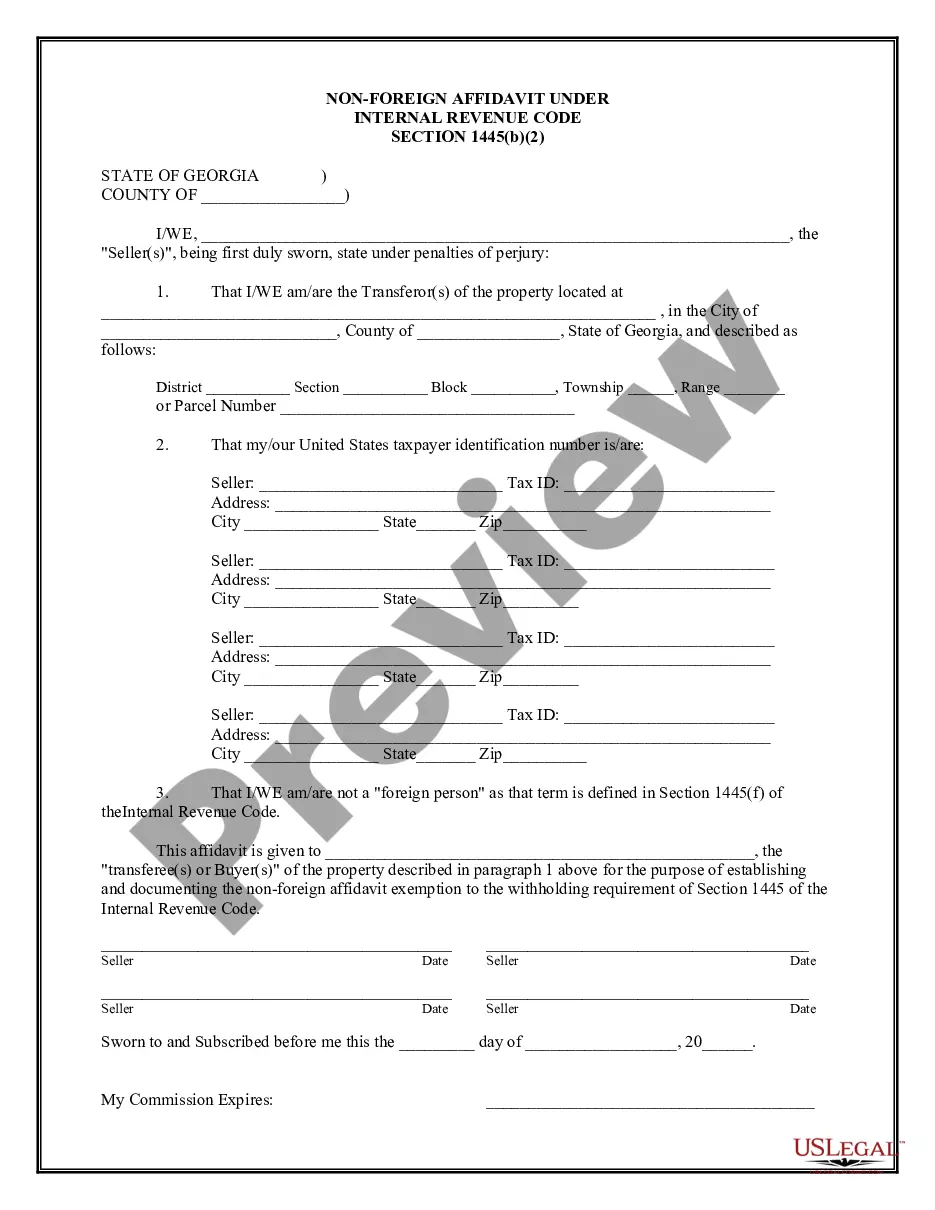

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Title: Understanding Savannah Georgia Non-Foreign Affidavit Under IRC 1445: Types and Key Considerations Introduction: The Savannah Georgia Non-Foreign Affidavit Under IRC 1445 is a crucial document for individuals involved in real estate transactions within the city. In this article, we will delve deeper into what this affidavit entails, its significance, and explore any distinct types that may exist. What is a Savannah Georgia Non-Foreign Affidavit Under IRC 1445? The Savannah Georgia Non-Foreign Affidavit Under IRC 1445 is a legal document required by the Internal Revenue Code (IRC) Section 1445. It serves as a confirmation that the seller of a real property within Savannah, Georgia, is not a foreign individual or entity and therefore subject to withholding tax obligations. Types of Savannah Georgia Non-Foreign Affidavit Under IRC 1445: While there may not be distinctly named types of Savannah Georgia Non-Foreign Affidavits, variations may arise based on the specific circumstances involved. Some common scenarios include: 1. Individual Non-Foreign Affidavit: This affidavit type confirms that the seller of a real estate property is an individual and not a foreign entity. It typically includes personal identification details, citizenship status, and other necessary information to establish non-foreign status. 2. Entity Non-Foreign Affidavit: In cases where the seller is a legal entity, such as a corporation, LLC, or partnership, the Entity Non-Foreign Affidavit ensures compliance with IRC regulations. It may require additional documentation, such as entity formation documents, proof of registration, and identification of authorized representatives. Key Considerations for Savannah Georgia Non-Foreign Affidavit Under IRC 1445: When preparing or reviewing a Savannah Georgia Non-Foreign Affidavit, several crucial factors demand attention. These include: 1. Identification of Seller: The affidavit should explicitly state the seller's legal name, address, taxpayer identification number (TIN), and any other necessary identification details. The accuracy of this information is vital for smooth processing. 2. Non-Foreign Status Confirmation: The affidavit must clearly declare that the seller is not a foreign individual or entity. Supporting documentation, such as passports, citizenship certificates, tax residency certificates, or other relevant proofs, should accompany the affidavit as required. 3. Detailed Property Information: To establish the connection between the affidavit and the property being sold, specific details, including the property address, legal description, and tax identification number, should be included. This ensures precise identification of the real estate asset. 4. Signature and Certification: The affidavit must be signed by the seller or their authorized representative. Additional certifications may be required from attorneys, notaries, or other qualified witnesses, confirming the truthfulness of the provided information. Conclusion: The Savannah Georgia Non-Foreign Affidavit Under IRC 1445 is a significant document in real estate transactions within the city. It verifies the non-foreign status of the seller and ensures compliance with tax requirements. Understanding the different types and key considerations associated with this affidavit is crucial for both buyers and sellers involved in real estate dealings in Savannah, Georgia.Title: Understanding Savannah Georgia Non-Foreign Affidavit Under IRC 1445: Types and Key Considerations Introduction: The Savannah Georgia Non-Foreign Affidavit Under IRC 1445 is a crucial document for individuals involved in real estate transactions within the city. In this article, we will delve deeper into what this affidavit entails, its significance, and explore any distinct types that may exist. What is a Savannah Georgia Non-Foreign Affidavit Under IRC 1445? The Savannah Georgia Non-Foreign Affidavit Under IRC 1445 is a legal document required by the Internal Revenue Code (IRC) Section 1445. It serves as a confirmation that the seller of a real property within Savannah, Georgia, is not a foreign individual or entity and therefore subject to withholding tax obligations. Types of Savannah Georgia Non-Foreign Affidavit Under IRC 1445: While there may not be distinctly named types of Savannah Georgia Non-Foreign Affidavits, variations may arise based on the specific circumstances involved. Some common scenarios include: 1. Individual Non-Foreign Affidavit: This affidavit type confirms that the seller of a real estate property is an individual and not a foreign entity. It typically includes personal identification details, citizenship status, and other necessary information to establish non-foreign status. 2. Entity Non-Foreign Affidavit: In cases where the seller is a legal entity, such as a corporation, LLC, or partnership, the Entity Non-Foreign Affidavit ensures compliance with IRC regulations. It may require additional documentation, such as entity formation documents, proof of registration, and identification of authorized representatives. Key Considerations for Savannah Georgia Non-Foreign Affidavit Under IRC 1445: When preparing or reviewing a Savannah Georgia Non-Foreign Affidavit, several crucial factors demand attention. These include: 1. Identification of Seller: The affidavit should explicitly state the seller's legal name, address, taxpayer identification number (TIN), and any other necessary identification details. The accuracy of this information is vital for smooth processing. 2. Non-Foreign Status Confirmation: The affidavit must clearly declare that the seller is not a foreign individual or entity. Supporting documentation, such as passports, citizenship certificates, tax residency certificates, or other relevant proofs, should accompany the affidavit as required. 3. Detailed Property Information: To establish the connection between the affidavit and the property being sold, specific details, including the property address, legal description, and tax identification number, should be included. This ensures precise identification of the real estate asset. 4. Signature and Certification: The affidavit must be signed by the seller or their authorized representative. Additional certifications may be required from attorneys, notaries, or other qualified witnesses, confirming the truthfulness of the provided information. Conclusion: The Savannah Georgia Non-Foreign Affidavit Under IRC 1445 is a significant document in real estate transactions within the city. It verifies the non-foreign status of the seller and ensures compliance with tax requirements. Understanding the different types and key considerations associated with this affidavit is crucial for both buyers and sellers involved in real estate dealings in Savannah, Georgia.