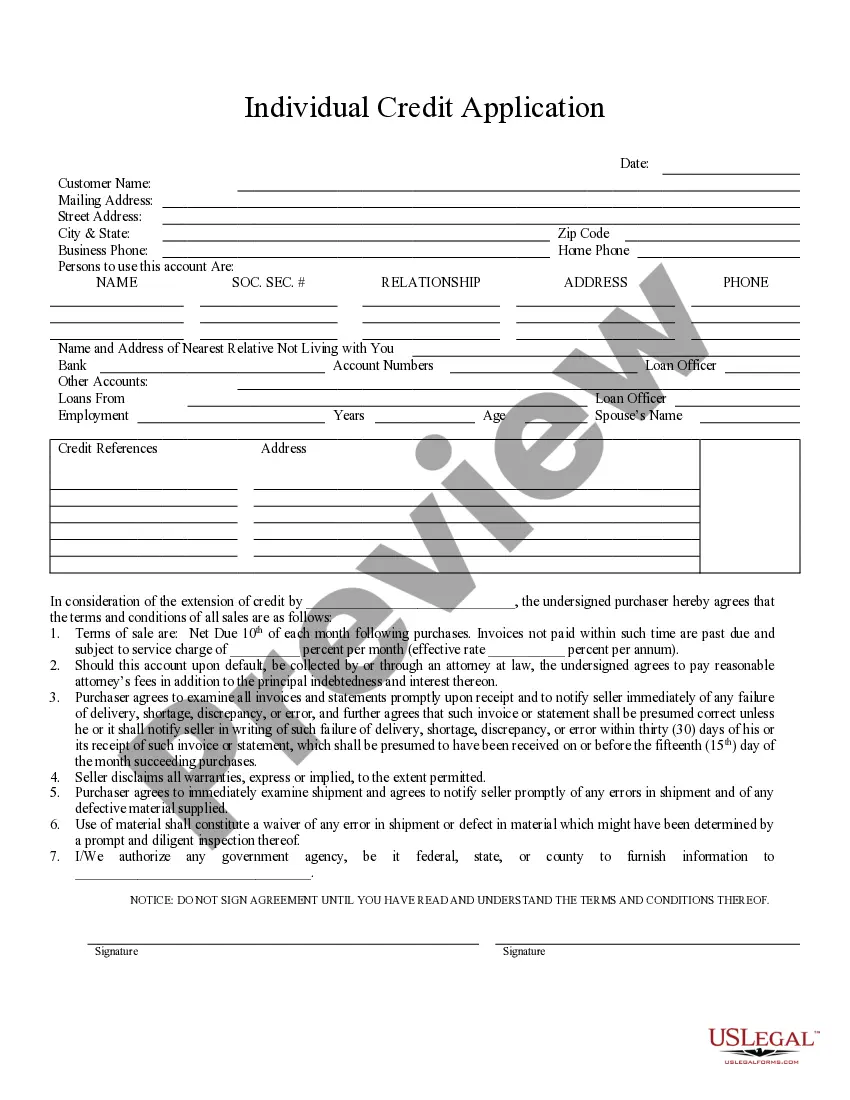

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Savannah Georgia Individual Credit Application is a comprehensive and standardized document used by financial institutions, lenders, and credit providers in the city of Savannah, Georgia. This application is designed to collect detailed information about an individual applicant's financial history, employment details, and personal information. The purpose of this application is to assess an individual's creditworthiness and determine their eligibility for credit products such as loans, credit cards, or mortgages. Keywords: Savannah, Georgia, individual credit application, financial institutions, lenders, credit providers, comprehensive, standardized, detailed information, financial history, employment details, personal information, creditworthiness, eligibility, credit products, loans, credit cards, mortgages. Different types of Savannah Georgia Individual Credit Applications may include: 1. Auto Loan Application: Specifically tailored for individuals who are seeking financing for purchasing a vehicle, this credit application focuses on relevant factors such as the make and model of the vehicle, current employment information, and previous auto loan history. 2. Personal Loan Application: This application is intended for individuals who require credit for personal expenses such as education, medical bills, or debt consolidation. It collects information about the purpose of the loan, the amount required, and the individual's income and expenses. 3. Mortgage Loan Application: Geared towards individuals interested in purchasing a home or refinancing an existing mortgage, this credit application gathers detailed financial information, employment history, and property-related information such as the address, property value, and loan amount requested. 4. Credit Card Application: Specifically designed for individuals who wish to apply for a credit card, this application focuses on the individual's income, employment status, and existing credit obligations. It aims to evaluate the individual's ability to handle revolving credit. 5. Business Loan Application: Tailored for entrepreneurs and business owners, this credit application gathers relevant information about the business, including financial statements, business plans, and personal financial details of the applicant. It assesses the creditworthiness of the business and its owner. 6. Student Loan Application: This application is intended for students who require financial assistance for educational expenses. It collects information about the educational institution, program of study, expected graduation date, and the student's income and expenses. 7. Debt Consolidation Loan Application: Geared towards individuals burdened with multiple debts, this application aims to consolidate these debts into a single loan. It collects information about the individual's outstanding debts, monthly payments, and current financial situation. Keywords: Auto loan application, personal loan application, mortgage loan application, credit card application, business loan application, student loan application, debt consolidation loan application, financial information, employment history, property-related information, income and expenses, creditworthy.Savannah Georgia Individual Credit Application is a comprehensive and standardized document used by financial institutions, lenders, and credit providers in the city of Savannah, Georgia. This application is designed to collect detailed information about an individual applicant's financial history, employment details, and personal information. The purpose of this application is to assess an individual's creditworthiness and determine their eligibility for credit products such as loans, credit cards, or mortgages. Keywords: Savannah, Georgia, individual credit application, financial institutions, lenders, credit providers, comprehensive, standardized, detailed information, financial history, employment details, personal information, creditworthiness, eligibility, credit products, loans, credit cards, mortgages. Different types of Savannah Georgia Individual Credit Applications may include: 1. Auto Loan Application: Specifically tailored for individuals who are seeking financing for purchasing a vehicle, this credit application focuses on relevant factors such as the make and model of the vehicle, current employment information, and previous auto loan history. 2. Personal Loan Application: This application is intended for individuals who require credit for personal expenses such as education, medical bills, or debt consolidation. It collects information about the purpose of the loan, the amount required, and the individual's income and expenses. 3. Mortgage Loan Application: Geared towards individuals interested in purchasing a home or refinancing an existing mortgage, this credit application gathers detailed financial information, employment history, and property-related information such as the address, property value, and loan amount requested. 4. Credit Card Application: Specifically designed for individuals who wish to apply for a credit card, this application focuses on the individual's income, employment status, and existing credit obligations. It aims to evaluate the individual's ability to handle revolving credit. 5. Business Loan Application: Tailored for entrepreneurs and business owners, this credit application gathers relevant information about the business, including financial statements, business plans, and personal financial details of the applicant. It assesses the creditworthiness of the business and its owner. 6. Student Loan Application: This application is intended for students who require financial assistance for educational expenses. It collects information about the educational institution, program of study, expected graduation date, and the student's income and expenses. 7. Debt Consolidation Loan Application: Geared towards individuals burdened with multiple debts, this application aims to consolidate these debts into a single loan. It collects information about the individual's outstanding debts, monthly payments, and current financial situation. Keywords: Auto loan application, personal loan application, mortgage loan application, credit card application, business loan application, student loan application, debt consolidation loan application, financial information, employment history, property-related information, income and expenses, creditworthy.