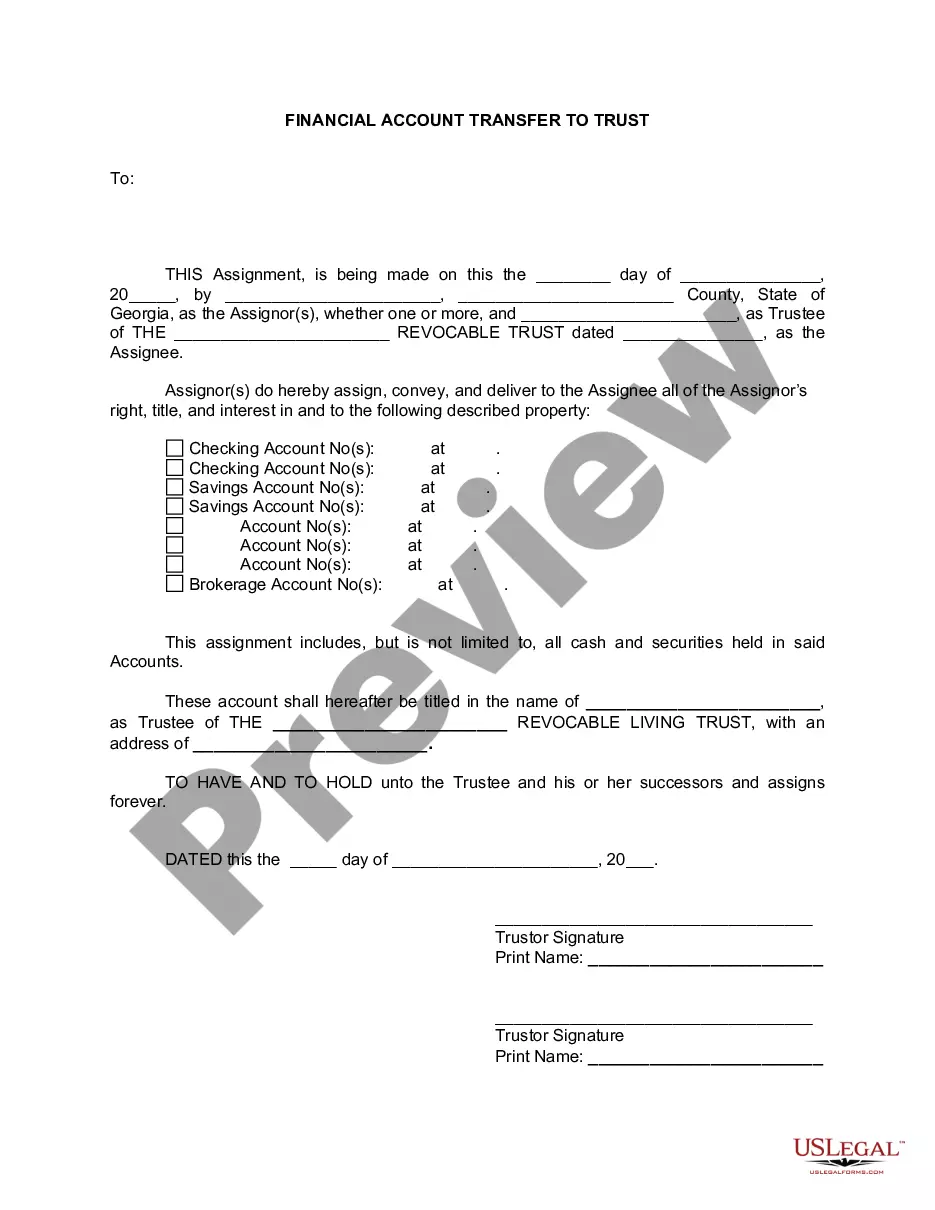

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Atlanta Georgia Financial Account Transfer to Living Trust is a legal process designed to ensure the seamless transition of assets and funds from an individual's financial accounts to a living trust in Atlanta, Georgia. This process allows individuals to manage and distribute their assets according to their wishes, while providing flexibility and protection. One type of Atlanta Georgia Financial Account Transfer to Living Trust is the traditional transfer, whereby individuals opt to transfer their checking, savings, and investment accounts to their living trust. By doing so, they ensure that these accounts are incorporated into their estate plan and will be managed by their designated trustee upon their incapacity or death. Another type of transfer is the retirement account transfer to a living trust. This involves transferring assets from individual retirement accounts (IRAs), 401(k)s, or other retirement savings accounts into the living trust. Transferring these accounts ensures that the designated beneficiaries will continue to receive the benefits of the retirement accounts while providing potential tax benefits and creditor protection. Additionally, there is the real estate account transfer to a living trust. This type of transfer involves transferring ownership of real estate property, such as a primary residence or investment property, into the living trust. By doing so, individuals can ensure seamless management of their real estate holdings while preserving their intended distribution upon their passing. It is important to note that Atlanta Georgia Financial Account Transfer to Living Trusts should be done in compliance with applicable federal and state laws, and individuals should consult with estate planning attorneys or financial advisors experienced in trust administration to ensure a smooth and legally sound transfer process. In conclusion, Atlanta Georgia Financial Account Transfer to Living Trust is a crucial element of comprehensive estate planning. By transferring various financial accounts, including checking, savings, investment, retirement, and real estate, to a living trust, individuals can have peace of mind knowing that their assets will be managed and distributed according to their wishes, while also providing potential tax benefits and protection to their beneficiaries.