Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Note: This summary is not intended to be an all-inclusive summary of the law of bad checks, but does contain basic and

other provisions.

CIVIL PROVISIONS

Georgia Code

TITLE 13 - CONTRACTS

CHAPTER 6 - DAMAGES AND COSTS GENERALLY

GA. Code 13-6-15 (Georgia Code (2016 Edition)

13-6-15.

(a) Notwithstanding any criminal sanctions which may apply, any person who makes, utters, draws, or delivers any check, draft, or order upon any bank, depository, person, firm, or corporation for the payment of money, which drawee refuses to honor the instrument for lack of funds or credit in the account from which to pay the instrument or because the maker has no account with the drawee, and who fails to pay the same amount in cash to the payee named in the instrument within ten days after a written demand therefor, as provided in subsection (c) of this Code section, has been delivered to the maker by certified mail, or statutory overnight delivery shall be liable to the payee, in addition to the amount owing upon such check, draft, or order, for damages of double the amount so owing, but in no case more than $500.00, and any court costs incurred by the payee in taking the action. In addition to delivery of notice as provided for herein, notice may be given by first-class mail to the address printed on the check given by the maker at the time of issuance or, in the case of a draft or order, to the last known address. If the question of sufficiency of notice becomes an issue, when notice is by first-class mail, the sender of the purported notice shall give an affidavit, under oath, that notice was made as provided for herein and there shall be a rebuttable presumption that proper notice was given.

(b) The payee may charge the maker of the check, draft, or order a service charge not to exceed $30.00 or 5 percent of the face amount of the instrument, whichever is greater, plus the amount of any fees charged to the holder of the instrument by a bank or financial institution as a result of the instrument not being honored, when making written demand for payment.

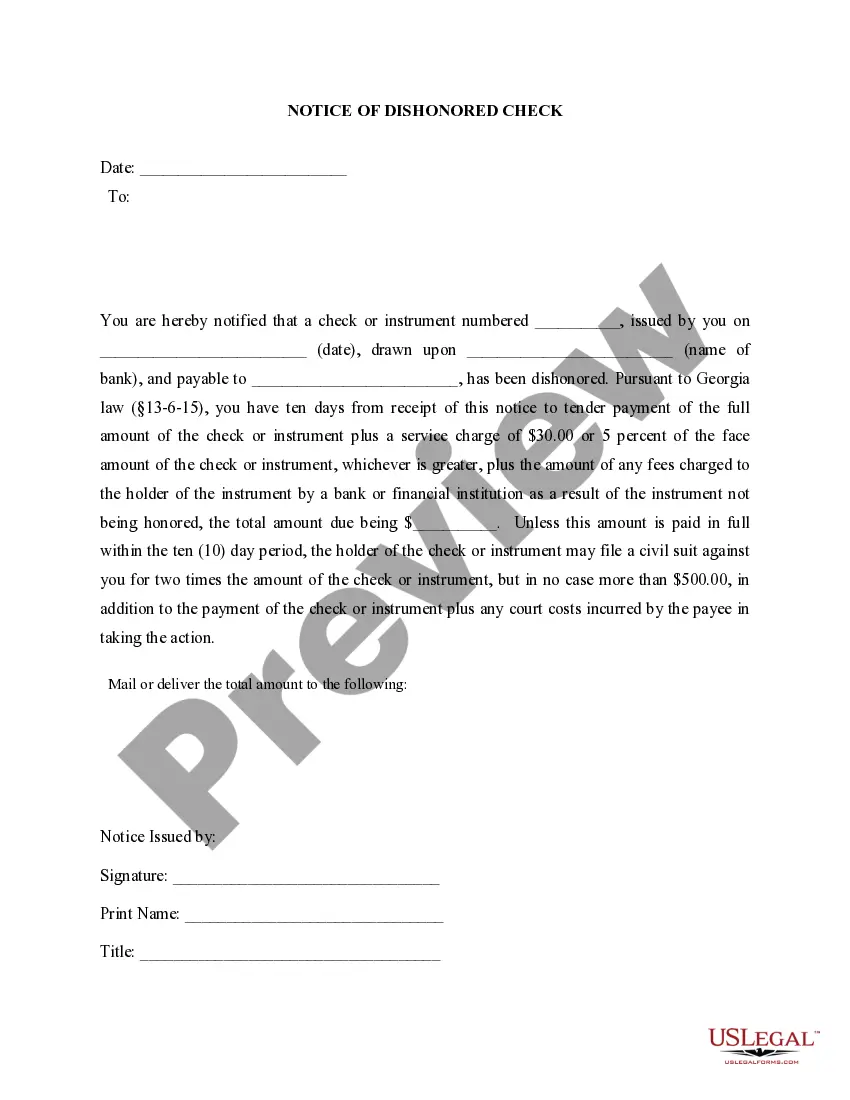

(c) Before any recovery under subsection (a) of this Code section may be claimed, a written demand in substantially the form which follows shall be sent by certified mail, statutory overnight delivery, or first-class mail supported by an affidavit of service to the address printed or written on the check given by the maker at the time of issuance of the check or, in the case of a draft or order, to the last known address, the notice to be deemed conclusive ten days following the date the affidavit is executed, to the maker of the instrument at the address shown on the instrument:

You are hereby notified that a check or instrument numbered , issued by you on (date), drawn upon (name of bank), and payable to , has been dishonored. Pursuant to Georgia law, you have ten days from receipt of this notice to tender payment of the full amount of the check or instrument plus a service charge of $30.00 or 5 percent of the face amount of the check or instrument, whichever is greater, plus the amount of any fees charged to the holder of the instrument by a bank or financial institution as a result of the instrument not being honored, the total amount due being $ . Unless this amount is paid in full within the ten-day period, the holder of the check or instrument may file a civil suit against you for two times the amount of the check or instrument, but in no case more than $500.00, in addition to the payment of the check or instrument plus any court costs incurred by the payee in taking the action.

(d) For purposes of this Code section, the holder of the dishonored check, draft, or order shall file the action in the county where the defendant resides.

(e) It shall be an affirmative defense, in addition to other defenses, to an action under this Code section if it is found that:

(1) Full satisfaction of the amount of the check or instrument plus the applicable service charge and any fees charged to the holder of the instrument by a bank or financial institution as a result of the instrument not being honored was made prior to the commencement of the action;

(2) The bank or depository erred in dishonoring the check or instrument; or

(3) The acceptor of the check or instrument knew at the time of acceptance that there were insufficient funds on deposit in the bank or depository with which to cause the check or instrument to be honored.

(f) In an action under this Code section, the court or jury may, however, waive all or part of the double damages upon finding that the defendant's failure to satisfy the dishonored check or instrument was due to the defendant receiving a dishonored check or instrument written to the defendant by another party.

(g) Subsequent to the commencement of the civil action under this Code section, but prior to the hearing, the defendant may tender to the plaintiff as satisfaction of the claim an amount of money equal to the sum of the amount of the dishonored check, service charges on the check, any fees charged to the holder of the instrument by a bank or financial institution as a result of the instrument not being honored, and any court costs incurred by the plaintiff in taking the action.

(h) In an action under this Code section, if the court or jury determines that the failure of the defendant to satisfy the dishonored check was due to economic hardship, the court or jury has the discretion to waive all or part of the double damages. However, if the court or jury waives all or part of the double damages, the court or jury shall render judgment against the defendant in the amount of the dishonored check plus service charges on the check plus any fees charged to the holder of the instrument by a bank or financial institution as a result of the instrument not being honored and any court costs incurred by the plaintiff in taking the action.

HISTORY: Code 1981, 13-6-15, enacted by Ga. L. 1987, p. 817, 1; Ga. L. 1991, p. 1299, 2, 3; Ga. L. 1993, p. 465, 1; Ga. L. 1997, p. 552, 1; Ga. L. 1999, p. 775, 1; Ga. L. 2000, p. 1589, 3; Ga. L. 2003, p. 479, 1.

GA. Code 16-9-20 (Georgia Code (2016 Edition)

16-9-20.

(a) A person commits the offense of deposit account fraud when such person makes, draws, utters, executes, or delivers an instrument for the payment of money on any bank or other depository in exchange for a present consideration or wages, knowing that it will not be honored by the drawee. For the purposes of this Code section, it is prima-facie evidence that the accused knew that the instrument would not be honored if:

(1) The accused had no account with the drawee at the time the instrument was made, drawn, uttered, or delivered;

(2) Payment was refused by the drawee for lack of funds upon presentation within 30 days after delivery and the accused or someone for him or her shall not have tendered the holder thereof the amount due thereon, together with a service charge, within ten days after receiving written notice that payment was refused upon such instrument. For purposes of this paragraph:

(A) Notice mailed by certified or registered mail or statutory overnight delivery evidenced by return receipt to the person at the address printed on the instrument or given at the time of issuance shall be deemed sufficient and equivalent to notice having been received as of the date on the return receipt by the person making, drawing, uttering, executing, or delivering the instrument. A single notice as provided in subparagraph (B) of this paragraph shall be sufficient to cover all instruments on which payment was refused and which were delivered within a ten-day period by the accused to a single entity, provided that the form of notice lists and identifies each instrument; and

(B) The form of notice shall be substantially as follows:

You are hereby notified that the following instrument(s)

Name

of

Number Date Amount Bank

drawn upon and payable to , (has) (have) been

dishonored. Pursuant to Georgia law, you have ten days from

receipt of this notice to tender payment of the total amount of

the instrument(s) plus the applicable service charge(s) of $

and any fee charged to the holder of the instrument(s) by a bank

or financial institution as a result of the instrument(s) not

being honored, the total amount due being dollars and

cents. Unless this amount is paid in full within the

specified time above, a presumption in law arises that you

delivered the instrument(s) with the intent to defraud and the

dishonored instrument(s) and all other available information

relating to this incident may be submitted to the magistrate for

the issuance of a criminal warrant or citation or to the district

attorney or solicitor-general for criminal prosecution.

(3) Notice mailed by certified or registered mail or statutory overnight delivery is returned undelivered to the sender when such notice was mailed within 90 days of dishonor to the person at the address printed on the instrument or given by the accused at the time of issuance of the instrument.

(b) (1) Except as provided in paragraphs (2) and (3) of this subsection and subsection (c) of this Code section, a person convicted of the offense of deposit account fraud shall be guilty of a misdemeanor and, upon conviction thereof, shall be punished as follows:

(A) When the instrument is for less than $500.00, a fine of not more than $500.00 or imprisonment not to exceed 12 months, or both;

(B) When the instrument is for $500.00 or more but less than $1,000.00, a fine of not more than $1,000.00 or imprisonment not to exceed 12 months, or both; or

(C) When more than one instrument is involved and such instruments were drawn within 90 days of one another and each is in an amount less than $500.00, the amounts of such separate instruments may be added together to arrive at and be punishable under subparagraph (B) of this paragraph.

(2) Except as provided in paragraph (3) of this subsection and subsection (c) of this Code section, a person convicted of the offense of deposit account fraud, when the instrument is for an amount of not less than $1,000.00 nor more than $1,499.99, shall be guilty of a misdemeanor of a high and aggravated nature. When more than one instrument is involved and such instruments were given to the same entity within a 15 day period and the cumulative total of such instruments is not less than $1,000.00 nor more than $1,499.00, the person drawing and giving such instruments shall upon conviction be guilty of a misdemeanor of a high and aggravated nature.

(3) Except as provided in subsection (c) of this Code section, a person convicted of the offense of deposit account fraud, when the instrument is for $1,500.00 or more, shall be guilty of a felony and, upon conviction thereof, shall be punished by a fine of not less than $500.00 nor more than $5,000.00 or by imprisonment for not more than three years, or both.

(4) Upon conviction of a first or any subsequent offense under this subsection or subsection (c) of this Code section, in addition to any other punishment provided by this Code section, the defendant shall be required to make restitution of the amount of the instrument, together with all costs of bringing a complaint under this Code section. The court may require the defendant to pay as interest a monthly payment equal to 1 percent of the amount of the instrument. Such amount shall be paid each month in addition to any payments on the principal until the entire balance, including the principal and any unpaid interest payments, is paid in full. Such amount shall be paid without regard to any reduction in the principal balance owed. Costs shall be determined by the court from competent evidence of costs provided by the party causing the criminal warrant or citation to issue; provided, however, that the minimum costs shall not be less than $25.00. Restitution may be made while the defendant is serving a probated or suspended sentence.

(c) A person who commits the offense of deposit account fraud by the making, drawing, uttering, executing, or delivering of an instrument on a bank of another state shall be guilty of a felony and, upon conviction thereof, shall be punished by imprisonment for not less than one nor more than five years or by a fine in an amount of up to $1,000.00, or both.

(d) The prosecuting authority of the court with jurisdiction over a violation of subsection (c) of this Code section may seek extradition for criminal prosecution of any person not within this state who flees the state to avoid prosecution under this Code section.

(e) In any prosecution or action under this Code section, an instrument for which the information required in this subsection is available at the time of issuance shall constitute prima-facie evidence of the identity of the party issuing or executing the instrument and that the person was a party authorized to draw upon the named account. To establish this prima-facie evidence, the following information regarding the identity of the party presenting the instrument shall be obtained by the party receiving such instrument: the full name, residence address, and home phone number.

(1) Such information may be provided by either of two methods:

(A) The information may be recorded upon the instrument itself; or

(B) The number of a check-cashing identification card issued by the receiving party may be recorded on the instrument. The check-cashing identification card shall be issued only after the information required in this subsection has been placed on file by the receiving party.

(2) In addition to the information required in this subsection, the party receiving an instrument shall witness the signature or endorsement of the party presenting such instrument and as evidence of such the receiving party shall initial the instrument.

(f) As used in this Code section, the term:

(1) Bank shall include a financial institution as defined in this Code section.

(2) Conviction shall include the entering of a guilty plea, the entering of a plea of nolo contendere, or the forfeiting of bail.

(3) Financial institution shall have the same meaning as defined in paragraph (21) of Code Section 7-1-4 and shall also include a national bank, a state or federal savings bank, a state or federal credit union, and a state or federal savings and loan association.

(4) Holder in due course shall have the same meaning as in Code Section 11-3-302.

(5) Instrument means a check, draft, debit card sales draft, or order for the payment of money.

(6) Present consideration shall include without limitation:

(A) An obligation or debt of rent which is past due or presently due;

(B) An obligation or debt of state taxes which is past due or presently due;

(C) An obligation or debt which is past due or presently due for child support when made for the support of such minor child and which is given pursuant to an order of court or written agreement signed by the person making the payment;

(D) A simultaneous agreement for the extension of additional credit where additional credit is being denied; and

(E) A written waiver of mechanic's or materialmen's lien rights.

(7) State taxes shall include payments made to the Georgia Department of Labor as required by Chapter 8 of Title 34.

(g) This Code section shall in no way affect the authority of a sentencing judge to provide for a sentence to be served on weekends or during the nonworking hours of the defendant as provided in Code Section 17-10-3.

(h) (1) Any party holding a worthless instrument and giving notice in substantially similar form to that provided in subparagraph (a)(2)(B) of this Code section shall be immune from civil liability for the giving of such notice and for proceeding as required under the forms of such notice; provided, however, that, if any person shall be arrested or prosecuted for violation of this Code section and payment of any instrument shall have been refused because the maker or drawer had no account with the bank or other depository on which such instrument was drawn, the one causing the arrest or prosecution shall be deemed to have acted with reasonable or probable cause even though he, she, or it has not mailed the written notice or waited for the ten-day period to elapse. In any civil action for damages which may be brought by the person who made, drew, uttered, executed, or delivered such instrument, no evidence of statements or representations as to the status of the instrument involved or of any collateral agreement with reference to the instrument shall be admissible unless such statements, representations, or collateral agreement shall be written simultaneously with or upon the instrument at the time it is delivered by the maker thereof.

(2) Except as otherwise provided by law, any party who holds a worthless instrument, who complies with the requirements of subsection (a) of this Code section, and who causes a criminal warrant or citation to be issued shall not forfeit his or her right to continue or pursue civil remedies authorized by law for the collection of the worthless instrument; provided, however, that if interest is awarded and collected on any amount ordered by the court as restitution in the criminal case, interest shall not be collectable in any civil action on the same amount. It shall be deemed conclusive evidence that any action is brought upon probable cause and without malice where such party holding a worthless instrument has complied with the provisions of subsection (a) of this Code section regardless of whether the criminal charges are dismissed by a court due to payment in full of the face value of the instrument and applicable service charges subsequent to the date that affidavit for the warrant or citation is made. In any civil action for damages which may be brought by the person who made, drew, uttered, executed, or delivered such instrument, no evidence of statements or representations as to the status of the instrument involved or of any collateral agreement with reference to the instrument shall be admissible unless such statements, representations, or collateral agreement shall be written simultaneously with or upon the instrument at the time it is delivered by the maker thereof.

(i) Notwithstanding paragraph (2) of subsection (a) of this Code section or any other law on usury, charges, or fees on loans or credit extensions, any lender of money or extender of other credit who receives an instrument drawn on a bank or other depository institution given by any person in full or partial repayment of a loan, installment payment, or other extension of credit may, if such instrument is not paid or is dishonored by such institution, charge and collect from the borrower or person to whom the credit was extended a bad instrument charge. This charge shall not be deemed interest or a finance or other charge made as an incident to or as a condition to the granting of the loan or other extension of credit and shall not be included in determining the limit on charges which may be made in connection with the loan or extension of credit or any other law of this state.

(j) For purposes of this Code section, no service charge or bad instrument charge shall exceed $30.00 or 5 percent of the face amount of the instrument, whichever is greater, except that the holder of the instrument may also charge the maker an additional fee in an amount equal to that charged to the holder by the bank or financial institution as a result of the instrument not being honored.

(k) An action under this Code section may be prosecuted by the party initially receiving a worthless instrument or by any subsequent holder in due course of any such worthless instrument.

HISTORY: Ga. L. 1959, p. 252, 1-3; Code 1933, 26-1704, enacted by Ga. L. 1968, p. 1249, 1; Code 1933, 41A-9909, enacted by Ga. L. 1974, p. 705, 1; Ga. L. 1975, p. 482, 1; Ga. L. 1977, p. 1266, 1, 2; Ga. L. 1978, p. 2020, 1; Ga. L. 1980, p. 1034, 1; Ga. L. 1980, p. 1147, 1-3; Ga. L. 1981, p. 1550, 1; Ga. L. 1983, p. 484, 1; Ga. L. 1983, p. 485, 1; Ga. L. 1983, p. 1189, 1, 2; Ga. L. 1984, p. 22, 16; Ga. L. 1984, p. 1435, 1; Ga. L. 1985, p. 708, 1; Ga. L. 1986, p. 209, 1; Ga. L. 1987, p. 983, 1; Ga. L. 1988, p. 268, 1; Ga. L. 1988, p. 762, 1; Ga. L. 1989, p. 1570, 1; Ga. L. 1990, p. 8, 16; Ga. L. 1994, p. 1787, 3; Ga. L. 1995, p. 910, 1, 2; Ga. L. 1996, p. 748, 10; Ga. L. 1996, p. 1014, 1, 2; Ga. L. 1999, p. 720, 1; Ga. L. 2000, p. 1352, 1; Ga. L. 2000, p. 1589, 4; Ga. L. 2003, p. 140, 16; Ga. L. 2003, p. 478, 1; Ga. L. 2012, p. 899, 3-6/HB 1176.