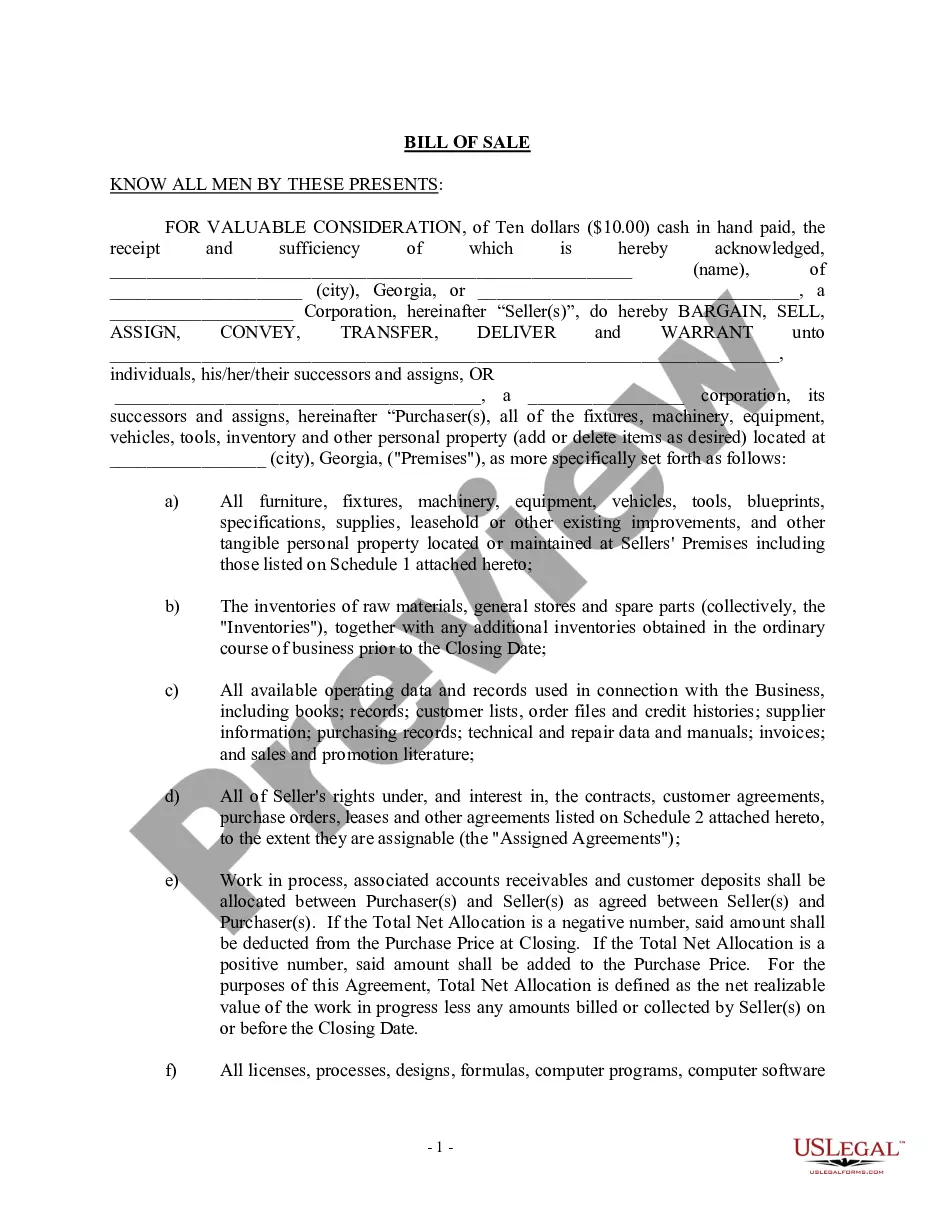

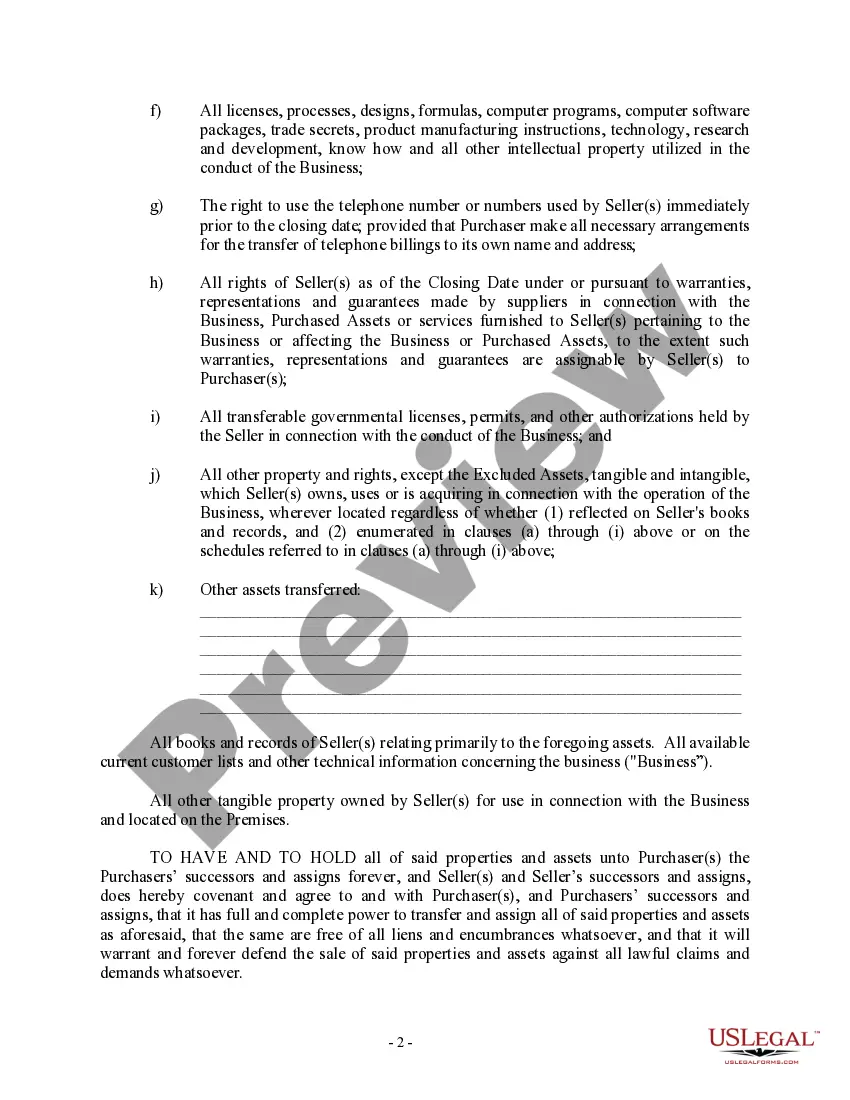

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

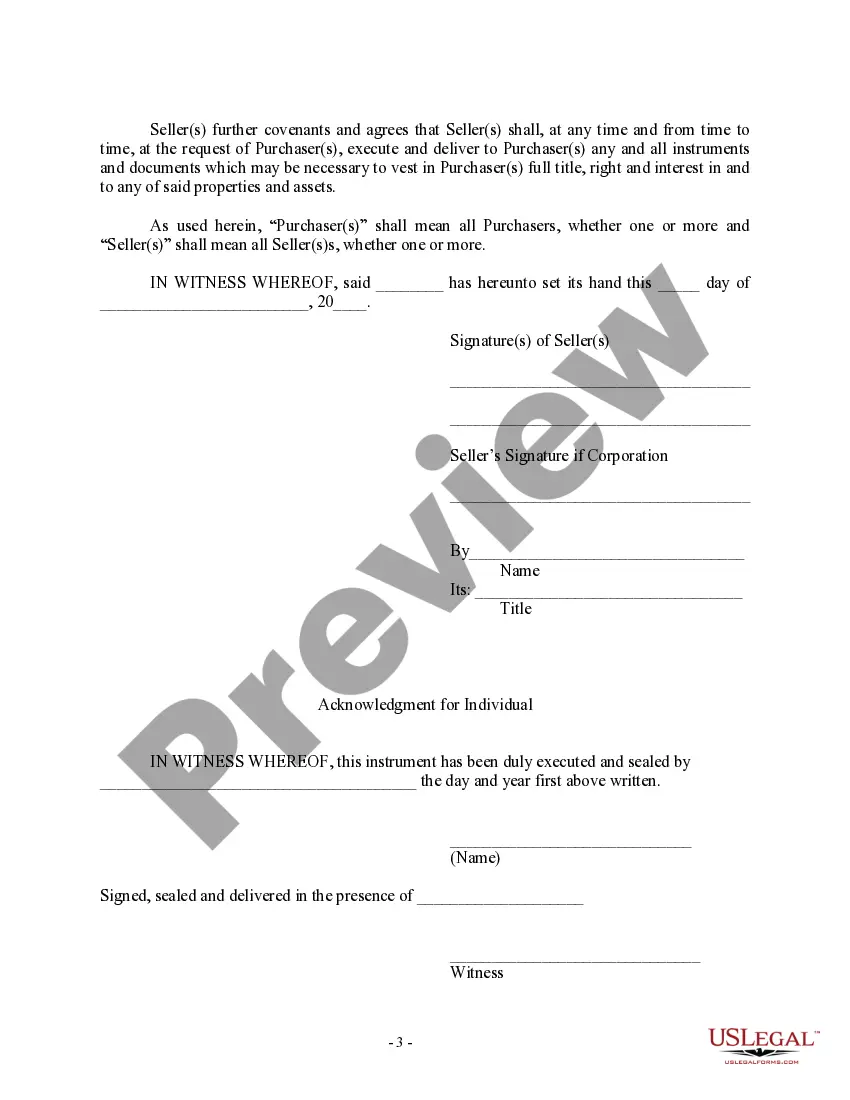

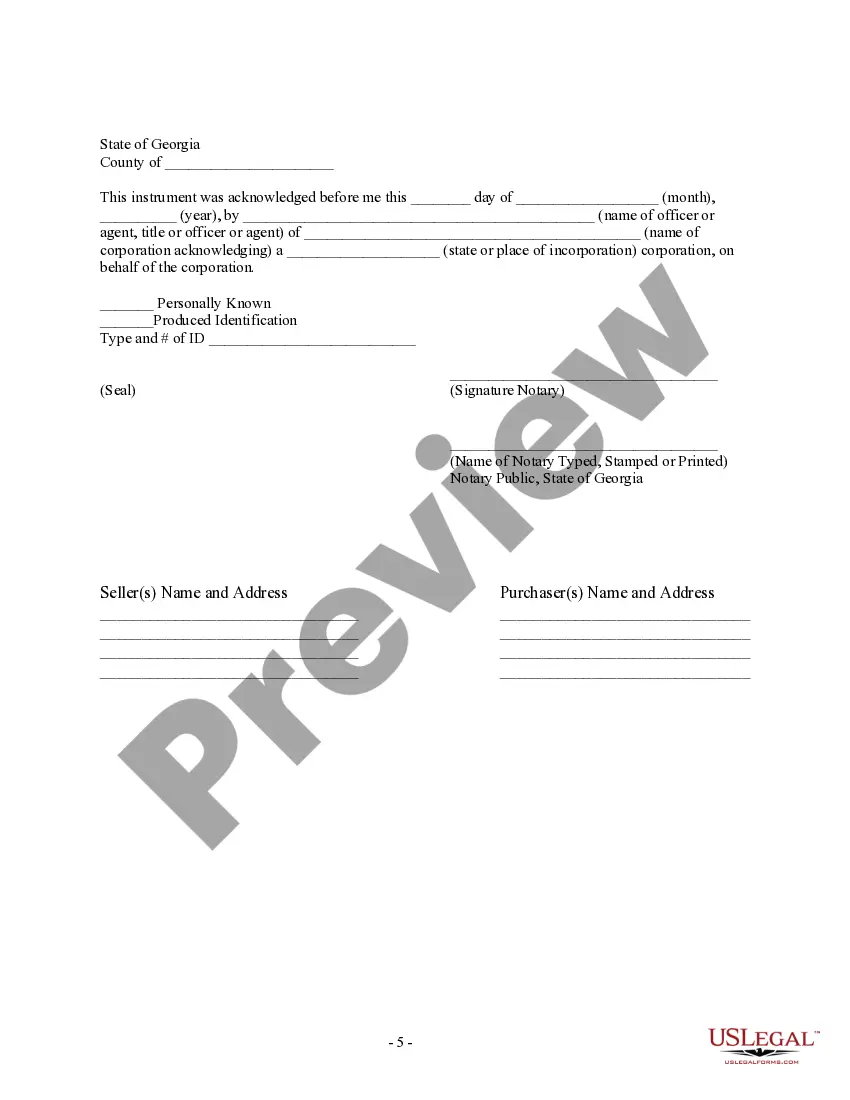

The Fulton Georgia Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legal document that facilitates the transfer of ownership of a business from the seller to the buyer. It serves as proof of the transaction and outlines the terms and conditions agreed upon by both parties. This document is crucial as it protects the interests of both the buyer and the seller, ensuring that the sale is conducted in a fair and transparent manner. The Fulton Georgia Bill of Sale includes various crucial details required for a business sale transaction. It typically includes the names and contact information of the seller and the buyer, the effective date of the sale, the purchase price or agreed-upon value of the business, and a detailed description of the business being sold. The description should encompass key elements such as the name and nature of the business, its assets, inventory, real estate, and any leases or licenses associated with the business. In addition to these basic details, the bill of sale may incorporate specific terms and conditions related to the sale. For instance, it may outline any warranties or guarantees provided by the seller regarding the business, the agreed-upon payment terms, and any conditions for closing the sale. It may also include provisions for the transfer of licenses, permits, and contracts held by the business. Moreover, it is essential to note that there can be different types of Fulton Georgia Bill of Sale forms, depending on the nature and structure of the sale. Some common types include: 1. Asset Purchase Agreement: This type of bill of sale is used when only the assets of a business are being sold rather than the entire entity. It specifies which assets are included in the sale, such as equipment, inventory, and intellectual property rights. 2. Stock Purchase Agreement: In the case of a corporate seller, this bill of sale is used when the buyer intends to acquire the entire business, including its stocks, thereby gaining control of the company. 3. Bulk Sale Agreement: This type of bill of sale is applicable when a significant portion or all of a business's assets are being sold in bulk, apart from regular inventory, as in the case of liquidation sales or business closure. It is important for both parties involved in the sale of a business in Fulton, Georgia, to carefully draft and review the bill of sale. Consulting with legal professionals or business advisors experienced in such transactions is highly recommended ensuring that the document accurately reflects the agreed-upon terms, protects the interests of both parties, and complies with applicable Georgia laws and regulations.The Fulton Georgia Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legal document that facilitates the transfer of ownership of a business from the seller to the buyer. It serves as proof of the transaction and outlines the terms and conditions agreed upon by both parties. This document is crucial as it protects the interests of both the buyer and the seller, ensuring that the sale is conducted in a fair and transparent manner. The Fulton Georgia Bill of Sale includes various crucial details required for a business sale transaction. It typically includes the names and contact information of the seller and the buyer, the effective date of the sale, the purchase price or agreed-upon value of the business, and a detailed description of the business being sold. The description should encompass key elements such as the name and nature of the business, its assets, inventory, real estate, and any leases or licenses associated with the business. In addition to these basic details, the bill of sale may incorporate specific terms and conditions related to the sale. For instance, it may outline any warranties or guarantees provided by the seller regarding the business, the agreed-upon payment terms, and any conditions for closing the sale. It may also include provisions for the transfer of licenses, permits, and contracts held by the business. Moreover, it is essential to note that there can be different types of Fulton Georgia Bill of Sale forms, depending on the nature and structure of the sale. Some common types include: 1. Asset Purchase Agreement: This type of bill of sale is used when only the assets of a business are being sold rather than the entire entity. It specifies which assets are included in the sale, such as equipment, inventory, and intellectual property rights. 2. Stock Purchase Agreement: In the case of a corporate seller, this bill of sale is used when the buyer intends to acquire the entire business, including its stocks, thereby gaining control of the company. 3. Bulk Sale Agreement: This type of bill of sale is applicable when a significant portion or all of a business's assets are being sold in bulk, apart from regular inventory, as in the case of liquidation sales or business closure. It is important for both parties involved in the sale of a business in Fulton, Georgia, to carefully draft and review the bill of sale. Consulting with legal professionals or business advisors experienced in such transactions is highly recommended ensuring that the document accurately reflects the agreed-upon terms, protects the interests of both parties, and complies with applicable Georgia laws and regulations.