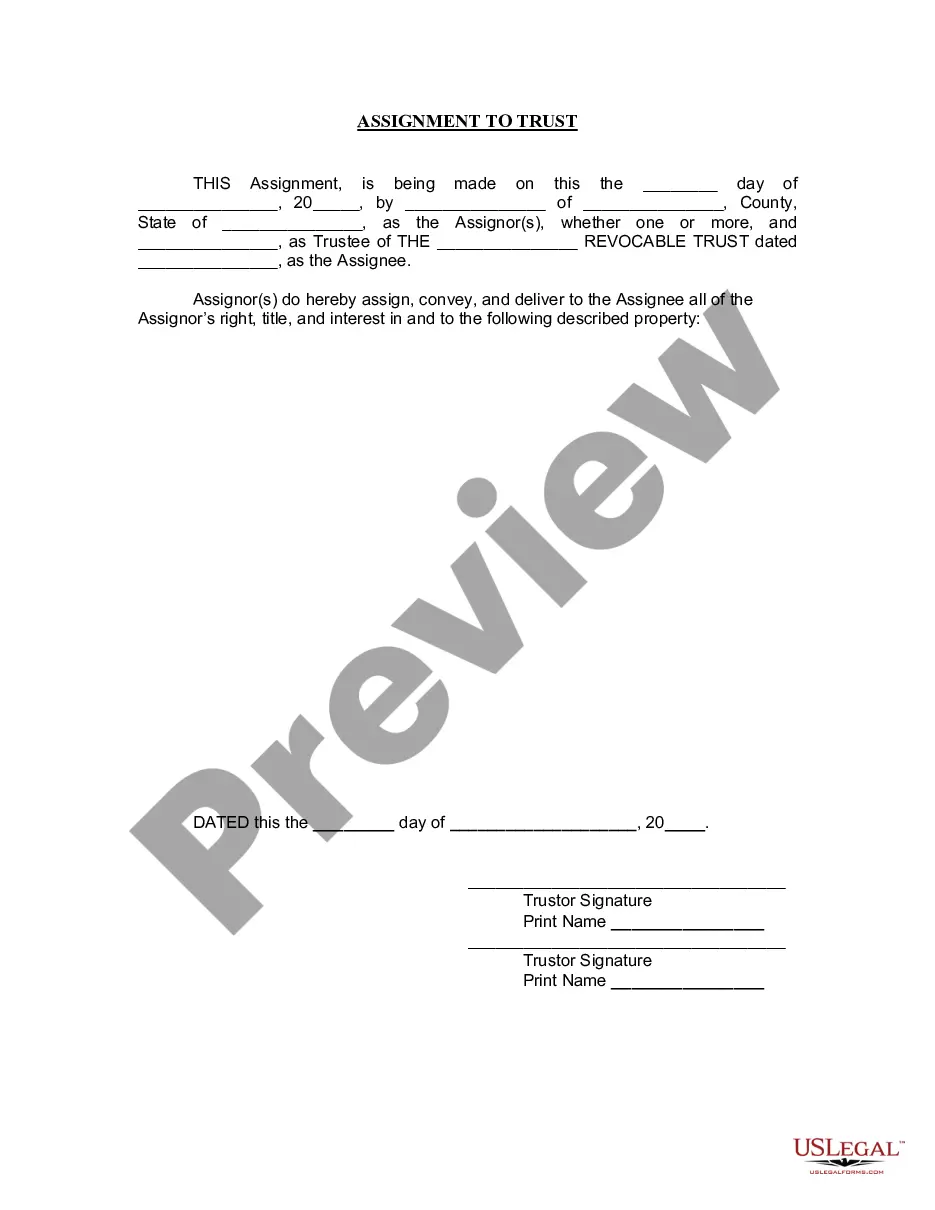

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Fulton Georgia Assignment to Living Trust is a legal document that allows individuals in Fulton County, Georgia, to transfer ownership of their assets to a trust during their lifetime. This assignment is an essential part of the estate planning process and provides numerous advantages in terms of asset management and distribution. What distinguishes Fulton Georgia Assignment to Living Trust from other types of trusts is its specific application to residents in Fulton County. It is important to note that there are various types of living trusts, including revocable living trusts and irrevocable living trusts. However, the Fulton Georgia Assignment to Living Trust specifically caters to individuals residing in Fulton County. By creating an Assignment to Living Trust, individuals in Fulton County can ensure that their assets, including real estate properties, bank accounts, investments, and personal belongings, are protected and managed as per their wishes. The assignment process involves transferring legal ownership of these assets into the trust's name while the individual maintains control and use of these assets during their lifetime. One significant benefit of the Fulton Georgia Assignment to Living Trust is the avoidance of probate. Probate is a court-supervised process that validates a deceased individual's last will and testament. By placing assets in a living trust, individuals can bypass probate, saving both time and money for their loved ones after their passing. Another advantage of this assignment is the potential reduction of estate taxes for Fulton County residents. By shifting assets into a trust, individuals may be able to minimize the taxable value of their estate, thus reducing the potential tax burden on their beneficiaries. Furthermore, creating a Fulton Georgia Assignment to Living Trust allows for privacy and discretion as this document is not made public like a will. It ensures that the distribution of assets and the details of the estate plan remain confidential among the involved parties, preventing potential disputes or external interference. To summarize, the Fulton Georgia Assignment to Living Trust is a crucial legal instrument for residents of Fulton County seeking to protect their assets, streamline the estate distribution process, minimize taxes, and maintain their privacy. It provides peace of mind, ensuring that one's wishes are upheld and assets are appropriately managed during their lifetime and after their passing.