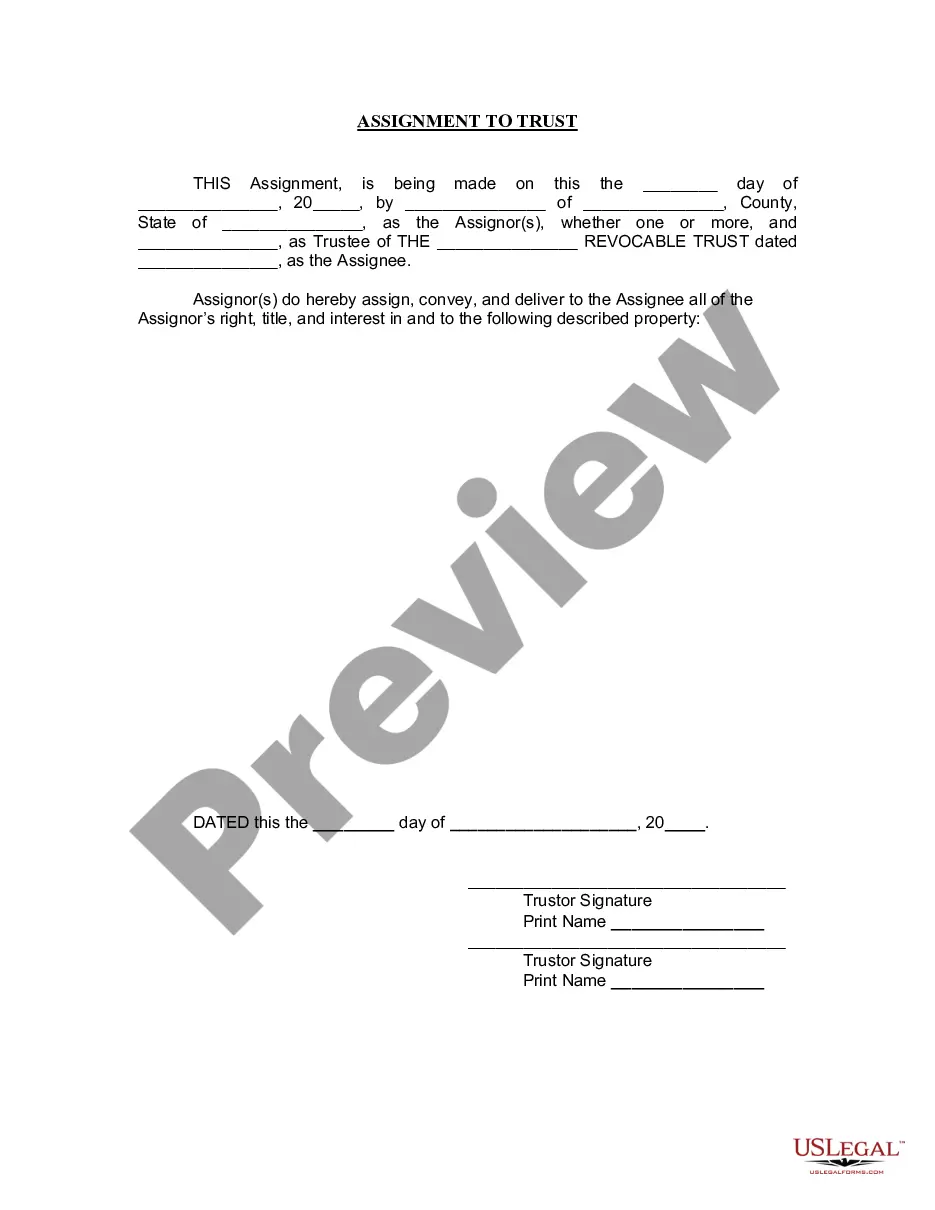

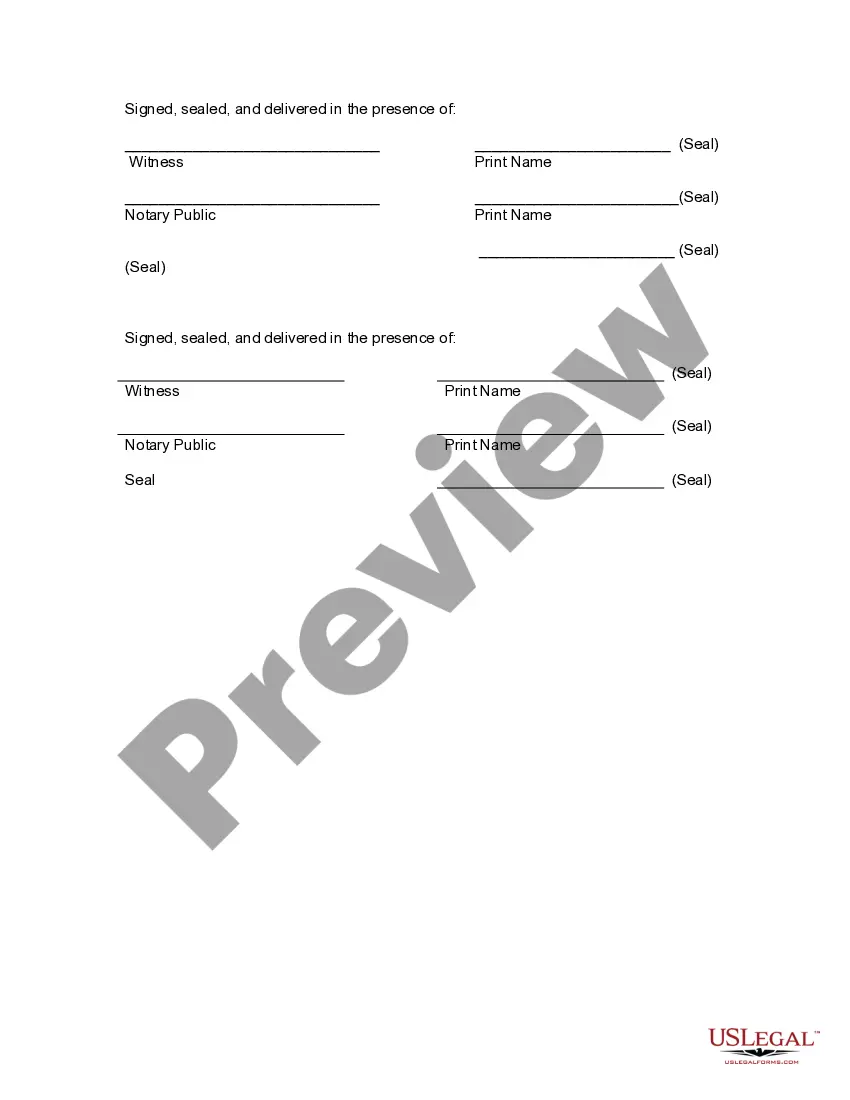

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Atlanta Georgia Assignment to Living Trust

Description

How to fill out Georgia Assignment To Living Trust?

We consistently strive to minimize or evade legal repercussions when managing intricate legal or financial matters.

To achieve this, we seek legal counsel solutions that are typically very expensive.

However, not every legal challenge is of the same degree of difficulty.

Many of these can be resolved independently.

Utilize US Legal Forms whenever you require to locate and download the Atlanta Georgia Assignment to Living Trust or any other document swiftly and securely. Just Log In to your account and click the Get button next to it. If you misplace the form, you can always retrieve it again from the My documents tab.

- US Legal Forms is an online repository of current DIY legal templates covering a range of documents from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our service enables you to handle your matters autonomously without relying on an attorney's services.

- We offer access to legal document templates that aren’t always readily accessible.

- Our templates are tailored to specific states and regions, which greatly streamlines the search process.

Form popularity

FAQ

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

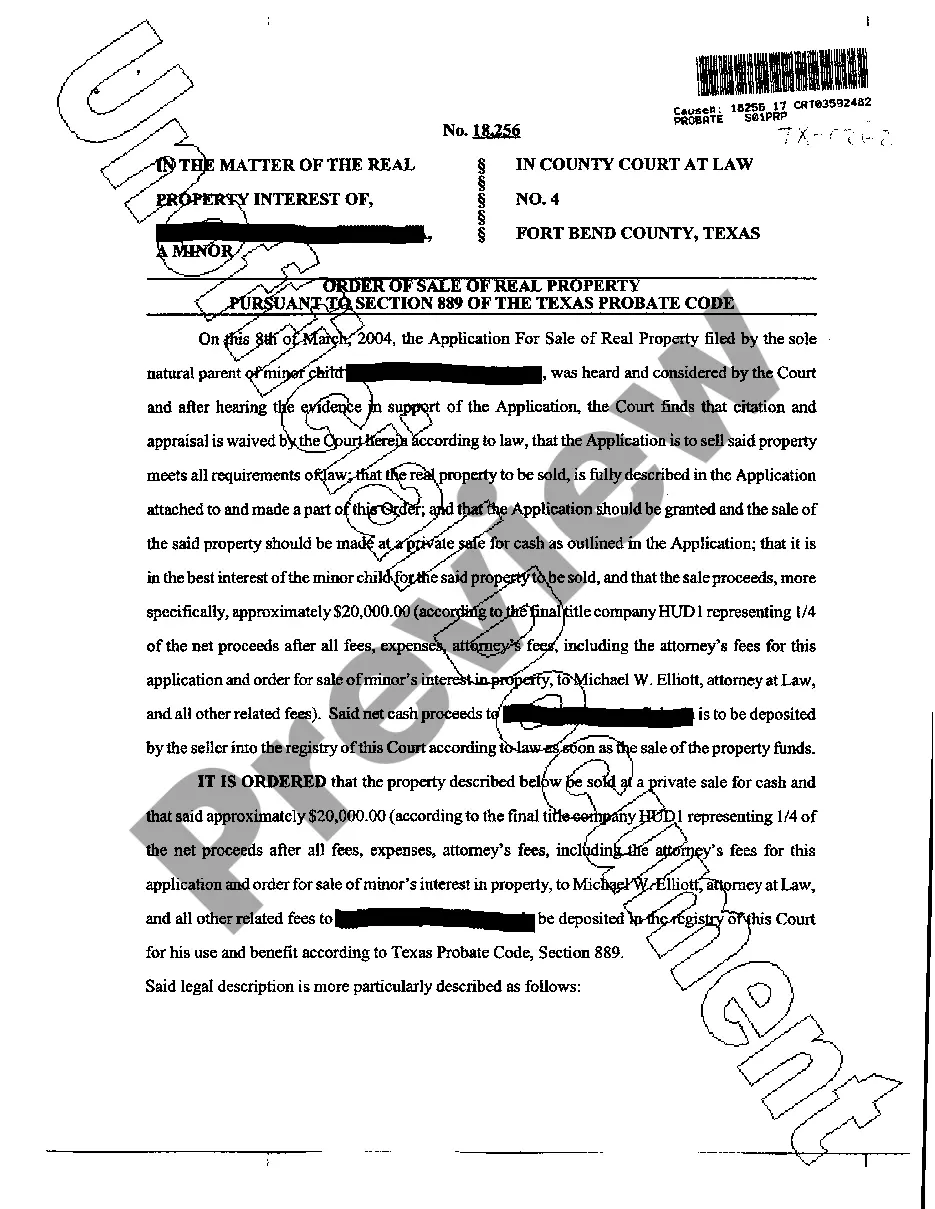

Living Trusts In Georgia, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

With a trust, you can appoint a successor trustee to handle your affairs if you become incapacitated or need additional assistance as you get older. On the other hand, a will may be more appropriate and affordable for those without many assets to manage.

In the State of Georgia, creating a living trust means drafting the trust document with your estate planning attorney and signing it in front of a notary public. Once signed and notarized, you must ?fund the trust? by transferring assets to the name of the trust.

A living trust in Georgia is a document that transfers ownership of some or most of your assets into a trust where you continue to use them until they pass to your beneficiaries after you die. A living trust is a popular estate planning option.

To make a living trust in Georgia, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

If you use an online program to write the trust document yourself, you'll probably spend less than a few hundred dollars. If you hire an attorney to help you create the trust, you'll probably spend more than $1,000.

For a Georgia will or trust, the average cost is between $300-600, but the amount you spend depends on how complex the document is and whether you use a template or an attorney. Again, this is an average. Your attorney may charge more or less. Some attorneys may work from a template.