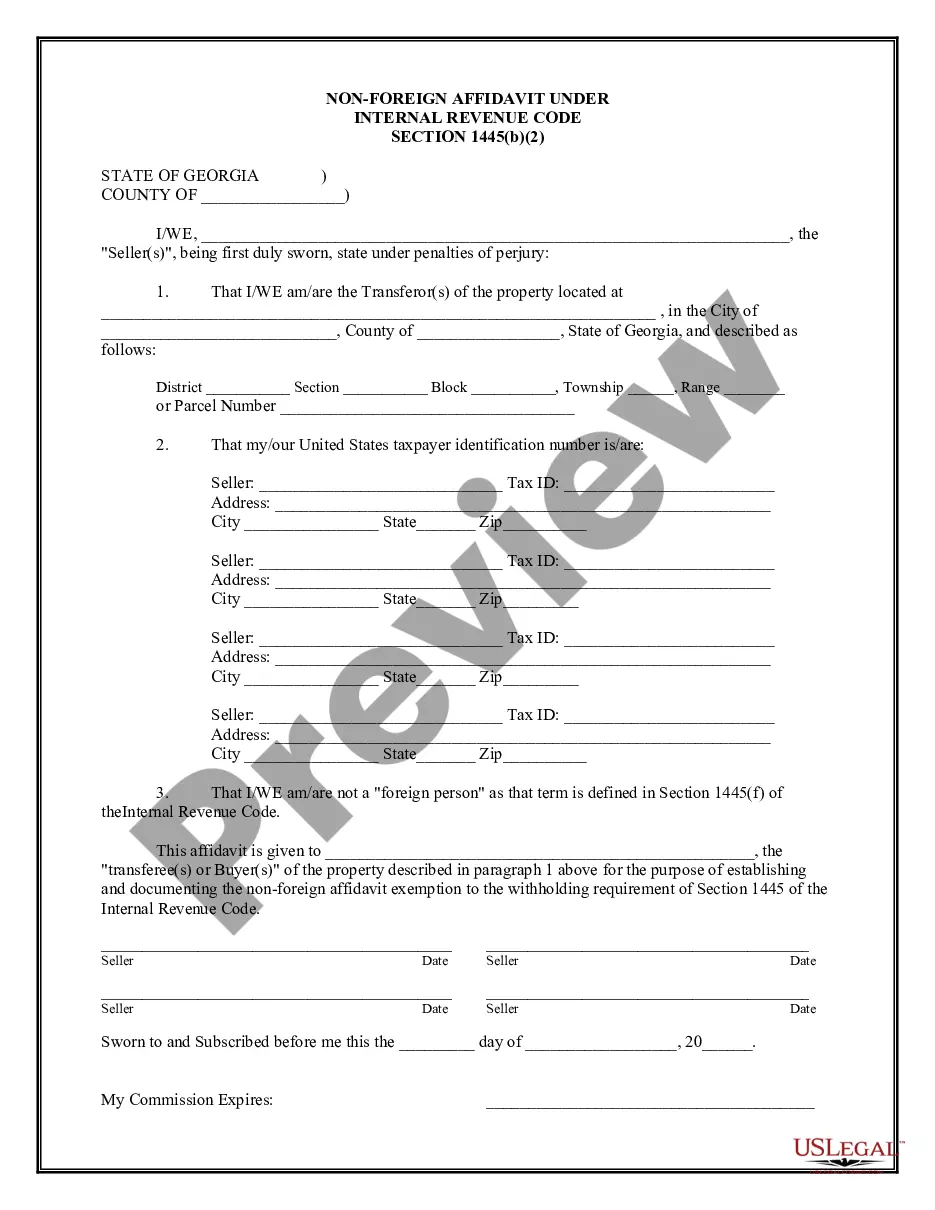

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

A Sandy Springs Georgia Non-Foreign Affidavit Under IRC 1445 is a document that is typically required in real estate transactions involving non-U.S. sellers. This affidavit affirms that the seller is not a foreign person or entity and therefore not subject to withholding tax under Section 1445 of the Internal Revenue Code (IRC). Here is a detailed description of what a Sandy Springs Georgia Non-Foreign Affidavit Under IRC 1445 entails, along with relevant keywords: 1. Purpose: The purpose of the Sandy Springs Georgia Non-Foreign Affidavit Under IRC 1445 is to declare the seller's non-foreign status to the buyer or the settlement agent. It helps to ensure compliance with U.S. tax laws and exempts the seller from the requirement to withhold a portion of the sales proceeds for tax purposes. 2. Contents: The affidavit typically includes the following information: — Identification: The seller's full legal name, address, and taxpayer identification number (TIN), such as a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN). — Non-Foreign Status Declaration: A statement affirming that the seller is not a foreign person, as defined by the IRC, and does not fall under the FIR PTA (Foreign Investment in Real Property Tax Act) regulations. — Supporting Documentation: Depending on the requirements of the buyer or the settlement agent, additional supporting documents may be requested to verify the seller's non-foreign status. These can include a copy of a passport or a visa, or other documents indicating the seller's status as a U.S. citizen, resident alien, or non-foreign entity. — Signature and Certification: The affidavit should be signed and dated by the seller, certifying under the penalties of perjury that the information provided is true and correct. 3. Types of Sandy Springs Georgia Non-Foreign Affidavit Under IRC 1445: While the basic structure and purpose of the affidavit remain the same, there might be variations in the format and specific requirements depending on the buyer, settlement agent, or specific circumstances of the transaction. For example, some buyers or settlement agents may require additional documentation or a notarized signature. However, the key objective remains to establish the non-foreign status of the seller. Keywords: Sandy Springs Georgia, Non-Foreign Affidavit Under IRC 1445, real estate transactions, foreign person, withholding tax, Internal Revenue Code, non-foreign status declaration, FIR PTA, supporting documentation, U.S. citizen, resident alien, non-foreign entity, penalties of perjury, buyer, settlement agent, notarized signature. It's important to note that while this information provides a general overview of a Sandy Springs Georgia Non-Foreign Affidavit Under IRC 1445, it's advisable to consult with a legal professional or tax advisor for specific guidance tailored to individual circumstances and the prevailing legal requirements in Sandy Springs, Georgia.A Sandy Springs Georgia Non-Foreign Affidavit Under IRC 1445 is a document that is typically required in real estate transactions involving non-U.S. sellers. This affidavit affirms that the seller is not a foreign person or entity and therefore not subject to withholding tax under Section 1445 of the Internal Revenue Code (IRC). Here is a detailed description of what a Sandy Springs Georgia Non-Foreign Affidavit Under IRC 1445 entails, along with relevant keywords: 1. Purpose: The purpose of the Sandy Springs Georgia Non-Foreign Affidavit Under IRC 1445 is to declare the seller's non-foreign status to the buyer or the settlement agent. It helps to ensure compliance with U.S. tax laws and exempts the seller from the requirement to withhold a portion of the sales proceeds for tax purposes. 2. Contents: The affidavit typically includes the following information: — Identification: The seller's full legal name, address, and taxpayer identification number (TIN), such as a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN). — Non-Foreign Status Declaration: A statement affirming that the seller is not a foreign person, as defined by the IRC, and does not fall under the FIR PTA (Foreign Investment in Real Property Tax Act) regulations. — Supporting Documentation: Depending on the requirements of the buyer or the settlement agent, additional supporting documents may be requested to verify the seller's non-foreign status. These can include a copy of a passport or a visa, or other documents indicating the seller's status as a U.S. citizen, resident alien, or non-foreign entity. — Signature and Certification: The affidavit should be signed and dated by the seller, certifying under the penalties of perjury that the information provided is true and correct. 3. Types of Sandy Springs Georgia Non-Foreign Affidavit Under IRC 1445: While the basic structure and purpose of the affidavit remain the same, there might be variations in the format and specific requirements depending on the buyer, settlement agent, or specific circumstances of the transaction. For example, some buyers or settlement agents may require additional documentation or a notarized signature. However, the key objective remains to establish the non-foreign status of the seller. Keywords: Sandy Springs Georgia, Non-Foreign Affidavit Under IRC 1445, real estate transactions, foreign person, withholding tax, Internal Revenue Code, non-foreign status declaration, FIR PTA, supporting documentation, U.S. citizen, resident alien, non-foreign entity, penalties of perjury, buyer, settlement agent, notarized signature. It's important to note that while this information provides a general overview of a Sandy Springs Georgia Non-Foreign Affidavit Under IRC 1445, it's advisable to consult with a legal professional or tax advisor for specific guidance tailored to individual circumstances and the prevailing legal requirements in Sandy Springs, Georgia.