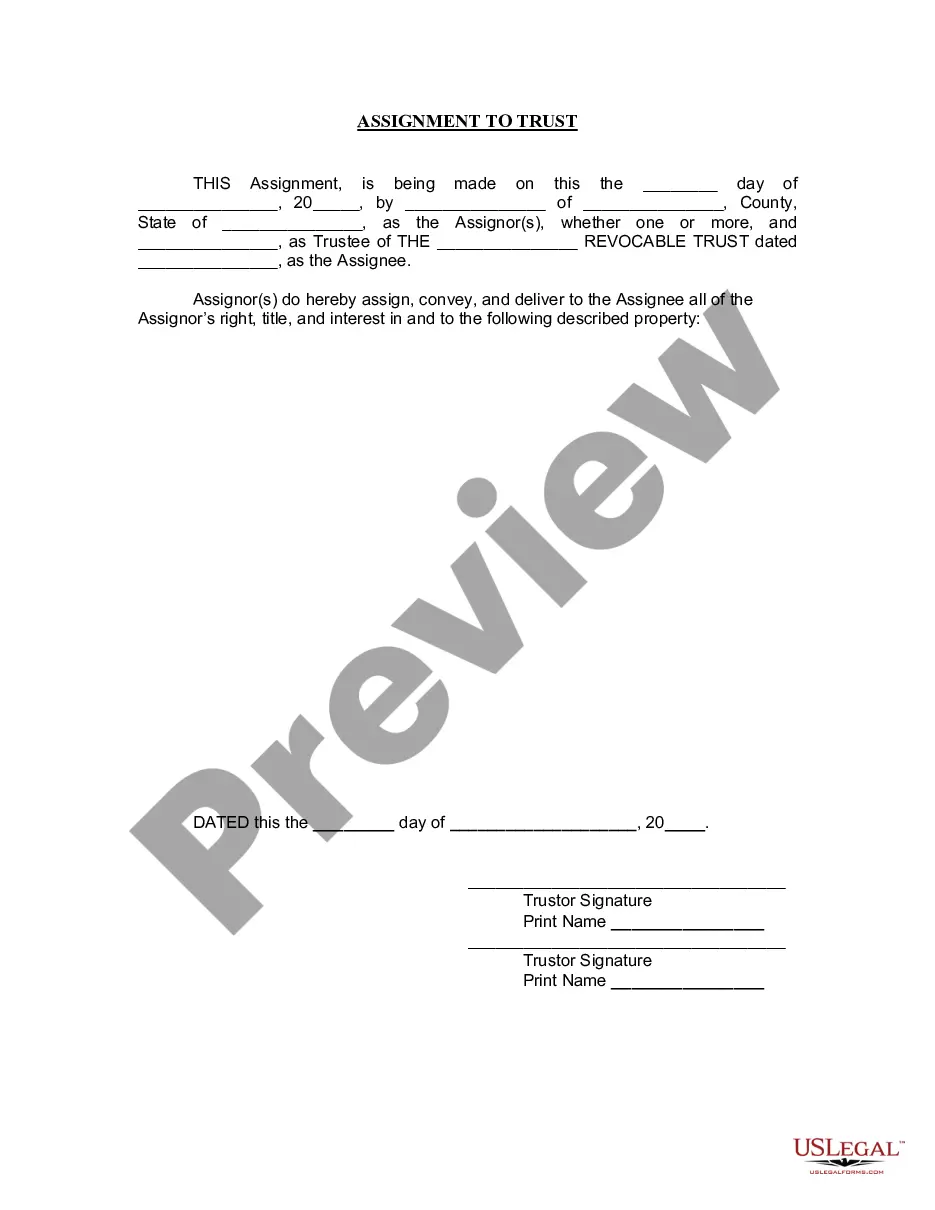

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

A living trust is a legal document that allows individuals in South Fulton, Georgia to transfer their assets into a trust during their lifetime and outline how those assets should be managed and distributed upon their death or incapacitation. This article aims to provide a detailed description of the South Fulton Georgia Assignment to Living Trust, including its purpose, benefits, and various types. The South Fulton Georgia Assignment to Living Trust serves as an essential estate planning instrument for individuals desiring to protect and manage their assets while alive and establish a roadmap for their distribution post their demise. This legal arrangement allows the creator (known as the granter or trust or) to maintain control over their assets during their lifetime and designate beneficiaries who will inherit those assets. There are multiple types of living trusts available in South Fulton, Georgia, each serving specific objectives and tailored to meet individual needs. Some common types of living trusts include: 1. Revocable Living Trust: This is the most prevalent type of living trust in South Fulton, Georgia, providing flexibility, as it can be modified or revoked by the granter during their lifetime. With a revocable living trust, the granter can act as both the trustee (person managing the trust) and the beneficiary (the person receiving trust assets). 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be altered, amended, or revoked once it is established. By setting up an irrevocable trust, the granter transfers their assets out of their estate, potentially reducing estate taxes and protecting assets from creditors. 3. Testamentary Living Trust: Unlike the other types of living trusts, a testamentary living trust is created within a will and does not become effective until the granter's death. This type of trust allows the granter to maintain control over their assets during their lifetime and ensures a smooth transfer of assets to designated beneficiaries upon their demise. Benefits of establishing a South Fulton Georgia Assignment to Living Trust include: 1. Avoidance of Probate: Assets held within a living trust do not go through the probate process, saving time and costs associated with the probate court. This enables a quicker and more private distribution of assets to beneficiaries. 2. Privacy and Confidentiality: While the probate process is public, living trusts provide privacy as they are not made public during the granter's lifetime or after death. Confidentiality is maintained as the transfer of assets occurs outside the court system. 3. Incapacity Planning: In the event of the granter's incapacitation, a living trust allows for a seamless transition of management of assets as predetermined successor trustees step in to oversee the trust and manage its assets as outlined in the trust documents. 4. Flexibility and Control: The granter has the ability to modify, revoke, or amend a revocable living trust during their lifetime, providing flexibility in managing assets. Additionally, it allows for the customization of distribution plans to meet the unique circumstances of the granter and beneficiaries. Establishing a South Fulton Georgia Assignment to Living Trust is a strategic move to protect assets, ensure efficient distribution, and maintain control during the granter's lifetime. Consultation with an experienced estate planning attorney in South Fulton, Georgia is highly recommended determining the most suitable type of living trust based on individual circumstances and goals.A living trust is a legal document that allows individuals in South Fulton, Georgia to transfer their assets into a trust during their lifetime and outline how those assets should be managed and distributed upon their death or incapacitation. This article aims to provide a detailed description of the South Fulton Georgia Assignment to Living Trust, including its purpose, benefits, and various types. The South Fulton Georgia Assignment to Living Trust serves as an essential estate planning instrument for individuals desiring to protect and manage their assets while alive and establish a roadmap for their distribution post their demise. This legal arrangement allows the creator (known as the granter or trust or) to maintain control over their assets during their lifetime and designate beneficiaries who will inherit those assets. There are multiple types of living trusts available in South Fulton, Georgia, each serving specific objectives and tailored to meet individual needs. Some common types of living trusts include: 1. Revocable Living Trust: This is the most prevalent type of living trust in South Fulton, Georgia, providing flexibility, as it can be modified or revoked by the granter during their lifetime. With a revocable living trust, the granter can act as both the trustee (person managing the trust) and the beneficiary (the person receiving trust assets). 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be altered, amended, or revoked once it is established. By setting up an irrevocable trust, the granter transfers their assets out of their estate, potentially reducing estate taxes and protecting assets from creditors. 3. Testamentary Living Trust: Unlike the other types of living trusts, a testamentary living trust is created within a will and does not become effective until the granter's death. This type of trust allows the granter to maintain control over their assets during their lifetime and ensures a smooth transfer of assets to designated beneficiaries upon their demise. Benefits of establishing a South Fulton Georgia Assignment to Living Trust include: 1. Avoidance of Probate: Assets held within a living trust do not go through the probate process, saving time and costs associated with the probate court. This enables a quicker and more private distribution of assets to beneficiaries. 2. Privacy and Confidentiality: While the probate process is public, living trusts provide privacy as they are not made public during the granter's lifetime or after death. Confidentiality is maintained as the transfer of assets occurs outside the court system. 3. Incapacity Planning: In the event of the granter's incapacitation, a living trust allows for a seamless transition of management of assets as predetermined successor trustees step in to oversee the trust and manage its assets as outlined in the trust documents. 4. Flexibility and Control: The granter has the ability to modify, revoke, or amend a revocable living trust during their lifetime, providing flexibility in managing assets. Additionally, it allows for the customization of distribution plans to meet the unique circumstances of the granter and beneficiaries. Establishing a South Fulton Georgia Assignment to Living Trust is a strategic move to protect assets, ensure efficient distribution, and maintain control during the granter's lifetime. Consultation with an experienced estate planning attorney in South Fulton, Georgia is highly recommended determining the most suitable type of living trust based on individual circumstances and goals.