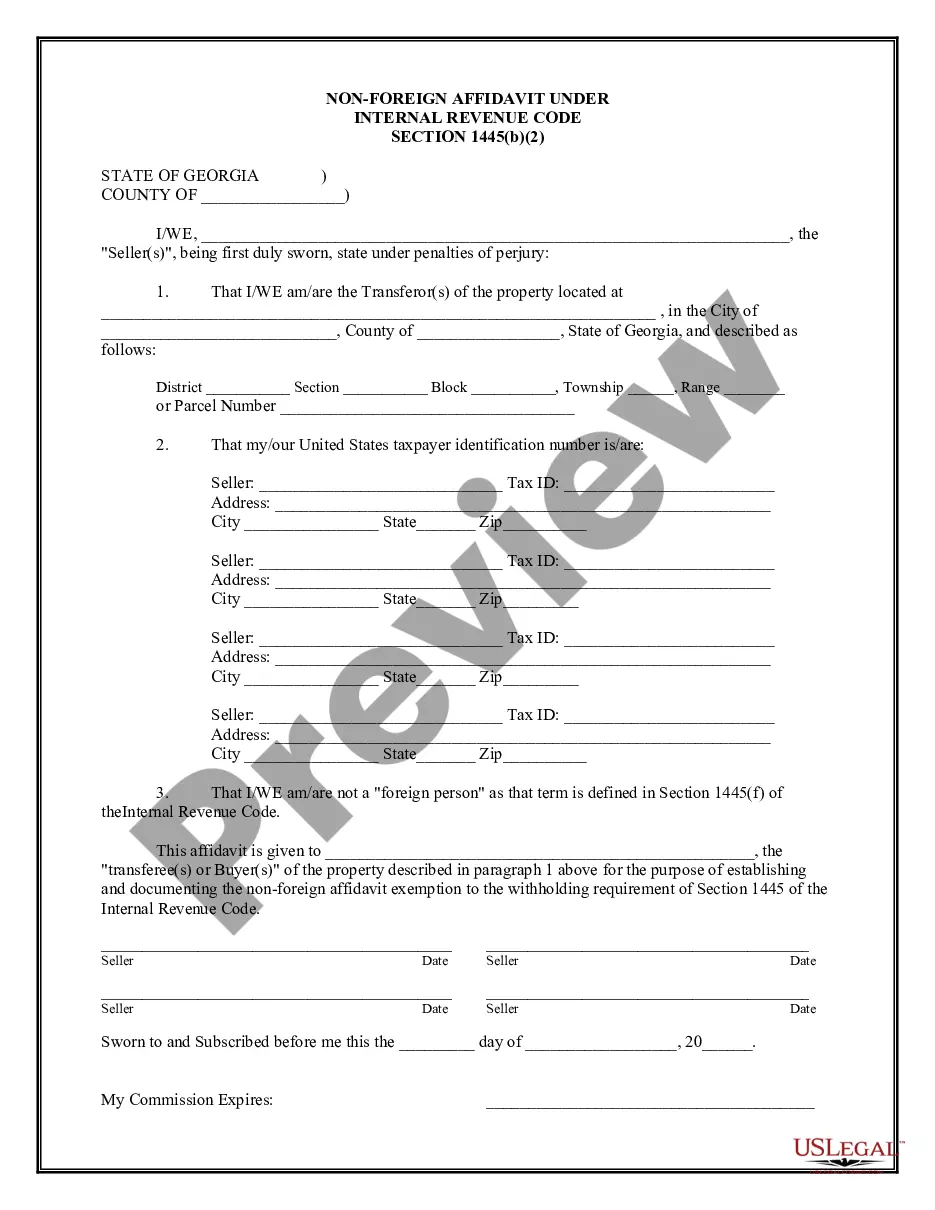

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Description: The South Fulton Georgia Non-Foreign Affidavit under IRC 1445 is a legal document required in certain real estate transactions in South Fulton, Georgia. This affidavit is necessary when a non-U.S. resident sells or transfers ownership of a property located in the United States. It falls under the scope of Internal Revenue Code (IRC) section 1445, which outlines the withholding of tax on dispositions of the United States real property interests by foreign persons. The affidavit serves as a declaration by the transferor, affirming their non-foreign status and eligibility for certain tax exemptions provided by the IRC. This document is crucial in ensuring compliance with the U.S. tax laws and minimizing the potential tax liability of the buyer or escrow agent involved in the transaction. Different Types of South Fulton Georgia Non-Foreign Affidavit under IRC 1445: 1. Non-Foreign Seller Affidavit: This type of affidavit is required when a non-U.S. resident sells a property located in South Fulton, Georgia. The affidavit confirms the seller's non-foreign status and provides necessary details about the transaction, such as the property's description, sale price, and the buyer's information. 2. Non-Foreign Transferee Affidavit: This affidavit is needed when a non-U.S. resident purchases or acquires ownership of a property in South Fulton, Georgia. It declares the transferee's non-foreign status and assists in determining whether any withholding tax obligations apply to the transaction. 3. Non-Foreign Affidavit for Loan Purposes: In certain cases, lenders may require a non-foreign affidavit from borrowers who are not U.S. residents but wish to obtain a mortgage or loan to purchase property in South Fulton, Georgia. This affidavit assures the lender that the borrower's non-foreign status aligns with specific tax provisions and helps mitigate potential tax risks for the lender. 4. Non-Foreign Affidavit for Estate Planning: This variant of the South Fulton Georgia Non-Foreign Affidavit under IRC 1445 may be necessary when structuring estate plans involving non-U.S. residents who own real estate in South Fulton, Georgia. The affidavit may accompany various estate planning documents to ensure proper compliance and tax implications. It is crucial to understand that the South Fulton Georgia Non-Foreign Affidavit under IRC 1445 requirements and specific types may vary depending on the jurisdiction and particular circumstances of the real estate transaction. Therefore, it is advisable to consult with legal professionals experienced in real estate law or taxation to ensure compliance with all applicable laws and regulations.Description: The South Fulton Georgia Non-Foreign Affidavit under IRC 1445 is a legal document required in certain real estate transactions in South Fulton, Georgia. This affidavit is necessary when a non-U.S. resident sells or transfers ownership of a property located in the United States. It falls under the scope of Internal Revenue Code (IRC) section 1445, which outlines the withholding of tax on dispositions of the United States real property interests by foreign persons. The affidavit serves as a declaration by the transferor, affirming their non-foreign status and eligibility for certain tax exemptions provided by the IRC. This document is crucial in ensuring compliance with the U.S. tax laws and minimizing the potential tax liability of the buyer or escrow agent involved in the transaction. Different Types of South Fulton Georgia Non-Foreign Affidavit under IRC 1445: 1. Non-Foreign Seller Affidavit: This type of affidavit is required when a non-U.S. resident sells a property located in South Fulton, Georgia. The affidavit confirms the seller's non-foreign status and provides necessary details about the transaction, such as the property's description, sale price, and the buyer's information. 2. Non-Foreign Transferee Affidavit: This affidavit is needed when a non-U.S. resident purchases or acquires ownership of a property in South Fulton, Georgia. It declares the transferee's non-foreign status and assists in determining whether any withholding tax obligations apply to the transaction. 3. Non-Foreign Affidavit for Loan Purposes: In certain cases, lenders may require a non-foreign affidavit from borrowers who are not U.S. residents but wish to obtain a mortgage or loan to purchase property in South Fulton, Georgia. This affidavit assures the lender that the borrower's non-foreign status aligns with specific tax provisions and helps mitigate potential tax risks for the lender. 4. Non-Foreign Affidavit for Estate Planning: This variant of the South Fulton Georgia Non-Foreign Affidavit under IRC 1445 may be necessary when structuring estate plans involving non-U.S. residents who own real estate in South Fulton, Georgia. The affidavit may accompany various estate planning documents to ensure proper compliance and tax implications. It is crucial to understand that the South Fulton Georgia Non-Foreign Affidavit under IRC 1445 requirements and specific types may vary depending on the jurisdiction and particular circumstances of the real estate transaction. Therefore, it is advisable to consult with legal professionals experienced in real estate law or taxation to ensure compliance with all applicable laws and regulations.