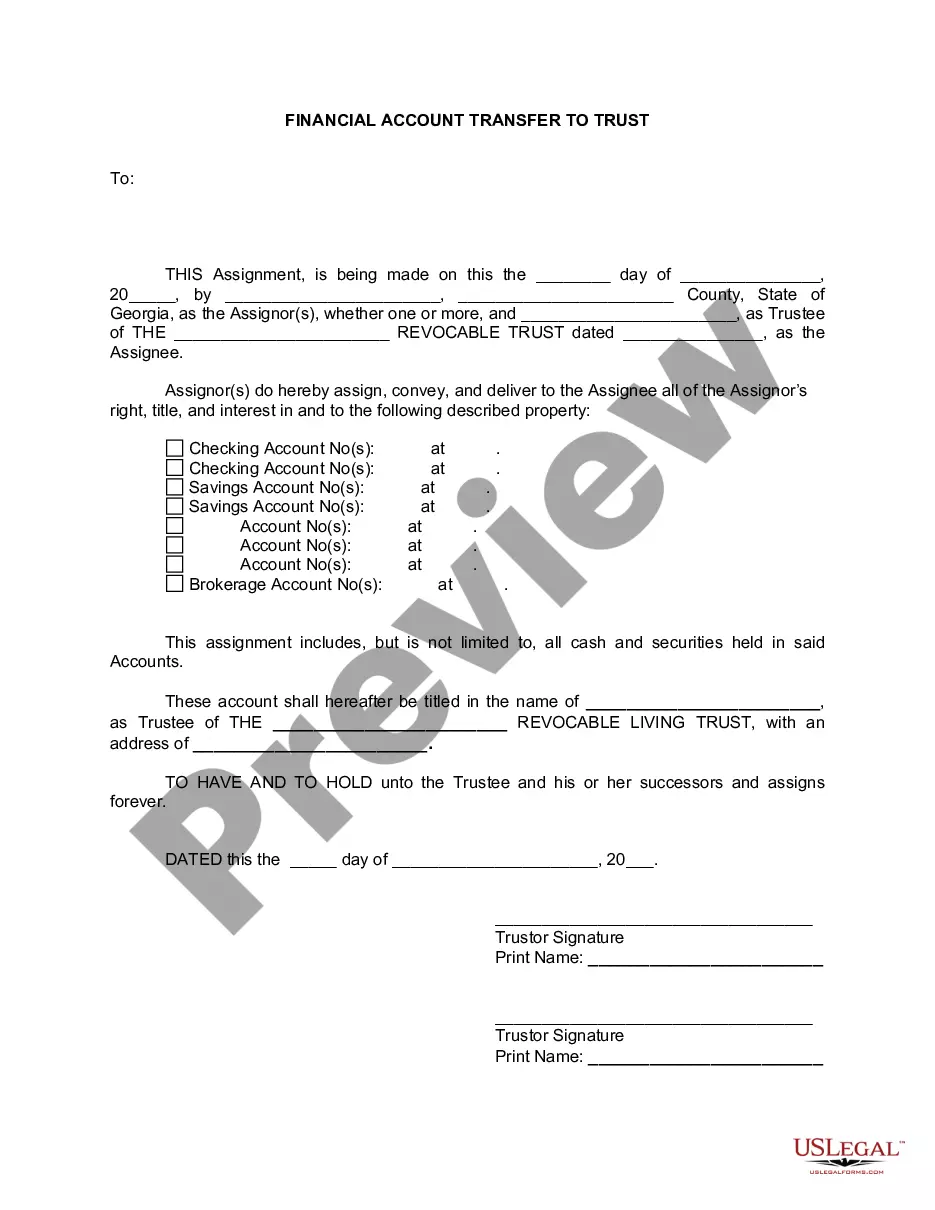

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Title: South Fulton Georgia Financial Account Transfer to Living Trust: An In-depth Guide Introduction: In South Fulton, Georgia, individuals have the option to transfer their financial accounts to a living trust to ensure a smooth management and distribution of assets. This comprehensive guide delves into the process of a financial account transfer, highlighting key aspects, benefits, and types of transfers available in South Fulton, Georgia. 1. Understanding Living Trusts: — Definition of a livinthusus— - Purpose and benefits of establishing a living trust in South Fulton, Georgia — Key differences between a living trust and a will 2. South Fulton Georgia Financial Account Transfer: — Definition and importance of transferring financial accounts to a living trust — Factors to consider before initiating a financial account transfer — Applicable laws and regulations governing financial account transfers in South Fulton, Georgia 3. Types of South Fulton Georgia Financial Account Transfer to Living Trust: a) Bank Account Transfer: — Exploring the process of transferring savings, checking, or other types of bank accounts to a living trust — Ensuring proper documentation and compliance with bank requirements — Benefits of a bank account transfer to a living trust in South Fulton, Georgia b) Investment Account Transfer: — Understanding the transfer process for investment accounts such as stocks, bonds, and mutual funds — Role of financial advisors and account custodians in facilitating the transfer — Advantages of transferring investment accounts to a living trust in South Fulton, Georgia c) Retirement Account Transfer: — Overview of transferring retirement accounts (such as IRAs or 401(k)s) to a living trust in South Fulton, Georgia — Beneficiary designation and tax implications involved in the transfer process — Considerations for ensuring continued tax-deferred growth within a living trust d) Real Estate Property Transfer: — Exploring the transfer of real estate properties into a living trust — Legal requirements, including deed transfer and title ownership changes — Benefits of transferring real estate properties to a living trust in South Fulton, Georgia 4. Key Considerations and Steps: — Carefully selecting a successor trustee and beneficiaries — Document preparation and professional legal assistance — Ensuring proper asset titling and beneficiary designations for financial accounts Conclusion: In South Fulton, Georgia, transferring financial accounts to a living trust offers individuals the opportunity to streamline their asset management and distribution. Understanding the various types of transfers available, including bank accounts, investment accounts, retirement accounts, and real estate properties, allows individuals to make informed decisions while safeguarding their wealth and legacy. Seek professional advice to navigate the complexities of financial account transfers to a living trust in South Fulton, Georgia.Title: South Fulton Georgia Financial Account Transfer to Living Trust: An In-depth Guide Introduction: In South Fulton, Georgia, individuals have the option to transfer their financial accounts to a living trust to ensure a smooth management and distribution of assets. This comprehensive guide delves into the process of a financial account transfer, highlighting key aspects, benefits, and types of transfers available in South Fulton, Georgia. 1. Understanding Living Trusts: — Definition of a livinthusus— - Purpose and benefits of establishing a living trust in South Fulton, Georgia — Key differences between a living trust and a will 2. South Fulton Georgia Financial Account Transfer: — Definition and importance of transferring financial accounts to a living trust — Factors to consider before initiating a financial account transfer — Applicable laws and regulations governing financial account transfers in South Fulton, Georgia 3. Types of South Fulton Georgia Financial Account Transfer to Living Trust: a) Bank Account Transfer: — Exploring the process of transferring savings, checking, or other types of bank accounts to a living trust — Ensuring proper documentation and compliance with bank requirements — Benefits of a bank account transfer to a living trust in South Fulton, Georgia b) Investment Account Transfer: — Understanding the transfer process for investment accounts such as stocks, bonds, and mutual funds — Role of financial advisors and account custodians in facilitating the transfer — Advantages of transferring investment accounts to a living trust in South Fulton, Georgia c) Retirement Account Transfer: — Overview of transferring retirement accounts (such as IRAs or 401(k)s) to a living trust in South Fulton, Georgia — Beneficiary designation and tax implications involved in the transfer process — Considerations for ensuring continued tax-deferred growth within a living trust d) Real Estate Property Transfer: — Exploring the transfer of real estate properties into a living trust — Legal requirements, including deed transfer and title ownership changes — Benefits of transferring real estate properties to a living trust in South Fulton, Georgia 4. Key Considerations and Steps: — Carefully selecting a successor trustee and beneficiaries — Document preparation and professional legal assistance — Ensuring proper asset titling and beneficiary designations for financial accounts Conclusion: In South Fulton, Georgia, transferring financial accounts to a living trust offers individuals the opportunity to streamline their asset management and distribution. Understanding the various types of transfers available, including bank accounts, investment accounts, retirement accounts, and real estate properties, allows individuals to make informed decisions while safeguarding their wealth and legacy. Seek professional advice to navigate the complexities of financial account transfers to a living trust in South Fulton, Georgia.