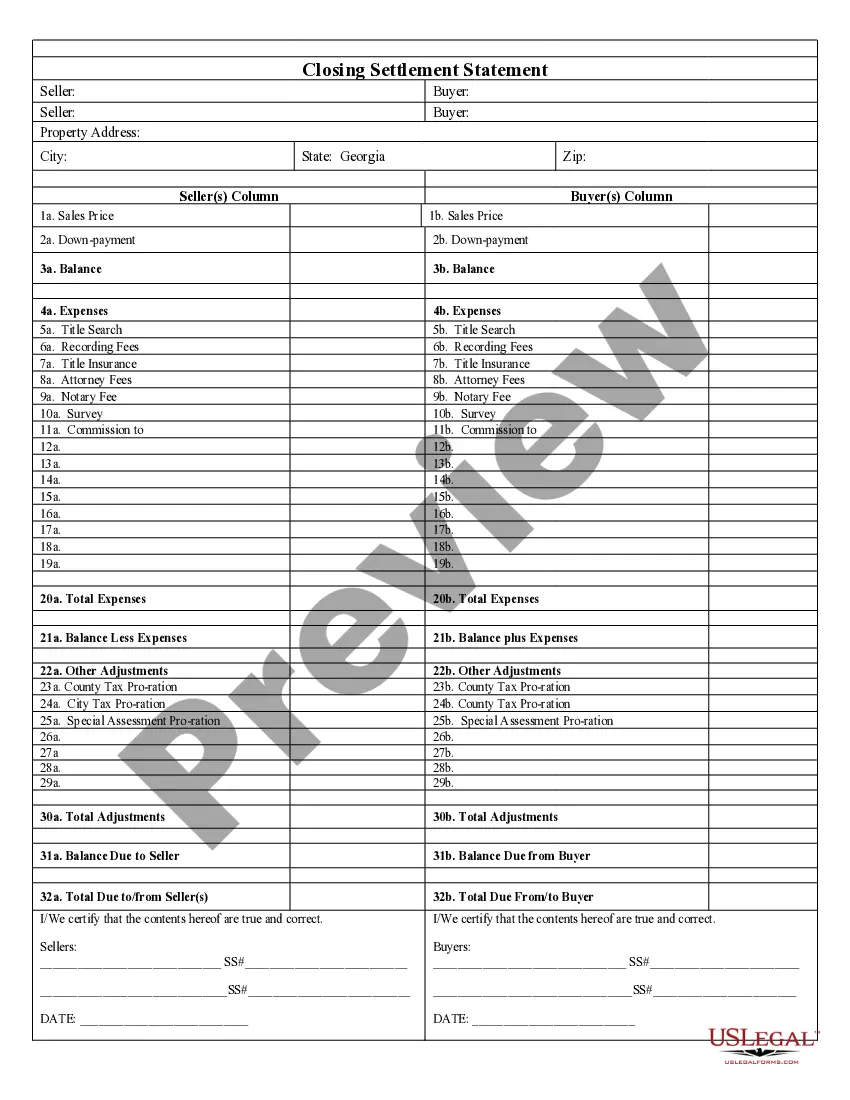

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

South Fulton Georgia Closing Statement is a crucial legal document that marks the final step in a real estate transaction. This comprehensive description will explain what a closing statement is, its purpose, and different types for South Fulton Georgia residents. A South Fulton Georgia Closing Statement, also known as a settlement statement or a HUD-1 statement, is a document used when closing a real estate deal in South Fulton, Georgia. It is prepared by the closing agent, typically an attorney or a title company, and outlines the financial details of the transaction for both the buyer and the seller. The primary purpose of a South Fulton Georgia Closing Statement is to provide a complete breakdown of all the costs involved in the real estate transaction. It acts as a financial snapshot, summarizing the fees, expenses, and payments related to the purchase or sale of the property. Some key components typically included in a South Fulton Georgia Closing Statement are: 1. Property details: The statement provides information about the property being bought or sold, including the address, legal description, and other relevant details. 2. Purchase price: This section indicates the agreed-upon purchase price between the buyer and the seller. 3. Closing costs: It lists all the fees associated with the transaction, such as loan origination fees, appraisal fees, survey fees, title search fees, insurance costs, and attorney fees. These costs can vary depending on the complexity of the deal and the parties involved. 4. Escrow and pre-paid items: The statement details the funds held in escrow for taxes, insurance, and other pre-paid expenses. 5. Loan details: If the purchase involves mortgage financing, the closing statement will include relevant loan information, such as the loan amount, interest rate, and any points or fees associated with the loan. 6. Prorations: Prorations are adjustments made to divide expenses between the buyer and the seller, such as property taxes, homeowner association fees, and utilities. 7. Credits and adjustments: This section outlines any credits, discounts or adjustments made to the final settlement amount, including earnest money deposits, seller concessions, and agreed-upon repairs. 8. Final balance due or payable: The closing statement calculates the final amount due from the buyer or payable to the seller after considering the payments, credits, and adjustments mentioned above. While the overall structure and content of a South Fulton Georgia Closing Statement remain generally consistent, there could be variations depending on the type of real estate transaction. Some common types of closing statements include: 1. Residential closing statement: Used for the purchase or sale of single-family homes, townhouses, or condominiums in South Fulton, Georgia. 2. Commercial closing statement: Designed for transactions involving commercial properties, such as office buildings, retail spaces, or industrial properties. 3. Refinance closing statement: Used when refinancing an existing mortgage, it highlights the changes in loan terms, repayment amounts, and any additional fees involved. In conclusion, a South Fulton Georgia Closing Statement is a vital document used to finalize a real estate transaction. It provides a detailed breakdown of the financial aspects of the deal, ensuring transparency for both parties involved. Whether it's a residential, commercial, or refinance closing, having a comprehensive closing statement is essential for a smooth and successful conclusion to any real estate transaction in South Fulton, Georgia.South Fulton Georgia Closing Statement is a crucial legal document that marks the final step in a real estate transaction. This comprehensive description will explain what a closing statement is, its purpose, and different types for South Fulton Georgia residents. A South Fulton Georgia Closing Statement, also known as a settlement statement or a HUD-1 statement, is a document used when closing a real estate deal in South Fulton, Georgia. It is prepared by the closing agent, typically an attorney or a title company, and outlines the financial details of the transaction for both the buyer and the seller. The primary purpose of a South Fulton Georgia Closing Statement is to provide a complete breakdown of all the costs involved in the real estate transaction. It acts as a financial snapshot, summarizing the fees, expenses, and payments related to the purchase or sale of the property. Some key components typically included in a South Fulton Georgia Closing Statement are: 1. Property details: The statement provides information about the property being bought or sold, including the address, legal description, and other relevant details. 2. Purchase price: This section indicates the agreed-upon purchase price between the buyer and the seller. 3. Closing costs: It lists all the fees associated with the transaction, such as loan origination fees, appraisal fees, survey fees, title search fees, insurance costs, and attorney fees. These costs can vary depending on the complexity of the deal and the parties involved. 4. Escrow and pre-paid items: The statement details the funds held in escrow for taxes, insurance, and other pre-paid expenses. 5. Loan details: If the purchase involves mortgage financing, the closing statement will include relevant loan information, such as the loan amount, interest rate, and any points or fees associated with the loan. 6. Prorations: Prorations are adjustments made to divide expenses between the buyer and the seller, such as property taxes, homeowner association fees, and utilities. 7. Credits and adjustments: This section outlines any credits, discounts or adjustments made to the final settlement amount, including earnest money deposits, seller concessions, and agreed-upon repairs. 8. Final balance due or payable: The closing statement calculates the final amount due from the buyer or payable to the seller after considering the payments, credits, and adjustments mentioned above. While the overall structure and content of a South Fulton Georgia Closing Statement remain generally consistent, there could be variations depending on the type of real estate transaction. Some common types of closing statements include: 1. Residential closing statement: Used for the purchase or sale of single-family homes, townhouses, or condominiums in South Fulton, Georgia. 2. Commercial closing statement: Designed for transactions involving commercial properties, such as office buildings, retail spaces, or industrial properties. 3. Refinance closing statement: Used when refinancing an existing mortgage, it highlights the changes in loan terms, repayment amounts, and any additional fees involved. In conclusion, a South Fulton Georgia Closing Statement is a vital document used to finalize a real estate transaction. It provides a detailed breakdown of the financial aspects of the deal, ensuring transparency for both parties involved. Whether it's a residential, commercial, or refinance closing, having a comprehensive closing statement is essential for a smooth and successful conclusion to any real estate transaction in South Fulton, Georgia.