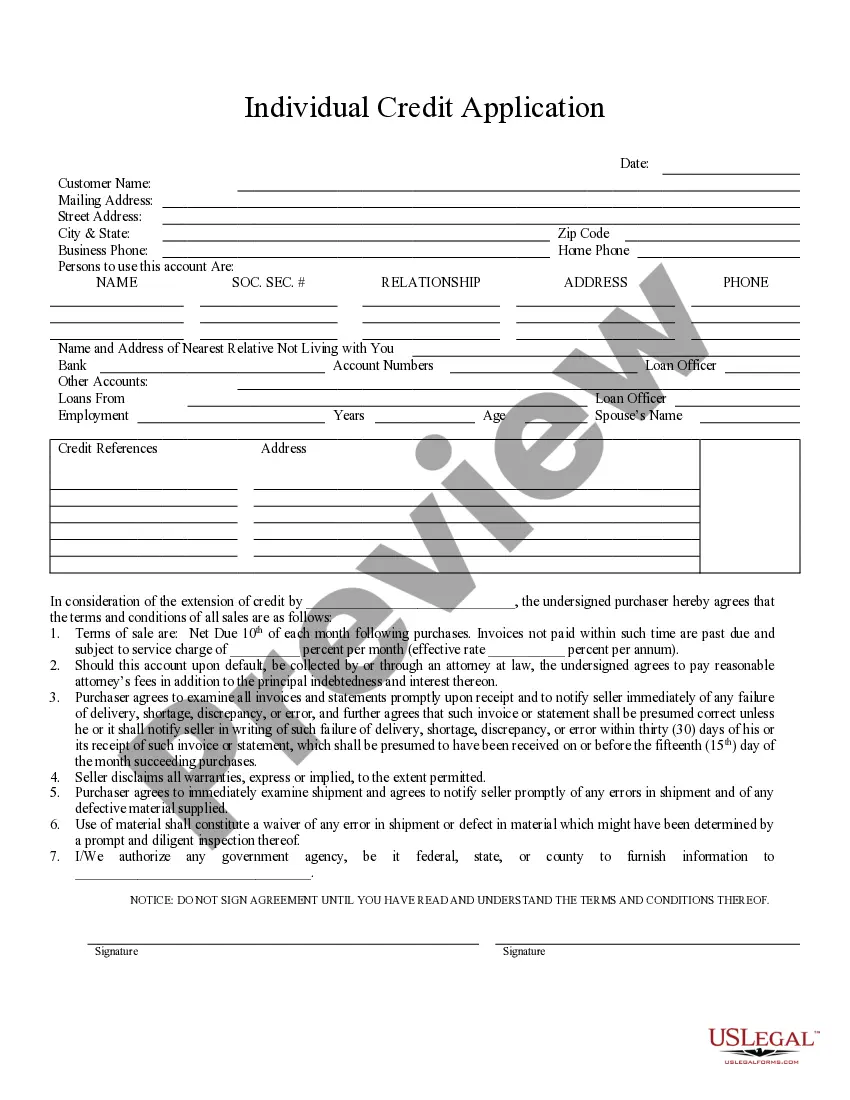

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Atlanta Georgia Individual Credit Application is a formal document used by individuals residing in Atlanta, Georgia, to apply for credit from financial institutions, such as banks or credit unions. This application is a crucial step in the process of accessing credit, as it allows lenders to evaluate an individual's creditworthiness and ability to repay debt. The Atlanta Georgia Individual Credit Application typically includes several sections that require detailed information from the applicant. Depending on the financial institution, the specific sections may vary slightly, but common elements include personal information, employment details, financial history, and references. Below are the key categories typically included in an Atlanta Georgia Individual Credit Application: 1. Personal Information: This section asks for the applicant's full name, social security number, date of birth, contact details (address, phone number, and email), and marital status. 2. Employment Details: Here, the applicant must provide information about their current and previous employment, including the employer's name, address, and contact number. This section may also require details about the applicant's job title, duration of employment, and monthly income. 3. Financial History: This segment seeks information about the applicant's financial background, such as their bank accounts, current debts, and other outstanding obligations. The applicant may be required to disclose their assets, including real estate, vehicles, and investments. 4. Credit References: In this section, the applicant may need to provide references who have firsthand knowledge of their credit history and financial responsibility. These references typically include personal acquaintances who can vouch for the applicant's character, financial stability, and ability to repay debts. 5. Agreement and Authorization: Towards the end of the Atlanta Georgia Individual Credit Application, there is often a section where the applicant agrees to the terms and conditions set by the financial institution. By signing this agreement, the applicant provides consent for the lender to conduct credit checks and verify the information provided. Different types of Atlanta Georgia Individual Credit Applications may exist depending on the specific institution or type of credit applied for. For instance, there can be separate applications for credit cards, lines of credit, personal loans, mortgages, or auto loans. Each type of credit may have unique additional sections or requirements tailored to the nature of the loan product. By accurately completing an Atlanta Georgia Individual Credit Application, individuals can provide lenders with the necessary information to assess their creditworthiness and make informed decisions on granting credit. It is essential for applicants to be honest and thorough when completing the credit application to maintain transparency and increase their chances of credit approval.Atlanta Georgia Individual Credit Application is a formal document used by individuals residing in Atlanta, Georgia, to apply for credit from financial institutions, such as banks or credit unions. This application is a crucial step in the process of accessing credit, as it allows lenders to evaluate an individual's creditworthiness and ability to repay debt. The Atlanta Georgia Individual Credit Application typically includes several sections that require detailed information from the applicant. Depending on the financial institution, the specific sections may vary slightly, but common elements include personal information, employment details, financial history, and references. Below are the key categories typically included in an Atlanta Georgia Individual Credit Application: 1. Personal Information: This section asks for the applicant's full name, social security number, date of birth, contact details (address, phone number, and email), and marital status. 2. Employment Details: Here, the applicant must provide information about their current and previous employment, including the employer's name, address, and contact number. This section may also require details about the applicant's job title, duration of employment, and monthly income. 3. Financial History: This segment seeks information about the applicant's financial background, such as their bank accounts, current debts, and other outstanding obligations. The applicant may be required to disclose their assets, including real estate, vehicles, and investments. 4. Credit References: In this section, the applicant may need to provide references who have firsthand knowledge of their credit history and financial responsibility. These references typically include personal acquaintances who can vouch for the applicant's character, financial stability, and ability to repay debts. 5. Agreement and Authorization: Towards the end of the Atlanta Georgia Individual Credit Application, there is often a section where the applicant agrees to the terms and conditions set by the financial institution. By signing this agreement, the applicant provides consent for the lender to conduct credit checks and verify the information provided. Different types of Atlanta Georgia Individual Credit Applications may exist depending on the specific institution or type of credit applied for. For instance, there can be separate applications for credit cards, lines of credit, personal loans, mortgages, or auto loans. Each type of credit may have unique additional sections or requirements tailored to the nature of the loan product. By accurately completing an Atlanta Georgia Individual Credit Application, individuals can provide lenders with the necessary information to assess their creditworthiness and make informed decisions on granting credit. It is essential for applicants to be honest and thorough when completing the credit application to maintain transparency and increase their chances of credit approval.