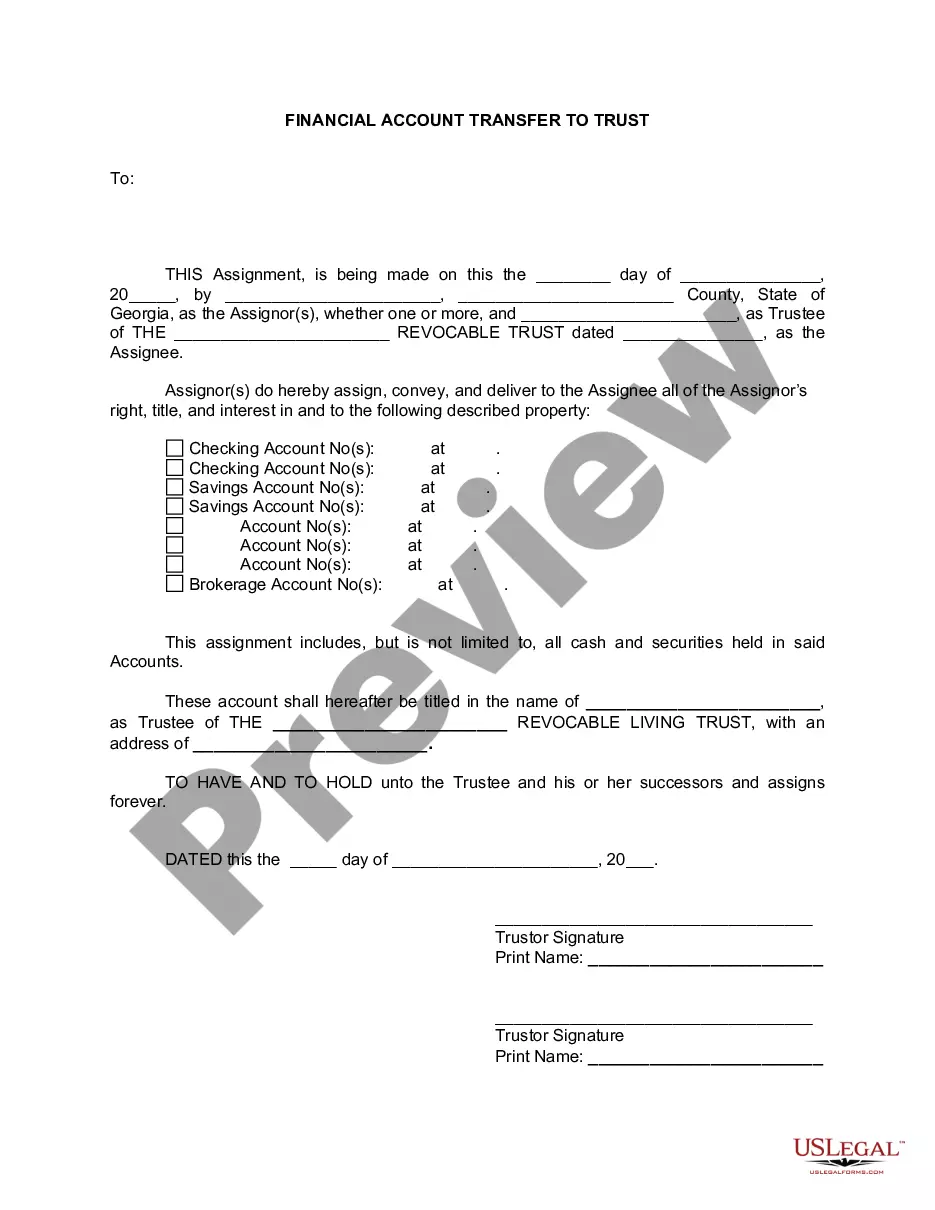

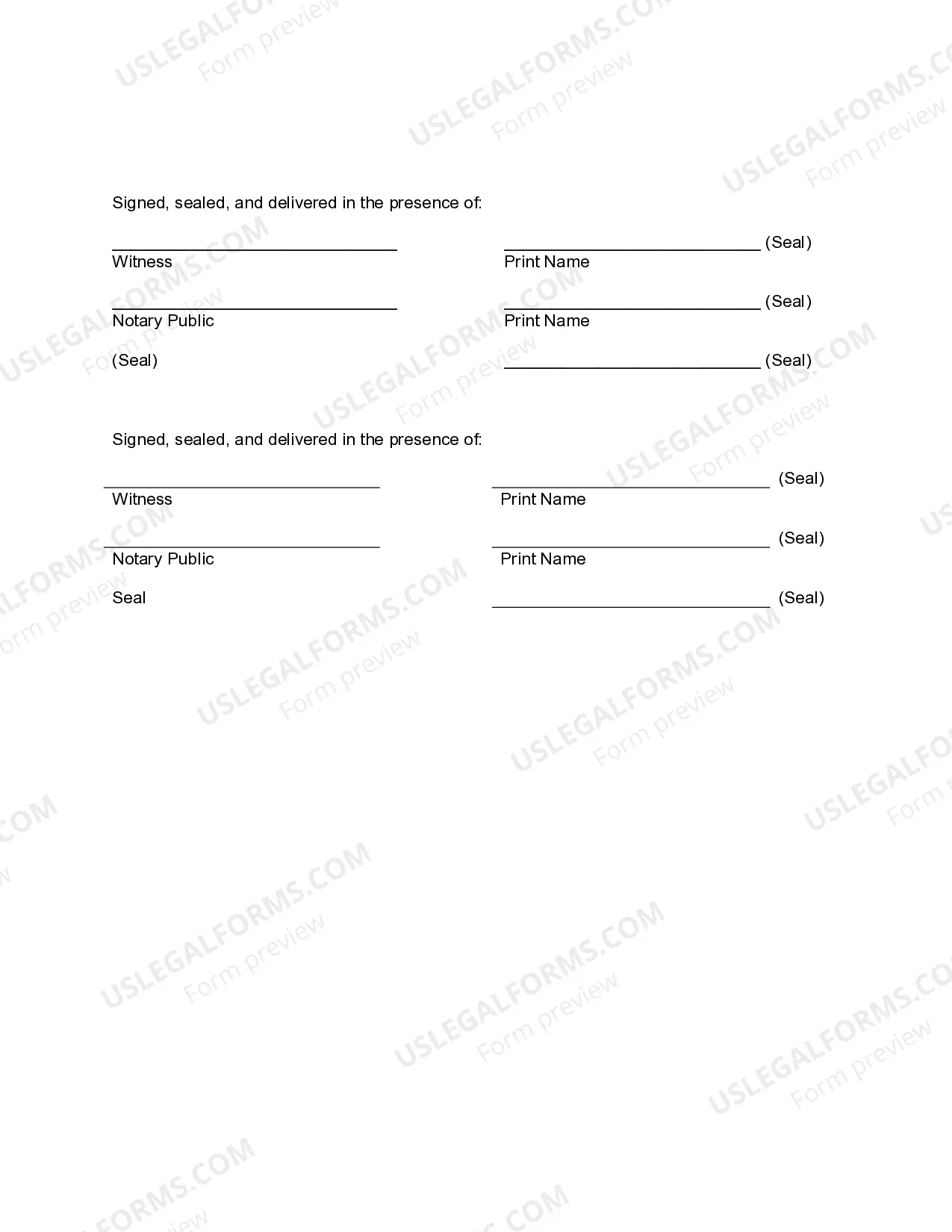

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

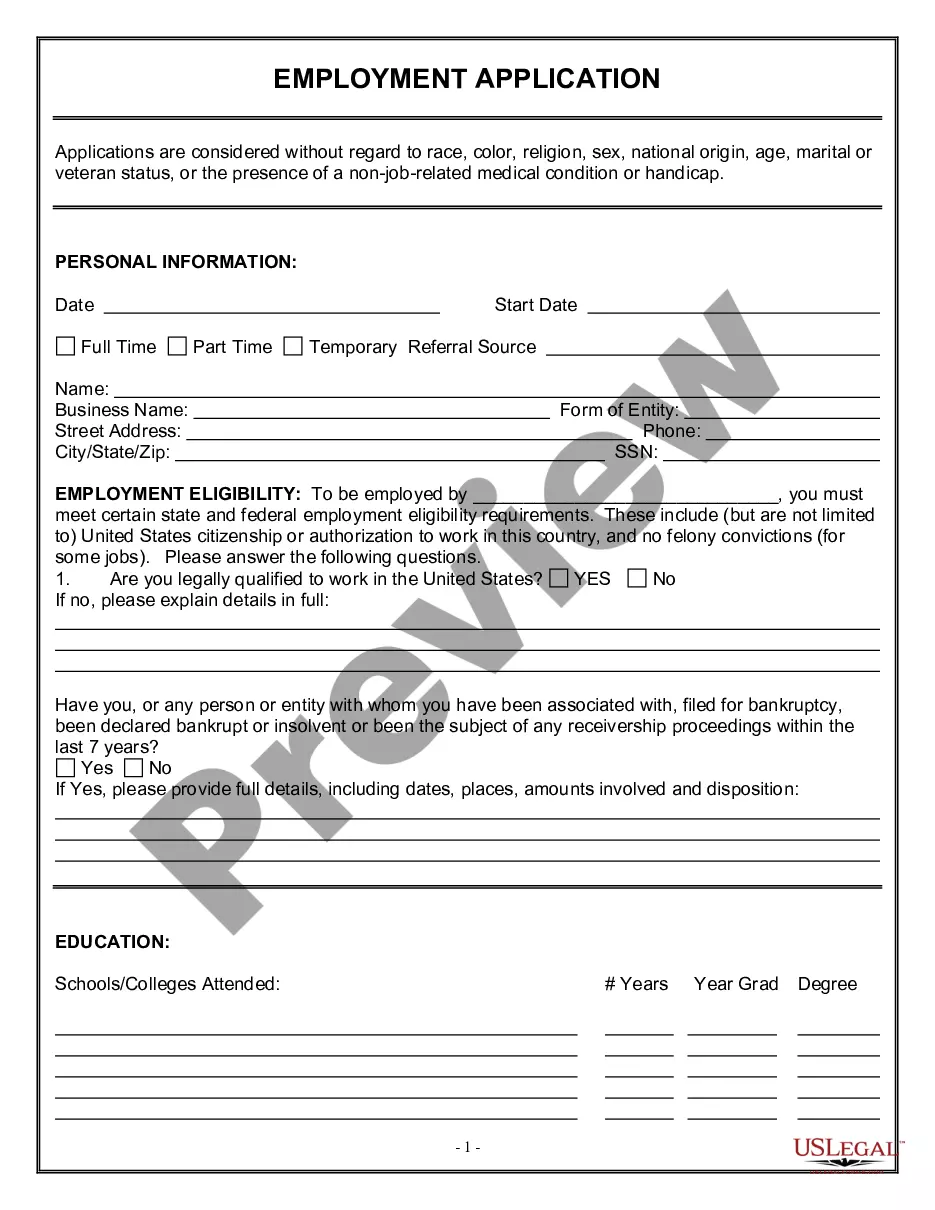

Title: Fulton Georgia Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: In Fulton, Georgia, transferring financial accounts to a living trust can be a beneficial step in estate planning. This article aims to provide a detailed description and useful information on Fulton Georgia Financial Account Transfer to Living Trust, exploring its significance, process, and different types available. 1. Understanding the Living Trust: A living trust is a legal entity created during an individual's lifetime to hold assets and manage them for beneficiaries. It allows for smoother estate distribution, privacy, and potential reduction of estate taxes. By transferring financial accounts to a living trust, individuals can gain control over the management and distribution of their assets. 2. The Importance of Financial Account Transfer to Living Trust: — Probate Avoidance: Transferring financial accounts to a living trust can help avoid the lengthy and costly probate process, allowing beneficiaries to access assets promptly. — Privacy Preservation: Unlike wills, living trusts are not subject to public probate proceedings, ensuring confidentiality in asset distribution. — Incapacity Planning: A living trust provides provisions for the management of assets in case the account holder becomes incapacitated, avoiding the need for conservatorship. 3. Process of Fulton Georgia Financial Account Transfer to Living Trust: a. Identify Eligible Accounts: Determine which financial accounts are eligible for transfer to a living trust, including bank accounts, investment portfolios, retirement accounts, and more. b. Review Legal Requirements: Consult with an attorney specializing in estate planning to understand the legal formalities and requirements specific to Fulton, Georgia. c. Document Preparation: Draft a trust document or amend an existing one to include the desired financial accounts, appoint trustees, and designate beneficiaries. d. Account Ownership Update: Contact financial institutions to change the ownership of accounts from individual to living trust. e. Maintain Beneficiary Designations: Ensure that beneficiary designations align with the stipulations in the living trust to avoid conflicts. f. Update Asset Registration: Update the registration of assets such as property titles, vehicle registrations, or shares to reflect the living trust's ownership. g. Seek Professional Guidance: Consult an accountant or financial advisor to navigate the tax implications and implications of the account transfer. 4. Types of Fulton Georgia Financial Account Transfers to Living Trust: a. Bank Account Transfer: This involves transferring funds from personal bank accounts to the living trust, ensuring smooth access for beneficiaries upon the individual's passing. b. Investment Account Transfer: Includes the transfer of securities, stocks, bonds, or mutual funds from individual ownership to the living trust. c. Retirement Account Transfer: Involves re-registering individual retirement accounts (IRAs), 401(k)s, or pensions under the living trust's name. Conclusion: The Fulton Georgia Financial Account Transfer to Living Trust is a prudent strategy to ensure a smooth transition of financial assets while preserving privacy, minimizing probate delays, and planning for incapacity. By following the process and seeking professional guidance, individuals can safeguard their wealth and provide for their loved ones efficiently.