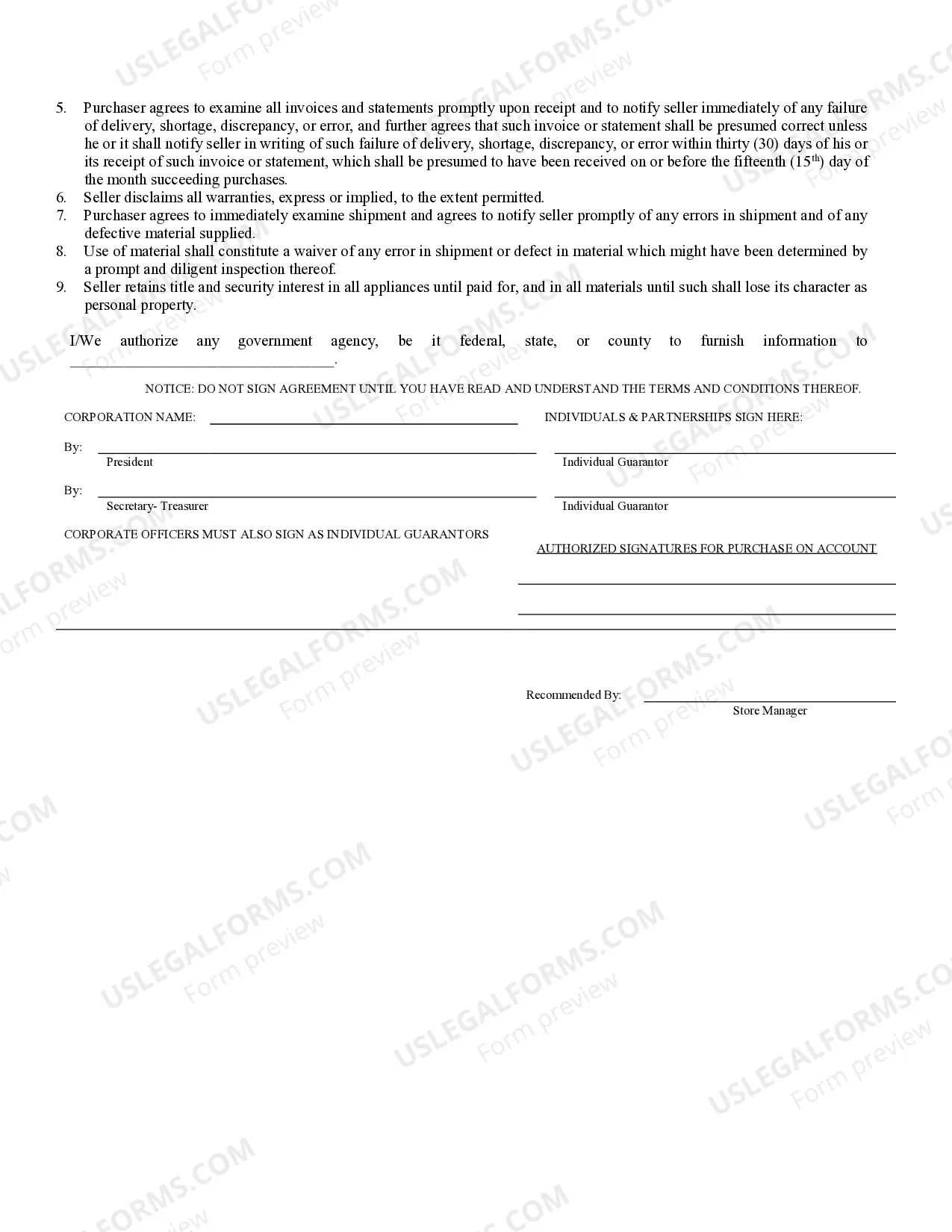

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Fulton Georgia Business Credit Application serves as a comprehensive tool that businesses in Fulton, Georgia can utilize to apply for credit. This application enables businesses to request credit from various financial institutions, lenders, or suppliers. By providing detailed information about their company, financial history, and credit needs, Fulton businesses can present a well-rounded picture to potential creditors. The Fulton Georgia Business Credit Application includes key sections that gather essential business details. Firstly, it typically requests basic information such as the company's legal name, address, phone number, and tax identification number. It may also require the submission of legal documents, such as a copy of the business license, articles of incorporation, or partnership agreement, depending on the type of entity. Moreover, this application delves into the financial aspects of the business. This section typically includes the company's annual revenue, profit margin, cash flow, and existing debts. Additionally, businesses may be required to present their financial statements, including balance sheets, income statements, and cash flow statements, to give creditors a clear understanding of their financial position. In terms of credit needs, the Fulton Georgia Business Credit Application allows businesses to specify the amount of credit they are seeking, their desired repayment terms, and the purposes for which the credit will be used. This helps creditors evaluate the viability and profitability of extending credit to the business. Different types of Fulton Georgia Business Credit Applications may include: 1. Small Business Credit Application: Specifically designed for small businesses operating in Fulton, Georgia, this application caters to the unique needs and requirements of small-scale enterprises. 2. Corporate Credit Application: Tailored for larger corporations, this application handles sizable credit requests and may require additional financial documentation and supporting evidence. 3. Supplier Credit Application: Geared towards businesses that are looking to establish credit accounts with various suppliers. This application focuses on obtaining trade credit for purchasing goods or services. 4. Line of Credit Application: This application is aimed at businesses seeking a line of credit to access funds as needed, rather than one-time credit requests. In conclusion, Fulton Georgia Business Credit Application plays a crucial role in assisting businesses based in Fulton, Georgia, to apply for credit from lenders, suppliers, or financial institutions. By providing essential company information, financial details, and credit requirements, this application maximizes the chances of businesses securing the credit they need to grow and thrive.Fulton Georgia Business Credit Application serves as a comprehensive tool that businesses in Fulton, Georgia can utilize to apply for credit. This application enables businesses to request credit from various financial institutions, lenders, or suppliers. By providing detailed information about their company, financial history, and credit needs, Fulton businesses can present a well-rounded picture to potential creditors. The Fulton Georgia Business Credit Application includes key sections that gather essential business details. Firstly, it typically requests basic information such as the company's legal name, address, phone number, and tax identification number. It may also require the submission of legal documents, such as a copy of the business license, articles of incorporation, or partnership agreement, depending on the type of entity. Moreover, this application delves into the financial aspects of the business. This section typically includes the company's annual revenue, profit margin, cash flow, and existing debts. Additionally, businesses may be required to present their financial statements, including balance sheets, income statements, and cash flow statements, to give creditors a clear understanding of their financial position. In terms of credit needs, the Fulton Georgia Business Credit Application allows businesses to specify the amount of credit they are seeking, their desired repayment terms, and the purposes for which the credit will be used. This helps creditors evaluate the viability and profitability of extending credit to the business. Different types of Fulton Georgia Business Credit Applications may include: 1. Small Business Credit Application: Specifically designed for small businesses operating in Fulton, Georgia, this application caters to the unique needs and requirements of small-scale enterprises. 2. Corporate Credit Application: Tailored for larger corporations, this application handles sizable credit requests and may require additional financial documentation and supporting evidence. 3. Supplier Credit Application: Geared towards businesses that are looking to establish credit accounts with various suppliers. This application focuses on obtaining trade credit for purchasing goods or services. 4. Line of Credit Application: This application is aimed at businesses seeking a line of credit to access funds as needed, rather than one-time credit requests. In conclusion, Fulton Georgia Business Credit Application plays a crucial role in assisting businesses based in Fulton, Georgia, to apply for credit from lenders, suppliers, or financial institutions. By providing essential company information, financial details, and credit requirements, this application maximizes the chances of businesses securing the credit they need to grow and thrive.