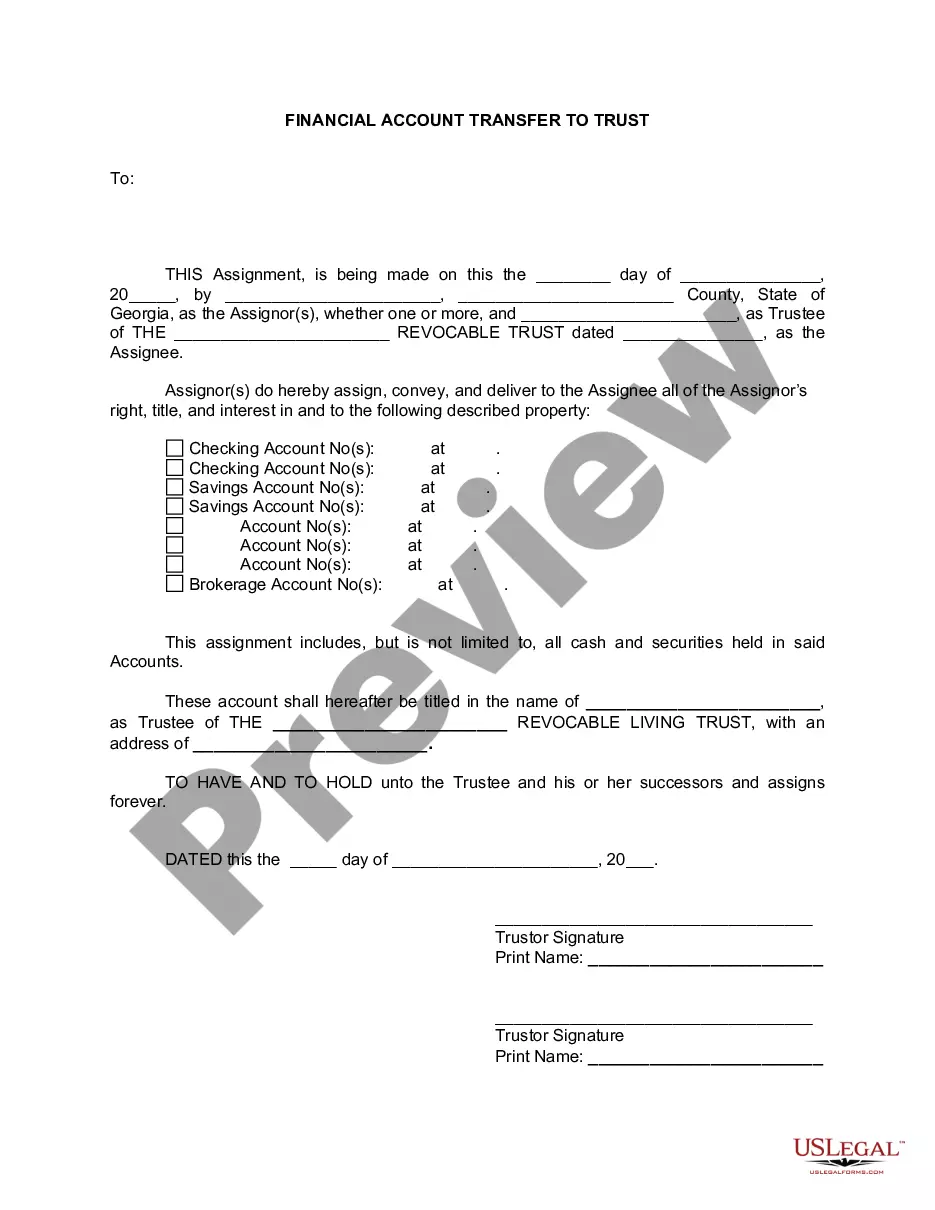

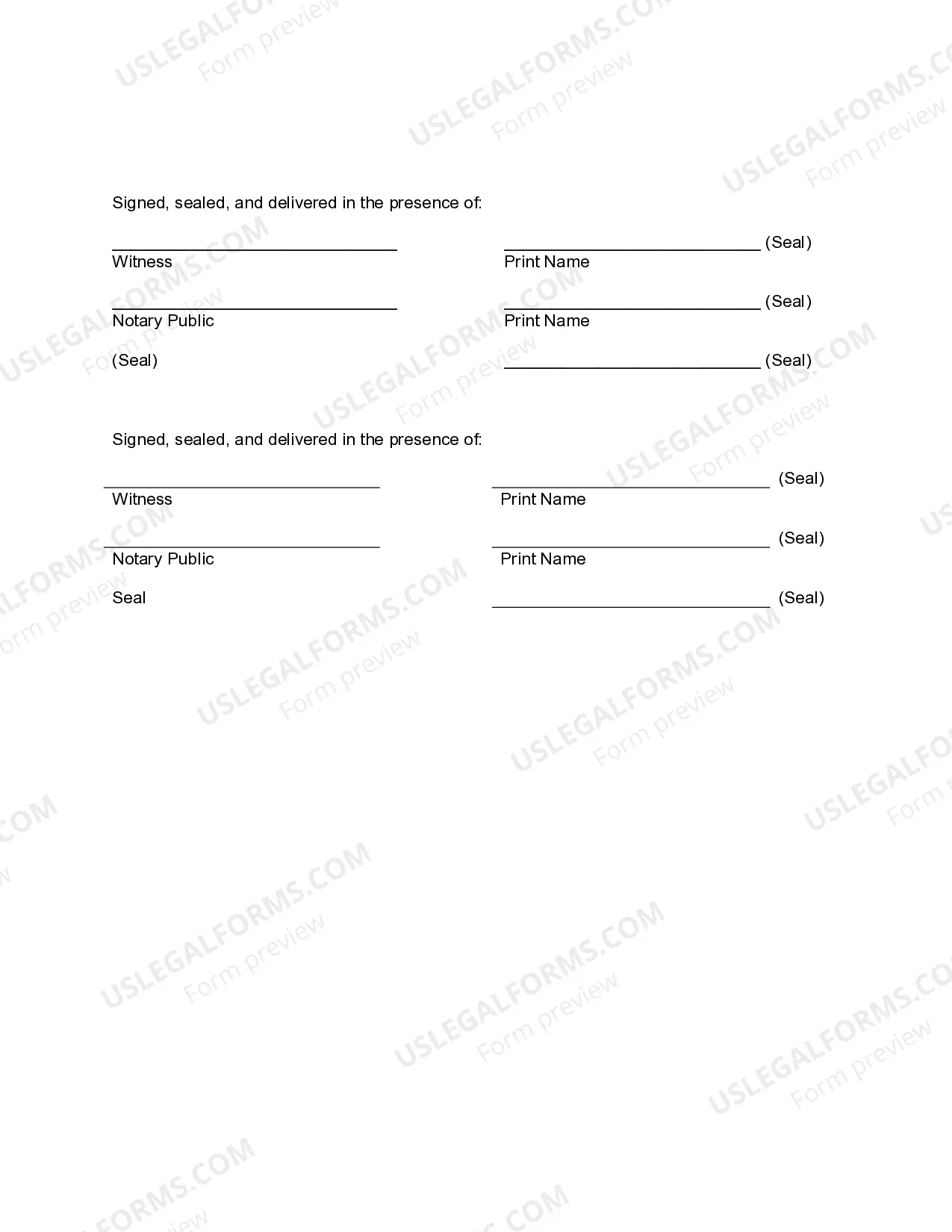

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Description: Sandy Springs Georgia Financial Account Transfer to Living Trust is a comprehensive process that involves transferring various types of financial accounts into a living trust for residents of Sandy Springs, Georgia. By creating a living trust, individuals can ensure that their assets are protected, distributed according to their wishes, and potentially avoid probate. Types of Sandy Springs Georgia Financial Account Transfers to Living Trust: 1. Bank Account Transfer: This type of transfer involves transferring funds from existing bank accounts, such as checking, savings, or money market accounts, into the living trust. By doing so, the assets held in these accounts become part of the trust's estate plan. 2. Investment Account Transfer: Individuals can also transfer different investment accounts into their living trust, including stocks, bonds, mutual funds, and other securities. By re-registering these accounts under the trust's name, the assets are protected and can be managed by the appointed trustee. 3. Retirement Account Transfer: Sandy Springs Georgia residents may choose to transfer their retirement accounts, such as Individual Retirement Accounts (IRAs), 401(k)s, or pensions, into a living trust. However, it is important to consult with a financial advisor or tax professional to understand the potential tax consequences of such transfers. 4. Real Estate Property Transfer: In addition to financial accounts, individuals can transfer real estate properties owned in Sandy Springs, Georgia, into their living trust. This ensures that the property is managed according to the trust's guidelines and can be easily transferred to beneficiaries upon the trust or's passing. 5. Business Ownership Transfer: If the trust or owns a business in Sandy Springs, Georgia, they can transfer the ownership of the business and related assets into the living trust. This allows for seamless business succession planning and protects the business's interests in the event of the trust or's incapacitation or death. Executing a Sandy Springs Georgia Financial Account Transfer to Living Trust involves several steps, including legal documentation, obtaining beneficiary designations, and updating account registrations. It is recommended to consult with an experienced estate planning attorney or financial advisor to ensure the process is conducted properly and in compliance with state and federal laws. By undertaking these transfers, individuals in Sandy Springs, Georgia, can achieve the benefits of a living trust, such as avoiding probate, maintaining privacy, and providing for the smooth transfer of assets to their chosen beneficiaries. It is important to regularly review and update the living trust document and associated accounts to account for any changes in financial circumstances or wishes.Description: Sandy Springs Georgia Financial Account Transfer to Living Trust is a comprehensive process that involves transferring various types of financial accounts into a living trust for residents of Sandy Springs, Georgia. By creating a living trust, individuals can ensure that their assets are protected, distributed according to their wishes, and potentially avoid probate. Types of Sandy Springs Georgia Financial Account Transfers to Living Trust: 1. Bank Account Transfer: This type of transfer involves transferring funds from existing bank accounts, such as checking, savings, or money market accounts, into the living trust. By doing so, the assets held in these accounts become part of the trust's estate plan. 2. Investment Account Transfer: Individuals can also transfer different investment accounts into their living trust, including stocks, bonds, mutual funds, and other securities. By re-registering these accounts under the trust's name, the assets are protected and can be managed by the appointed trustee. 3. Retirement Account Transfer: Sandy Springs Georgia residents may choose to transfer their retirement accounts, such as Individual Retirement Accounts (IRAs), 401(k)s, or pensions, into a living trust. However, it is important to consult with a financial advisor or tax professional to understand the potential tax consequences of such transfers. 4. Real Estate Property Transfer: In addition to financial accounts, individuals can transfer real estate properties owned in Sandy Springs, Georgia, into their living trust. This ensures that the property is managed according to the trust's guidelines and can be easily transferred to beneficiaries upon the trust or's passing. 5. Business Ownership Transfer: If the trust or owns a business in Sandy Springs, Georgia, they can transfer the ownership of the business and related assets into the living trust. This allows for seamless business succession planning and protects the business's interests in the event of the trust or's incapacitation or death. Executing a Sandy Springs Georgia Financial Account Transfer to Living Trust involves several steps, including legal documentation, obtaining beneficiary designations, and updating account registrations. It is recommended to consult with an experienced estate planning attorney or financial advisor to ensure the process is conducted properly and in compliance with state and federal laws. By undertaking these transfers, individuals in Sandy Springs, Georgia, can achieve the benefits of a living trust, such as avoiding probate, maintaining privacy, and providing for the smooth transfer of assets to their chosen beneficiaries. It is important to regularly review and update the living trust document and associated accounts to account for any changes in financial circumstances or wishes.