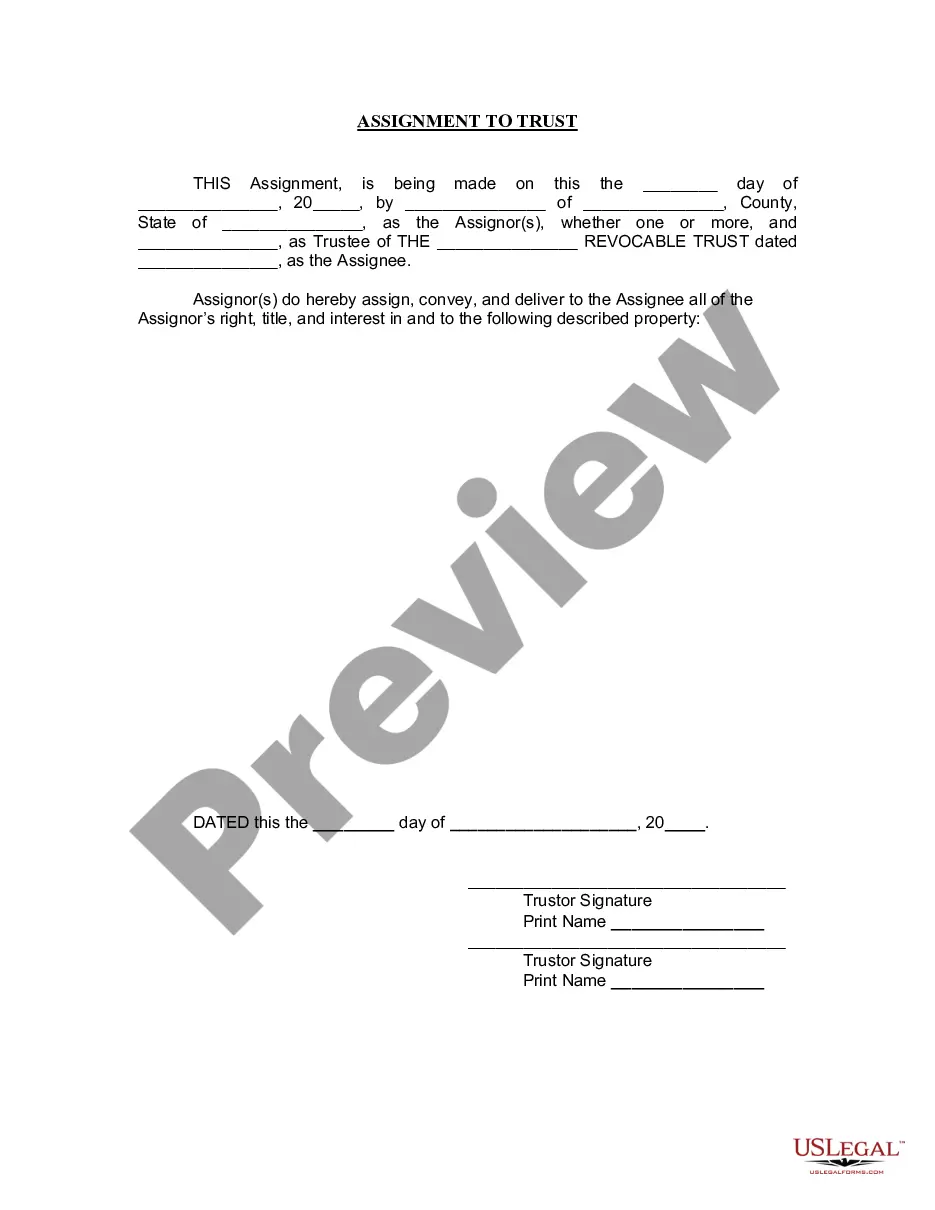

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Sandy Springs Georgia Assignment to Living Trust: A Comprehensive Overview A Sandy Springs Georgia assignment to living trust refers to the process of transferring assets and properties into a trust by individuals or families residing within the Sandy Springs area. A living trust is a legal arrangement that allows individuals (known as granters or trustees) to place their assets and properties into a trust during their lifetime. Upon the granter's passing, the assets in the trust are managed and distributed according to the terms outlined in the trust document. Assigning assets to a living trust can provide numerous benefits, including probate avoidance, asset protection, and privacy. By establishing a living trust in Sandy Springs, Georgia, you can ensure a smooth transition of your assets to your designated beneficiaries, while also reducing the burden and expenses often associated with probate proceedings. Different Types of Sandy Springs Georgia Assignment to Living Trust: 1. Revocable Living Trust: A revocable living trust in Sandy Springs, Georgia allows the granter to maintain control over the trust assets during their lifetime. This type of trust can be modified, altered, or revoked at any time, providing flexibility to the granter. 2. Irrevocable Living Trust: In contrast, an irrevocable living trust cannot be modified or revoked once it is established. Assets placed in this type of trust are considered separate from the granter's estate and may offer potential tax benefits. 3. Testamentary Trust: While not technically a living trust, a testamentary trust is created through a will and is established upon the death of the granter. This type of trust ensures that assets are distributed according to the granter's wishes. 4. Special Needs Trust: A special needs trust allows a granter to provide financial support and care for a loved one with special needs, while simultaneously preserving their eligibility for government benefits. 5. Charitable Remainder Trust: A charitable remainder trust offers a way for individuals to donate assets to a charitable organization of their choice while retaining an income stream from those assets during their lifetime. 6. Family Trust: A family trust, also known as a dynasty trust, can be established to preserve and manage family wealth for future generations. This type of trust ensures that assets are protected and distributed according to the granter's instructions, safeguarding the family's financial legacy. Whether you choose to establish a revocable living trust, irrevocable living trust, testamentary trust, or any other type of living trust in Sandy Springs, Georgia, it is crucial to consult with a knowledgeable attorney specializing in estate planning to ensure that your specific needs and objectives are met. With a well-structured living trust, you can have peace of mind knowing that your assets will be managed and distributed efficiently, while minimizing legal complications and maximizing the benefits for your loved ones.Sandy Springs Georgia Assignment to Living Trust: A Comprehensive Overview A Sandy Springs Georgia assignment to living trust refers to the process of transferring assets and properties into a trust by individuals or families residing within the Sandy Springs area. A living trust is a legal arrangement that allows individuals (known as granters or trustees) to place their assets and properties into a trust during their lifetime. Upon the granter's passing, the assets in the trust are managed and distributed according to the terms outlined in the trust document. Assigning assets to a living trust can provide numerous benefits, including probate avoidance, asset protection, and privacy. By establishing a living trust in Sandy Springs, Georgia, you can ensure a smooth transition of your assets to your designated beneficiaries, while also reducing the burden and expenses often associated with probate proceedings. Different Types of Sandy Springs Georgia Assignment to Living Trust: 1. Revocable Living Trust: A revocable living trust in Sandy Springs, Georgia allows the granter to maintain control over the trust assets during their lifetime. This type of trust can be modified, altered, or revoked at any time, providing flexibility to the granter. 2. Irrevocable Living Trust: In contrast, an irrevocable living trust cannot be modified or revoked once it is established. Assets placed in this type of trust are considered separate from the granter's estate and may offer potential tax benefits. 3. Testamentary Trust: While not technically a living trust, a testamentary trust is created through a will and is established upon the death of the granter. This type of trust ensures that assets are distributed according to the granter's wishes. 4. Special Needs Trust: A special needs trust allows a granter to provide financial support and care for a loved one with special needs, while simultaneously preserving their eligibility for government benefits. 5. Charitable Remainder Trust: A charitable remainder trust offers a way for individuals to donate assets to a charitable organization of their choice while retaining an income stream from those assets during their lifetime. 6. Family Trust: A family trust, also known as a dynasty trust, can be established to preserve and manage family wealth for future generations. This type of trust ensures that assets are protected and distributed according to the granter's instructions, safeguarding the family's financial legacy. Whether you choose to establish a revocable living trust, irrevocable living trust, testamentary trust, or any other type of living trust in Sandy Springs, Georgia, it is crucial to consult with a knowledgeable attorney specializing in estate planning to ensure that your specific needs and objectives are met. With a well-structured living trust, you can have peace of mind knowing that your assets will be managed and distributed efficiently, while minimizing legal complications and maximizing the benefits for your loved ones.