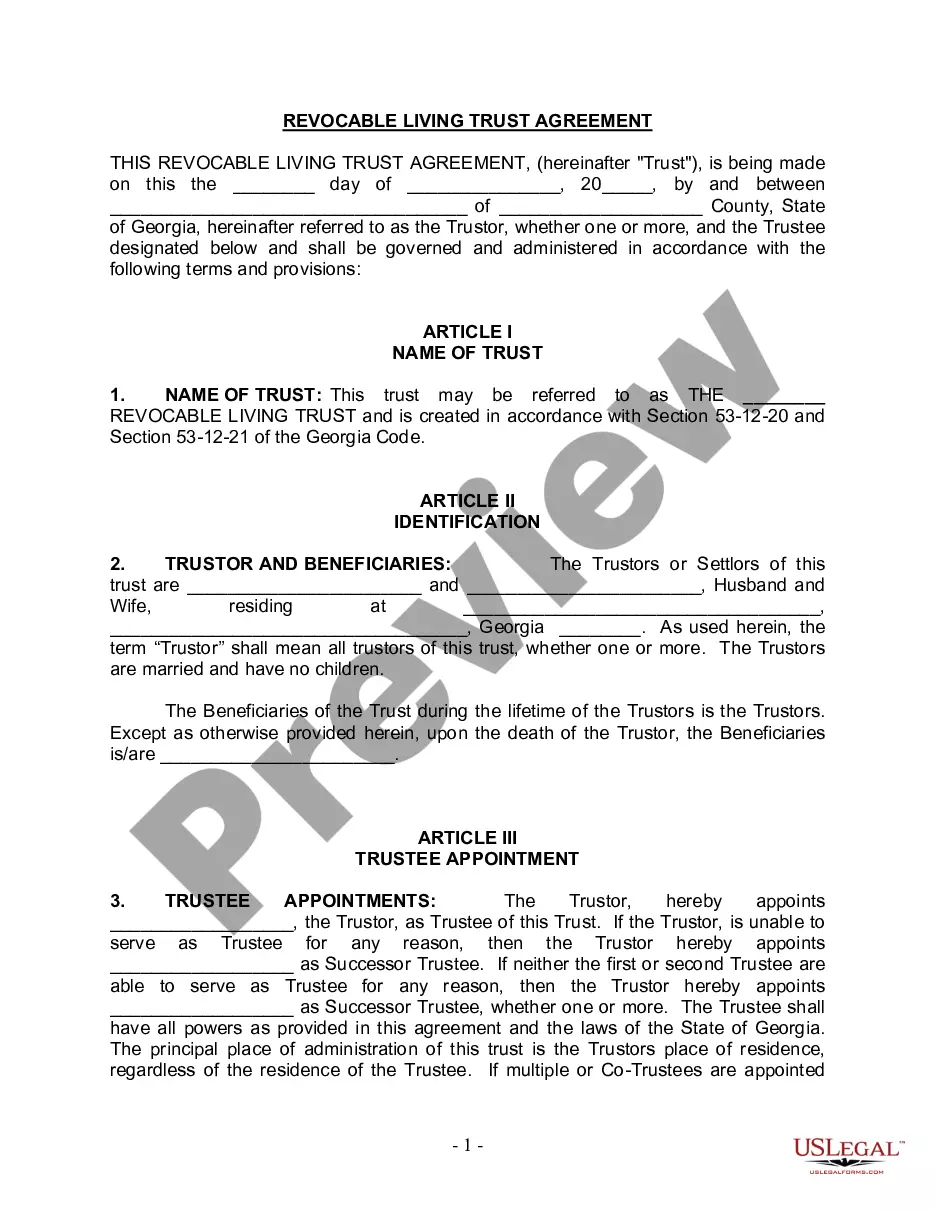

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

South Fulton Georgia Living Trust for Husband and Wife with No Children, also referred to as a revocable living trust, is a legal document designed to protect assets and ensure the smooth transfer of property upon the death of both spouses. This trust is highly beneficial for couples without children as it allows them to control their assets during their lifetime, and distribute them efficiently according to their wishes after their passing. Keywords: South Fulton Georgia Living Trust, Husband and Wife, No Children, Revocable Living Trust, Legal Document, Assets, Transfer of Property, Control, Distribution, Passing. There are two primary types of South Fulton Georgia Living Trust for Husband and Wife with No Children: 1. Joint Revocable Living Trust: This type of living trust is established jointly by both spouses and includes all of their assets. The couple acts as co-trustees, maintaining control and management of their assets during their lifetime. They have the authority to modify or revoke the trust, allowing flexibility to adapt to any changes in their circumstances. In the event of the death of one spouse, the surviving spouse continues to have complete control and access to the trust assets, ensuring financial security. Upon the death of both spouses, the assets are distributed according to the specified terms in the trust. 2. Separate Revocable Living Trusts: Some couples may opt to establish separate trusts instead of a joint trust. In this scenario, each spouse creates an individual living trust, holding their respective assets. Similar to a joint trust, they maintain control and have the ability to modify or revoke their trust during their lifetime. The separate trusts provide asset protection and efficient distribution after both spouses pass away. This approach is commonly chosen when each partner has different assets or estate planning goals. Regardless of the type chosen, a South Fulton Georgia Living Trust for Husband and Wife with No Children offers numerous benefits. It simplifies estate administration, preserves privacy (as there is no need for court intervention), minimizes probate costs, and ensures a smooth transfer of assets to the intended beneficiaries. Seeking advice from an experienced estate planning attorney is highly recommended creating a tailored living trust that aligns with individual circumstances and goals. Keywords: South Fulton Georgia Living Trust, Husband and Wife, No Children, Joint Revocable Living Trust, Separate Revocable Living Trusts, Co-trustees, Assets, Control, Modify, Revoke, Surviving Spouse, Distribution, Estate Administration, Privacy, Probate Costs, Beneficiaries, Estate Planning Attorney.South Fulton Georgia Living Trust for Husband and Wife with No Children, also referred to as a revocable living trust, is a legal document designed to protect assets and ensure the smooth transfer of property upon the death of both spouses. This trust is highly beneficial for couples without children as it allows them to control their assets during their lifetime, and distribute them efficiently according to their wishes after their passing. Keywords: South Fulton Georgia Living Trust, Husband and Wife, No Children, Revocable Living Trust, Legal Document, Assets, Transfer of Property, Control, Distribution, Passing. There are two primary types of South Fulton Georgia Living Trust for Husband and Wife with No Children: 1. Joint Revocable Living Trust: This type of living trust is established jointly by both spouses and includes all of their assets. The couple acts as co-trustees, maintaining control and management of their assets during their lifetime. They have the authority to modify or revoke the trust, allowing flexibility to adapt to any changes in their circumstances. In the event of the death of one spouse, the surviving spouse continues to have complete control and access to the trust assets, ensuring financial security. Upon the death of both spouses, the assets are distributed according to the specified terms in the trust. 2. Separate Revocable Living Trusts: Some couples may opt to establish separate trusts instead of a joint trust. In this scenario, each spouse creates an individual living trust, holding their respective assets. Similar to a joint trust, they maintain control and have the ability to modify or revoke their trust during their lifetime. The separate trusts provide asset protection and efficient distribution after both spouses pass away. This approach is commonly chosen when each partner has different assets or estate planning goals. Regardless of the type chosen, a South Fulton Georgia Living Trust for Husband and Wife with No Children offers numerous benefits. It simplifies estate administration, preserves privacy (as there is no need for court intervention), minimizes probate costs, and ensures a smooth transfer of assets to the intended beneficiaries. Seeking advice from an experienced estate planning attorney is highly recommended creating a tailored living trust that aligns with individual circumstances and goals. Keywords: South Fulton Georgia Living Trust, Husband and Wife, No Children, Joint Revocable Living Trust, Separate Revocable Living Trusts, Co-trustees, Assets, Control, Modify, Revoke, Surviving Spouse, Distribution, Estate Administration, Privacy, Probate Costs, Beneficiaries, Estate Planning Attorney.