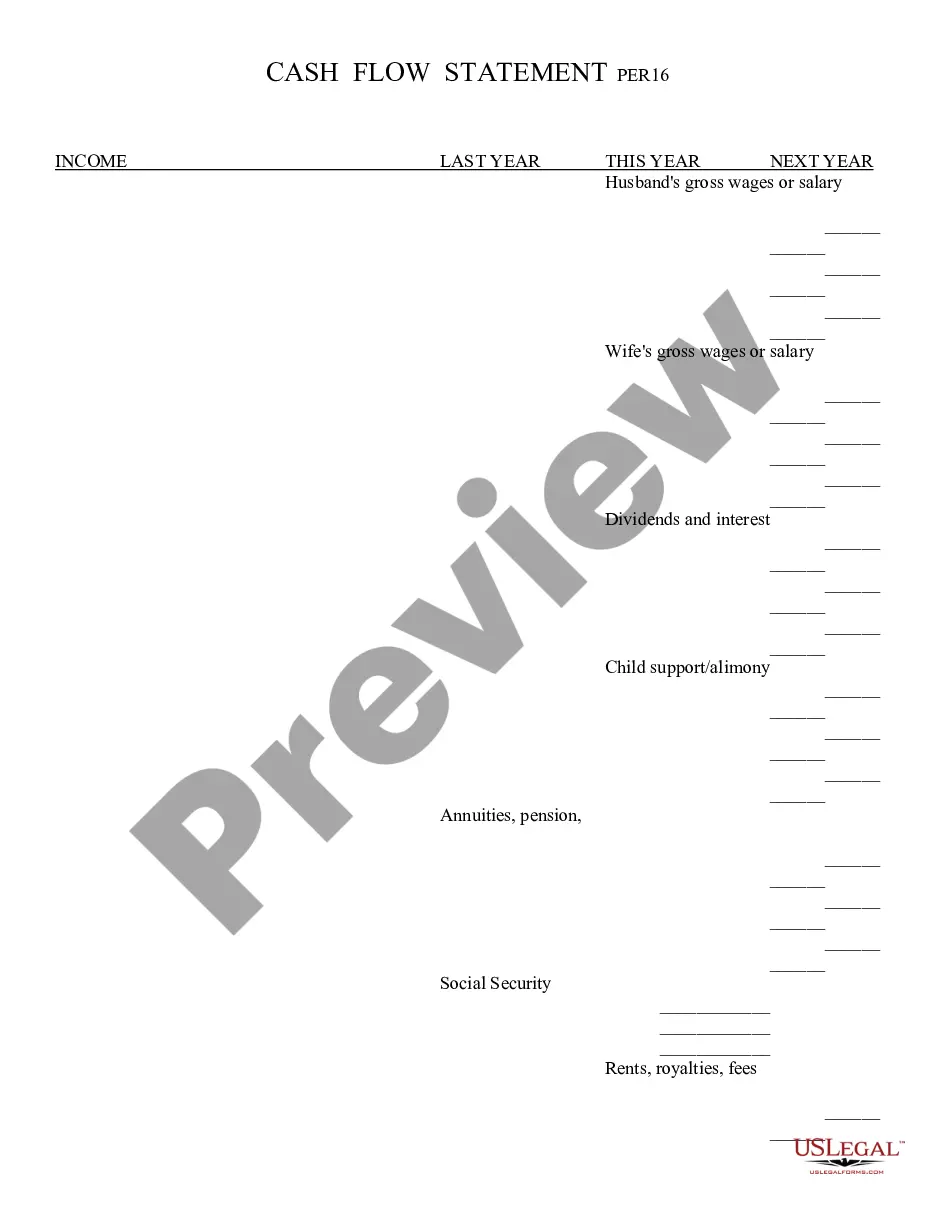

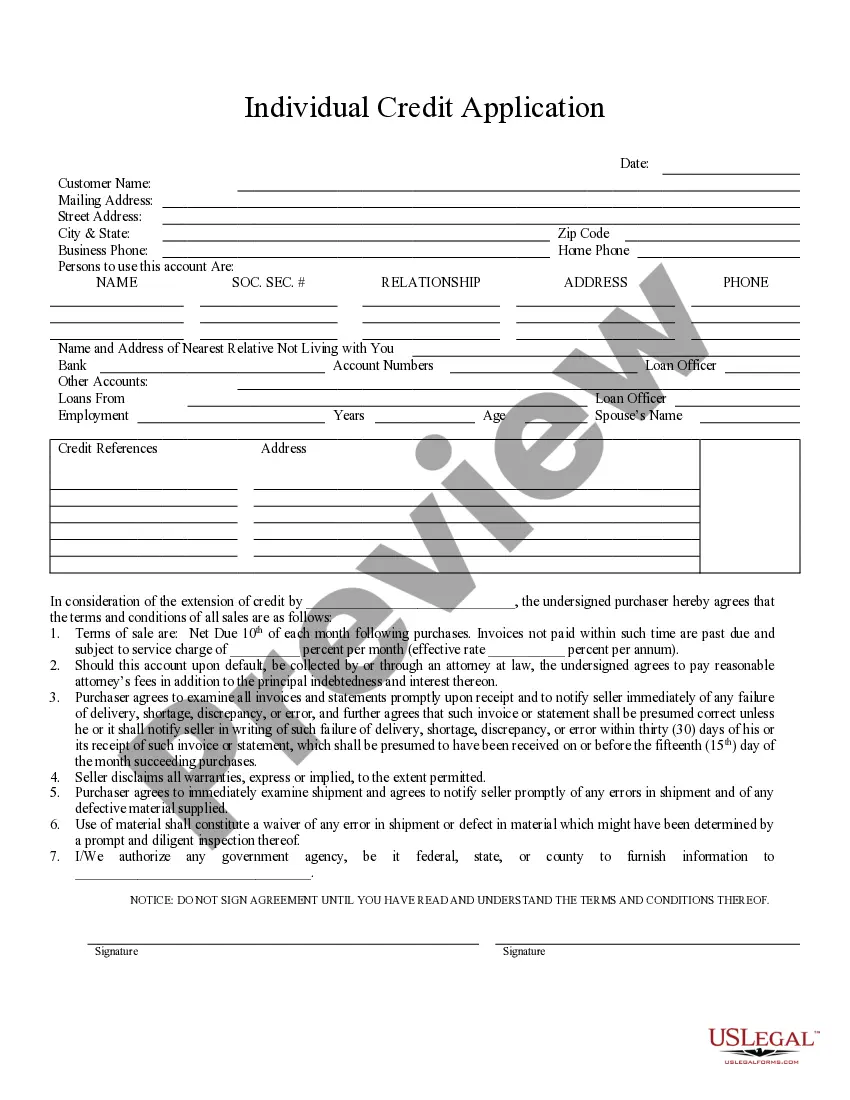

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Sandy Springs Georgia Individual Credit Application is a comprehensive financial document used by residents of Sandy Springs, Georgia, to apply for various credit-related services and transactions. This application plays a crucial role in determining an individual's creditworthiness and eligibility for loans, credit cards, mortgages, or other financial obligations. The Sandy Springs Georgia Individual Credit Application typically requests a wide range of personal and financial information. These details may include the applicant's full name, contact information, social security number, date of birth, current employment details, income sources, and overall financial status. It also requires the disclosure of existing debts, credit history, and other relevant financial obligations. The purpose of the application is to enable lenders, banks, and financial institutions to assess an individual's ability to manage credit responsibly. By analyzing the information provided, lenders can evaluate the risk associated with extending credit to the applicant. They consider factors such as income stability, credit score, past payment history, and outstanding debts. This thorough evaluation helps determine the interest rate, credit limit, and repayment terms applicable to the individual's credit account. Sandy Springs Georgia may offer different types of Individual Credit Applications catering to specific financial needs and institutions. Some variations may include: 1. Mortgage Credit Application: This type of individual credit application is designed specifically for individuals seeking mortgage loans to purchase or refinance a property in Sandy Springs, Georgia. 2. Personal Loan Credit Application: Individuals looking for unsecured loans for various purposes, such as debt consolidation, home improvements, or unexpected expenses, can utilize this credit application form. 3. Credit Card Application: This specific form pertains to individuals interested in applying for a credit card in Sandy Springs, Georgia. It captures essential information necessary for the credit card issuer to assess the applicant's creditworthiness. 4. Auto Loan Credit Application: Residents of Sandy Springs, Georgia, looking to finance the purchase of a new or used vehicle can complete this form to apply for an auto loan. It is important to note that each financial institution or lender may have their own unique Sandy Springs Georgia Individual Credit Application, with slight variations in format and specific requirements.